Rigid Packaging Market Report Scope & Overview:

Get E-PDF Sample Report on Rigid Packaging Market - Request Sample Report

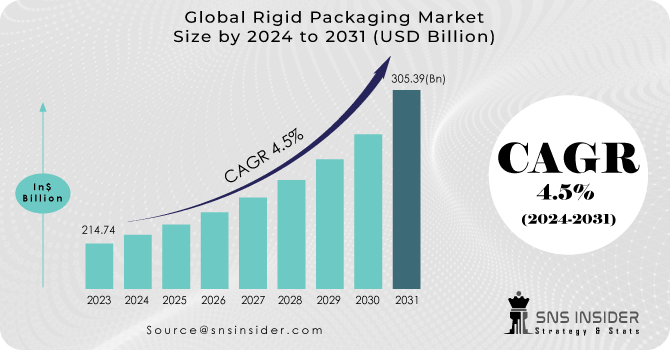

The Rigid Packaging Market size was USD 455.94 billion in 2023 and is expected to reach USD 792.23 billion by 2032 and grow at a CAGR of 6.33% over the forecast period of 2024-2032.

The rigid packaging market is growing driven by increasing demand across industries such as food and beverages, pharmaceuticals, personal care, and automotive. The rising need for durable, protective, and sustainable packaging solutions has fueled innovation in materials like plastic, metal, glass, and bioplastics. Rigid packaging offers superior strength, extended shelf life, and enhanced product safety, making it a preferred choice for manufacturers and consumers alike.

One of the key trends shaping the market is the growing emphasis on sustainability. With rising environmental concerns and stringent regulations on plastic waste, companies are shifting towards recyclable and biodegradable materials such as bioplastics and paper-based rigid packaging. Additionally, advancements in lightweight packaging technology are helping manufacturers reduce material usage while maintaining structural integrity. The demand for smart and intelligent packaging solutions is also rising, with features like QR codes, RFID tags, and tamper-evident seals gaining popularity. The food and beverage sector remains a dominant consumer of rigid packaging, particularly for bottled beverages, dairy products, and ready-to-eat meals. The pharmaceutical and healthcare industries are also witnessing increased adoption of rigid packaging for secure storage and transportation of medicines, medical devices, and vaccines. Moreover, e-commerce growth has significantly contributed to the demand for sturdy and impact-resistant packaging solutions.

According to research indicate a strong trajectory for rigid packaging, with billions of units being produced annually. The increasing shift towards sustainable alternatives is evident, as the demand for recyclable rigid plastic packaging has surged by over 15% in recent years. Furthermore, the global production of glass bottles continues to rise, with millions of tons manufactured annually to cater to beverage and pharmaceutical needs. As consumer preferences evolve and regulatory frameworks tighten, the rigid packaging industry is expected to witness continuous advancements in material innovation and design efficiency.

MARKET DYNAMICS

DRIVERS

-

The growing demand for packaged food and beverages, coupled with sustainability trends and packaging innovations, is driving the steady expansion of the global rigid packaging market.

The rising demand for packaged food and beverages is a key driver of the rigid packaging market. Consumers increasingly prefer convenience foods, ready-to-eat meals, and on-the-go beverages, leading to higher adoption of rigid packaging solutions such as plastic containers, glass bottles, and metal cans. The beverage industry, particularly bottled water, carbonated drinks, and dairy products, continues to expand, further fueling market growth. Additionally, advancements in packaging materials that enhance durability, shelf life, and product safety are boosting demand. Sustainable and recyclable rigid packaging options are also gaining traction as brands respond to consumer preferences and regulatory mandates. The global rigid packaging market is projected to grow steadily, driven by urbanization, rising disposable incomes, and the expanding foodservice sector. Manufacturers are innovating with lightweight, eco-friendly materials and smart packaging technologies to cater to evolving industry needs while maintaining cost efficiency and environmental sustainability.

RESTRAINT

-

The high cost of raw materials poses a significant challenge to the rigid packaging market, directly impacting production costs and profitability.

The prices of essential materials like plastics, metals, and glass have been rising due to supply chain disruptions, increased energy costs, and geopolitical uncertainties. Plastic-based rigid packaging is particularly vulnerable to crude oil price fluctuations, as petroleum-derived resins such as PET and HDPE form a major component. As a result, manufacturers face cost pressures, leading to higher product prices or reduced margins. This challenge is driving a shift towards cost-effective alternatives, including recycled plastics and bio-based materials. Additionally, companies are investing in lightweight packaging solutions to reduce material consumption. Despite these challenges, the rigid packaging market continues to grow, driven by increasing demand in the food, beverage, and pharmaceutical industries. The trend toward sustainability is further influencing material choices, encouraging innovations in eco-friendly and cost-efficient packaging solutions.

MARKET SEGMENTATION

By Material

Plastic segment dominated with the market share over 40% in 2023, due to its versatility, ease of processing, and recyclability, making it ideal for a wide range of applications. Materials like polyethylene (PE) and polyethylene terephthalate (PET) are particularly favored because of their chemical resistance, durability, and ability to maintain the integrity of packaged products. PE is commonly used for flexible packaging, while PET is widely used for bottles and containers, especially in the food and beverage industry. Both materials offer excellent barrier properties, ensuring that contents remain fresh and protected. Furthermore, plastics are cost-effective and lightweight, reducing transportation costs and environmental impact. Their ability to be recycled also supports sustainability efforts, making plastic the preferred choice for many packaging solutions.

By Product

The Bottles & Jars segment dominated with the market share over 52% in 2023, due to its widespread use in various industries such as food and beverages, pharmaceuticals, and personal care products. These containers are preferred for their versatility in holding a wide range of products, from liquids to solids, and their durability in preserving product quality. The growing consumer demand for packaged goods further fuels the market for bottles and jars, as they offer convenience, safety, and ease of storage. Additionally, advancements in design and material, such as eco-friendly and tamper-evident features, have enhanced their appeal. This combination of practicality and consumer preference makes bottles and jars a key driver of the rigid packaging sector.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

KEY REGIONAL ANALYSIS

The Asia-Pacific region dominated with the market share over 44% in 2023. The growth in the region is primarily driven by the increasing demand from the food and beverage sector, with China being a major contributor. The country’s rapidly urbanizing population and rising disposable incomes have led to a shift towards packaged food products for convenience and quality assurance. Additionally, the Chinese government’s push for sustainable packaging solutions has led to the adoption of rigid plastics and paperboard due to their durability and environmental benefits. In India, the rigid packaging market is experiencing significant growth, fueled by the expansion of the e-commerce sector and changing consumer lifestyles. The rising middle class and urban population are driving demand for packaged goods, especially in food and beverages, where rigid packaging ensures safety and extends shelf life. Innovations in sustainable packaging are further propelling the market's growth in both countries.

North America is projected to experience the fastest growth in the rigid packaging market due to significant technological advancements in packaging materials. This includes the development of lightweight designs that reduce material usage without compromising strength and the creation of advanced materials that are both sustainable and cost-effective. These innovations are in response to the growing emphasis on environmental sustainability and regulatory pressures to reduce plastic waste. Additionally, the rise of e-commerce has spurred the demand for robust, protective rigid packaging solutions to ensure safe product delivery. North America’s strong manufacturing capabilities and the presence of key industry players have further accelerated this growth. In the U.S., the market expansion is driven by the increasing popularity of online shopping, where rigid packaging protects a wide range of products, from electronics to cosmetics.

Some of the major key players of the Rigid Packaging Market

-

Berry Global Inc.: (Plastic bottles, containers, closures, specialty packaging solutions)

-

Alpla Group: (Plastic bottles, jars, caps, closures, preforms)

-

Silgan Holdings Inc.: (Metal and plastic containers, closures, dispensing systems)

-

Reynolds Group Holding: (Plastic containers, beverage closures, specialty cartons)

-

Sonoco Products Company: (Paperboard and plastic containers, closures, protective packaging)

-

Sealed Air Corporation: (Rigid packaging solutions, cushioning and protective packaging, trays, containers)

-

Plastipak Holdings: (Rigid plastic containers for beverages, food, personal care, household products)

-

Coveris Holdings: (Metal, plastic, and paper-based rigid containers for food, beverage, industrial markets)

-

3M: (Packaging materials, including tapes, labels, protective films)

-

Bemis Manufacturing Company: (Plastic containers, closures, dispensing systems)

-

Flexcon Company, Inc.: (Pressure-sensitive films and labels for packaging applications)

-

NORAH Plastics: (Plastic containers and closures for various industries)

-

Manjushree Technopack Limited: (PET, HDPE, PP bottles, containers, preforms)

-

DS Smith: (Recyclable corrugated packaging solutions)

-

Vetropack Holding: (Glass containers for food and beverages)

-

Myers Industries: (Plastic containers, pallets, material handling products)

-

Brambles: (Pallets and containers for supply chain logistics]

-

Schoeller Allibert: (Plastic reusable packaging solutions, including containers and pallets)

-

Schutz GmbH & Co.: (Intermediate bulk containers (IBCs) for liquid and dry products)

-

Aramco: (Plastic and metal containers, packaging solutions for oil and gas industry)

Suppliers for (Innovation in sustainable packaging solutions and a wide range of materials including plastic, metal, and glass) on Rigid Packaging Market

-

Amcor Limited

-

Berry Global Inc.

-

Ball Corporation

-

Bemis Company Inc.

-

DS Smith Plc

-

Georgia-Pacific LLC

-

Reynolds Group Holdings Limited

-

Sealed Air Corporation

-

Resilux NV

-

Mondi Group

RECENT DEVELOPMENT

In October 16, 2024: Silgan Holdings finalized its acquisition of Weener Plastics for €838 million. Weener Plastics is a provider of dispensing solutions for the personal care, food, and healthcare industries. Silgan anticipates achieving operational cost synergies of around €20 million within 18 months and funded the acquisition through borrowings under its senior secured credit facility.

In June 12, 2024: The ALPLA Group acquired Heinlein Plastik-Technik to enhance its pharma division, ALPLApharma, and broaden its injection moulding capabilities. The Ansbach facility will be transformed into a technology center focused on injection moulding and automation.

In September 2023: Berry Global, a leading supplier of packaging and engineered products, began developing a new sustainable rigid packaging solution. This innovative packaging will be made from plant-based materials that are both compostable and recyclable.

In April 2023: Hygiena introduced a new tiered Software as a Service (SaaS) offering, SureTrend Cloud. This solution provides food safety and quality managers with valuable, data-driven insights that are essential for making key business decisions to minimize risk and optimize profit.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 455.94 billion |

| Market Size by 2032 | USD 792.23 billion |

| CAGR | CAGR of 6.33% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Plastic, Metal, Paper & Paperboard, Glass, Bioplastic) • By Product (Bottles & Jars, Trays & Clamshells, Tubs, Cups, and Pots, Pallets, Drums & Barrels, Crates, Others) • By Application (Food, Beverages, Pharmaceutical & Healthcare, Personal Care & Cosmetics, Automotive, Building & Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Berry Global Inc., Alpla Group, Silgan Holdings Inc., Reynolds Group Holding, Sonoco Products Company, Sealed Air Corporation, Plastipak Holdings, Coveris Holdings, 3M, Bemis Manufacturing Company, Flexcon Company, Inc., NORAH Plastics, Manjushree Technopack Limited, DS Smith, Vetropack Holding, Myers Industries, Brambles, Schoeller Allibert, Schutz GmbH & Co., Aramco. |

| Key Drivers | •The growing demand for packaged food and beverages, coupled with sustainability trends and packaging innovations, is driving the steady expansion of the global rigid packaging market. |

| Restraints | • The rising cost of raw materials, driven by supply chain disruptions and crude oil fluctuations, pressures rigid packaging manufacturers to adopt cost-effective, sustainable alternatives while maintaining market growth in food, beverage, and pharmaceutical sectors. |