Electrical Equipment Market Report Scope & Overview:

Get More Information on Electrical Equipment Market - Request Sample Report

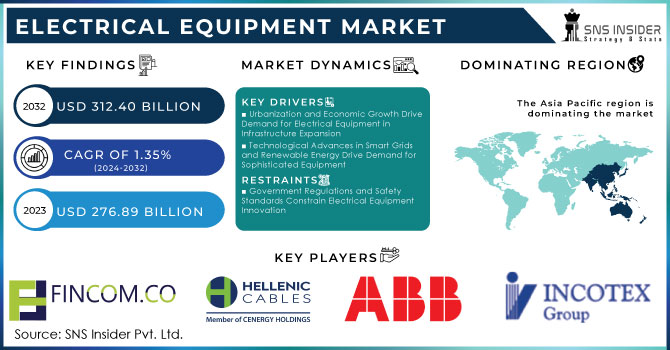

The Electrical Equipment Market was valued at USD 276.89 Billion in 2023, and it is expected to reach USD 312.40 Billion by 2032, registering a CAGR 1.35% of during the period of 2024-2032.

The Electrical Equipment Market includes electricity meters, transformers, switchgear, circuit breakers, and distribution boards. The increase in building permits and housing starts suggests a rise in new constructions. This is significant because new buildings require electrical equipment for functionality So, in June, building permits for privately-owned housing units were issued, at a seasonally adjusted annual rate of 1,446,000 units. This represents a 3.4% increase from May, but a 3.1% decrease from June 2023. Single-family home authorizations declined to 2.3% while permits for multi-family buildings with 5 units or more were estimated at 460,000. Housing starts in June were recorded at 1,353,000, demonstrating a 3% increase from the previous month, but a 4.4% decrease compared to the last year. Single-family starts decreased by 2.2% to 980,000 while multi-family starts were estimated at 360,000 units. The housing completions in June increased significantly to 1,710,000 units, which is 10.1% growth from May, and 15.5% gain from the previous year. Single-family completions amounted to 1,037,000 million, up by 1.8% from the previous month while multi-family completions stood at 656,000. Overall, this is a strong indication of construction activity, which can lead to higher demand for electrical equipment since every new building requires many electrical installations.

Smart grids and smart cities also provide a big sector opening up for the market expansion. Smart grid is the technology that makes it possible to manage and monitor the flow of electricity or power, to make it flow as efficiently and effectively as possible. It needs electrical equipment like smart meters, sensors, and other telecommunication equipment. Smart cities are designed in such a way that different information and communication technologies are used to make urban living more comfortable for the citizens. Opening up of smart cities increases the demand for sophisticated electrical systems and their component parts. The electrical equipment market is definitely booming because of the increasing urbanization and industrialization in developing countries. High frequency of operation is also going to be a reason behind this market increase in the forecast period.

At the same time, smart grids will be able to save 1060 terawatt-hours per year by 2026, compared to 316 terawatt-hours in 2021, and the accelerated growth of efficiency indicator promotes significant investments in smart grid software by energy transmission operators. The total annual turnover of software for this equipment will amount to about 38.3 billion euros by 2026, instead of 11.9 billion euros in 2021. The prevalence of smart meters is noteworthy, especially in Italy, and in the world more than 2 billion certain devices will be used by 2026 instead of 1.1 billion in 2021. An increased integration of smart technologies in the electrical equipment market both in newly constructed facilities and the modernization of the existing infrastructure.

DRIVERS

-

In Infrastructure expansion rapid urbanization and economic growth globally are fueling the need for new buildings, factories, and transportation networks, all requiring significant electrical equipment.

The growth in world’s population and industry has become urge for new buildings, plants, and a vast network of transportation. Electrical equipment is needed for construction of virtually every big building, canning plant, and any other industrials object. This is especially supposed emerging or developed countries where urbanization processes have reached their peak. This is not surprising that the infrastructure of these countries needs power transmission and switching facilities, electric light, and other advanced electrical systems. Indeed, spreading cities require a prepared grid to distribute energy to residential, commercial, and industrial buildings, each requiring private railroads, highways, and aerodromes. Naturally, enhanced systems are needed for railways for high-speed trains and light rail tracks for trams. Moreover, new plants for green power generation such as solar panels or wind stations do require peculiar electric equipment. Thus, the current growth is not only the major customer for conventional electric components, but also raises the need for new sophisticated components meeting the requirements of modern infrastructure.

-

Technological advancement innovations in areas like smart grids, renewable energy integration, and energy-efficient solutions are creating a demand for more sophisticated equipment.

The market of electrical equipment is being revolutionized by new technological advances like, Smart grids represent new technology on the market of electrical equipment, which allows real-time monitoring and efficient distribution of energy. The increasing share of power losses in modern grids ruins the necessity of controlling energy distribution and the speed of performing such operations. The increasing use of renewable sources of energy, such as solar panels and wind turbines, for bigger stability and consistency implies using advanced inverters, powerful controllers and battery systems. Both individually and by industries LED lighting represent an energy-efficient solution for cost reduction problem. High efficiency transformers justify their use by efficiently lowering power outages, maintenance and repair costs. On the other hand, the increasing popularity of the Internet of Things requires the use of smarter electrical devices, which could be tailored to optimize their function, increase their durability and communicate among each other. All of the above-mentioned technologies not only satisfy the demand of energy-efficient and powerful electrical equipment on the market, but also provide the precondition for future development, vis. the market of electrical equipment will remain innovative for new technologies even in a long run.

RESTRAIN

-

Government regulations, including safety standards and environmental mandates, can constrain the design and functionality of electrical equipment, thereby affecting innovation.

The ones for safety standards and ones concerned with the environment being paramount. While many innovations in the sphere of electrical equipment are affected by those standards, much of that influence is actually constraint. Safety standards require difficult testing and certification, which leads to companies wanting to develop some new product or technology having to spend a lot of money developing it and then having it certified. This results in manufacturers being unwilling to invest in something new, to use new materials and technologies in ways that they were not extensively tested. The same happens with regulations related to environmental concerns both reducing hazardous substances and energy use reduction. These regulations actually enable companies to invest in green technologies but also make their production more costly, as well as putting restrictions on it. As such, most companies must balance on the thin edge of compliance with regulation and development of new products, as those new products have to comply with, for example, safety standards and contain less of certain substances. At the same time, the very presence of these regulations gives companies the necessary nudge to make their products safer and with far less negative environmental impact. Hence, these government regulations do indeed affect multiple aspects of products, but many of these influences are factors by which the process of production is being constrained for companies who produce electrical equipment.

KEY MARKET SEGMENTATION

By Product

The Electronic and Electrical Wires and Cables has a market share of 42.14% in 2023, and it is crucial for transmitting electricity throughout various applications, which is the main reason of dominance of this segment due to ongoing infrastructure development.

The Wiring Devices is expected to be the fastest growing segment during the forecast period 2024-2032, due to infrastructure expansion, smart home trends, and the rise of Electric Vehicles (EVs) requiring charging stations.

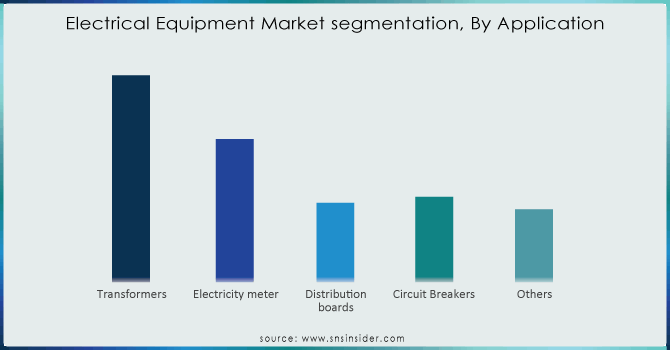

By Applications

The Transformers has a market share of 39.53% in 2023, and dominating this segment due to their vital role in regulating voltage levels for power transmission and distribution across various applications.

The Electricity Meters projected to be the fastest growing segment during the forecast period 2024-2032, these devices track and measure electricity consumption, playing a key role in billing and managing energy usage.

Need any customization research on Electrical Equipment Market - Enquiry Now

By End User

The Industrial currently the leader in terms of revenue share of 44.02% in 2023, due to the extensive use of heavy machinery and industrial processes requiring specialized electrical equipment.

The Commercial projected to be the fastest growing segment during the forecast period 2024-2032, with rising construction of commercial buildings and the increasing focus on energy efficiency through smart electrical equipment.

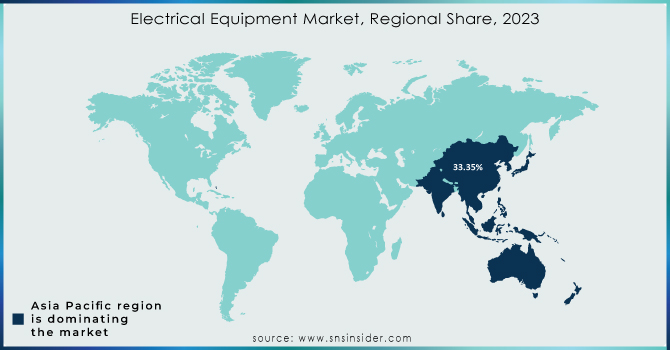

REGIONAL ANALYSIS

Asia-Pacific region is the leader in the global market with a market share 33.35% due to accelerated industrialization and wide-spread urbanization, along with active actions of the governments. In view of rapid urbanization in the region, substantial investment in power grid infrastructure, as well as residential and commercial construction is required.

Asia-Pacific will be the fastest-growing region during the forecasted period with a CAGR 1.42% in 2023. The growth of the disposable income of the population allows increasing consumer spending on electronics and durable goods. In addition, the focus on renewable energy sources, such as solar and wind energy, in the region leads to the increasing demand of the special equipment required for the generation and transmission of electric power.

Key Players

The major Players are Samel, Solar LED Powers, Hellenic Cables, Incotex Group, Fincom-2, ABB, Datecs, Monbat, Emka, Gamakabela, Octa light, Legrand and other players

Recent Developments

In March 2024: The International Electrical Testing Association (NETA) introduced its Qualified Electrical Equipment Maintenance Contractor and Worker Program at PowerTest24, an annual safety and reliability conference. This initiative responds to the new ANSI-approved NFPA 70B Standard, which mandates and enforces proper electrical equipment maintenance.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 276.89 Billion |

| Market Size by 2032 | US$ 312.40 Billion |

| CAGR | CAGR of 1.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Wiring devices, Batteries and accumulators, Electronic and electrical wires and cables, Electrical Lightning, Electric household appliances Others) •By Applications (Transformers, Electricity meter, Distribution boards, Circuit Breakers, Others) •By End User (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samel, Solar LED Powers, Hellenic Cables, incotex Group, Fincom-2, ABB, Datecs, Monbat, Emka, Gamakabela, Octa light, Legrand |

| Key Drivers | • In Infrastructure expansion rapid urbanization and economic growth globally are fueling the need for new buildings, factories, and transportation networks, all requiring significant electrical equipment. • Technological advancement innovations in areas like smart grids, renewable energy integration, and energy-efficient solutions are creating a demand for more sophisticated equipment. |

| RESTRAINTS | • Government regulations, including safety standards and environmental mandates, can constrain the design and functionality of electrical equipment, thereby affecting innovation. |