RFID Readers Market Report Scope & Overview:

RFID Readers Market was valued at USD 14.06 billion in 2023 and is expected to reach USD 36.89 billion by 2032, growing at a CAGR of 11.37% from 2024-2032. This report includes insights on demand & adoption metrics, supply chain & production statistics, cost & pricing trends, regulatory & compliance metrics, and investment trends. The market is experiencing significant growth due to increasing demand for automated tracking solutions across industries such as retail, logistics, healthcare, and manufacturing. Advances in IoT and cloud-based RFID solutions are further driving adoption. However, regulatory challenges and pricing fluctuations impact market expansion. Investments in R&D and supply chain optimization are expected to shape future growth.

Get more Information on IPS Displays Market - Request Sample Report

Market Dynamics

Drivers

-

RFID Readers Transform Retail & Logistics with Real-Time Inventory Tracking, Enhanced Supply Chain Efficiency, and Automated Asset Management

Growing demand for real-time inventory visibility, asset tracking, and supply chain optimization is driving the use of RFID readers in the retail and logistics sectors. Retailers utilize RFID technology to enhance stock accuracy, minimize shrinkage, and maximize customer satisfaction through product availability. In logistics, RFID readers automate warehouse processes, facilitate automatic tracking of shipments, and maximize overall supply chain efficiency. Multiple scanning and data retrieval without line-of-sight facilitate greater operational speed and accuracy. As e-commerce continues to increase and consumers' expectations for expedited delivery become higher, organizations are adopting RFID solutions to optimize inventory management with no seams, minimize operational expenditures, and derive a competitive advantage in an accelerating marketplace environment.

Restraints

-

High Costs and Complex Implementation Slow RFID Reader Adoption for Small and Mid-Sized Businesses, Limiting Market Growth and Integration

The installation of RFID readers calls for a high upfront cost in hardware, software integration, and infrastructure renewal, which is a stumbling block for small and mid-sized companies. The cost of RFID tags, readers, and related systems contributes to the expense, further compounded by the additional expense for employee training and maintenance on an ongoing basis. Most companies are reluctant to implement RFID technology because of return on investment concerns, especially in sectors with limited budgets. Integration with existing IT infrastructures can also be challenging, demanding specialized skills and extra resources. These technical and financial hurdles delay adoption rates, hindering most organizations from taking advantage of the full potential of RFID solutions for improved operational effectiveness and supply chain optimization.

Opportunities

-

RFID Integration with IoT, AI, and Automation Boosts Operational Efficiency, Enhancing Tracking, Inventory Control, and Smart Manufacturing Processes

Growing usage of IoT, AI, and automation is revolutionizing the application of RFID readers across industries by facilitating smooth real-time data transfer and smart decision-making. Organizations are using RFID-integrated IoT systems to improve asset tracking, predictive maintenance, and operational transparency. In production, RFID readers facilitate intelligent production lines through automated stock management and minimised downtime. RFID-driven analytics by retailers optimize inventories and customer experiences, and logistics providers leverage automated tracking and fleet management for supply chain efficiency. As digital transformation in Industry 4.0 quickens, RFID technology continues to grow, enabling enterprises with innovative processes to minimise expenses and increase productivity in an ever-more interconnected world.

Challenges

-

RFID Reader Performance is Affected by Metals, Liquids, and Environmental Interference, Leading to Signal Disruptions and Reduced Accuracy

RFID technology is subject to substantial limitations because of interference caused by metals, liquids, and environmental factors, weakening signal strength and decreasing accuracy. In the manufacturing and warehouse settings, metal surfaces reflect RFID signals, resulting in read errors or loss of signal, and liquids absorb radio waves, which complicate effective tracking of items with tags. Temperature, humidity, and electromagnetic interference from surrounding devices are additional influences on system reliability. Companies applying RFID to mission-critical applications like healthcare, logistics, and manufacturing invest in proprietary RFID tags and readers that are able to counteract these issues. With industries calling for more robust solutions, continued research in RFID antenna design and frequency tuning is focused on enhancing performance in challenging environments.

Segment Analysis

By System

The Passive RFID System segment dominated the RFID Readers Market in 2023 and held a market share of nearly 77% of the market. The factor behind this market dominance is the cost savings associated with it, its longer lifecycle, and their extensive usage by industries including retail, logistics, healthcare, and manufacturing. As passive RFID tags do not demand an inbuilt power source, they are cheap and fit large-scale implementation well. Their capability to enable high-volume tracking, inventory management, and supply chain optimization has also consolidated their leadership position in the market.

The Active RFID System segment expected to grow at the fastest CAGR of 13.39% during 2024-2032 due to increased demand for real-time location tracking and asset monitoring in logistics, defense, and healthcare industries. In contrast to passive RFID, active RFID tags contain an internal battery, which allows for long-range communication and constant data transmission. This makes them suitable for tracking high-value assets, vehicle fleets, and personnel in large buildings, driving their fast growth and market penetration.

By Application

The Retail segment was the leader in the RFID Readers Market in 2023 with around 29% revenue share, spurred by the high uptake of RFID in inventory management, theft protection, and smooth checkout solutions. Retailers employ RFID to enhance accuracy of stock, automate restocking, and raise the level of customer experience. The e-commerce and omnichannel retailing growth have further fueled demand as companies aim to get real-time visibility into supply chains and into store operations for the sake of maximizing efficiency and minimizing losses.

The Industrial application segment expected to grow at the fastest CAGR of 15.19% during 2024-2032, driven by increased automation, Industry 4.0 technology, and asset tracking requirement in manufacturing and logistics. RFID readers boost organizational efficiency through the ability to track raw materials, tools, and finished goods in real time. The demand for smart factories, predictive maintenance, and efficient supply chains is propelling heightened adoption, as companies want more accuracy, efficiency, and cost-reduction in their manufacturing and distribution practices.

By Frequency

The High Frequency (HF) RFID segment accounted for the maximum market share of the RFID Readers Market in 2023 with around 47% due to high uptake across such applications as access control, payment systems, and healthcare. HF RFID has a mid-range frequency, providing improved performance in metal and liquid environments over UHF. It is commonly used in NFC devices, public transit cards, and secure identification systems, and is the industry choice for applications that need secure short-range communication and data protection.

The Ultra-High Frequency (UHF) RFID segment expected to grow at the fastest CAGR of 12.40% during the period from 2024 to 2032, underpinned by its higher read range, quicker data transfer rate, and greater use in logistics, retail, and industrial automation. UHF RFID allows bulk scanning of tagged products, thus being suitable for large-scale inventory management and supply chain optimization. As companies pursue greater efficiency and real-time visibility, the capacity of UHF RFID to deliver high-speed data capture over long ranges is driving its market growth.

By Component

The Tags segment accounted for the largest share of the RFID Readers Market in 2023 with about 41% revenue share, attributed to increasing use of RFID tags for inventory tracking, asset management, and supply chain operations. RFID tags are the integral elements of RFID systems that facilitate effortless identification and real-time data capture. Their low cost, robustness, and applicability across various industries like retail, healthcare, and logistics make them universally accepted. The growing use of smart labels and item-level tagging further solidifies their market leadership.

Middleware segment expected to grow at the fastest CAGR of 13.81% during 2024 to 2032 due to growing demands for secure, efficient RFID hardware-venture application integration. Middleware ensures clean processing, processing, and transit of RFID information to venture administration systems to optimize ventures' flow and data veracity. As companies embrace RFID for automation and immediate decision-making, there is increasing demand for sophisticated middleware solutions that provide more analytics, security, and interoperability across platforms.

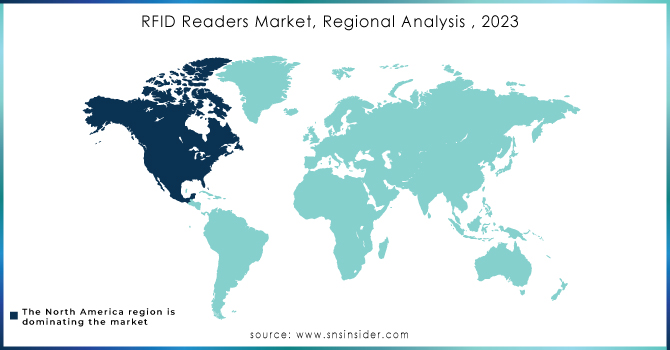

Regional Analysis

The North America market led the RFID Readers Market in 2023, with a market share of around 37%, on account of robust adoption in retail, healthcare, logistics, and manufacturing sectors. The availability of top RFID solution vendors, coupled with significant investments in automation and integration with IoT, has driven the market. Government mandates for the use of RFID in industries like pharmaceuticals and defense have further increased demand. Extensive use in smart payment systems and access control solutions has further strengthened the dominance of North America in the market.

The Asia Pacific is anticipated to grow at the fastest CAGR of 12.96% during 2024-2032 due to speedy industrialization, growth in e-commerce, and smart technology adoption. Increasing government efforts towards digital transformation and supply chain optimization are fueling the adoption of RFID in manufacturing and logistics. The retail explosion, growing demand for contactless payment options, and rising investments in smart city initiatives also add to the region's high growth prospects, which makes it a prime driver of market growth.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

Zebra Technologies(FX9600, RFD40)

-

Avery Dennison Corporation(AD-229r6, AD-237r6)

-

Honeywell International Inc. (IF2B, IH40)

-

HID Global Corp. (TS100, iCLASS SE)

-

Datalogic S.p.A. (RFID UHF Handheld, DLR-BT001)

-

Impinj, Inc. (Speedway R420, R700)

-

GAO RFID Inc. (216007, 216031)

-

Alien Technology LLC (ALR-F800, ALR-H460)

-

CAEN RFID S.r.l. (R4300P, QuarkUp)

-

Xemelgo, Inc. (Xemelgo Edge, Xemelgo Cloud)

-

Linxens (Elyctis e-ID Reader, HF Dual Interface)

-

Identiv, Inc. (uTrust 3700 F, uTrust 4701 F)

-

Jadak (ThingMagic Sargas, ThingMagic M6e)

-

Unitech Electronics Co., Ltd. (RP902, RS804)

-

GlobeRanger (iMotion Edgeware, iMotion Stratus)

-

ORBCOMM Inc. (IDP-800, ST-6100)

-

Nedap (iD Top, iD Hand)

-

NXP Semiconductors (Pegoda CLRD710, CLRC663)

-

Invengo Technology(XC-RF812, XC-RF850)

Recent Developments:

-

In January 2024, Zebra Technologies introduced new solutions at NRF 2024 to enhance modern retail operations. The innovations focus on improving efficiency, inventory management, and the customer experience through advanced automation and data-driven insights.

-

February 2025: Avery Dennison and its partners will present an RFID-enabled digital ID solution at Pharmapack 2025 to enhance traceability for pre-filled syringes. This innovation aims to improve patient safety, reduce counterfeit risks, and optimize pharmaceutical supply chain transparency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 14.06 Billion |

| Market Size by 2032 | USD 36.89 Billion |

| CAGR | CAGR of 11.37% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Tags, Antennas, Readers, Middleware) • By System (Active RFID System, Passive RFID System) • By Frequency (Low Frequency (LF) RFID, High Frequency (HF) RFID, Ultra-high Frequency |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Zebra Technologies Corp., Avery Dennison Corp., Honeywell International Inc., HID Global Corp., Datalogic S.p.A., Impinj, Inc., GAO RFID Inc., Alien Technology LLC, CAEN RFID S.r.l., Xemelgo, Inc., Linxens, Identiv, Inc., Jadak, Unitech Electronics Co., Ltd., GlobeRanger, ORBCOMM Inc., Nedap, NXP Semiconductors, Invengo Information Technology Co., Ltd. |