Explosion Proof Lighting Market Size & Growth:

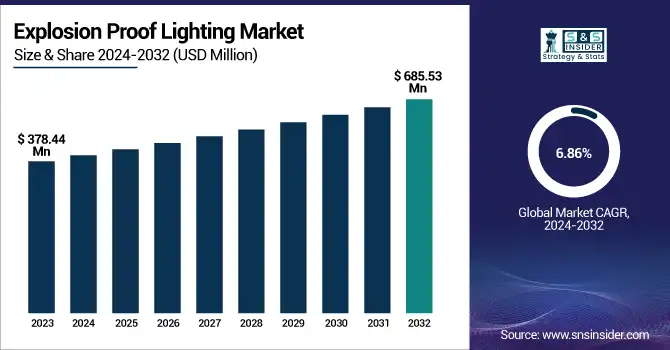

The Explosion Proof Lighting Market Size was valued at USD 378.44 million in 2023 and is expected to reach USD 685.53 million by 2032, growing at a CAGR of 6.86% over the forecast period 2024-2032. The Market is adapting to the changes associated with operational efficiency, application-based designs, workforce up-skilling, and smart technologies. Hazardous Areas for Zone 0, Zone 1, and Zone 2 need Specialist lighting for the above industries, any evacuation or parade area in oil & gas, mining, and chemical processing needs specialized lighting solutions. There are performance metrics such as energy efficiency, lifespan, ingress protection (IP ratings), as well as temperature resistance.

Proper installation, regular maintenance, and compliance with safety standards are all important aspects of an industrial environment, and workforce training is an important component of ensuring that these standards are met. Furthermore, the growth of smart lighting with embedded sensors and IoT connectivity fuel automation, remote monitoring, and energy optimization which is a contributing factor toward the adoption of the product in several industrial verticals.

To Get more information on Explosion Proof Lighting Market - Request Free Sample Report

Explosion Proof Lighting Market Dynamics

Key Drivers:

-

Growing Safety Regulations and LED Adoption Driving Demand for Explosion Proof Lighting in Industries

Safety regulations in sectors such as oil & gas, mining, and chemical manufacturing have created a wave of demand for explosion-proof lighting, and this is the key factor that is estimated to propel the growth of the explosion-proof lighting market over the forecast period. Strict government regulations and industry standards require explosion-proof lighting in hazardous environments to mitigate the fire hazards generated by sparks or high temperatures, such as ATEX and IECEx certifications. The growing adoption of LED-based explosion-proof lighting is also helping the market expand since LED lights are more energy-efficient, have a longer life span, as well as lower maintenance costs than traditional lighting solutions. Rising investments in industrial infrastructure, especially in developing economies, are also contributing to the increasing demand for a reliable explosion-proof lighting solution.

Restrain:

-

Regulatory Compliance and Lack of Technical Awareness Pose Challenges for Explosion Proof Lighting Market

The certification and compliance requirements of regulatory bodies like ATEX, IECEx, and UL offer a big challenge for the explosion-proof lighting market. Aside from that, strict standards for each molecule in the norms are tested to make sure it does not affect the safety of the vehicle and the final performance of manufacturing is a long process. These certifications differ by region leading companies to undergo additional approvals to go around the world. Moreover, since end users are unaware and also lack the technical know-how to install and maintain explosion-proof lighting properly, misuse is likely, to negatively impact the efficiency and effectiveness of these solutions.

Opportunity:

-

IoT Integration and Green Lighting Solutions Unlock New Growth Opportunities in Explosion-Proof Lighting

There is potential in this space to combine those smart lighting solutions with IoT-enabled Integrated Resource Monitoring Systems. Vast opportunities for the development of highly intelligent explosion-proof lighting systems for operational efficiency, real-time monitoring, and remote control due to the growing trend of Industry 4.0 and digital transformation in industrial sectors. Moreover, rising demand for renewable and green lighting solutions such as solar-powered explosion-proof lights is bolstering their market growth. The explosion-proof lighting market is anticipated to be propelling robustly in the years to come with ongoing developments in lighting technologies and rising awareness about workplace safety.

Challenges:

-

Technological Limitations and Retrofitting Challenges Hinder Explosion Proof Lighting Adoption in Hazardous Industries

The major barrier comes from technology, which has limitations in heavy or hazardous environments. Although LED explosion-proof light has been widely used, heat dissipation and electromagnetic interference (EMI) can affect performance and reliability in extreme conditions. However, the life cycle reliability of a long life-bearing lighting solution in such extremely high vibration, high temperature, and high corrosion scenarios, such as oil & gas and mining industries, still has no reliable solution. In addition, retrofitting current hazardous locations with new explosion-proof lighting can be challenging, as special fixtures must be used and can often be more expensive so it's not easy to fit the old with the new. Solutions present the need for persistent research and development of stronger, adjustable, and even easier to easier-to-install explosion-proof lighting.

Explosion Proof Lighting Market Segment Analysis

By Type

The Linear segment contributed to 36.8% share of the Explosion Proof Lighting Market in 2023. This dominance is due to its use in oil & gas, chemical & manufacturing industries, requiring long, narrow lighting to offer illumination to hazardous work areas. The durability and energy efficiency along with the concerns for safety regulations are leading to the increase in the linear explosion-proof lights market.

The High Bay & Low Bay segment is expected to be the most lucrative, exhibiting the fastest CAGR from 2024 – 2032. The rising development of industrial establishments, service centers, and large-scale manufacturing plants is in the high demand for high-intensity lighting solutions. In addition to this, integration with LED technology and smart lighting is likely to create more opportunities for this segment over the forecast period thereby creating more growth for this segment in the coming years.

By Light Source

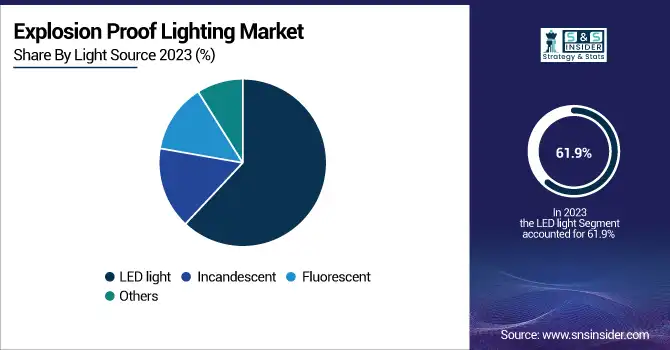

The LED light segment accounted for the highest in the Explosion Proof Lighting Market share in 2023, contributing 61.9% of the overall market in revenue. The dominance is mainly ascribed to the energy efficiency of LED-based explosion-proof lighting, which requires less maintenance and lasts longer than traditional lighting technologies. Moreover, the growing stringent safety regulations in sectors such as oil & gas, mining, and chemical manufacturing have stimulated the demand for LED explosion-proof lights, which provide greater toughness and adequate illumination in space.

The Fluorescent segment is anticipated to be the fastest-growing segment during the forecast period (2024–2032) LEDs still rule the roost, however, fluorescent explosion-proof lighting is still in demand thanks to competitive upfront pricing, even light distribution, and the versatility to be applied in certain industrial applications. The development of efficient fluorescent technologies along with smart lighting controls is likely to spur market growth in the future.

By Zone

Zone 1 contributed to 47.7% of the market share in the explosion Proof Lighting Market in the year 2023. Such leadership results from high growth in demand for explosion-proof lighting in industries particularly oil & gas, chemicals, and mining, which almost always tend to operate in environments containing hazardous gases & vapors. Lighting Zone 1 is also one of the most expensive investments for any industrial facility because it is important to ensure safety in areas where explosive atmospheres may exist for longer periods under normal operating conditions.

Zone 0 is anticipated to hold the largest growth CAGR from 2024 to 2032. It is becoming mainstream because of the strict safety regulations being enforced and the growing emphasis on worker safety in dangerous workplaces. In addition, constant technological developments in LED-based explosion-proof lighting solutions for extremely hazardous locations are anticipated to assist the segment in witnessing sturdy growth.

By End Use

The Oil & Gas sector accounted for the largest share of 32.7% in the explosion Proof Lighting Market in 2023. The bulk of this dominance is due to the high-risk environments of the industry, whereby explosion-proof lighting is one of the essentials to prevent ignition in areas with flammable gases and vapors. The high safety standards and demand for reliable and durable lighting solutions from offshore platforms, refineries, and petrochemical plants have driven the need for explosion-proof lighting in this sector.

The Mining sector, however, should remain the most rapid-growing from 2024 through 2032. Growing expansion of underground as well as surface mines along with concerns regarding work safety will drive explosion-proof lighting in the industry. Moreover, LED technology innovations, light fixtures for heavy-duty applications, and enhancement of automation in mining are also contributing to the growth of this segment.

Explosion Proof Lighting Market Regional Landscape

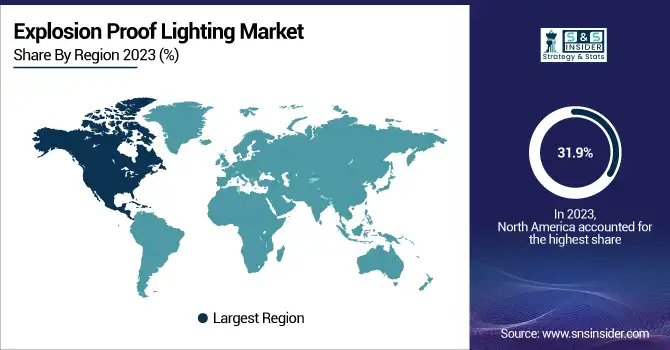

The Explosion Proof Lighting Market was led by North America with a market share of 31.9% in 2023. The dominance of explosion-proof light fits has been majorly attributed to the set safety regulations required by OSHA (Occupational Safety and Health Administration) and NEC (National Electrical Code). A growing number of explosion-proof lighting markets in the United States and Canada due to the oil & gas industry and chemical and manufacturing industry. To illustrate, ExxonMobil and Chevron have been utilizing cutting-edge LED-based explosion-proof lighting systems in their refineries and offshore rigs to improve energy efficiency and safeguard employees. Moreover, increasing investments also in smart industrial lighting solutions are propelling the growth of the market in the region.

Asia Pacific is anticipated to register the highest CAGR during the forecast period from 2024 to 2032, owing to factors such as fast-paced industrialization, increasing mining activities, and growing infrastructure projects. China, India, and, Australia are expected to see growing demand for explosion-proof lighting as their oil & gas, mining, and chemical sectors expand. Modern explosion-proof lighting is being adopted by companies, such as India-based ONGC (Oil and Natural Gas Corporation) and China-based Sinopec to meet safety standards in hazardous environments. In addition, development in the region for smart manufacturing coupled with Industry 4.0 initiatives is also driving the growth of the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Explosion Proof Lighting Market are:

-

Eaton (Crouse-Hinds series Champ LED)

-

Emerson (Appleton Areamaster LED)

-

R. STAHL (EXLUX 6001 LED)

-

Phoenix Lighting (SturdiLED Series)

-

Dialight (SafeSite LED High Bay)

-

Hubbell (KILLARK XFL LED Floodlight)

-

Larson Electronics (EPL-48-100LED Explosion Proof LED Light)

-

ABB (Hazlux XFMV LED)

-

GE Current (EFH Series LED)

-

Cooper Lighting Solutions (Metalux VHB LED)

-

LDPI (LED Hazardous Location Linear Fixture)

-

AZZ Inc. (Rig-A-Lite Hazardous LED)

-

Kenall (Millenium OS QSSI)

-

Nemalux (Hazardous Location LED Floodlight)

-

Appleton Group (Areamaster Generation 2 LED)

Recent Trends

-

In March 2024, Emerson's new Rosemount SAM42 will provide real-time sand monitoring in pipelines, helping operators minimize erosion risks and optimize production with a non-intrusive, high-temperature-resistant design.

-

In December 2024, Dialight expanded the ProSite Series with a New Streetlight for Hazardous & Non-Hazardous Areas, Dialight introduced the ProSite Streetlight, offering high efficiency (up to 150 lm/W) and customizable optics for industrial and roadway lighting.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 378.44 Million |

| Market Size by 2032 | USD 685.53 Million |

| CAGR | CAGR of 6.86% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Linear, Flood, High bay & low bay, Others) • By Light Source (LED light, Incandescent, Fluorescent, Others) • By Zone (Zone 0, Zone 1, Zone 2, Others) • By End Use (Oil & Gas, Mining, Chemical & Petrochemical, Pharmaceutical, Food Processing, Marine, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Eaton, Emerson, R. STAHL, Phoenix Lighting, Dialight, Hubbell, Larson Electronics, ABB, GE Current, Cooper Lighting Solutions, LDPI, AZZ Inc., Kenall, Nemalux, Appleton Group. |