Polyethylene Wax Market Report Scope & Overview:

The Polyethylene Wax Market Size was valued at USD 1.97 billion in 2023 and is expected to reach USD 2.88 billion by 2032 and grow at a CAGR of 4.93% over the forecast period 2024-2032. One of the main factors driving the market is the growing usage of polyethylene wax in various applications, including plastic processing, hot-melt adhesive, printing and industrial coating, and others. Throughout the projection period, the market is anticipated to grow as a result of rising shale gas production in North America and China as well as growing demand from the coatings and printing inks industries. The increase of shale gas deposits is the main factor anticipated to propel the product categories in the United States. Chevron Phillips Chemical, INEOS, Williams Company, Dow Chemical, Formosa Plastics, Westlake Chemical, and LyondellBasell are among the regional industry participants that have expanded through programs to increase their end-use productions and customer base.

Get More Information on Polyethylene Wax Market - Request Free Sample Report

For instance, in August 2023 Chevron Phillips Chemical a U.S based company invested USD 6 billion for construction of a polymers complex in Qatar. It included two high-density polyethylene derivative units with a total capacity of 1680 KTA. This construction helped the company to increase its production capacity and increase its expansion in other countries.

The market is characterized by strict rules from numerous international authorities. In contrast to the developed regulatory frameworks of Europe and North America, developing regions such as the Asia Pacific region are currently improving their regulatory frameworks to guarantee appropriate safeguarding of the environment, public health, safety, and human rights.

Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH), FDA (Food and Drug Administration) and EPA (Environment Protection Agency), have formulated stringent emission standards on harmful automobile emission. Therefore, this initiated is to increase the demand for polyethylene wax in various application market.

Polyethylene Wax Market Dynamics

Drivers

-

Rising usage of polyethylene wax’s in end-use applications is boosted the market growth.

Due to advancements in polyethylene wax quality and a rise in the material's end-use applications, the polyethylene wax market is anticipated to grow during the forecast period. The growing need for printing inks as a product contributed to the expansion of the polyethylene wax market. The main factor expected to boost American product sectors is the expansion of shale gas reserves. Players in the regional market have started expansion initiatives to increase the size of their end-use productions and customer base.

Additionally, because of its premium qualities like UV resistance, wear, scratch resistance, corrosion resistance, and Mar, nanotechnology is anticipated to become a major market driver in the coating industry. Paints and coating products will use both metallic and micro-ceramic particles. Strict environmental regulations and technological advancements will fuel global demand for high-solid, UV-curable, aqueous coatings. Strict restrictions enforced by multiple international authorities define the market.

For instance, in December 2023, QGP Quimica Geral was acquired by Innospec Inc. QPG is a well-known manufacturer of specific chemicals in Brazil. The purpose of this action was to increase the company's clientele in South America.

-

Increasing textile industry expansion drives the polyethylene wax market growth.

Restraint

-

Volatility of raw material price and fluctuations in crude oil price hamper market growth.

The price and availability of raw materials have a major impact on the polyethylene wax industry. Changes in the cost of crude oil, a vital component used in the manufacturing of polyethylene wax, can have a big effect on how profitable businesses in this sector are.

Opportunities

-

Development of bio-based polyethylene wax

-

Increasing shale gas deposits in various regions

Polyethylene Wax Market Segmentation

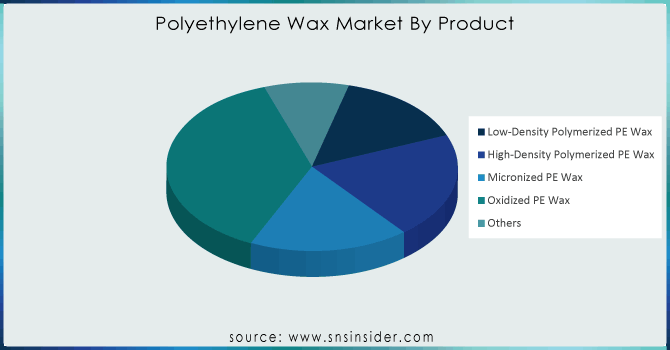

By Product

-

Low-Density Polymerized PE Wax

-

High-Density Polymerized PE Wax

-

Micronized PE Wax

-

Oxidized PE Wax

-

Others

The oxidized PE wax dominated the polyethylene wax market with the highest revenue share of more than 38% in 2023 due to a rise in use in the masterbatches, rubber, plastics, inks, rubber, shoe, and leather sectors. The oxidized market in Asia Pacific is anticipated to expand significantly as a result of increased R&D and rapid industrialization.

PE wax has become widely accepted in the coatings business and is being used more and more in PVC processing, water-based wax emulsions, and nonionic emulsions in a variety of manufacturing sectors, including the paper coating, adhesives, textiles, packaging, and automotive industries.

The second-largest segment was High Density Polymerized PE Wax, which is expected to hold a sizable market share. The most often used PE wax is high density polymerized, which has a high density and tensile strength. Due to their significant market penetration and anticipated growth, they are utilized in a variety of application sectors.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Technology

-

Polymerization

-

Thermal Cracking

-

Micronization

-

Modification

-

Others

The polymerization dominated the market with the highest revenue share of more than 48.54% in 2023. Manufacturers have recently turned to metallocene, a type of polymerization technology, as an upgraded and improved performance solution for HDP and LDP manufacturing. This is anticipated to support the PE wax market's rise in polymerization technology.

Modification technique is employed in the production of co-polymers, oxidized, acid-modified, and unique monomers. Over the course of the forecast period, it is anticipated that the technological share will rise due to the significant expansion in demand for acid-modified and oxidized products.

The expanding market for oxidized, specific monomer, acid modified, and co-polymer products has a commensurate impact on the demand for the modification segment. Over the course of the forecast period, the growth in the application sector of oxidized inks, adhesives, and masterbatches, as well as acid-modified coatings, is expected to drive the market volume.

By Application

-

Woods & Fire Logs

-

Packaging

-

Plastic Additives

-

Lubricants

-

Candles

-

Cosmetics

-

Printing Inks

-

Rubber

-

Others

The candle dominated the application segment with the highest revenue share of more than 30% in 2023. The second-largest application sector, packaging, is expected to account for a sizeable portion of the market. Among the qualities of PE wax that are highly valued in the packaging industry are heat seal ability and grease and scuff resistance. The growing use of wax packaging in coating, treating, impregnating, and laminating major food contact materials like paper, paperboards, and aluminium is anticipated to drive significant growth in the Indian market.

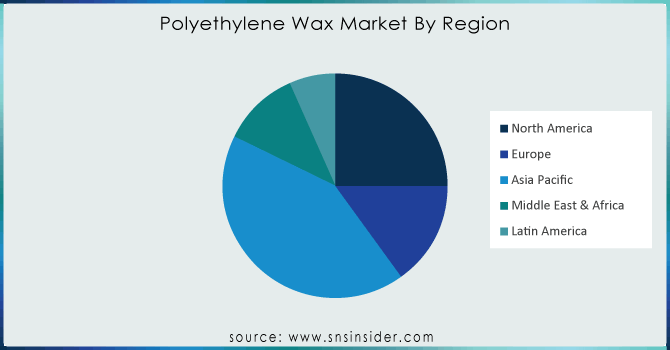

Polyethylene Wax Market Regional Analysis

Asia Pacific led the polyethylene wax market with the highest revenue share of approx. 33.12% in 2023. This dominance is a result of the region's PE wax market expanding rapidly due to China and India's ample supply of polyethylene and fast industrialization. Asia Pacific's growth is also increased due to the China's well-established infrastructure for the manufacturing of polyethylene wax, along with the presence of important industry participants. The fast industrial boom that nations like Vietnam and India are experiencing will cause demand for PE wax to soar in the region. In the near future, these countries' expanding industries are anticipated to fuel demand for PE wax.

Due to the rising demand for hot melt adhesives across a range of industries, including the automotive and construction sectors, North America is anticipated to develop at a notable compound annual growth rate (CAGR) of roughly 4.5% over the projected period. Additionally, growing investments in end-use industries are expected to propel the polyethylene wax market. In nations like the United States, Canada, and Mexico, the consumption of magazines, catalogs, periodicals, and directories in end-use applications has been a major driver of market expansion. These nations have distinct structural characteristics and strong performance requirements, which have helped the industry grow remarkably.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major key players are Clariant, BASF SE, Baker Hughes, SCG Chemicals, Mitsui Chemicals, Honeywell International Inc., Trecora Chemical, Zellag, Marcus Oil & Chemicals Pvt. Ltd., Oxidized Polyethylene Innovations, and other key players are mentioned in the final report.

SCG Chemicals-Company Financial Analysis

Recent Development:

-

June 2023 BASF SE, has established its production plant in China. The new plant with a capacity of 500,000 metric tons PE annually. This new production plant helped the company to increase its production capacity and increase its revenue.

-

In March 2022, Sasol sod its Germany- based subsidiary which is dealing in development, production, and distribution of wax products. It has two production facilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.97 billion |

| Market Size by 2032 | US$ 2.88 Billion |

| CAGR | CAGR of 4.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Low-Density Polymerized PE Wax, High-Density Polymerized PE Wax, Micronized PE Wax, Oxidized PE Wax, And Others) •By Technology (Polymerization, Thermal Cracking, Micronization, Modification, And Others), •By Application (Woods & Fire Logs, Packaging, Plastic Additives, Lubricants, Candles, Cosmetics, Printing Inks, Rubber, And Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Clariant, BASF SE, Baker Hughes, SCG Chemicals, Mitsui Chemicals, Honeywell International Inc., Trecora Chemical, Zellag, Marcus Oil & Chemicals Pvt. Ltd., Oxidized Polyethylene Innovations and other players |

| Key Drivers | •Rising usage of polyethylene wax’s in end-use applications is boosted the market growth |

| RESTRAINTS | •Volatility of raw material price and fluctuations in crude oil price |