Bag-in-Box Container Market Key Insights:

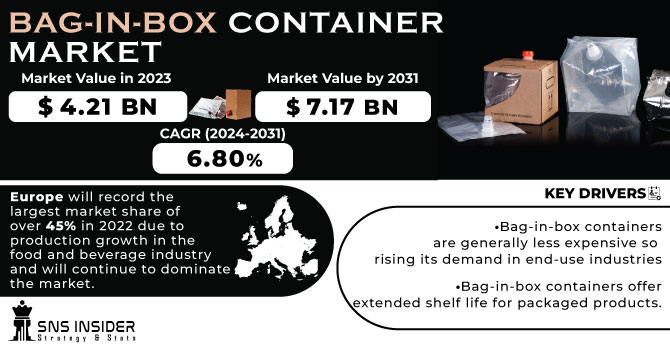

The Bag-in-Box Container Market size was USD 4.21 billion in 2023 and is expected to Reach USD 7.17 billion by 2031 and grow at a CAGR of 6.80 % over the forecast period of 2024-2031.

The growth of the industry is due to increasing demand from various industries such as food and beverages and household products. Increasing consumer preference for packaged natural foods is expected to drive market growth during the forecast period.

Get More Information on Bag-in-Box Container Market - Request Sample Report

Due to the increasing demand for beverages, the market is expected to increase the demand for bag-in-box containers in the food and beverage industry. In 2022, US generated over $1.2 billion in sales from its organic wine exports. Consumer health concerns and increasing demand for packaged natural and liquid food products are driving the growth of the bag-in-box container products market in the country.

Increasing consumption of bag-in-box containers, especially 3-liter size, by various wine brands is expected to drive the growth of Bag in box containers during the forecast period. In addition, the advantages that containers offer in alcohol packaging have led manufacturers to see increased demand for their products. In addition, the large surface area of bag-in-box containers offers more space and colorful text and graphics than traditional bottle labels, which is expected to drive market growth during the forecast period.

In addition, the development of innovative and unique packaging technology in various segments including soft drinks, food and household segments is expected to drive the market growth. Manufacturers focus on producing eco-friendly packaging using biodegradable plastics materials, which is expected to bring in profits during the forecast period.

MARKET DYNAMICS

KEY DRIVERS:

-

Bag-in-box containers are generally less expensive so rising its demand in end-use industries

Flexible film bags used in bag-in-box packaging are usually less expensive than rigid packaging materials such as bottles and cans. In addition, these containers take up less storage space and are lighter, which reduces shipping costs.

-

Bag-in-box containers offer extended shelf life for packaged products.

RESTRAIN:

-

Unavailability of certain raw materials in major restrain

Bag-in-box containers usually require certain types of packing materials such as films, valves and fittings. These materials may be in limited supply or sourced from specific suppliers, which can create material sourcing and cost issues. Reliance on limited supply chains can affect the stability and flexibility of bag-in-box container production lines.

OPPORTUNITY:

-

Growth of BIB market in other industries can provide growth opportunities

While bag-in-box containers are commonly used in beverages, there are opportunities to expand their application into other industries. The food industry can use bag-in-box containers for sauces, oils, and condiments, while the industry can consider using them for chemicals, detergents, and other liquid products. By opening up new market segments, the market for bag-in-box containers is likely to register significant growth.

-

The growth of e-commerce and direct-to-consumer channels is creating opportunities for the bag-in-box container market.

CHALLENGES:

-

Setting up recycling infrastructure is a challenge for industries

Bag-in-box containers are generally recyclable, but recycling infrastructure and processes are not well established in all regions. Collecting, sorting and recycling multi-layer bag-in-box packaging can be challenging. Addressing this challenge requires the development of efficient recycling and waste management systems, especially for bag-in-box containers.

IMPACT OF RUSSIAN UKRAINE WAR

Due to the conflict, many companies stopped production and business in Russia. For example, Smurfit Kappa has completely exited from Russia. Prices of raw materials such as plastic were increased due to less export of petroleum-related products. The US banned the import of oil from Russia. So crude oil prices went to $100/barrel. Due to this, there was less production which caused the rise of prices at the consumer end.

Polyethylene suppliers and Polypropylene suppliers increased prices by 4 % and again by 6 % due to the high implications of the war on the businesses. Clariant has announced that it will cease business with Russia with immediate effect. Clariant's Russian operations, which include a sales office and laboratory in Moscow, account for approximately 2% of the company's annual turnover.

IMPACT OF ONGOING RECESSION

Inflation is showing a rise and will affect the overall industry. In June 2022, inflation was at 30 % which has risen to 48 % by 2023. The manufacturing supply chain is getting affected due to the recession which will affect the growth of the market during the recession period.

Plastic resin costs will increase during a recession. Since resin is the main raw material used to manufacture these products, increased spending translates into higher spending and thus higher prices for consumers. This could reduce the demand for plastic and encourage people to look for cheaper alternatives.

Federal Reserve raised interest rates 7 times during 2022, hence it became difficult for companies to borrow money to finance investments. This could lead to delays in projects and will affect the growth of the market. The plastics industry uses debt to fund processes.

These factors are likely going to affect the Bag in Box container market and its production during the time of recession.

KEY MARKET SEGMENTS

By Material

-

Plastic

-

PET

-

Polyethylene

-

Metallized Polyester

-

Others

By Capacity

-

5 litres

-

5-10 litres

-

10-15 litres

-

15-20 litres

-

More than 20 litres

By Application

-

Household Products

-

Industrial Liquids

-

Alcoholic Beverages

-

Others

REGIONAL ANALYSIS

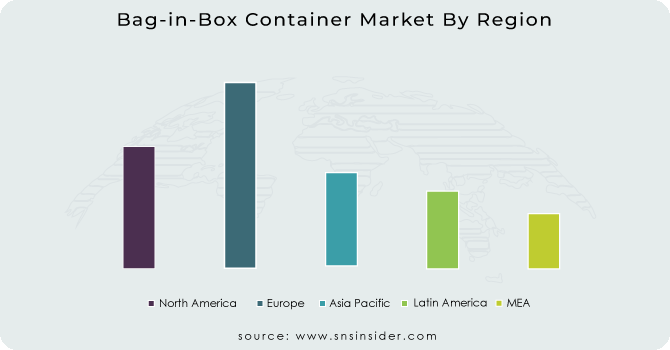

Europe will record the largest market share of over 45% in 2022 due to production growth in the food and beverage industry and will continue to dominate the market. Changing consumption preferences of consumers, increasing urbanization, and the rising popularity of such packaging solutions are expected to drive market growth during the forecast period. Countries such as Germany, the United Kingdom and Russia are expected to see increased demand from the food industry. Changes in consumer eating habits and a shift towards healthier, organic foods have increased the demand for natural alternatives in food. These factors are expected to increase the demand for bag-in-box container packaging in the food and beverage industry during the forecast period.

Asia-Pacific will grow at the CAGR of 7.5% during the forecast period 2023-2030, owing to the increase in per capita income accompanying industrialization. Rapid growth of bag-in-box containers in household, food and beverage, and industrial liquid end-use industries is expected to drive the market during the forecast period. Factors such as emerging economies, increasing purchasing power, younger populations, increasing urbanization, growth in fast-moving consumer goods markets, and increased interest in growing bag-in-box health and wellness markets have created significant It is one of the developing regions. container industry during the forecast period.

A growing population and high disposable income make China one of the most important consumer markets for food and beverages in the world. Changes in consumer behavior in China, increased local competition, fragmented distribution, increased dual income, growing interest in health foods, and growing preference for foreign foods have all contributed to the growth of the food and beverage sector. Central and South America has witnessed significant growth in the food and beverage market in recent years, owing to heavy investments in the country's manufacturing sector, due to which there will be impact on the bag-in-box container market. Moreover, increasing urbanization in countries such as Brazil and Argentina and increasing purchasing power of consumers are expected to increase the market share during the forecast period.

Middle Eastern and African countries such as South Africa are among the largest importers of food and beverages. The population growth in the region and the increasing disposable income of consumers are creating a high demand for high-quality organic food. However, the region's manufacturing industry is growing slower than other regions due to its geographical disadvantage and lack of availability of raw materials. Hence this region will show slow growth.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Bag-in-Box market are Arlington Packaging (Rental) Limited, Amcor Ltd, DS Smith, CDF Corporation, Optopack Ltd, Aran Group, Hangzhou Hansin New Packing Material Co., Ltd, Central Package & Display, Scholle IPN, Smurfit Kappa and other players.

Amcor Ltd-Company Financial Analysis

RECENT DEVELOPMENTS

-

Smurfit Kappa, presents its patented Vitop Uno tap for bag-in-box applications. This will be the first on the market with tamper-proof features.

-

Fenton Packaging Solutions, offers UN bag-in-box (BIB) containers as an alternative to traditional rigid liquid packaging.

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.21 Bn |

| Market Size by 2031 | US$ 7.17 Bn |

| CAGR | CAGR of 6.80 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Plastic, Paper & Paperboards, PET, Polyethylene, Metallized Polyester, Others) • By Capacity (5 litres, 5-10 litres, 10-15 litres, 15-20 litres, More than 20 litres) • By Application (Household Products, Industrial Liquids, Alcoholic Beverages, Non-Alcoholic Beverages, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Arlington Packaging (Rental) Limited, Amcor Ltd, DS Smith, CDF Corporation, Optopack Ltd, Aran Group, Hangzhou Hansin New Packing Material Co., Ltd, Central Package & Display, Scholle IPN, Smurfit Kappa |

| Key Drivers | • Bag-in-box containers are generally less expensive so rising its demand in end-use industries • Bag-in-box containers offer extended shelf life for packaged products. |

| Market Restraints | • Unavailability of certain raw materials in major restrain |