Retail Ready Packaging Market Report Scope & Overview:

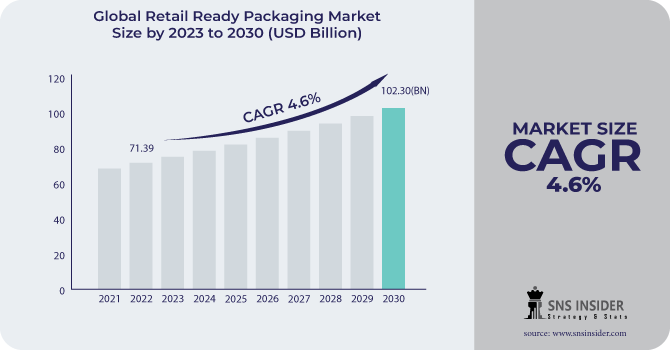

The Retail Ready Packaging Market size was USD 74.7 billion in 2023 and is expected to Reach USD 107 billion by 2031 and grow at a CAGR of 4.6% over the forecast period of 2024-2031.

Retail packaging, also known as shelf-ready packaging, refers to the packaging of products for sale that are easy to carry without an outer box. This package is eco-friendly and can store a large number of products at once.

Get More Information on Retail Ready Packaging Market - Request Sample Report

The growing number of supermarkets and retail outlets has increased the demand for retail packaging, thus increasing the demand for retail packaging. Also, high growth in food and beverage applications and pharmaceutical applications will have a significant impact on the growth of retail packaging during the forecast period. For the above reasons, the establishment of rapidly growing mass retailers and club stores as well as small stores is also expected to stimulate the demand for the retail ready-to-use packaging market, which is expected to grow at a considerable rate during the forecast period. In addition, rising global cosmetics sales and increasing technological innovations for producing highly secure packaging are expected to drive the growth of the retail packaging market during the forecast period mentioned above.

A key factor positively driving demand for retail packaging is the ongoing trend toward recyclable packaging. Similarly, different manufacturers of different consumer goods are demanding multi-pack folding boxes that help in multi-branding and cost reduction, providing various growth opportunities for retail ready-made packaging market growth during the forecast period.

However, rapid growth in the e-commerce packaging sector and the ready availability of high-performance substitutes are also expected to hamper the growth of the retail ready-made packaging market over the forecast period mentioned above. The use of materials and product specifications along with increased packaging densities and rising supply chain costs may threaten the growth of the retail prepackaged packaging market.

MARKET DYNAMICS

KEY DRIVERS:

-

Rising Demand from retail sector will give growth to the market

The die-cut display container market has been primarily driven by the development of the retail sector. Due to the expansion of hypermarkets and supermarkets, the die cut display container market is also growing. They provide product safety. A growing middle class and increased consumption of processed foods will also boost the ready-made retail market.

-

Technological advancements in printing which increased the brand image and demand for retail ready packaging

RESTRAIN:

-

Growth of e-commerce sector will affect the retail ready packaging

OPPORTUNITY:

-

Growth of paper and paper boards to propel the growth of the retail packaging market

Paper and cardboard are the main materials used to make boxes and other retail packaging. Therefore, the growth of paper and paperboard will affect the growth of the retail packaging market.

-

Growth in food industry will give growth to retail ready packaging.

CHALLENGES:

-

Cost of manufacturing is higher which can affect the market growth.

IMPACT OF RUSSIAN UKRAINE WAR

Global retailers and consumer packaged goods (CPG) makers were affected by Russia's February 2022 invasion of Ukraine. The Russian invasion has prevented ships and air cargo, including food, from leaving Ukraine to destinations around the world. As a result, demand for packaged food is reduced. Declining exports from Ukraine quickly drove up prices for food & beverages industry.

Both Ukraine and Russia are among the world's top five exporters of packaging material accounting for 18.9% of exports before the war. Now they strain global supply chains and drive up prices. Raw material prices rose 16% in April 2022. Countries that rely on food imports from Ukraine and Russia, especially the Middle East and Africa, have been hit hard by global food inflation and potential food shortages also affecting the retail ready packaging market growth.

IMPACT OF ONGOING RECESSION

A recession puts finances and businesses at risk. All costs are affected, including costs associated with the product and its packaging. The food packaging film market may be affected in various ways by the ongoing economic recession. Declining demand for packaged food may indirectly affect the demand for food packaging films due to lower consumer spending and increased price sensitivity. Demand for certain types of packaging films could be affected if consumer preferences shift to lower-cost alternatives. Manufacturers can implement cost-reduction strategies to meet economic challenges. This includes finding cheaper packaging options and reducing your overall packaging costs. The exact impact on the food packaging film market will depend on the depth and duration of the recession, the state of the local economy, and the nature of the industry. Many retail stores may stop operating due to the unavailability of capital. According to one survey conducted, there are chances that if a sudden recession arrives the retail stores will face a loss of around 20-25% and 12% of small retailers will close their businesses.

KEY MARKET SEGMENTS

By Material

-

Plastic

-

Paper

-

Paperboards

By Packaging Type

-

Die Cut Display Containers

-

Shrink Wrapped Trays

-

Corrugated Cardboard Boxes

-

Modified Cases

-

Plastic Containers

By End User

-

Food & Beverages

-

Pharmaceuticals

-

Household

-

Others

.png)

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS

North America is the leading market for retail packaging due to the presence of an established retail industry and large retail chains. The region focuses on sustainable packaging solutions and promotes the use of environmentally friendly and recyclable materials. The demand for ready-to-sell packaging is also driven by the growth of the e-commerce sector and the need for efficient packaging for online retail. The market is characterized by an emphasis on innovative design, customization and in-store appeal that attracts consumers.

Europe is another important market for retail packaging. The region has strict regulations on packaging waste disposal and sustainability, resulting in high demand for environmentally friendly solutions. There is also a growing focus on reducing food waste, driving the need for retail packaging that reliably protects products and extends shelf life. In addition, the growth of organized retail and the rise of convenience stores are contributing to the expansion of the European market.

The retail packaging market in the Middle East and Africa region is affected by factors such as expanding retail sector, urbanization and the emergence of modern retail formats. Market dynamics in the region vary from country to country, with economic development and urbanization leading to greater acceptance of retail packaging in some countries. Demand for efficient shelf replenishment, attractive branding, and customization to suit different consumer tastes is driving market growth.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Retail Ready Packaging market are Smurfit Kappa, International Paper, WestRock Company, DS Smith, Weedon Group Ltd, Mondi, Kapco Packaging, Georgia-Pacific, Packaging Corporation of America, SIG Combibloc Group Ltd and other players.

International Paper-Company Financial Analysis

RECENT DEVELOPMENT

-

A new sustainable, shelf-ready packaging solution called DD Wrap has been launched by DS Smith.

-

Solidus Solutions present its Future line range of retail-ready packaging solutions for fruit and vegetables.

-

Tyson Foods is introducing packaging for case-ready beef products with flow wrap.

| Report Attributes | Details |

| Market Size in 2023 | US$ 74.7 Bn |

| Market Size by 2031 | US$ 107 Bn |

| CAGR | CAGR of 4.6% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Plastic, Paper, Paperboards) • By Packaging Type (Die Cut Display Containers, Shrink Wrapped Trays, Corrugated Cardboard Boxes, Modified Cases, Plastic Containers) • By End User (Food & Beverages, Pharmaceuticals, Household, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Smurfit Kappa, International Paper, WestRock Company, DS Smith, Weedon Group Ltd, Mondi, Kapco Packaging, Georgia-Pacific, Packaging Corporation of America, SIG Combibloc Group Ltd |

| Key Drivers | • Rising Demand from retail sector will give growth to the market • Technological advancements in printing which increased the brand image and demand for retail ready packaging |

| Market Restraints | • Growth of e-commerce sector will affect the retail ready packaging |