Mobile VoIP Market Report Scope & Overview:

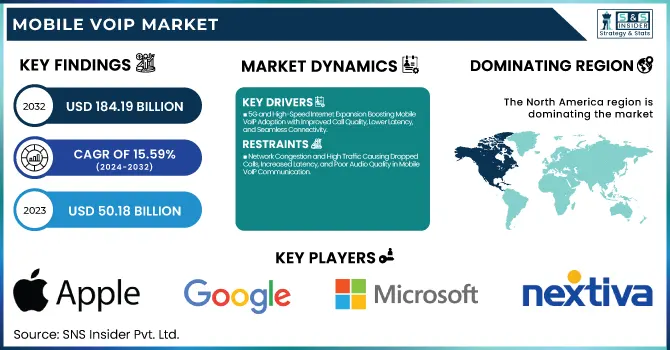

The Mobile VoIP Market was valued at USD 50.18 billion in 2023 and is expected to reach USD 184.19 billion by 2032, growing at a CAGR of 15.59% from 2024-2032. This report includes an analysis of customer satisfaction and usage behavior, which indicates the drivers of demand for low-cost communication services. It also looks at the churn rate, which is an indicator of customer retention issues in a competitive market. Price sensitivity is one of the most important drivers of consumer choice, with users looking for low-cost solutions. Voice quality indicators are most important for market expansion, as users value clear communication. Further, the report investigates regulatory influence, reviewing how government regulations and telecommunications rules affect the Mobile VoIP scenario.

To Get more information on Mobile VoIP Market- Request Free Sample Report

Mobile VoIP Market Dynamics

Drivers

-

5G and High-Speed Internet Expansion Boosting Mobile VoIP Adoption with Improved Call Quality, Lower Latency, and Seamless Connectivity

The expanding deployment of 5G networks and high-speed internet is transforming mobile VoIP communication by dramatically enhancing call quality, lowering latency, and providing flawless connectivity. With the continuous development of network infrastructure, the users enjoy seamless voice transmission and fewer interruptions, making VoIP a more convenient substitute for legacy telephony. The popularity of high-speed mobile internet also reinforces the increasing needs for video calling, real-time collaboration, and cloud-based communications solutions. Businesses and individuals increasingly take advantage of these advancements to embrace VoIP for cost savings and flexibility. With unbroken connectivity and increased bandwidth, 5G-powered mobile VoIP solutions will redefine global communication patterns, leading to increased adoption among industries and regular mobile users.

Restraints

-

Network Congestion and High Traffic Causing Dropped Calls, Increased Latency, and Poor Audio Quality in Mobile VoIP Communication

Increased mobile network congestion is a major challenge to smooth VoIP communication, resulting in dropped calls, increased latency, and poor audio quality during peak usage hours. As mobile VoIP usage becomes increasingly popular for voice and video calls, network bandwidth cannot keep up with the surging demand, particularly in urban areas. Unstable signal strength and data packet loss further impair call stability, making it challenging for users to have smooth conversations. Organizations that use VoIP for vital communications encounter interruptions, impacting productivity and customer engagements. Without ongoing enhancements in network capacity and traffic management, the growth of mobile VoIP services might be challenged in providing a quality and reliable communication experience for consumers.

Opportunities

-

AI and Cloud Integration Enhancing Mobile VoIP with Voice Assistants, Real-Time Transcription, Automated Translations, and Scalable Communication Solutions

The combination of AI and cloud technology is revolutionizing mobile VoIP with the addition of smart features like voice assistants, real-time call transcription, and automatic translations. Companies are taking advantage of these innovations to enhance productivity, simplify communication, and increase customer engagement. Cloud-hosted VoIP services are making it possible for companies and individuals to scale effortlessly, save money, and access from anywhere, making it a desirable option for enterprises and consumers alike. As companies increasingly adopt digital-first communication strategies, VoIP platforms that provide AI-powered automation and cloud integration are being adopted at an accelerated pace. With constant developments in technology, mobile VoIP providers can potentially extend their range of services, providing more intelligent, more effective, and high-quality communications solutions to an expanding global base of users.

Challenges

-

Older Devices Lacking Support for Advanced VoIP Features, Leading to Poor Call Quality, Lag, and Restricted Adoption in Mobile VoIP Market

Most legacy devices and older smartphones do not support next-generation VoIP features, forming a boundary for smooth adoption. With newer development of mobile VoIP technology along with high-definition voice, video calling, and AI-based features, older hardware lags behind in meeting performance demands. Incompatible users would face low call quality, latency, and feature limitations, which results in frustration and lower adoption rates. Companies using VoIP for communication will also incur added expenses in the upgrade of equipment to achieve optimum performance. Since VoIP depends on widespread compatibility of devices, VoIP vendors need to create ways to connect the gap either by software tweaking or light version applications to broaden market coverage and enhance user availability with older phones.

Segment Analysis

By Service

The Video and Voice Calls segment captured the most in 2023 revenue share within the Mobile VoIP Market of around 54%. The drivers are high-demand cost-saving quality voice and video calls both business-to-business and personal usage. It is widespread technology deployment for both high-speed internet and 5G, substantially enhancing voice calls' reliability and quality and so reinforcing VoIP-based video calls and voice preference among consumers. Also, companies are increasingly using video conferencing for remote work, collaboration, and customer communication, which is driving market growth.

The Instant Messaging segment is set to advance at the fastest CAGR of around 18.35% between 2024 and 2032, as more people prefer rapid, text-based communications compared to making calls. The transition towards mobile-first messaging, adoption of AI-driven chatbots, and increasing use of messaging applications for business communications are among the reasons for this speedy growth. End-to-end encryption, sharing of multimedia, and easy integration with enterprise communication platforms are some of the features that make instant messaging a choice pick, particularly among younger generation users and digital customer engagement adopting businesses.

By Platform

The Android OS segment led the Mobile VoIP Market in 2023 with the largest revenue share of around 66%. Android's global popularity, low cost, and support across a wide variety of devices are the main reasons for its leading position. Android is an open-source operating system that can be easily customized and integrated with VoIP applications, which makes it the first choice among consumers and enterprises alike. Also, cheap Android-based smartphones have made VoIP more accessible in the emerging markets, contributing further to its market dominance.

The iOS segment is expected to grow at the fastest CAGR of around 17.13% during 2024-2032, led by rising Apple device adoption and increasing demand for advanced security and privacy features. iOS users tend to embrace paid VoIP offerings more because of greater disposable income and the native integration of VoIP applications into Apple's environment. Apple's progress in 5G technology and hardware optimization also improves the experience of VoIP, fueling growth in this segment even more.

By Pricing Model

The Subscription-based segment led the Mobile VoIP Market in 2023, with the largest revenue share of about 55%. This leadership is fueled by companies and consumers choosing high-end VoIP solutions that provide more security, better call quality, and added features like unlimited global calling, cloud storage, and enterprise-level communication software. Subscription-based models guarantee steady revenue for the providers while providing customers affordable plans with predictable costs. Businesses increasingly use subscription-based VoIP services for remote collaboration and unified communications, further cementing this segment's leadership.

The Hybrid segment will expand at the fastest CAGR of nearly 18.29% during 2024-2032, driven by the rising need for flexible and cost-effective communication solutions. Enterprises and individuals look for hybrid VoIP models blending free and premium services, enabling users to scale features in accordance with their requirements. The increasing popularity of cloud-based VoIP and pay-as-you-go schemes allows budget-conscious users to enjoy high-quality communication without tying up in full-time subscriptions, fueling high-speed market growth.

Regional Analysis

North America dominated the Mobile VoIP Market in 2023, holding the highest revenue share of approximately 36%. This dominance is driven by the widespread adoption of advanced communication technologies, high smartphone penetration, and strong 5G infrastructure. The region’s well-established corporate sector heavily relies on VoIP for business communication, remote work, and unified collaboration solutions. Additionally, the presence of major VoIP service providers and increasing demand for cloud-based communication solutions contribute to the market's strong performance in North America.

Asia Pacific is expected to grow at the fastest CAGR of approximately 17.78% from 2024 to 2032, fueled by the rapid expansion of internet connectivity, increasing smartphone penetration, and rising demand for cost-effective communication solutions. The region’s large population, particularly in emerging economies, is shifting towards mobile VoIP due to affordability and accessibility. Additionally, growing investments in 5G infrastructure and the adoption of digital communication tools by businesses and individuals are accelerating the market’s expansion across Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Apple Inc. (FaceTime, iMessage)

-

Google LLC (Google Voice, Google Meet)

-

Microsoft (Skype, Microsoft Teams)

-

RingCentral, Inc. (RingCentral Office, RingCentral Video)

-

Nextiva (Nextiva VoIP, Nextiva Video Conferencing)

-

Grasshopper (Grasshopper VoIP, Virtual Receptionist)

-

Cisco Systems, Inc. (Cisco Webex, Cisco Jabber)

-

Aircall (Aircall VoIP, Aircall Integrations)

-

Mitel Networks Corp. (Mitel MiCloud Connect, Mitel VoIP Phone Systems)

-

Meta (WhatsApp, Facebook Messenger)

-

Zoom Video Communications, Inc. (Zoom Phone, Zoom Meetings)

-

3CX (3CX Phone System, 3CX WebRTC Phone)

-

8x8, Inc. (8x8 Voice for Microsoft Teams, 8x8 Video Meetings)

-

GoTo Group (GoTo Connect, GoTo Meeting)

-

Twilio (Twilio Voice, Twilio Video)

-

Citrix Systems Inc. (Citrix Workspace, Citrix ShareFile)

-

Ribbon Communications (Ribbon SBC, Ribbon Analytics)

-

Rakuten Group, Inc. (Rakuten Mobile, Rakuten Communications Platform)

Recent Developments:

-

In 2024, Apple plans to introduce satellite communication in the Apple Watch Ultra, enabling users to send messages without a cellular or internet connection. This feature is expected to expand Apple's satellite services, enhancing connectivity for users in remote areas.

-

In the Q4 2024, Twilio announced product updates aimed at enhancing customer experiences, optimizing internal processes, and incorporating consumer preference analysis to improve communication services.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 50.18 Billion |

| Market Size by 2032 | USD 184.19 Billion |

| CAGR | CAGR of 15.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Video and Voice Calls, Video Conferencing, Instant Messaging, Others) • By Platform (Android OS, iOS, Windows OS, Others) • By Pricing Model (Subscription-based, Pay-as-you-go, Hybrid) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple Inc., Google LLC, Microsoft, RingCentral, Inc., Nextiva, Grasshopper, Cisco Systems, Inc., Aircall, Mitel Networks Corp., Meta, Zoom Video Communications, Inc., 3CX, 8x8, Inc., GoTo Group, Twilio, Citrix Systems Inc., Ribbon Communications, Rakuten Group, Inc. |