Metal-Air Battery Market Size & Growth Trends:

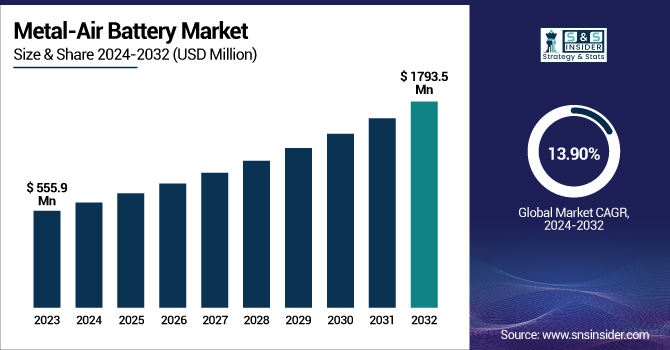

The Metal-Air Battery Market was valued at USD 555.9 Million in 2023 and is projected to reach USD 1793.5 Million by 2032, growing at a CAGR of 13.90% from 2024 to 2032.

To Get More Information About Metal-Air Battery Market - Request Free Sample Report

This growth is fueled by increasing demand for high-energy-density, lightweight, and environmentally friendly energy storage solutions across industries such as electric vehicles, military technology, and stationary power systems. One of the primary market drivers is the shift from conventional lithium-ion batteries to metal-air alternatives due to their superior energy density and lower environmental impact. Technological advancements, particularly in zinc-air and lithium-air battery chemistries, are further enhancing battery efficiency and lifespan.

In the United States, the market was valued at USD 70.2 million in 2023 and is forecasted to reach USD 225.1 million by 2032, growing at a CAGR of 13.80%, highlighting strong regional adoption and investment. Additionally, metal-air batteries contribute significantly to emission reduction goals and sustainability targets. Improved lifecycle metrics and performance reliability are also making these batteries more attractive for large-scale, long-term applications, reinforcing their role in the future of clean energy storage.

Metal-Air Battery Market Dynamics:

Drivers:

-

Advancing Metal-Air and Aluminum-Air Batteries for Defense and Aviation

Metal-air batteries are emerging as a transformative solution for military and aerospace sectors, offering superior energy-to-weight ratios vital for applications demanding high mobility and extended operation, such as UAVs, soldier-worn systems, and tactical backup units. Their quiet function, high energy density, and long shelf life make them ideal for stealth and resilience in harsh environments. Among these, aluminum-air batteries hold particular promise for enabling fully electric regional air travel due to their theoretical energy potential. A study conducted at the Southwest Research Institute (SwRI) has addressed integration challenges such as material compatibility and cell architecture. Researchers optimized aluminum anodes by evaluating foil thickness and mesh designs, and improved air cathodes using nickel foam structures coated with catalysts. Additionally, polyacrylic acid-based gel-polymer electrolytes were fabricated into 200-micron films, showing strong performance. These engineered cells have successfully powered a UAV testbed, marking a significant step toward next-gen, lightweight, energy-resilient aerospace systems.

Restraints:

-

Power Output Limitations of Metal-Air Batteries in High-Load Applications

Metal-air batteries, despite their high energy density and lightweight characteristics, struggle to meet the demands of high-load applications due to their inherently low power density. In situations requiring rapid energy bursts such as electric vehicle acceleration, power tools, or industrial machinery the slow oxygen reduction reaction at the air cathode limits the battery’s ability to deliver quick, sustained output. This is compounded by challenges such as electrode clogging, restricted airflow, and cathode degradation, which further diminish efficiency under heavy load conditions. The air-dependent nature of these batteries introduces variability and inconsistency in performance, making them less reliable for high-intensity use. As a result, while they are advantageous for long-duration, low-drain applications like backup power or military field equipment, their current technological limitations prevent broader adoption in sectors that demand high power throughput and fast discharge rates.

Opportunities:

-

Powering the Next Wave of Commercial Drones with Metal-Air Battery Innovation

Metal-air batteries are rapidly emerging as a game-changer for commercial drone applications due to their exceptional energy density and lightweight build, enabling significantly extended flight durations. These batteries are particularly beneficial in industries like logistics, agriculture, and infrastructure inspection, where prolonged air time is essential for efficiency and coverage. Their lightweight nature allows drones to carry heavier payloads or cover wider areas without frequent battery swaps. Moreover, their silent operation and low emissions are ideal for use in environmentally sensitive or noise-regulated areas. As the demand for affordable and high-performance drones grows, beginner-friendly models like the DJI Mini 4K and Potensic Atom both priced under USD 1,500 are leading the way, offering 4K video, stabilization, and compact, foldable designs. These models illustrate the growing trend of accessible commercial drones paired with advanced energy solutions. As research continues to enhance Rechargeability and output, metal-air batteries are set to power the next generation of professional aerial platforms.

Challenges:

-

Electrolyte instability remains a critical barrier hindering the advancement and practical deployment of metal-air battery technology.

Electrolyte management stands as a major challenge in the development of metal-air batteries, directly impacting their efficiency, lifespan, and reliability. These batteries rely on stable and high-performing electrolytes to facilitate ion transport between the metal anode and the air cathode. However, current electrolyte formulations often face problems such as degradation from CO₂ absorption, moisture sensitivity, and unwanted side reactions that reduce conductivity and energy output. Poor electrolyte performance can cause issues like dendrite formation, corrosion, and reduced charge cycles limiting their practical use in demanding applications like defense, aviation, and commercial drones. Innovative alternatives like gel-polymer and solid-state electrolytes are being researched, but challenges related to cost, scalability, and integration persist. Addressing electrolyte instability is essential not only to enhance battery performance but also to unlock the full potential of metal-air technology in future energy solutions.

Metal Air Battery Industry Segment Analysis:

By Metal

The zinc segment is expected to dominate the metal-air battery market with the largest revenue share, accounting for approximately 27% by 2023. This dominance is primarily driven by zinc's abundance, low cost, and safety compared to other metals, making it an attractive choice for various applications. Zinc-air batteries are widely used in hearing aids, electric vehicles, and grid energy storage due to their high energy density and environmental friendliness. Moreover, advancements in rechargeable zinc-air battery technologies are accelerating their adoption in commercial and industrial sectors. As the demand for sustainable and high-performance energy storage solutions continues to rise, the zinc segment is projected to grow at the fastest rate throughout the forecast period from 2024 to 2032, reinforcing its pivotal role in the evolving battery landscape.

By Voltage

The Low (<12 V) segment is projected to dominate the metal-air battery market, capturing the largest revenue share of around 51% by 2023, this segment is expected to be the fastest-growing throughout the forecast period of 2024 to 2032, positioning itself as a key driver of market expansion across multiple industries. This segment's growth is fueled by the increasing use of low-voltage batteries in compact and portable electronic devices, medical equipment, hearing aids, and small-scale IoT applications. Metal-air batteries within this voltage range offer lightweight design, high energy density, and longer operational life, making them ideal for devices that prioritize efficiency and mobility over high power output. Additionally, the widespread demand for cost-effective and sustainable energy storage solutions in consumer electronics and emerging wearables is further boosting adoption. As innovation continues to improve the Rechargeability and performance of low-voltage metal-air batteries

By Type

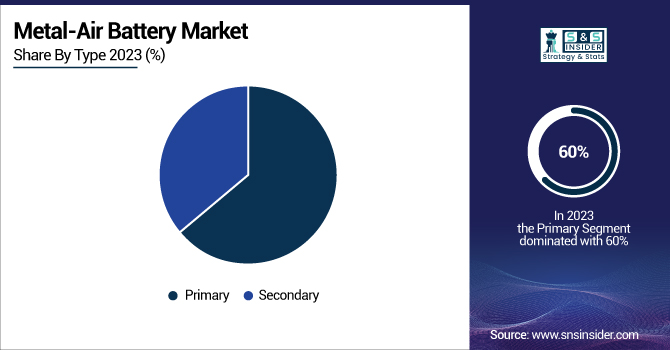

The Primary segment dominated the metal-air battery market with the largest revenue share of approximately 60% in 2023 and is anticipated to remain the fastest-growing segment over the forecast period of 2024 to 2032. Primary metal-air batteries, which are non-rechargeable, are widely favored for their high energy density, long shelf life, and cost-effectiveness in single-use applications. These batteries are commonly used in military operations, medical devices, and backup power systems where reliability and immediate energy availability are critical. Their lightweight structure and ability to deliver consistent power over time make them particularly valuable in field-based and remote applications. As demand grows for efficient, disposable power sources that can operate in harsh environments, primary metal-air batteries are expected to witness strong adoption, driving substantial growth in this segment across defense, healthcare, and industrial sectors.

By Application

The Electric Vehicles (EV) segment dominated the metal-air battery market with the largest revenue share of around 30% in 2023 and is expected to be the fastest-growing segment throughout the forecast period of 2024 to 2032. This dominance is driven by the increasing global push toward sustainable transportation and the need for high energy density solutions to extend vehicle range. Metal-air batteries, especially aluminum-air and zinc-air types, offer significantly lighter alternatives to conventional lithium-ion batteries, enabling longer driving ranges and reduced vehicle weight. Their ability to provide high specific energy makes them particularly appealing for next-generation EVs where performance and efficiency are crucial. With ongoing research into improving Rechargeability and commercial viability, along with rising environmental regulations and EV adoption worldwide, the metal-air battery market in the electric vehicle segment is poised for rapid and sustained growth.

Metal-Air Battery Market Regional Outlook:

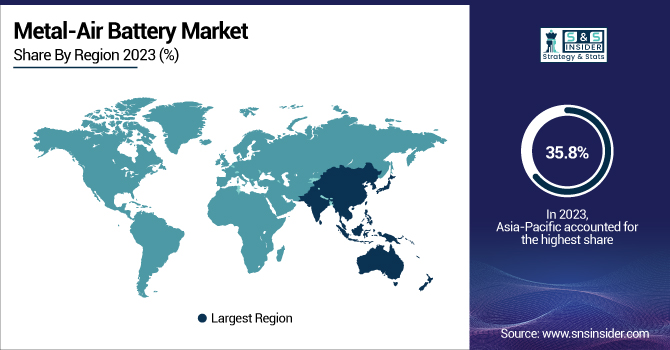

The Asia-Pacific region dominated the metal-air battery market with the largest revenue share of around 60% in 2023, driven by rapid industrialization, growing adoption of electric vehicles, and strong government support for clean energy technologies. Countries like China, Japan, and South Korea are at the forefront of advanced battery research and large-scale deployment of next-generation energy storage solutions. The region’s expanding electronics and automotive sectors, coupled with increasing investment in renewable energy infrastructure, are significantly boosting the demand for high-performance, lightweight, and energy-dense battery systems. Moreover, favorable regulatory frameworks, rising environmental awareness, and strong presence of key manufacturers contribute to Asia-Pacific’s leadership position in the market, with continued growth expected through 2032.

North America is expected to witness the fastest growth in the metal-air battery market over the forecast period of 2024–2032, fueled by increasing investments in defense, aerospace, and electric vehicle technologies. The region’s robust research and development landscape, supported by institutions and government agencies, is accelerating innovation in advanced battery chemistries. Additionally, rising demand for lightweight, high-density energy storage systems across sectors such as military, commercial drones, and grid energy storage is propelling market expansion. The United States, in particular, is focusing on reducing reliance on traditional lithium-ion systems, favoring alternatives like metal-air batteries for their sustainability and extended operational capabilities. This growing interest, combined with supportive policies and strategic partnerships, positions North America as a key emerging market for metal-air battery technologies.

Get Customized Report As Per Your Business Requirement - Enquiry Now

Key Players Listed in Metal-Air Battery Market are:

-

GP Batteries International Limited (Singapore) – Manufactures zinc-air batteries for hearing aids and specialty applications.

-

Arotech (USA) – Develops zinc-air batteries for military and defense-grade energy systems.

-

Energizer Holdings, Inc. (USA) – Produces zinc-air batteries primarily for consumer electronics and hearing aids.

-

Duracell Inc. (USA) – Offers zinc-air batteries for medical devices and portable electronics.

-

Renata SA (Switzerland) – Specializes in micro zinc-air cells for hearing aids and wearable electronics.

-

Phinergy (Israel) – Focuses on aluminum-air batteries for electric mobility and backup energy.

-

Log9 Materials (India) – Develops aluminum-air battery solutions for electric vehicles and stationary storage.

-

Poly Plus Battery (USA) – Known for lithium-air and aluminum-air battery prototypes for high-energy applications.

-

Zinc8 Energy Solutions (Canada) – Provides zinc-air flow batteries for grid-scale energy storage.

-

Panasonic Energy Co., Ltd. (Japan) – Produces zinc-air batteries for consumer and industrial uses.

-

Epsilor Electric Fuel (Israel) – Designs zinc-air batteries for military and aerospace applications.

-

ZeniPower (Zhuhai Zhi Li) Battery Co., Ltd. (China) – Produces zinc-air batteries for medical and consumer electronics.

-

Guangdong Tianqju Electronics Technology Co., Ltd. (China) – Manufactures zinc-air cells for hearing aids and industrial tools.

-

NantEnergy (United States) – Develops rechargeable zinc-air battery systems for microgrids and off-grid energy.

-

Fuji Pigment Co. Ltd. (Japan) – Engaged in R&D of aluminum-air batteries for clean energy applications.

List of Suppliers who Provide Raw Material and components for Metal-Air Battery Market:

-

Alcoa Corporation (USA)

-

Glencore plc (Switzerland)

-

Teck Resources Limited (Canada)

-

Umicore (Belgium)

-

BASF SE (Germany)

-

SGL Carbon (Germany)

-

Celgard LLC (USA)

-

Solvay SA (Belgium)

-

3M Company (USA)

-

Daramic LLC (USA)

-

Toyal America Inc. (USA)

-

Nippon Denko Co., Ltd. (Japan)

-

Tosoh Corporation (Japan)

-

ILC Dover (USA)

-

Evonik Industries AG (Germany)

Recent Development:

-

April 02, 2025, Panasonic Energy Co., Ltd. and Sumitomo Metal Mining Co., Ltd. have launched a closed-loop battery recycling initiative in Japan to recover nickel from EV battery scrap for use in cathode materials.

-

On February 14, 2024, Indian Oil Corporation (IOC) increased its stake in Israel-based Phinergy to 17% by investing USD 12.5 million in a second funding round.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 555.9 Million |

| Market Size by 2032 | USD 1793.5 Million |

| CAGR | CAGR of 13.90% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Metal (Zinc, Lithium, Aluminum, Iron, Others) • By Voltage (Low (<12 V), Medium (12 - 36 V), High (>36 V)) • By Type (Primary, Secondary) • By Application (Electric Vehicles, Military Electronics, Electronics Devices, Stationary Power, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GP Batteries International Limited (Singapore), Arotech (USA), Energizer Holdings, Inc. (USA), Duracell Inc. (USA), Renata SA (Switzerland), Phinergy (Israel), Log9 Materials (India), Poly Plus Battery (USA), Zinc8 Energy Solutions (Canada), Panasonic Energy Co., Ltd. (Japan), Epsilor Electric Fuel (Israel), ZeniPower Battery Co., Ltd. (China), Guangdong Tianqju Electronics Technology Co., Ltd. (China), NantEnergy (United States), Fuji Pigment Co. Ltd. (Japan). |