Sand Control Solutions Market Report Scope & Overview:

The Sand Control Solutions Market size was valued at USD 2.85 billion in 2023 and is expected to grow to USD 5.83 billion by 2031 and grow at a CAGR of 9.4% over the forecast period of 2024-2031.

Sand control is a crucial process in the oil and gas industry that involves preventing sand and other solid particles from entering and damaging the wellbore. This process is essential for maintaining the integrity and productivity of the well. There are various methods of sand control, including gravel packing, sand screens, and chemical treatments.

Get More Information on Sand Control Solutions Market - Request Sample Report

Gravel packing involves placing a layer of gravel around the wellbore to filter out sand and other particles. Sand screens are mesh-like structures that are placed around the wellbore to prevent sand from entering. Chemical treatments involve injecting chemicals into the well to solidify the sand and prevent it from flowing into the wellbore. Effective sand control is critical for maximizing the production of oil and gas wells. Without proper sand control, sand and other particles can clog the wellbore, reducing the flow of oil and gas and ultimately leading to decreased production and revenue. Therefore, it is essential to implement the appropriate sand control method for each well to ensure its long-term productivity and profitability.

The market for sand control solutions is a rapidly growing industry that provides innovative solutions for the oil and gas industry. The demand for sand control solutions has increased due to the rise in unconventional oil and gas exploration, which requires the use of hydraulic fracturing or "fracking" techniques. These techniques involve injecting high-pressure fluids into the well to fracture the rock and release the oil and gas. However, this process can also cause sand and other particles to enter the well, which can lead to clogging and reduced production. These solutions are designed to meet the specific needs of each well and can be customized to provide optimal performance and longevity. As the demand for oil and gas continues to grow, the sand control solutions market is expected to expand further. With advancements in technology and increased investment in research and development, the industry is poised for continued growth and innovation.

Market Dynamics

Drivers

-

Increasing demand for oil and gas

-

Increasing unconventional oil and gas exploration activities

The sand control solution market is being propelled by the rise in unconventional oil and gas exploration activities. Despite the ongoing global energy crisis, new oil and gas discoveries in 2022 have led to exploration reaching its highest value creation in over a decade, with a staggering $33 billion at base price. In fact, the average discovery in 2022 was over 150 million barrels of oil equivalent, which is more than double the average of the previous decade. This surge in exploration activities has created a significant demand for sand control solutions, which are essential for maintaining the integrity of oil and gas wells. As the demand for sand control solutions continues to grow, companies in the oil and gas industry are investing heavily in research and development to create more efficient and effective solutions. This has led to the development of new technologies and techniques that are helping to improve the efficiency and effectiveness of sand control solutions.

Restrain

-

High cost of sand control solutions

-

Fluctuation in the crude oil prices impacted the drilling activities

The sand control solution market is heavily dependent on the drilling industry, as it provides the necessary equipment and services to ensure the efficient extraction of oil and gas. However, the volatility of crude oil prices has led to a decrease in drilling activities, as companies are forced to cut costs and reduce their investments in exploration and production. This, in turn, has resulted in a decline in demand for sand control solutions, as there are fewer drilling projects that require such services.

Opportunities

-

Increasing demand for unconventional oil and gas resources, such as shale gas

-

Development of new and innovative sand control solutions that are environmentally friendly and cost-effective

Challenges

-

Environmental concerns associated with sand control solutions

Impact of COVID-19

Covid-19 impacted the sand control solution market negatively. The dual supply-demand shock and subsequent oil price crash have forced many explorers to reduce their 2020 planned capital expenditure budgets by between 10% and 50%. This has resulted in a multi-year low for exploration activities, with all major indicators for exploration activity levels seeing a significant decline in 2020. The number of international rigs has declined by 20%, and the number of new seismic contracts awarded has dropped by 45%. These figures are a clear indication of the impact of the pandemic on the industry. However, the pandemic has also resulted in a decrease in the demand for oil and gas, which has had a knock-on effect on the sand control solutions market.

Impact of Russia-Ukraine War:

In 2022, when Russia launched an attack on Ukraine, the global market saw a significant surge in crude oil prices. The cost per barrel rose from approximately $76 at the start of January to over $110 on March 4th. This sudden increase in crude oil prices had a ripple effect on the exploration activities of the oil and gas industry, which, in turn, impacted the sand control solution market. The rise in crude oil prices led to a decrease in exploration activities, as companies were forced to cut back on their budgets due to the increased costs. This, in turn, led to a decrease in demand for sand control solutions, as companies were not actively seeking new oil and gas reserves. The impact of the rise in crude oil prices on the sand control solution market was significant, as it led to a decrease in revenue for companies operating in this sector.

Impact of Recession:

According to the Energy Information Administration (EIA), a worldwide economic downturn is expected to decrease the demand for energy. As a result, the prices of WTI and natural gas at the Henry Hub are predicted to decline by 18.2% and 54.2%, respectively, until July 2023. This decrease in oil prices has led to a reduction in drilling activity, which, in turn, has resulted in a decrease in demand for sand control solutions. The EIA's forecast of a global economic downturn is a cause for concern for the energy industry. The decrease in demand for energy will have a significant impact on the prices of WTI and natural gas at the Henry Hub. The decline in oil prices has already led to a reduction in drilling activity, which has affected the demand for sand control solutions.

Key Market Segmentation

By Type:

-

Gravel Pack

-

Frac Pack

-

Sand Screens

-

Inflow Control Devices

-

Others

By Well Type:

-

Horizontal Wells

-

Vertical Wells

By Location:

-

Onshore

-

Offshore

By Application

-

Open Hole

-

Cased Hole

Regional Analysis

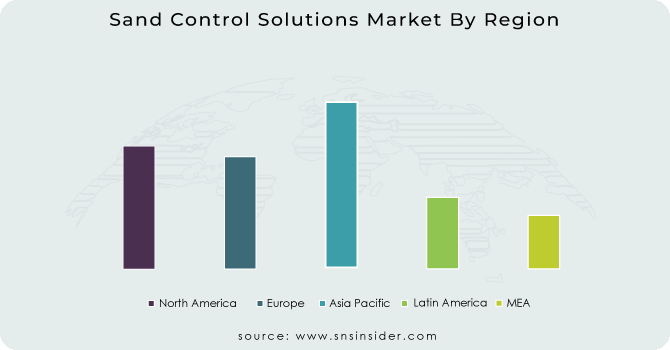

Asia Pacific region dominated the sand control solution market and is expected to lead this market in the future also. This can be attributed to several factors, including the region's vast oil and gas reserves, increasing demand for energy, and the presence of major oil and gas companies. Furthermore, the Asia Pacific region has a large number of offshore oil and gas fields, which require effective sand control solutions to prevent sand production and maintain good productivity. This has led to a surge in demand for sand control solutions in the region, driving the market growth. In addition, the Asia Pacific region has a highly skilled workforce and advanced technology, which has enabled the development of innovative sand control solutions. This has further strengthened the region's position in the market.

The North America region is projected to experience the highest CAGR in the sand control solution market during the forecast period. This can be attributed to the increasing demand for oil and gas production in the region, the growing number of shale gas reserves, and the implementation of advanced technologies in the oil and gas industry. Furthermore, the North American region has a well-established oil and gas industry, which has led to the development of advanced sand control solutions. In addition, the region has a favorable regulatory environment, which has encouraged the adoption of sand control solutions by oil and gas companies. This has further contributed to the growth of the sand control solution market in North America.

Need any customization research on Sand Control Solutions Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are Schlumberger Limited, Halliburton Company, Baker Hughes, Weatherford International, Oil States International, Inc., Expro International Group, Tendeka, Mitchell Industries, China Oilfield Services, and other key players mentioned in the final report.

Baker Hughes-Company Financial Analysis

Recent Developments:

-

In June of 2023, Expro Group Holdings N.V., a leading energy services provider, announced a significant milestone in their partnership with TotalEnergies EP Uganda. The two companies have entered into a five-year Well Intervention and Integrity contract for the Tilenga project, which involves multiple wells. This exciting development is a testament to the expertise and dedication of both Expro and TotalEnergies EP Uganda in the field of energy services. With this contract, Expro will continue to provide top-notch well intervention and integrity services to ensure the success of the Tilenga project.

| Report Attributes | Details |

| Market Size in 2023 | US$ 2.85 Bn |

| Market Size by 2031 | US$ 5.83 Bn |

| CAGR | CAGR of 9.4% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Gravel Pack, Frac Pack, Sand Screens, Inflow Control Devices, and Others) • By Well Type (Horizontal and Vertical) • By Location (Onshore and Offshore) • By Application (Open Hole and Cased Hole) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Schlumberger Limited, Halliburton Company, Baker Hughes, Weatherford International, Oil States International, Inc., Expro International Group, Tendeka, Mitchell Industries, China Oilfield Services |

| Key Drivers | • Increasing demand for oil and gas • Increasing unconventional oil and gas exploration activities |

| Market Opportunities | • Environmental concerns associated with sand control solutions |