Residential Filters Market Report Scope & Overview:

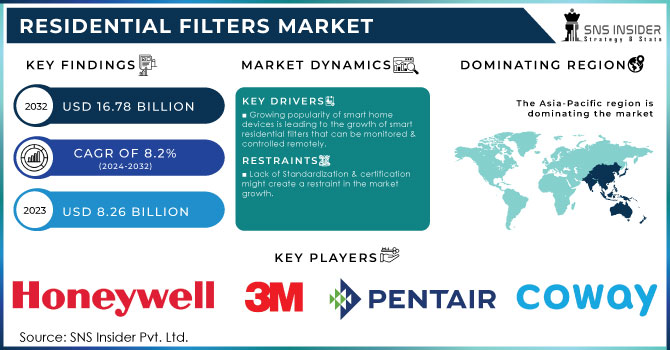

The Residential Filters Market size was valued at USD 8.26 Billion in 2023 and is now anticipated to grow to USD 16.78 Billion by 2032, displaying a CAGR of 8.2% during the forecast period of 2024-2032. The Residential Filters Market is experiencing steady growth due to increasing concerns about indoor air quality and the need for clean water. As consumers become more health-conscious, demand for air and water filtration systems has surged, driving advancements in filter technologies. The market includes various types of filters such as air, water, and HVAC filters, all aimed at improving the quality of life by removing pollutants, allergens, and harmful contaminants from household environments. This has led to a notable rise in product innovations, including the integration of smart technologies that enable monitoring and maintenance of filtration systems in real-time.

Get More Information on Residential Filters Market - Request Sample Report

In terms of growth, the market is projected to expand significantly over the next decade. Factors contributing to this growth include the increasing awareness of health risks associated with poor air and water quality, government regulations promoting clean air and water standards, and the rise in urbanization, which contributes to environmental pollution. Additionally, the expansion of residential construction activities, especially in emerging economies, is creating more opportunities for filter manufacturers. These filters are becoming a necessity in urban households, further boosting market demand. Recent trends in the market highlight a shift towards sustainable and energy-efficient products. Many manufacturers are focusing on developing eco-friendly filters made from biodegradable or recyclable materials to cater to environmentally conscious consumers. The adoption of smart filters that are compatible with home automation systems is another trend gaining traction. These smart filters not only enhance convenience by alerting users when replacements are needed but also optimize energy usage. Additionally, the pandemic has heightened consumer focus on indoor hygiene, driving increased sales of advanced air filters capable of removing viruses and bacteria, further boosting market prospects.

MARKET DYNAMICS

DRIVERS

- Increasing health awareness is driving demand for residential filters as consumers seek to protect their families from respiratory issues, allergies, and waterborne diseases caused by poor air and water quality.

Increasing health awareness is a major driver of growth in the Residential Filters Market, as consumers become more conscious of the health risks posed by poor air and water quality. Pollutants such as dust, pollen, allergens, bacteria, and harmful chemicals are prevalent in both indoor air and household water supplies, contributing to a range of health issues, including respiratory conditions, allergies, and waterborne diseases. This has led to a surge in demand for air and water filtration systems that can effectively remove these contaminants, ensuring a safer living environment.

Many households are now prioritizing filtration systems to improve indoor air quality, especially in urban areas where pollution levels are higher. Indoor air can often be more polluted than outdoor air due to the accumulation of dust, pet dander, and other allergens. This makes air purifiers with HEPA filters, which capture fine particles, highly desirable. Similarly, water contamination from outdated plumbing systems, industrial pollutants, and pesticide runoff has heightened the need for advanced water filtration systems. Consumers are seeking solutions that can provide clean, contaminant-free water to protect against illnesses caused by bacteria, lead, and other toxins. Filtration systems that ensure safe drinking water and clean household environments are now seen as essential, not just luxury items. With increasing education about the long-term health benefits of cleaner air and water, the demand for residential filters continues to rise, making this a significant market growth factor.

- Technological advancements, including HEPA filters and smart filtration systems with real-time monitoring, are enhancing filtration efficiency and convenience, thereby driving growth in the residential filters market.

Technological advancements play a crucial role in driving growth in the Residential Filters Market, primarily through innovations that enhance filtration efficiency and user convenience. One of the most significant developments is the introduction of HEPA (High-Efficiency Particulate Air) filters, which can capture up to 99.97% of airborne particles as small as 0.3 microns. This capability makes HEPA filters exceptionally effective in removing allergens, dust, pollen, and other harmful pollutants from indoor air, significantly improving air quality in residential spaces. As consumers become more health-conscious, the demand for such high-performance filters continues to rise.

Moreover, the emergence of smart filters has revolutionized the market by integrating technology that enables real-time monitoring of air and water quality. These smart systems can provide users with timely notifications about filter performance, remaining lifespan, and necessary replacements via smartphone apps or smart home systems. This convenience not only helps ensure that filtration systems are maintained optimally but also empowers consumers with valuable information about their indoor environment. Additionally, advancements in materials science have led to the development of filters with longer lifespans and lower maintenance requirements, further enhancing their appeal. For example, newer filters are often designed to withstand more significant stress and operate effectively over extended periods without needing frequent replacements. As a result, these technological innovations contribute to increased consumer satisfaction and market growth, as homeowners seek efficient and convenient solutions for maintaining clean air and water in their living spaces.

RESTRAIN

- The maintenance and replacement costs associated with filtration systems can deter homeowners from investing in high-end options, as regular upkeep is necessary to ensure optimal performance and adds to the overall cost of ownership.

Maintenance and replacement costs significantly influence consumer decisions in the Residential Filters Market, acting as a barrier for some homeowners. While high-quality filtration systems offer superior performance, they often require regular upkeep to maintain efficiency. This includes periodic cleaning or replacement of filters, which can lead to increased long-term expenses. For many consumers, particularly those on a tight budget, the thought of ongoing costs can make investing in premium filtration systems less appealing. Furthermore, the initial purchase price of advanced filters may be attractive, but the prospect of future maintenance and replacement expenses can deter potential buyers. As a result, homeowners may opt for more basic, cost-effective options that, while less efficient, do not impose the same financial burden over time. Ultimately, the total cost of ownership, including maintenance and replacements, plays a crucial role in shaping consumer attitudes toward residential filtration solutions.

KEY SEGMENTATION ANALYSIS

By Product Type

The Water Filter type dominated the market with a share of around 63.2% in 2023. Drive for awareness through consumers on water quality concerns such as hardness, contamination, depletion of fresh water sources and increasing focus towards safe and healthy water consumption is rising. On the other hand, the dominance of water filters also lies in rapid urbanization.

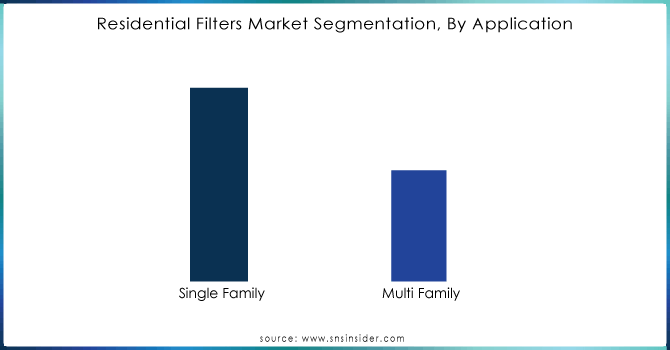

By Application

The Single-Family Application is dominating the market with a share of more than 60%in 2023. Rising adoption of air filtration systems in single-family housing sectors such as bungalows and cottages a driving factor for the market. Demand for single-family homes has increased due to the ability to reduce pollutants such as particles, gases, vapors from connecting indoors. Moreover, the increasing consumer expenditure on a healthy lifestyle due to growing global pollution is driving the market.

Need any customization research on Residential Filters Market - Enquiry Now

REGIONAL ANALYSIS

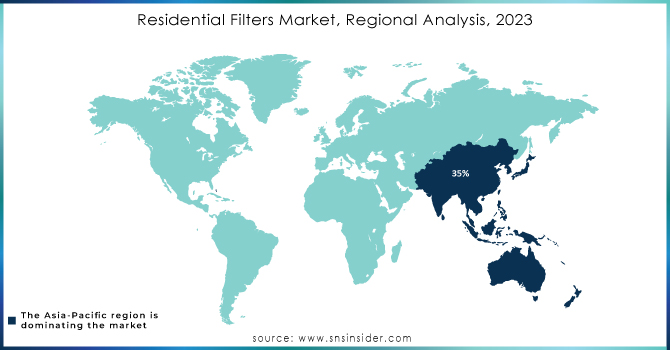

The Asia-Pacific region dominates the Residential Filters Market, holding approximately 35% in 2023. This region's dominance is driven by a variety of factors, including rising awareness about air and water pollution, increasing demand for clean water and air, and the rapid growth of filtration technologies. The continuous industrialization and urbanization in key countries such as China and India have led to a significant surge in pollution levels, increasing the need for residential filters.

North America is the fastest-growing market for residential filters, trailing closely behind Asia-Pacific. The region's growth is primarily attributed to its robust economic development and the implementation of stringent regulatory standards promoting sustainability and clean-living environments. Countries like the United States and Canada are experiencing an uptick in the installation of residential filtration systems due to the growing awareness of health-related concerns associated with poor air and water quality.

KEY PLAYERS

Some of the major key players of Residential Filters Market

- 3M Company: (Filtrete Air Filters, Drinking Water Filters)

- Honeywell International Inc.: (Honeywell Air Purifiers, Water Filters)

- Pentair plc: (Pentair Everpure Water Filters, Whole House Water Filtration Systems)

- Unilever Group: (Pureit) (Pureit Water Filters, Pureit Advanced RO Systems)

- Culligan International Company: (Culligan Whole House Water Filters, Culligan Drinking Water Systems)

- Coway Co. Ltd.: (Coway Airmega Air Purifiers, Water Purifiers)

- Amway Corporation: (Amway eSpring Water Treatment Systems, Atmosphere Sky Air Treatment Systems)

- Blueair: (Blueair Blue Series Air Purifiers, Classic Air Purifiers)

- Eureka Forbes Ltd.: (Aquaguard Water Purifiers, Forbes Air Purifiers)

- Kent RO Systems Ltd.: (Kent Grand RO Water Purifiers, Kent Aura Air Purifiers)

- Whirlpool Corporation: (Whirlpool Water Filtration Systems, Whirlpool Air Purifiers)

- Samsung Electronics Co. Ltd.: (Samsung Smart Air Purifiers, Water Filtration Solutions)

- LG Electronics Inc.: (LG PuriCare Air Purifiers, LG Water Purifiers)

- Panasonic Corporation: (Panasonic Air Purifiers, Alkaline Ionizer Water Purifiers)

- Daikin Industries, Ltd.: (Daikin Air Purifiers, Streamer Air Cleaning Systems)

- Midea Group Co. Ltd.: (Midea Water Filters, Midea Air Purifiers)

- A.O. Smith Corporation: (A.O. Smith Whole House Water Filters, Drinking Water Filtration Systems)

- Philips: (Philips Air Purifiers, Philips UV Water Purifiers)

- TCL Technology Group Corporation: (TCL Breeva Air Purifiers, Water Filters)

- Sharp Corporation: (Sharp Plasmacluster Air Purifiers, Water Purification Systems)

RECENT DEVELOPMENTS

In February 2023: Honeywell introduced a new line of air purifiers with integrated air quality monitors. These purifiers automatically adjust fan speed and filtration based on real-time indoor air quality readings, optimizing performance for specific needs.

In January 2023: A.O. Smith invested in research for self-cleaning reverse osmosis filters aiming to eliminate the need for manual membrane replacements, reducing maintenance for homeowners.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.26 Billion |

| Market Size by 2032 | USD 16.78 Billion |

| CAGR | CAGR of 8.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Air Filter, Water Filter) • By Application (Single Family, Multi Family) • By Efficiency (MERV 1-4, MERV 6-10, MERV 10-13, MERV 14-16, MERV 17-20) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M Company, Honeywell International Inc., Pentair plc, Unilever Group (Pureit), Culligan International Company, Coway Co. Ltd., Amway Corporation, Blueair, Eureka Forbes Ltd., Kent RO Systems Ltd.,Whirlpool Corporation,Samsung Electronics Co. Ltd, LG Electronics Inc, Panasonic Corporation, Daikin Industries, Ltd, Midea Group Co. Ltd, O. Smith Corporati, Philips, TCL Technology Group Corporation, Sharp Corporation |

| Key Drivers | • Increasing health awareness is driving demand for residential filters as consumers seek to protect their families from respiratory issues, allergies, and waterborne diseases caused by poor air and water quality. • Technological advancements, including HEPA filters and smart filtration systems with real-time monitoring, are enhancing filtration efficiency and convenience, thereby driving growth in the residential filters market. |

| RESTRAINTS | • The maintenance and replacement costs associated with filtration systems can deter homeowners from investing in high-end options, as regular upkeep is necessary to ensure optimal performance and adds to the overall cost of ownership. |