Procurement and Supply Chain in Global Capability Centers Market Key Insights:

To Get More Information on Procurement and Supply Chain in Global Capability Centers Market - Request Sample Report

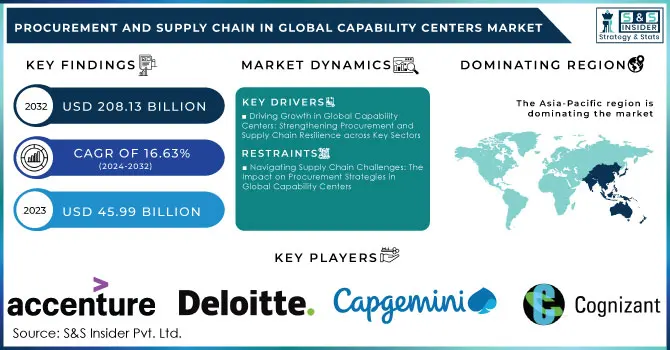

The Procurement and Supply Chain in Global Capability Centers Market Size was valued at USD 45.99 Billion in 2023, and is expected to reach USD 208.13 Billion by 2032, and grow at a CAGR of 16.63% over the forecast period 2024-2032.

The Procurement and Supply Chain in global capability centers market is witnessing transformative growth, particularly in the procurement and supply chain sectors, driven by the strategic need for cost efficiency and operational excellence. Organizations are increasingly establishing these centers in emerging markets to capitalize on lower labor costs while ensuring high operational standards. Reports indicate that companies leveraging capability centers can achieve savings of up to 30% on operational costs and enhance their supply chain processes by reducing lead times by approximately 25%. This trend is further enhanced by advancements in technologies such as artificial intelligence (AI) and blockchain, which facilitate smarter procurement strategies and improve supply chain visibility.

The diversification of supply chains through global market expansion is also gaining traction, allowing companies to mitigate risks associated with reliance on a single supplier or region. In fact, a recent survey revealed that over 70% of companies are prioritizing supply chain diversification to bolster resilience. As organizations adapt to post-pandemic realities, there is a growing emphasis on resilience in supply chain operations. Efficient procurement processes, driven by e-procurement solutions and data analytics, are becoming pivotal in addressing challenges such as rising costs and supply chain disruptions. Organizations are focusing on integrating sustainable practices into their procurement strategies, ensuring that their supply chains are not only cost-effective but also socially responsible.

The healthcare sector, for instance, is adopting innovative procurement models to tackle hidden supply costs while maintaining service delivery. In this evolving landscape, capability centers serve as essential hubs for innovation and efficiency, ultimately enabling organizations to enhance their competitive edge while navigating the complexities of global supply chains. This multifaceted approach positions the global capability centers market for sustained growth, emphasizing the importance of agility, technology adoption, and strategic sourcing in procurement and supply chain management.

| Source | Details |

|---|---|

| RE Global | The Asia-Pacific region is positioned as a critical hub for renewable supply chains, contributing to global sustainability efforts. |

| Supply Chain Digital | 79% of organizations believe building local capabilities can enhance supply chain resiliency against global disruptions. |

| GEP | Asia's suppliers recorded the fastest growth rate since early 2023, with a notable increase in global manufacturing activity. |

| Procurement Tactics | 79% of companies report that supply chain optimization is critical for ensuring business continuity. |

| Supply Chain Asia | Southeast Asia is highlighted as a key region for global supply chain resilience and adaptability. |

| PwC | 73% of businesses are actively seeking to diversify their supply chains to reduce risks. |

| PwC Digital Procurement Survey | Over 60% of companies indicate an increase in investments in digital procurement technologies. |

| ADB | Discusses the necessity of fostering resilient global supply chains in response to growing risks and uncertainties. |

| World Economic Forum | The evolution of supply chains in the Asia-Pacific region is accelerating, influenced by technological advancements. |

| Supply Chain Asia About Us | Collaborative efforts are being made to enhance supply chain capabilities across Asia. |

Expanding Role of Global Capability Centers in Procurement and Supply Chain Optimization

The procurement and supply chain landscape within the Global Capability Centers (GCC) market is undergoing significant expansion, fueled by evolving operational requirements, strategic outsourcing, and advancements in technology. As companies shift focus towards their core competencies, GCCs are emerging as vital hubs for effectively managing procurement operations and supply chains. Industry reports show that GCCs greatly enhance cost efficiency by streamlining procurement processes and improving supply chain visibility. This trend is particularly evident in India, where the GCC market has seen rapid growth, thanks to its vast talent pool and supportive regulatory framework. Increasingly, centers are being set up in tier-2 cities to capitalize on local expertise and reduce operational expenses.

Technological innovation is a major driver of this growth. Modern procurement systems that utilize artificial intelligence (AI), machine learning, and blockchain technologies are helping organizations handle complex, global supply chains more efficiently. These tools offer real-time data insights, enabling businesses to monitor supply chain performance, anticipate disruptions, and optimize procurement strategies. Reports highlight the crucial role of cloud-based procurement platforms in enhancing collaboration across global teams, allowing businesses to quickly adapt to supply chain challenges. This is particularly important in industries such as healthcare and pharmaceuticals, where supply chain resilience has been a critical focus, especially in the wake of disruptions like the COVID-19 pandemic.

Furthermore, sustainability is becoming a key focus for GCCs. Companies are integrating environmental, social, and governance (ESG) factors into their procurement strategies, encouraging GCCs to adopt sustainable sourcing practices and reduce their supply chain carbon footprint. Reports show that India's GCCs are aligning with these global sustainability goals by leveraging technology to create more efficient and environmentally friendly operations.

With the GCC market expected to grow significantly in the coming years, driven by increasing demand for cost-efficiency, supply chain transparency, and regulatory compliance, GCCs will play a critical role in maintaining global supply chain resilience and driving future market growth.

Market Dynamics

Drivers

- Driving Growth in Global Capability Centers: Strengthening Procurement and Supply Chain Resilience across Key Sectors

The procurement and supply chain operations within Global Capability Centers (GCCs) are evolving rapidly, particularly in key sectors like aerospace, technology, and semiconductors. For instance, the Indian government's approval of ₹26,000 crore for aero-engine procurement underlines the growing focus on indigenous capabilities, with Hindustan Aeronautics Limited (HAL) playing a central role in enhancing the country’s aerospace supply chain. Meanwhile, India's positioning as a trusted partner in the global semiconductor supply chain reflects its emerging role in supporting diversified supply chain operations. As global tech giants such as Google integrate nuclear energy into their AI data centers, it emphasizes the importance of sustainable procurement strategies and supply chain resilience to manage energy costs and disruptions. Furthermore, reports from the Council on Foreign Relations (CFR) highlight how the U.S. is focusing on improving supply chain policy through advanced procurement technologies, emphasizing the role of AI, cloud platforms, and block chain in optimizing supply chain transparency and efficiency within GCCs.

Restraints

- Navigating Supply Chain Challenges: The Impact on Procurement Strategies in Global Capability Centers

One significant restraint factor affecting procurement and supply chain operations within the Global Capability Centers (GCC) market is the ongoing supply chain disruptions faced by the healthcare sector, particularly hospitals. As highlighted in reports, over 200 hospitals across the U.S. are grappling with critical supply shortages, which have been exacerbated by global events, including pandemics and geopolitical tensions. The COVID-19 pandemic alone has caused a surge in demand for essential medical supplies, leading to shortages of vital medications and equipment. These shortages not only hinder hospitals' ability to procure necessary supplies but also drive up costs, leading to inefficiencies in the supply chain. For GCCs supporting healthcare organizations, this translates to increased pressure to maintain inventory levels and ensure timely delivery of products, which can strain operational capacities. Additionally, 45% of hospitals have reported delays in surgical procedures due to supply chain issues, forcing them to adapt to fluctuating demand patterns. This volatility highlights the need for robust supply chain resilience and adaptability, which are crucial for maintaining efficient operations. As GCCs navigate these challenges, they must enhance their procurement practices by leveraging technology and adopting flexible supply chain solutions to mitigate disruptions and ensure continuity in service delivery. The ability to respond quickly to market changes and maintain inventory will be essential for GCCs to thrive in the evolving landscape of global supply chains.

Segment Analysis for Procurement and Supply Chain in Global Capability Centers

By Function

In 2023, Procurement accounted for approximately 60% of the total revenue in the global procurement and supply chain market, underscoring its significant impact. This dominance stems from several key factors. First, organizations are increasingly recognizing the importance of streamlined procurement processes to enhance operational efficiency. By outsourcing these functions to specialized providers, companies can concentrate on their core activities while leveraging external expertise and resources. Additionally, the need for cost reduction has driven businesses to utilize procurement services, enabling them to negotiate better pricing and terms with suppliers, thereby lowering total ownership costs. The integration of advanced technologies, such as artificial intelligence (AI) and data analytics, has transformed procurement practices, making services more appealing for organizations seeking agility and efficiency. Furthermore, as sustainability becomes a priority, procurement services are adapting to include responsible sourcing and align with environmental, social, and governance (ESG) standards. This trend is increasingly influencing procurement decisions. Lastly, globalization necessitates specialized procurement expertise, particularly as companies expand into emerging markets. Overall, the significant share of procurement services in the market highlights its crucial role in driving operational efficiency, cost savings, and strategic adaptability, positioning it for continued growth in the future.

By Services Type

In 2023, Procurement Services became a leading segment in the global capability centers market, accounting for approximately 30% of total revenue in procurement and supply chain services. This remarkable performance can be attributed to several key factors that underscore the significance of procurement services in the market. Organizations increasingly seek operational efficiency by outsourcing procurement functions to specialized centers, allowing them to focus on their core competencies while leveraging expert service providers to manage procurement effectively. Cost reduction is another driving force, as companies utilize procurement services to negotiate better pricing and contract terms with suppliers, thereby achieving a lower total cost of ownership. Additionally, the integration of advanced technologies like artificial intelligence (AI) and data analytics has transformed procurement practices, making these services more attractive to businesses aiming to enhance efficiency and agility in their supply chains. As sustainability becomes a priority, procurement services are evolving to incorporate responsible sourcing practices that align with environmental, social, and governance (ESG) standards. Furthermore, the globalization of supply chains necessitates specialized procurement expertise to navigate complex markets. Overall, the growing demand for procurement services reflects their vital role in promoting operational efficiency, cost savings, and sustainability within organizations.

Regional Analysis for Procurement and Supply Chain in Global Capability Centers

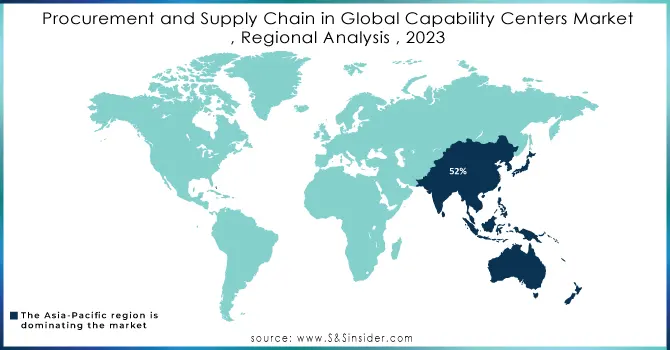

In 2023, the Asia-Pacific region solidified its position as a leader in the global capability centers market for procurement and supply chain services, capturing around 52% of total revenue. This dominance is driven by several factors, including robust economic growth in emerging economies like India and China, where government initiatives significantly enhance the business landscape. The region boasts a large talent pool, with global capability centers projected to hire 40% more fresh graduates this year to meet rising demand for skilled procurement and supply chain professionals. Technological advancements also play a crucial role, as companies increasingly leverage innovations such as AI and data analytics to optimize their supply chains, highlighted by Google's significant investments in the smartphone market. Organizations are focusing on cost efficiency by outsourcing procurement functions, exemplified by PSA Singapore's expansion of its supply chain facility at Tuas Port. Furthermore, increased participation in global trade has amplified the need for specialized procurement services. Supportive government initiatives across the region continue to foster a conducive environment for business growth, as demonstrated by events like the Asia Digital Supply Chain Innovation Summit 2024, emphasizing the region’s commitment to advancing supply chain management.

Following Asia-Pacific, Europe holds approximately 16% of the market share. The region's established businesses prioritize efficient supply chain management while adhering to stringent regulatory frameworks. European companies are increasingly adopting innovative technologies to enhance procurement practices, enabling them to remain competitive in a rapidly changing global environment.

North America captures around 14% of the market, where organizations are focused on leveraging technology to optimize procurement processes and enhance supplier relationships. This region's mature market benefits from advanced infrastructure and a strong emphasis on efficiency, driving demand for specialized procurement services.

South America contributes 12% to the market, reflecting a growing interest in improving supply chain efficiencies amid economic fluctuations and the need for sustainable practices. Lastly, the Middle East and Africa, accounting for 8%, are gradually increasing their focus on global supply chain integration and foreign investments, despite facing challenges related to infrastructure and regulatory complexities.

Do You Need any Customization Research on Procurement and Supply Chain in Global Capability Centers Market - Inquire Now

Key Players

Some of the Major Players in Procurement and supply chain in Global Capability Centers with their product:

-

Accenture (Procurement Outsourcing)

-

Deloitte (Supply Chain Consulting)

-

IBM (IBM Watson Supply Chain)

-

Capgemini (Supply Chain and Operations Consulting)

-

Infosys (Digital Automation Tools)

-

Tata Consultancy Services (TCS) (Procurement Management Services)

-

Wipro (Analytics and Automation Solutions)

-

Cognizant (Digital Transformation Consulting)

-

SAP (SAP Ariba)

-

Oracle (Oracle Procurement Cloud)

-

Amazon Web Services (AWS) (Cloud Computing Services)

-

HCL Technologies (Procurement Solutions)

-

KPMG (Advisory Services)

-

Siemens (Digital Industries Software)

-

Zebra Technologies (Supply Chain Visibility Solutions)

-

GE Digital (Predix Platform)

-

JDA Software (Blue Yonder) (Supply Chain Planning Solutions)

-

GEP Worldwide (GEP SMART)

-

LTI (Larsen & Toubro Infotech) (Supply Chain Optimization Services)

-

Manhattan Associates (Warehouse Management Systems)

List of some others notable suppliers providing third-party services for procurement and supply chain in the global capability center market:

-

HCL Technologies

-

Tech Mahindra

-

CGI Group

-

ManpowerGroup

-

Robert Half

-

Allegis Group

-

Zensar Technologies

-

Mu Sigma

-

L&T Technology Services

-

Sourcing Solutions

Recent Developments

-

On November 7, 2023, S&P Global Market Intelligence introduced the Supply Chain Console, a new platform that consolidates extensive supply chain data, including over 2 billion shipment records and insights into trade, pricing, and risk analysis. This solution aims to enhance decision-making by providing businesses with forward-looking insights to navigate complex supply chain dynamics

-

On May 23, 2024, Xeneta published an article outlining the top 10 global supply chain risks for 2024. The piece highlights significant challenges such as geopolitical instability, rising fuel costs, and evolving trade regulations, which could adversely affect supply chain efficiency and resilience. The report emphasizes the importance for businesses to proactively manage these risks to ensure operational stability amid a complex global environment.

-

On August 16, 2024, it was reported that Chinese new energy vehicle (NEV) companies are expanding their global footprint by establishing overseas factories in regions like Thailand and Eastern Europe, enhancing resilience against export restrictions. This strategic shift is part of China's effort to transition from product export to brand and capacity export, positioning itself to maintain a dominant share of the NEV market by 2030

-

On June 24, 2024, it was reported that a global power shortage is severely affecting the data center market, leading to declining vacancy rates and heightened competition for available capacity. Markets like Singapore are particularly affected, with a vacancy rate of just 1% and only 7.2 MW of capacity available, illustrating the challenges faced by large corporations in securing data center resources amid low supply and construction delays.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 45.99 Billion |

| Market Size by 2032 | USD 208.13 Billion |

| CAGR | CAGR of 16.63% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Function ( Procurement Services, Supply Chain Services) • By Services Type(Procurement Services, Supply chain Management Services , Business process outsourcing, Information Technology (IT) Services, Business Process Management (BPM)) • By Industry (Manufacturing, Retail and E-commerce, Healthcare and Life Sciences, Banking, Financial Services, and Insurance (BFSI)) • By Organization Size(Large Enterprises, Small & Medium Enterprises (SMEs), Startups) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Accenture, Deloitte, IBM, Capgemini, Infosys, Tata Consultancy Services (TCS), Wipro, Cognizant, SAP, Oracle, Amazon Web Services (AWS), HCL Technologies, KPMG, Siemens, Zebra Technologies, GE Digital, JDA Software (Blue Yonder), GEP Worldwide, LTI (Larsen & Toubro Infotech), Manhattan Associates. |

| Key Drivers | • Driving Growth in Global Capability Centers: Strengthening Procurement and Supply Chain Resilience across Key Sectors |

| RESTRAINTS | • Navigating Supply Chain Challenges: The Impact on Procurement Strategies in Global Capability Centers |