Optical Amplifiers Market Size & Trends:

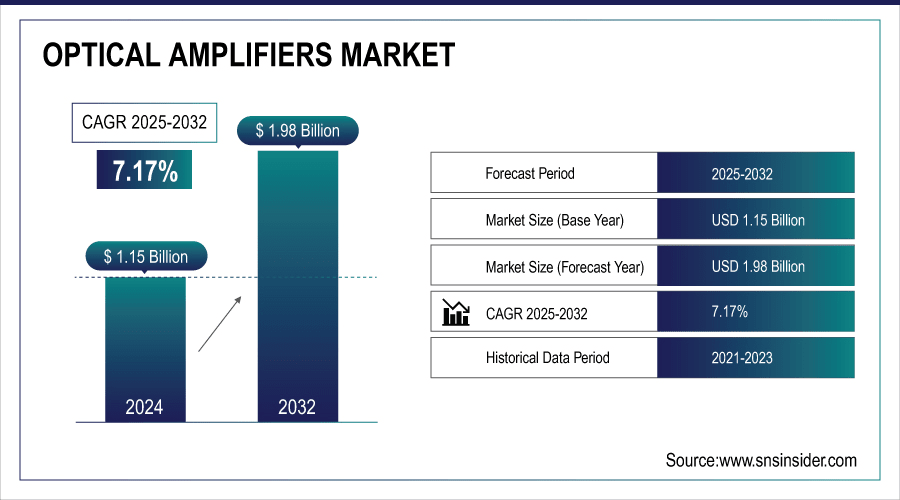

The Optical Amplifiers Market Size was valued at USD 1.15 billion in 2024 and is expected to reach USD 1.98 billion by 2032 and grow at a CAGR of 7.17 % over the forecast period of 2025-2032.

To Get More Information On Optical Amplifiers Market - Request Free Sample Report

The global optical amplifiers market growth is mainly boosted by increasing global data traffic and the extensive deployment of the fiber optic cable. Expansion of market is supported by increase in the telecom infrastructure and demand for high-speed internet and cloud-based services. Emergence of new technology and growing investment in network capacity continue to create a positive market outlook.

According to research, over 70% of new network infrastructure deployments in 2024 involved fiber optic cables, reflecting the shift toward high-speed broadband.

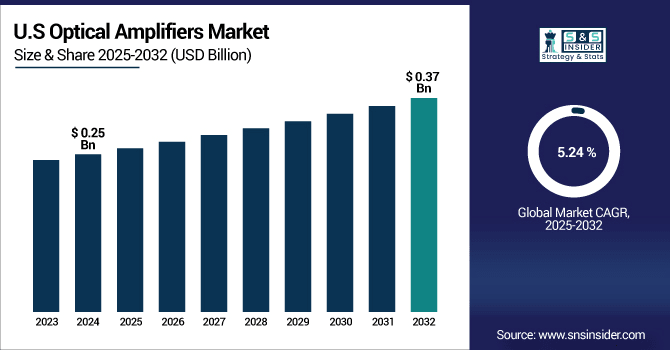

The U.S. Optical Amplifiers Market size was USD 0.25 billion in 2024 and is expected to reach USD 0.37 billion by 2032, growing at a CAGR of 5.24 % over the forecast period of 2025–2032.

The U.S. growth is mainly attributed to increasing investment in advanced telecom infrastructure and 5G deployment. Rising demand for optical amplifiers to increase data transmission capacities due to growing adoption of cloud computing along with expansion in data centers. Further, the government policies toward broadband penetration and fiber optic network deployment are the major factors influencing the expansion of the market in the U.S.

According to research, data centers accounted for approximately 4.4% of total U.S. electricity consumption in 2023, with energy use increasing from 58 TWh in 2014 to 176 TWh, reflecting the growing demand for data processing and storage.

The U.S. broadband providers invested around USD 94.7 billion in communications infrastructure in 2023, marking the second-highest annual capital expenditure in over two decades, underscoring the nation's commitment to expanding its digital and network capabilities.

Optical Amplifiers Market Dynamics:

Key Drivers:

-

Growing Adoption of 5G and Data Center Upgrades Increases Need for Optical Amplifiers

5G network rollouts along with increasing number of data centers globally are the other factors driving the optical amplifier market. 5G networks rely heavily on high capacity back- and fronthaul networks, and is dominated by optical amplifiers that are used to aid in extending the link distance while preserving the received signal quality. Data centers, critical for cloud services and IoT, require large-scale, reliable, and scalable optical amplifiers, to support data-heavy transmission. These developments combined drive the demand for high performance, energy efficient, optical amplifiers that can be used in next generation high speed and low latency networks.

According to research, by the end of 2023, there were approximately 1.76 billion 5G connections globally, marking a 66% increase from the previous year. North America led this growth, with the U.S. playing a pivotal role in the expansion.

In 2023, 5G home broadband became the preferred choice for 96% of new broadband subscribers in the U.S., covering 94 million households. This surge underscores the critical role of optical amplifiers in enhancing signal quality and extending network reach NTT Corporation achieved a significant breakthrough by developing a multi-core optical amplifier that reduces power consumption by 67% compared to conventional technologies.

Restraints:

-

Complex Integration and Compatibility Issues Hinder Optical Amplifier Deployment

Integration difficulties, and interface problems with present network technology are inhibiting the market for optical amplifiers. Various amplifier topologies may not present a seamless fit with existing equipment, thereby contributing to added complexity and cost of operation. Operators also struggles with controlling multivendor networks and achieving interoperability. Furthermore, protecting and operating optical amplifiers required specific technical skill, lead to deployment delays, and limited penetration into the markets of small service providers not possessing a skilled workforce.

Opportunities:

-

Increasing Demand for Energy-Efficient Optical Amplifiers in Green Networking

Increased environmental and regulatory pressure are driving the demand for energy-efficient optical amplifiers. The scope is in amplifiers with low power consumption and better thermal management which makes the telecoms infrastructure greener. Power-saving optical amplifiers not only save operational expenses, but also cater to the green policy of the all-service providers and governments. Further advances in amplifier materials and designs, and overall increasing investments in green networking technologies bring enormous market potential for green optical amplification technologies.

According to research, Energy-efficient optical amplifiers can reduce power consumption by up to 30-40% compared to traditional models, significantly cutting operational costs and carbon footprints.

Challenges:

-

Supply Chain Disruptions Affect Optical Amplifier Production and Delivery Timelines

Global supply chain risks are creating new challenges for optical amplifier suppliers. Production schedules are affected by the lead-times of the most critical components including specialty fibers and semiconductor materials. Geopolitical rivalries, shortages of raw materials and transport bottlenecks only further complicate the reliability of the supply chain. They create longer lead times, cost overruns, and contract terminations, which impacts customer satisfaction. Concerns of supply chain risk will see solid growth within the optical amplifier market continue and meet the increasing demand globally.

Optical Amplifiers Market Segmentation Analysis:

By Type

Fiber Amplifier segment dominated the highest Optical Amplifiers Market share of about 56.97% in 2024, as they have high gain, low noise and wide bandwidth, which are better than the other amplifiers. They are indispensable for long distance optical signal transmission without loss. One of the leading suppliers in this space is Lumentum Holdings Inc., which manufactures high-performance EDFAs used in DWDM systems throughout the world's telecom fiber routes. Leadership in the segment is also buoyed by submarine cable construction, broadband coverage expansion, and larger 5G backhaul network investments requiring robust, high-capacity amplification for data traffic that wants to break free.

Semiconductor Optical Amplifier segment is expected to grow at the fastest CAGR of about 8.11% over 2025–2032, because they can easily be integrated with photonic circuits, are compact and power-efficient. Their flexibility in short-haul situations, such as access networks and metro connections, is driving demand. Halfway through this trend and Cisco Systems, Inc. is leading with the introduction of next-generation SOA services for the data center and software-defined networks. With the explosion of traffic across cloud platforms and hyperscale designs, SOAs offer adaptability, and they are well suited for those who are deploying flexible, agile networks either today or in the future in a wide array of industry segments.

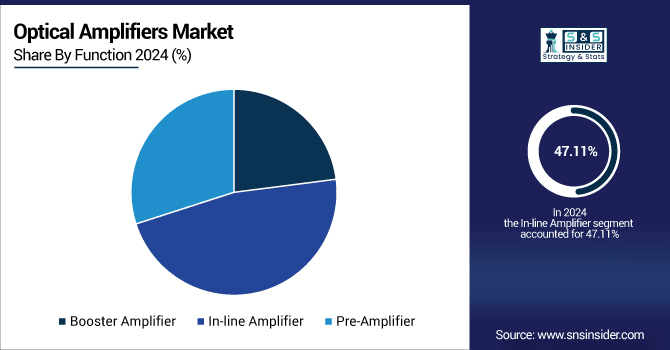

By Function

In-line Amplifier segment dominated the Optical Amplifiers Market with the highest revenue share of about 47.11% in 2024, due to the capability of maintaining high quality optical signal transmission up to tens of thousands of kilometers without regeneration of signals. Their effectiveness help accelerate deployment of fiber in high-traffic avenues. In it, Ciena Corporation offers next-gen in-line amplification systems for next-gen metro and core networks. As broadband penetration and needs for greater bandwidth increases, these amplifiers enable telecom carriers to meet performance requirements while lowering costs and keeping service quality solid across regional and transcontinental transmission lines.

Pre-Amplifier segment is expected to grow at the fastest CAGR of about 8.37% over 2025–2032, due to their role in the improvement of the reception of weak signals before conversion at the optical receivers. The employing of these components is very essential in long-haul coherent transmission systems. Optical amplifiers companies including NeoPhotonics Corporation, which offers pre-amplifier solutions with industry-leading ultra-low noise performance for high-capacity optical links. As higher-order modulations and bit rates increase and with the expansion of cloud data centre interconnects together with rapid deployment of next-generation coherent optical technologies, it means the role of the pre-amplifier is further highlighted to ensure that best system sensitivities and performance are achieved.

By Industry Vertical

The IT and Telecommunication segment dominated the Optical Amplifiers Market with the highest revenue share of about 36.78% in 2024, owing to a surge in data traffic from video streaming, cloud computing, and fast 5G rollouts. Fiber-optic networks need amplification to compensate for fade of the signal in long distance transmission. Central to this market, Huawei Technologies Co., Ltd. delivers strong amplifier offerings driving large-scale telecom infrastructure globally. The increased pace of digital transformation is widening the need for stable and high-capacity networks, contributing to growth of this vertical, backed by government and private investments.

The industrial segment is expected to grow at the fastest CAGR of about 8.76% during 2025–2032, because of smart manufacturing, IIoT, and increasing demand for real-time communication in automation systems. Signal booster maintains a stable connection at high speed in a complicated environment. II-VI Incorporated is the leading player in the provision of ruggedized amplifier solutions for industrial and harsh environments. With the proliferation of intelligent sensing, robotics and predictive analytics in these industries, the market for robust optical communication infrastructure is growing, driving increased adoption throughout factories, transportation networks, energy infrastructure and process automation globally.

Optical Amplifiers Market Regional Outlook:

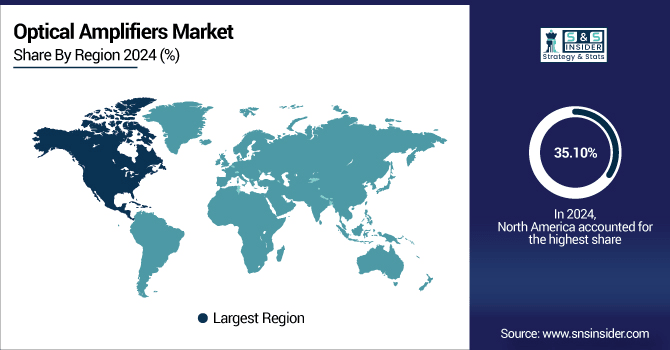

North America dominated the Optical Amplifiers Market with the highest revenue share of about 35.10% in 2024 owing to its well-developed telecommunications and the early introduction of fibre-optics. Leading high-internet-penetration, growing demand for high-speed broadband, and significant investment in data centers and 5G rollouts support market dominance. At the same time, the presence of big industry players and government initiatives focused on digital transformation make the region even more important, especially in the U.S. and Canada where various network capex contributes are ongoing.

Get Customized Report as Per Your Business Requirement - Enquiry Now

The North America Optical Amplifiers Market is dominated by the U.S owing to its strong infrastructure of fiber optic, high consumption of data, the presence of next-generation telecom networks, and the prominent control of major technology firms in the region investing on a large scale on 5G, cloud computing and long haul data transmission services.

Asia Pacific is expected to grow at the fastest CAGR of about 8.46% over 2025–2032 due to the increasing pace of urbanization, digitalization, and telecom network expansion in China, India, and Japan. Growth is propelled by government-supported broadband projects, growing demand for mobile data and a rise in investments in subsea cable projects. The region is also supported by the rapid growth of electronics and semiconductor industry and the popularity of smart devices that contribute to the momentum of reliable and scalable optical communication infrastructure.

China is the leading market in the Asia Pacific Optical Amplifiers Market due to the huge investment made for fibre optics infrastructure, fast deployment of 5G and a strong manufacturing base in this country, China itself is a hub for telecom expansion and high-speed data transfer technologies developed and implemented by the government through digital initiatives.

The Optical Amplifiers market in Europe is getting propelled due to the growth of digitalization in various industries and government initiatives on expanding broadband services. The region's strong emphasis on plans for 5G roll out, cloud and IoT ecosystem integration is resulting in growing demand for high-capacity, dedicated optical network systems. Furthermore, increased investment in “green” data centers and international subsea cable systems help to advance Europe’s status in the global optical connectivity race.

Germany dominates the European optical amplifiers market as it has developed telecom infrastructure, a robust industrial background and large industrial frameworks with an increased demand for high speeds technologies. Heavy government directives and investments in fiber optics and data centers contribute to the country’s leadership in optical network technologies.

The Middle East & Africa Optical Amplifiers Market is led by the UAE on account of its developed telecom infrastructure, the rapid rollout of 5G technology, along with smart city projects, such as the Dubai Smart City. In Latin America, Brazil pulls ahead thanks to large fiber optic deployments, a surge in internet usage, and increasing demand for high-speed data services.

Optical Amplifiers Companies are:

Major Key Players in Optical Amplifiers Market are Coherent Corp., Lumentum Holdings Inc., Accelink Technologies Co., Ltd., Wuxi Taclink Optoelectronics Technology Co., Ltd., Cisco Systems, Inc., Ciena Corporation, Huawei Technologies Co., Ltd., Nokia Corporation, Fujitsu Optical Components Limited, NEC Corporation.

Recent Developments:

-

In September 2024, Wuxi Taclink introduced its new line of high-power EDFAs at ECOC 2024, designed for long-haul and metro applications, offering improved performance and reliability.

-

In September 2024, Fujitsu introduced its new line of high-power EDFAs at ECOC 2024, optimized for 400G and 800G coherent transmission systems, supporting long-haul and metro networks with enhanced signal amplification capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.15 Billion |

| Market Size by 2032 | USD 1.98 Billion |

| CAGR | CAGR of 7.17% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Semiconductor Optical Amplifier, Fiber Amplifier, Others) • By Function (Booster Amplifier, In-line Amplifier, Pre-Amplifier) • By Industry Vertical (IT and Telecommunication, Industrial, Government and Defense, Healthcare and Life Sciences, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Coherent Corp., Lumentum Holdings Inc., Accelink Technologies Co., Ltd., Wuxi Taclink Optoelectronics Technology Co., Ltd., Cisco Systems, Inc., Ciena Corporation, Huawei Technologies Co., Ltd., Nokia Corporation, Fujitsu Optical Components Limited, NEC Corporation |