Smart Coatings Market Report Scope & Overview

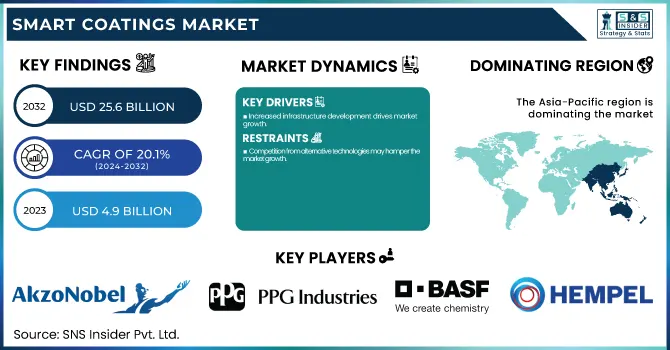

The Smart Coatings Market was USD 4.9 billion in 2023 and is expected to reach USD 25.6 billion by 2032, growing at a CAGR of 20.1 % over the forecast period of 2024-2032.

To Get more information on Smart Coatings Market - Request Free Sample Report

The smart coatings market growth is mainly attributed to the increasing demand for corrosion-resistant coatings. Sectors like automotive, aerospace, marine, and oil and gas utilize long-lasting materials that can endure harsh environments at saltwater, chemicals, as well as extreme temperatures. Smart coatings having novel properties for resisting corrosion can bring economic benefits through longer equipment and infrastructure lifespan, along with decreased maintenance and downtime costs in the long term. Take oil and gas as an example in which pipelines and storage tanks operate under exposure to corrosives and hence coatings play an important role in safety and productivity. Moreover, the rise in infrastructure investment and modernization of infrastructure across the globe from governments and organizations is also driving the market for corrosion-resistant coatings. To meet this increasing need, novel self-healing and anti-corrosive smart coatings are being developed, which provide improved protection while also complying with burning environmental restrictions on conventional coatings.

In the United States, the Department of Defense (DoD) allocates around USD 20 billion annually to corrosion maintenance, which constitutes nearly 20% of its maintenance budget.

The most significant factor for the growth of the smart coatings market is the increasing demand for corrosion-resistant coatings, as they are critical to achieving superior durability and life of infrastructure, vehicles, and equipment. Corrosion is considered a $2.5 trillion annual global economic problem affecting numerous industries the equivalent of approximately 3.4% of the GDP of the world, NACE International estimates. Corrosion creates these costs in reality, with the Department of Defense in the United States alone paying about $20 billion to maintain corrosion, emphasizing how corrosive damage is an economic burden to just about any industrial and governmental function. For counteractions to such a shortfall, industries such as oil and gas, automotive, aerospace, and marine beginning to implement advanced corrosion-resistant smart coatings with self-healing capabilities and performance at extreme conditions. Less than a month before this announcement in October 2024, the U.S. Department of Transportation had dispersed nearly $200 million toward the effort to modernize these aging natural gas pipelines needing corrosion-resistant solutions to line and coat to help sustain safety and efficiency. With worldwide governments and private sectors investing more in modernizing and securing infrastructure, the demand for new sustainable corrosion-resistant smart coatings is expected to contribute to market growth.

In the United States, the Department of Defense (DoD) allocates around USD 20 billion annually to corrosion maintenance, which constitutes nearly 20% of its maintenance budget.

Smart Coatings Market Dynamics

Drivers

-

Increased infrastructure development drives market growth.

The booming infrastructure development has been the prime driving ingredient for the smart coatings market because the smart coating technologies need to help all the industry in making the enduring infrastructure. The rapid urbanization along with rising government spending for the modernization and expansion of public infrastructure including bridges, highways, airports, and pipelines is having a positive impact on demand for protective coatings. Examples include the U.S. Infrastructure Investment and Jobs Act, which directed USD 1.2 trillion to revamping infrastructure a clear signal that the time is come for something stronger than old builds. Due to their unique characteristics such as self-healing, corrosion resistance, and anti-fouling, smart coatings are becoming vital in ensuring the durability and function of these projects while decreasing downtime and maintenance costs. In addition, with growing attention to sustainable development, the increasing inclination towards the use of green and energy-efficient coatings significantly drives their demand across the global construction and infrastructure sector.

Restraint

-

Competition from alternative technologies may hamper the market growth.

The availability of alternative technologies poses significant competition to the Smart Coatings market in the years to come. The oil and gas industry is evolving and innovative technologies are in place to lessen the need for biocides, corrosion inhibitors, and other chemical solutions. As another example, there is an emerging interest in electric fracturing and other new stimulation methods because they may be much less energy-intensive and environmentally damaging by having little or no reliance on large quantities of chemical additives that are usually used for hydraulic fracturing. In addition to causing less environmental impact, these technologies also allow for savings by decreasing the use of chemicals and improving operational efficiency. These alternative technologies are gradually reducing the United States market acceptance of traditional oilfield chemistries and, therefore, competition for chemical-based solutions, and they may even diminish the United States market growth.

Smart Coatings Market Segmentation

By Layer

Single layer held the largest market share around 64% in 2023. It is owing to cost-effective and wider ease of application, as well as versatility in a wide range of industries. These coatings with a simple structure for key functions (corrosion resistance, self-cleaning, anti-microbial), at a lower production cost than traditional multi-layer coatings. This is especially true in industries such as automotive, aerospace, and construction, where the need for cost-effective yet efficient solutions drive the use of single-layer coatings. They provide a lot of protection and performance without the requirement of added layers, so it is a perfect fit for applications that need protection and performance such as marine coatings, pipelines, and metal surfaces. In addition, the coatings are easily applied at the get-go along with decreased curing times, resulting in their higher efficiency in large-scale operations, which helps in further market pulling of the coatings.

By End-User Industry

The automotive & transportation segment held the largest market share around 44% in 2023. This is owing to the rising need for advanced coatings that improve vehicle performance, durability, and appearance. With an aim towards innovation, the automotive sector is making the move into coatings that must have self-healing, anti-corrosion, and scratch resistance properties to maintain vehicle integrity as well as aesthetics under harsh environmental conditions. Increased uptake of electric vehicles (EVs) along with the increasing necessity for lightweight and durable materials to enhance fuel efficiency drives the demand for smart coatings in the automotive sector. There is wide adoption of smart coatings, as the transportation industry is focusing on upgrading maintenance and durability to prolong vehicle life and reduce maintenance costs.

By Function

The anti-corrosion segment held the largest market share around 28% in 2023. Due to the high demand for material protection against corrosion, the anti-corrosion segment accounts for the largest market share in the smart coatings market. Corrosion is a serious problem in the oil & gas, automotive, aerospace, and marine sectors, where expensive maintenance, safety issues, and shortened service life due to long-term exposure to severe environmental conditions are common. In some cases, anti-corrosion smart coatings provide a reliable solution by preventing rust and deterioration, offering reduced maintenance and replacement needs. The rising emphasis on infrastructure and industrial activities especially in coastal locations offshore environment is propelling the curtailing need for anti-corrosion coatings. Demand for anti-corrosion coatings is boosted, as governments and industries are making investments to satisfy regulatory standards reduce operational expenses and also to ensure the durability of critical assets.

Smart Coatings Market Regional Analysis

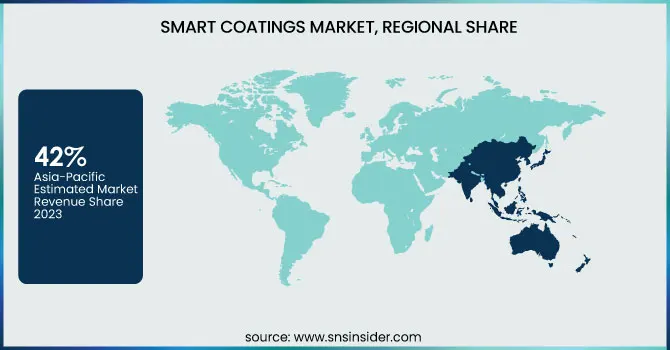

Asia Pacific held the largest market share around 42% in 2023. This is due to rapid industrialization, large-scale infrastructure establishment, and evolving demand for coatings in the automotive, construction, and manufacturing industries. China, India, and Japan lead this growth, with smart coating penetration attributed to local government projects focused on upgrading infrastructure along with the development of eco–friendly solutions. Moreover, the automotive and transportation sectors flourish in the region, and smart coatings are progressively employed to boost the performance and durability of vehicles. The strong base of manufacturing and cost-effective production capability in the Asia Pacific region also contributes to making advanced coatings more practical across industries. In addition to this, the demand for anti-corrosion, anti-fouling, and self-healing coatings in the marine and aerospace sector in the Asia Pacific as the region hosts the most of the larger shipbuilding and aerospace industries in the world further accentuates the positive growth of the market. The smart coatings market in Asia Pacific is expected to follow the trend and remain in the leading position as the region continues to witness rapid economic expansion with an increasing emphasis on environmental sustainability.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

AkzoNobel N.V. (Interpon, Carbozinc)

-

PPG Industries, Inc. (PPG Sigmashield, PPG Steelguard)

-

BASF SE (BASF Lumogen, BASF Master Builders Solutions)

-

Sherwin-Williams Company (Sher-Clear, Sherwin-Williams Protective & Marine Coatings)

-

3M Company (Scotchgard, 3M Novec)

-

Hempel A/S (Hempel Alu-Zinc, Hempel Multicoat)

-

Jotun Group (Jotashield, Jotun Marine Coatings)

-

RPM International Inc. (Rust-Oleum, Zinsser)

-

Axalta Coating Systems (Corlar, Nap-Gard)

-

Nippon Paint Holdings Co., Ltd. (Nippon Paint Anti-Corrosive Coatings, Nippon Paint Marine Coatings)

-

Kansai Paint Co., Ltd. (Kansai Cote, Kansai Protective Coatings)

-

Valspar Corporation (Valspar Duramax, Valspar Anti-Rust)

-

Tiger Coatings GmbH & Co. KG (Tiger Drylac, Tiger Protect)

-

Sika AG (Sikagard, SikaCor)

-

Bayer AG (Bayer Coatings, Bayer Nano Coatings)

-

AkzoNobel Industrial Coatings (Interpon D, Carbotec)

-

Hempel A/S (Hempel Topcoat, Hempel Marine Paint)

-

Kraton Polymers (Kraton Polymers Smart Coatings, Kraton High Performance Coatings)

-

Sherwin-Williams Protective & Marine Coatings (Sher-Guard, Duraplate)

-

Behr Process Corporation (Behr Premium Plus, Behr Advanced Technology Coatings)

Recent Development:

-

In 2024: AkzoNobel launched a new corrosion-resistant coating called Interpon D2020 designed to improve the longevity of metal surfaces in industrial environments. This smart coating enhances protection against UV degradation and environmental stresses.

-

In 2023: PPG introduced PPG Sigmashield 8800, a new high-performance marine anti-corrosion coating that provides enhanced resistance to harsh environmental conditions and offers long-lasting protection for both commercial and military vessels.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.9 Billion |

| Market Size by 2032 | USD 25.6 Billion |

| CAGR | CAGR of 20.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Layer (Single layer, Multi-Layer) By End-User Industry (Automotive & Transportation, Marine, Aerospace & Defense, Building & Construction), • By Function (Anti-corrosion, Anti-icing, Anti-fouling, Anti-microbial, Self-cleaning, Self-healing) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Schlumberger Limited, Halliburton, Baker Hughes, Chevron Phillips Chemical, Clariant, Dow, Nalco Champion, Croda International, Stepan Company, SNF Group, AkzoNobel, Solvay, Ashland, Huntsman Corporation, Kemira, Albemarle Corporation, Innospec, Lamberti Group, Thermax Limited. |

| Key Drivers | • Increased infrastructure development drives market growth. |

| Restraints | • Competition from alternative technologies may hamper the market growth. |