Intelligent Flow Meter Market Scope & Overview:

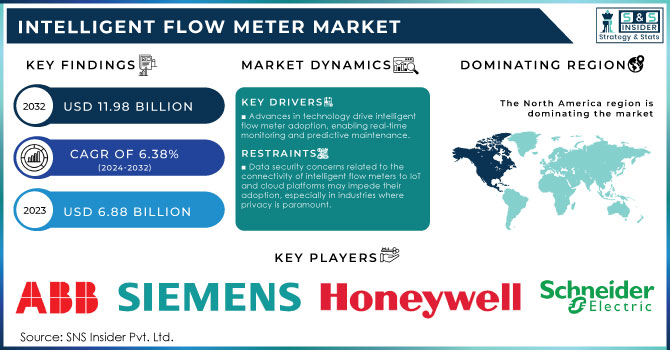

The Intelligent Flow Meter Market size was estimated at USD 6.88 Billion in 2023 and is expected to reach USD 11.98 Billion by 2032 at a CAGR of 6.38% during the forecast period of 2024-2032. The Intelligent Flow Meter Market is witnessing transformative changes with the adoption of advanced technologies. According to research 60% of industries are integrating IoT capabilities into their flow metering systems, which enhances connectivity and allows for real-time data exchange. Moreover, predictive analytics embedded in these meters can reduce maintenance costs by up to 25% through proactive monitoring and forecasting of potential issues. Notably, approximately 70% of water utilities are adopting intelligent flow measurement solutions to optimize water usage and minimize wastage, aligning with global sustainability goals. In the oil and gas sector, intelligent flow meters contribute to reducing operational inefficiencies, with reports suggesting that companies can save up to 15% on operational costs by implementing smart metering solutions.

To Get More Information on Intelligent Flow Meter Market - Request Sample Report

The chemical processing industry is also leveraging these technologies, where intelligent flow meters facilitate compliance with stringent regulatory standards by improving measurement accuracy and reporting capabilities. Furthermore, the demand for advanced flow measurement systems is reflected in a projected increase in the adoption rate of electromagnetic flowmeters, which are expected to account for nearly 30% of total flow measurement devices used by 2025. This shift underscores the importance of precise measurement solutions in supporting industrial operations and sustainability initiatives. As industries strive to enhance efficiency and reduce their carbon footprint, intelligent flow meters are becoming essential tools, driving a paradigm shift towards smarter, more sustainable operational practices.

| Technology | Description | Commercial Products |

|---|---|---|

| Electromagnetic Flow Meters | Uses electromagnetic induction to measure the flow rate of liquid with electrical conductivity. | Siemens MAG 8000, Endress+Hauser Proline Promag |

| Coriolis Flow Meters | Measures mass flow by detecting the deflection of vibrating tubes caused by fluid flow. | Emerson Micro Motion Series, Yokogawa ROTAMASS |

| Ultrasonic Flow Meters | Uses high-frequency sound waves to measure the velocity of fluid flow. | GE Panametrics TransPort PT900, Siemens SITRANS FS |

| Thermal Mass Flow Meters | Measures flow based on heat dissipation from a heated element in the flow stream. | Bronkhorst EL-FLOW, Sage Metering Sage Prime |

| Vortex Flow Meters | Measures vortices shed by a bluff body placed in a flow stream, which correlates to the flow rate. | Yokogawa DY, Rosemount 8800 Series |

| Differential Pressure Flow Meters | Infers flow rate by measuring pressure drop over a pipe constriction. | Honeywell SmartLine, ABB DP Flow Meters |

MARKET DYNAMICS

DRIVERS

- Technological advancements in sensor technology, wireless communication, and data analytics are propelling the adoption of intelligent flow meters by enabling real-time monitoring and predictive maintenance, thereby improving operational efficiency.

Technological advancements play a pivotal role in driving the adoption of intelligent flow meters across various industries. Innovations in sensor technology have led to the development of highly accurate and reliable flow measurement devices. These advanced sensors can operate under challenging conditions, providing precise readings even in extreme temperatures and pressures, with accuracy rates reaching up to 0.5%. Furthermore, the integration of wireless communication technologies, such as IoT and cloud computing, allows for seamless data transmission and real-time monitoring of flow parameters. It is estimated that around 70% of flow meters in use today are equipped with wireless capabilities, enabling organizations to track their processes remotely and optimize resource management.

The incorporation of data analytics into intelligent flow meters has revolutionized how companies interpret flow data. Advanced analytics tools can process vast amounts of data generated by these meters, offering insights that facilitate predictive maintenance and anomaly detection. For instance, organizations can anticipate equipment failures before they occur, reducing downtime and maintenance costs by up to 30%. Additionally, studies indicate that companies leveraging intelligent flow measurement technologies can improve operational efficiency by approximately 20%.

In sectors like oil and gas, where accuracy is paramount, these technological advancements have been particularly impactful. The increasing demand for automation and digitalization in industries further fuels the growth of intelligent flow meters, with reports showing that up to 40% of organizations are actively investing in advanced flow measurement technologies to enhance productivity while ensuring compliance with regulatory standards.

- The growing demand for automation in industries enhances accuracy, efficiency, and safety, leading to the seamless integration of intelligent flow meters into automated systems for improved flow management.

The growing demand for automation across various industries is significantly influencing the adoption of intelligent flow meters. As companies strive to enhance operational accuracy, efficiency, and safety, automating processes has become a strategic priority. Intelligent flow meters play a crucial role in this automation trend by integrating seamlessly into existing systems, allowing for improved flow management and monitoring. The oil and gas sector has seen a substantial shift toward automated flow measurement solutions to ensure precision in resource extraction and transportation. According to a recent report, approximately 85% of oil and gas companies are investing in digital technologies, including intelligent flow meters, to optimize operations. With these advanced tools, operators can achieve real-time data collection and analysis, enabling immediate responses to fluctuations in flow rates. This capability not only enhances accuracy but also reduces operational risks and downtime, leading to more reliable processes.

Additionally, the food and beverage industry benefits from automation by employing intelligent flow meters to monitor ingredient flow, ensuring quality control and compliance with health regulations. A survey indicated that about 65% of food and beverage manufacturers are increasing their automation budgets to incorporate technologies like intelligent flow meters. Moreover, the integration of intelligent flow meters with data analytics platforms allows industries to leverage insights from collected data, facilitating predictive maintenance and further improving efficiency.

RESTRAIN

- Data security concerns related to the connectivity of intelligent flow meters to IoT and cloud platforms may impede their adoption, especially in industries where privacy is paramount.

Data security concerns significantly hinder the adoption of intelligent flow meters, particularly as these devices become more integrated with the Internet of Things (IoT) and cloud-based platforms. While IoT connectivity enables real-time data collection and analysis, enhancing operational efficiency and decision-making, it simultaneously introduces considerable risks related to data privacy and security.

flow meters frequently manage sensitive information, including operational data and proprietary details, rendering them appealing targets for cybercriminals. For example, the Cybersecurity and Infrastructure Security Agency (CISA) highlighted in 2021 that critical infrastructure sectors like water treatment and oil and gas—face escalating threats from cyberattacks targeting vulnerabilities in connected devices. According to research, 63% of organizations encountered data breaches attributed to weaknesses in IoT devices, illustrating the severity of the issue. Industries such as pharmaceuticals and food and beverage are particularly vulnerable to data breaches, which can jeopardize product safety and regulatory compliance. As a result, companies may be reluctant to implement intelligent flow meters without robust security protocols and measures in place to protect their data. To foster trust in intelligent flow meter technologies and promote their widespread adoption, it is essential to address these security concerns through enhanced cybersecurity frameworks, regular vulnerability assessments, and comprehensive training programs for personnel.

KEY SEGMENTATION ANALYSIS

By Type

Coriolis dominated the market share over 28.06% in 2023, due to their exceptional accuracy and reliability across various industries, including oil and gas, chemicals, and food and beverage. These meters excel in measuring mass flow and density, typically offering an accuracy range of ±0.1% to ±0.5%. They can handle a wide array of fluids, including high-viscosity liquids and gases, and require minimal maintenance due to their robust design. Recent advancements have led to smart Coriolis meters with enhanced digital communication capabilities, improving integration into modern automation systems, and further boosting their adoption in various applications.

By Communication Protocol

The PROFIBUS segment dominated the market share by over 38.02% in 2023, due to its cost-effectiveness, adaptability, and suitability for automation. By utilizing a single two-core copper connection, PROFIBUS facilitates communication among multiple devices, significantly reducing wiring and installation costs by up to 50% compared to traditional non-digital systems. This streamlined approach minimizes installation time and complexity, enhancing operational efficiency. Additionally, PROFIBUS supports various applications, making it versatile in addressing diverse automation challenges without requiring supplementary technologies.

KEY REGIONAL ANALYSIS

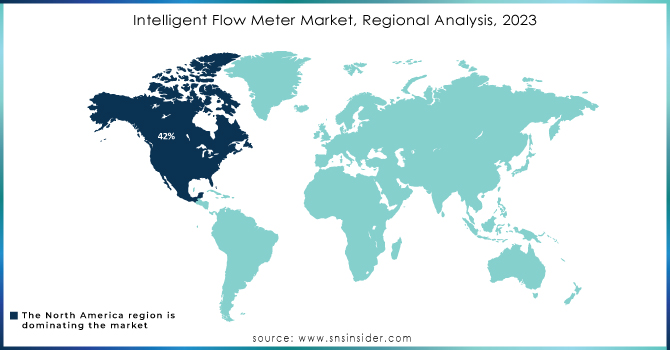

North America region dominated with market share over 42 % in 2023, primarily due to its strong industrial base and advanced technological infrastructure. The oil and gas sector, particularly in the U.S., accounts for approximately 40% of the region's intelligent flow meter demand, driven by the need for precise measurements in exploration and refining processes. Additionally, around 65% of industries in North America have integrated intelligent flow meters into their automation systems, reflecting a high adoption rate and significant integration with Industrial Internet of Things (IIoT) solutions. Over 70% of manufacturers prioritize energy-efficient systems, further boosting the demand for intelligent flow meters aimed at optimizing energy consumption. This robust market position is also supported by stringent regulatory frameworks for process automation and efficiency, along with substantial investments in research and development, which foster continuous innovation in flow measurement technology across various sectors, including water and wastewater management, chemicals, and power generation.

The Asia-Pacific (APAC) region is experiencing the fastest growth in the Intelligent Flow Meter Market, fueled by rapid industrialization and urbanization, particularly in countries like China, India, and Japan. The region's expanding oil and gas, chemical, and water treatment industries are major drivers of this growth. Increasing investments in infrastructure development and smart city projects further enhance the demand for intelligent flow meters in APAC. Governments are also implementing stricter environmental regulations, which drive the adoption of flow meters to ensure accurate monitoring and control of resource consumption and emissions. Additionally, the rise in industrial automation and the growing emphasis on improving operational efficiency in manufacturing plants make APAC a significant player in the market.

Do You Need any Customization Research on Intelligent Flow Meter Market - Inquire Now

KEY PLAYERS

Some of the major key players of Intelligent Flow Meter Market

-

ABB (CoriolisMaster, VortexMaster)

-

Emerson Electric Co. (Micro Motion Coriolis, Rosemount Vortex)

-

Siemens (SITRANS F M, SITRANS FS)

-

Honeywell International Inc. (VersaFlow Coriolis, SmartLine Multivariable Transmitter)

-

Yokogawa Electric Corporation (ROTAMASS TI Coriolis, ADMAG AXG Magnetic)

-

Azbil Corporation (AX Series Vortex, MagneW Magnetic Flow Meters)

-

Brooks Instrument (Quantim Coriolis, SLA Series Thermal Mass Flow Meters)

-

Sierra Instruments Inc. (Sierra InnovaMass, QuadraTherm 640i/780i)

-

KROHNE Messtechnik GmbH (OPTIMASS Coriolis, OPTISONIC Ultrasonic)

-

General Electric (PanaFlow Ultrasonic, XMT868i Transmitter)

-

RIELS INSTRUMENTS S.rl. (Ultrasonic Flow Meter RIF600, Magnetic Flow Meter RIF300)

-

KOBOLD Messring GmbH (DFM Paddle Wheel, MIM Magnetic Inductive Flow Meter)

-

DISTRIBUIDORA INTERNACIONAL CARMEN, S.A.U. (Vortex Flow Meter, Magnetic Flow Meter)

-

Baker Hughes (Panametrics Ultrasonic, PanaFlow LC Clamp-on)

-

Fuji Electric Co., Ltd. (Portaflow C Ultrasonic, FSC-4 Vortex Flow Meter)

-

Endress+Hauser Group (Proline Promass Coriolis, Proline Prowirl Vortex)

-

Badger Meter, Inc. (Dynasonics Ultrasonic, Magnetoflow)

-

OMEGA Engineering, Inc. (FMA Series Mass Flow, FV101 Vortex Flow Meters)

-

Schneider Electric (Foxboro Coriolis, Foxboro Magnetic Flow Meters)

-

Siargo Ltd. (MFM Series MEMS Mass Flow, SF6200 Thermal Mass Flow Meters)

Suppliers for precise flow measurement, process automation, and real-time monitoring of Intelligent Flow Meter Market:

-

Siemens AG

-

ABB Ltd.

-

Emerson Electric Co.

-

Endress+Hauser Group

-

Honeywell International Inc.

-

KROHNE Group

-

Yokogawa Electric Corporation

-

Badger Meter, Inc.

-

Schneider Electric SE

-

Azbil Corporation

RECENT DEVELOPMENTS

-

In 2024: Endress+Hauser introduces the Prosonic Flow G 300, an intelligent flow meter optimized for gas measurement, enhancing efficiency and reliability in various industries.

-

In July 2023: Lookout Lab, Inc., a leading provider of intelligent water management systems, proudly announced the launch of its highly anticipated mobile application, bluebot water, available on iOS and Android platforms. This innovative app, designed to work with the company’s cloud-based water flow meter, marks the completion of an extensive software redevelopment process.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.88 Billion |

| Market Size by 2032 | USD 11.98 Billion |

| CAGR | CAGR of 6.38%From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Coriolis, Magnetic, Vortex, Multiphase, Ultrasonic, Variable Area, Differential Pressure, Thermal, Turbine) •By Offering (Hardware, Software, Services) •By Communication Protocol (PROFIBUS, Modbus, HART, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB, Emerson Electric Co., Siemens, Honeywell International Inc., Yokogawa Electric Corporation, Azbil Corporation, Brooks Instrument, Sierra Instruments Inc., KROHNE Messtechnik GmbH, General Electric, RIELS INSTRUMENTS S.rl., KOBOLD Messring GmbH, DISTRIBUIDORA INTERNACIONAL CARMEN, S.A.U., Baker Hughes, Fuji Electric Co., Ltd., Endress+Hauser Group, Badger Meter, Inc., OMEGA Engineering, Inc., Schneider Electric, Siargo Ltd. |

| Key Drivers | • Technological advancements in sensor technology, wireless communication, and data analytics are propelling the adoption of intelligent flow meters by enabling real-time monitoring and predictive maintenance, thereby improving operational efficiency. • The growing demand for automation in industries enhances accuracy, efficiency, and safety, leading to the seamless integration of intelligent flow meters into automated systems for improved flow management. |

| RESTRAINTS | • Data security concerns related to the connectivity of intelligent flow meters to IoT and cloud platforms may impede their adoption, especially in industries where privacy is paramount. |