Animal Genetics Market Report Scope & Overview:

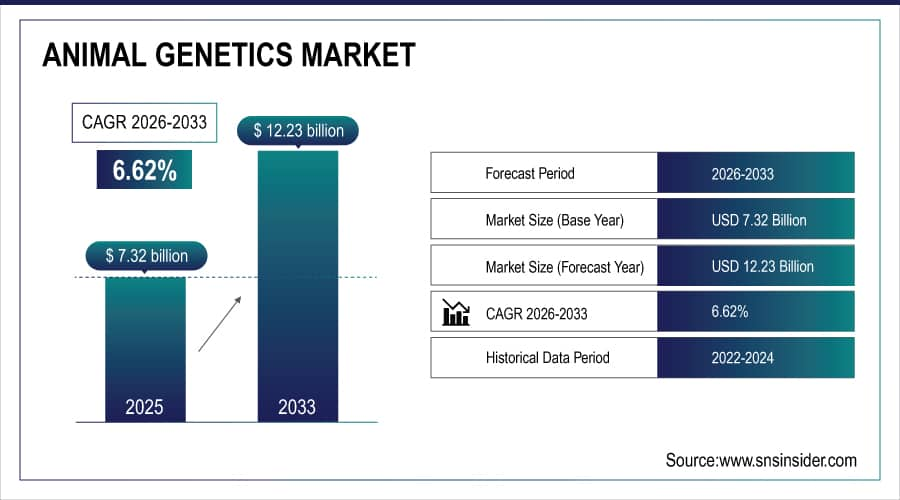

The Animal Genetics Market size is estimated at USD 7.32 Billion in 2025 and is expected to reach USD 12.23 Billion by 2033, growing at a CAGR of 6.62% over the forecast period of 2026-2033.

The global animal genetics market is growing due to intensifying global demand for high-quality animal protein and dairy products. To meet this need, cattle productivity, disease resistance, and feed efficiency must all be greatly improved. Advanced genetic technology can help with all of these things. At the same time, the rapid growth of genomic testing and sequencing technology has made them much cheaper and easier to get, allowing for precise trait selection and breeding on a scale never seen before. The growing investment in new genetic solutions for pets, especially dogs and horses, that focus on health, disease predisposition testing, and desirable phenotypic qualities is a primary driver of the market. Strict rules that protect animal welfare, the use of big data and artificial intelligence in genetic analysis, and strong public-private collaborations in research and development all help the business grow.

For instance, in January 2025, a leading genomics firm announced a 40% year-over-year increase in cattle genotyping volumes in North America, attributed to wider adoption of genomic-enhanced breeding values by commercial dairy and beef producers.

Animal Genetics Market Size and Forecast:

-

Market Size in 2025E: USD 7.32 Billion

-

Market Size by 2033: USD 12.23 Billion

-

CAGR: 6.62% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Animal Genetics Market - Request Free Sample Report

Animal Genetics Market Report Highlights

-

Rising demand for efficient livestock to meet global protein needs, boosting adoption of advanced genetics in cattle, pigs, and poultry.

-

Declining genomic sequencing costs driving wider DNA testing for trait selection, parentage, and disease screening in livestock and pets.

-

Strong growth in companion animal genetic testing for breed ID, health screening, and trait prediction.

-

Faster adoption of reproductive technologies such as IVF and embryo transfer to enhance genetic gains.

-

Market consolidation via mergers and acquisitions to expand reach, services, and genomic databases.

-

Growing use of data analytics and AI to analyze genomics, predict breeding values, and optimize mating.

-

Tightening regulations and standards for genetic testing, disease traceability, and cross-border genetic trade.

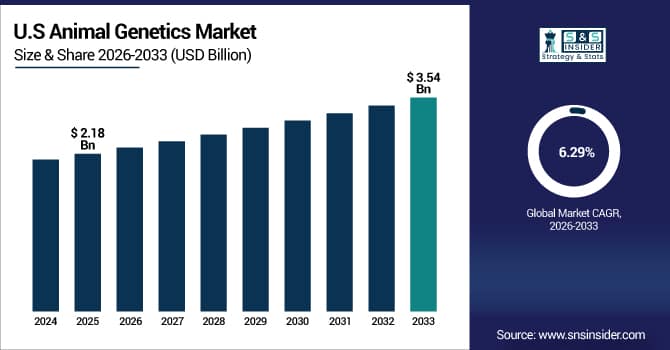

The U.S. Animal Genetics Market is estimated at USD 2.18 billion in 2025 and is expected to reach USD 3.54 billion by 2033, growing at a CAGR of 6.29% from 2026-2033. The U.S. is the leader in the animal genetics market as it has a well-developed livestock business, a lot of genomic technology, and a solid infrastructure for breeding and reproducing animals. The presence of top genetics businesses, advanced artificial insemination networks, strong investment in research and development, and rising demand for high-quality meat and dairy products are all helping the market thrive.

Animal Genetics Market Growth Drivers:

-

Rising Protein Demand and Need for Higher Livestock Productivity Drive Market Growth

As the world's population and wages rise, so does the need for meat, milk, and eggs. However, there are restrictions on land, water, and feed that make it hard for herds to grow. So, it's important to make each animal more productive. Advanced animal genetics lets you choose animals with better features, such higher yields, better feed efficiency, faster growth, and better quality. Genetics is a major reason why people in the cattle industry invest in the market. This is because there is a clear correlation between genetic improvement and economic rewards.

For instance, a 2024 industry study showed dairy herds using genomic testing achieved 15% faster genetic gains in milk production than those using traditional methods, demonstrating strong ROI.

Animal Genetics Market Restraints:

-

High Upfront Costs and Technical Complexity Restrict Adoption in Emerging Markets

Even while genotyping, data systems, and skilled workers will pay off in the long run, the hefty initial costs make it hard for small farmers and developing areas to use them. The difficulty of understanding genetic data makes the difference even worse, keeping new technology in the hands of big manufacturers and established nations. This slows market expansion in areas with a lot of potential.

Animal Genetics Market Opportunities:

-

Emerging Markets and Precision Genetics Offer Significant Growth Potential

Major opportunities exist in providing affordable, localized genetic solutions for expanding livestock sectors in Asia Pacific, Latin America, and Africa. Innovations such as low-cost genotyping, mobile data platforms, and local support can boost adoption. In parallel, precision genetics, including tools like CRISPR for disease resistance and specialized traits, presents new market segments and long-term value as regulations evolve.

For instance, in March 2024, a global genetics firm partnered with a Brazilian beef cooperative to launch a localized genomic program for Nelore cattle, targeting improved feed efficiency under local conditions.

Animal Genetics Market Segment Analysis:

-

By Type, the Genomic/Genetic Testing segment led with about 48.2% share in 2025E and is projected to grow at a CAGR of 7.3% during 2026–2033.

-

By Animal Type, the Cattle segment held nearly 45.5% share in 2025E, while Companion Animals are expected to witness the fastest growth at a CAGR of 8.1%.

-

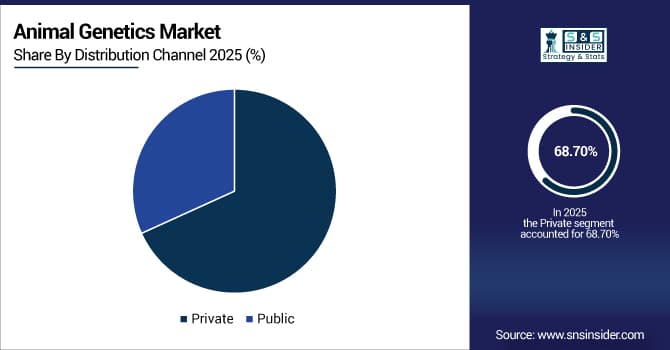

By Distribution Channel, the Private channel dominated with around 68.7% share in 2025E and is forecast to grow at a CAGR of 6.8%.

By Type, Genomic/Genetic Testing Dominates and Drives Market Evolution

The Genomic/Genetic Testing segment is the cornerstone of the modern animal genetics market, commanding the largest revenue share. This dominance is attributed to the critical role DNA-based tools play in unlocking genetic potential. Services include parentage verification, trait predisposition screening (for both production and health traits), genetic defect carrier status, and genomic profiling for calculating genomic estimated breeding values (GEBVs). The shift from subjective phenotypic selection to objective, data-driven genomic selection is accelerating genetic progress exponentially. The segment's leading growth rate is fueled by continuous technological advancements reducing test costs, expanding panel densities, and the development of novel tests for emerging traits, such as methane emissions and animal welfare indicators.

By Animal Type, Cattle Leads in Value, While Companion Animals Exhibit Explosive Growth

The Cattle segment, encompassing both dairy and beef, represents the largest and most established market due to the high economic value of individual animals and the well-organized global breeding industry. The intensive use of artificial insemination, embryo transfer, and genomic testing in dairy cattle, in particular, drives significant and recurring revenue. In contrast, the Companion Animals segment (dogs, cats, and horses) is experiencing the fastest growth. This surge is driven by the humanization of pets, increasing disposable income spent on animal health, and the proliferation of direct-to-consumer genetic testing kits for dogs that offer breed mix analysis, health risk reports, and trait insights. The equine market for performance and disease genetics adds further high-value momentum to this segment.

By Distribution Channel, Private Sector is the Primary Engine, Demonstrating Strong Sustained Growth

The Private distribution channel, comprising corporate genetics companies, specialized breeders, and private veterinary diagnostics labs, holds a commanding market share. This reflects the commercial, for-profit nature of most advanced genetic services. Private companies drive innovation through significant R&D investments, possess extensive proprietary genetic databases, and offer integrated solutions from testing to breeding stock sales. Their growth is sustained by global expansion, continuous service portfolio enhancement, and direct marketing to producers and pet owners. The Public channel, including government-run breeding programs and academic institutions, remains vital for foundational research, conservation genetics, and support in developing regions but operates at a different scale and commercial dynamic.

Animal Genetics Market Regional Highlights:

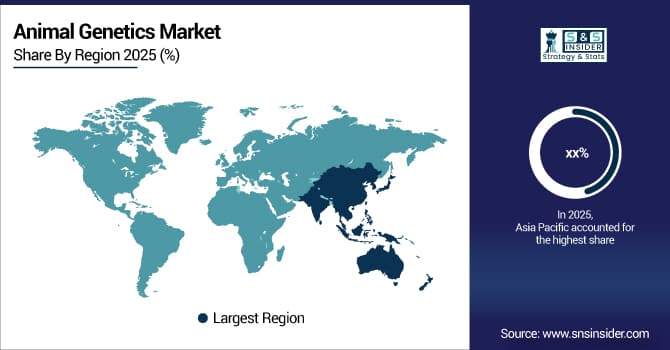

Asia Pacific Animal Genetics Market Insights:

Asia Pacific is expected to be the fastest-growing geographical market, with a CAGR of 8.4% from 2026 to 2033. The region's huge and modernizing livestock sectors, especially in China, India, and Southeast Asia, are driving this rise. Governments and big producers are spending a lot of money to improve the genetics of their herds at home by bringing in better germplasm and setting up local genomic selection programs. This is because more people are eating meat and dairy. Also, the demand for companion animal genetic services is growing since the middle class is developing quickly and more people are getting pets. The APAC area has the fastest growth rate in the world, even though it started from a lower basis. This is the biggest chance for industry players in the future.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Animal Genetics Market Insights:

In 2025, North America had the biggest revenue share, about 37.5%, which made it the market leader. This dominance comes from a well-developed, technology-driven cattle industry with high requirements for productivity. There are breeding firms and breed associations in the area that are known globally and were the first to use genomic selection, especially in dairy (with almost universal heifer genotyping) and pigs. A well-developed system for assisted reproduction, a strong culture of registering purebred dogs and horses, and rules that are good for genetic innovation all work together to make a dense, high-value market that sets global trends and standards.

Europe Animal Genetics Market Insights:

Europe is a well-established and technologically advanced market, characterized by stringent regulations on animal health, welfare, and breeding. Countries like Germany, France, the Netherlands, and Denmark have highly productive livestock industries that are early adopters of genetic technologies. The European market is driven by a focus on sustainability, disease resistance (reducing antibiotic use), and functional traits alongside production metrics. Strong national and EU-level research programs support innovation, while a mature companion animal sector contributes steady demand. Europe represents a stable, high-quality market with an emphasis on precision and regulation.

Latin America (LATAM) and Middle East & Africa (MEA) Animal Genetics Market Insights:

These regions present a dynamic mix of opportunity and challenge. LATAM, led by Brazil and Argentina, has massive, export-oriented beef and poultry industries that are progressively integrating genetic tools to enhance competitiveness. The market growth is supported by large-scale farming operations. In MEA, growth is driven by government-led initiatives to achieve food security, leading to investments in dairy and poultry genetics, often through imports and technology transfer. While infrastructure and adoption levels vary, the underlying need to improve animal productivity ensures these regions remain important growth frontiers, particularly for companies offering scalable and adaptable genetic solutions.

Animal Genetics Market Competitive Landscape:

Genus plc (est. 1990) is a global leader in bovine and porcine genetics, operating through its ABS Global (cattle) and PIC (pigs) brands. The company's strategy is built on a vast proprietary genomics database, continuous R&D in reproductive technologies, and a global supply network for high-genetic-merit breeding stock and semen.

-

In February 2025, Genus PIC launched a new genomic panel for swine that includes markers for resilience to Porcine Reproductive and Respiratory Syndrome (PRRS), aiming to reduce economic losses for pork producers worldwide.

Neogen Corporation (est. 1982) provides a comprehensive suite of animal genomics and food safety solutions. Its GeneSeek subsidiary is one of the world's largest agricultural genomics laboratories, offering a wide array of genetic tests for livestock and companion animals, leveraging high-throughput sequencing and informatics.

-

In November 2024, Neogen launched a new canine health panel screening for over 250 genetic diseases and traits, directly targeting the expanding market for comprehensive pet wellness diagnostics.

URUS (formerly Alta Genetics/CRV) is a major player in the global dairy genetics market, formed by the merger of Alta Genetics and CRV. The group focuses on delivering integrated breeding programs, genomics, and herd management software to dairy farmers to optimize profitability and sustainability.

-

In January 2025, URUS announced a strategic alliance with a leading AI software company to integrate genomic breeding values directly into robotic milking and herd management systems, enabling real-time genetic decision-making.

Animal Genetics Market Key Players:

-

Genus plc

-

Neogen Corporation

-

URUS Group

-

Zoetis Inc.

-

EW Group (via its subsidiaries like Hy-Line International, Aviagen)

-

Groupe Grimaud (Choice Genetics)

-

Topigs Norsvin

-

Semex

-

ABS Global (a subsidiary of Genus plc)

-

PIC (a subsidiary of Genus plc)

-

Hendrix Genetics

-

Animal Genetics Inc.

-

VetGen

-

Wisium (a subsidiary of the Lallemand Group)

-

Generatio GmbH

-

EasyDNA

-

Orivet Genetic Pet Care

-

Mars Petcare (via its genetic testing services)

-

Embryonics International Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 7.32 Billion |

| Market Size by 2033 | USD 12.23 Billion |

| CAGR | CAGR of 6.62% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Assistive Reproduction Technologies, Live Animals, Genomic/Genetic Testing) • By Animal Type (Cattle, Pigs, Sheep & Goats, Companion Animals, Others) • By Distribution Channel (Private, Public) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Genus plc, Neogen Corporation, URUS Group, Zoetis Inc., EW Group, Groupe Grimaud, Topigs Norsvin, Semex, ABS Global, PIC, Hendrix Genetics, Animal Genetics Inc., VetGen, Wisium, Generatio GmbH, EasyDNA, Orivet Genetic Pet Care, Mars Petcare, Embryonics International Ltd. |