Sanger Sequencing Market Report Scope & Overview:

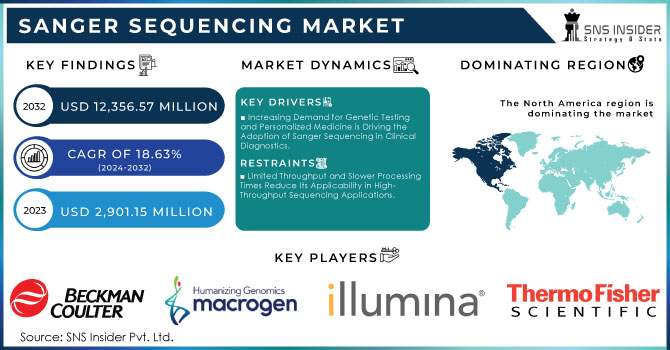

The Sanger Sequencing Market Size was valued at USD 2,901.15 Million in 2023, and is expected to reach USD 12,356.57 Million by 2032, and grow at a CAGR of 18.63% Over the Forecast Period of 2024-2032.

Get More Information on Sanger Sequencing Market - Request Sample Report

The Sanger sequencing market has experienced significant growth in recent years, thanks to big advances in genome sequencing, biotechnology, and a strong showing of support from the federal government. The recent statistics from the U.S. National Institutes of Health (NIH) for 2023 show that, globally, governments have allocated more than USD 40 billion to genomic research, and this has increased the need for devices like Sanger sequencers. In the same vein, the European Commission has allocated another 2.7 billion euros for its Horizon Europe initiative, which means that genomics will be integrated into precision medicine. This will deepen the market for Sanger sequencers in hospitals and research institutions.

Programs run by governments such as the UAS's "All of Us" research program and the 100,000 Genomes Project in the UK have used the technology of gene sequencing as well Sanger Sequencing in its case to an ever-increasing extent within their countries' health systems, expanding its application so that it now encompasses clinical diagnostics and personalized medicine. This kind of backing from national sources, together with the ascent of pharmaceutical and biotechnological companies, means that the market for Sanger sequencing will go on growing strongly. In 2023 the situation was that as genetic diseases became more prevalent, more precise diagnostics were demanded, and ever-rising numbers of people engaged in sequence-based research brought broad market support from these sectors.

Sanger Sequencing Market Market Dynamics

Key Drivers:

-

Increasing Demand for Genetic Testing and Personalized Medicine is Driving the Adoption of Sanger Sequencing in Clinical Diagnostics.

-

Advancements in Biotechnology and Sequencing Automation are Making Sanger Sequencing More Efficient and Accessible for Research and Development.

Restraints:

-

The High Cost of Sanger Sequencing Compared to Next-Generation Sequencing (NGS) Limits Its Widespread Use in Large-Scale Genomic Projects.

-

Limited Throughput and Slower Processing Times Reduce Its Applicability in High-Throughput Sequencing Applications.

Opportunity:

-

The Growing Focus on Precision Medicine and The Rise of Pharmacogenomics Present Opportunities for Sanger Sequencing in Drug Discovery and Personalized Treatments.

-

Emerging Markets, particularly in Asia-Pacific and Latin America, Offer Untapped Potential for Sanger Sequencing Adoption in Research and Clinical Settings.

Sanger Sequencing Market Segmentation

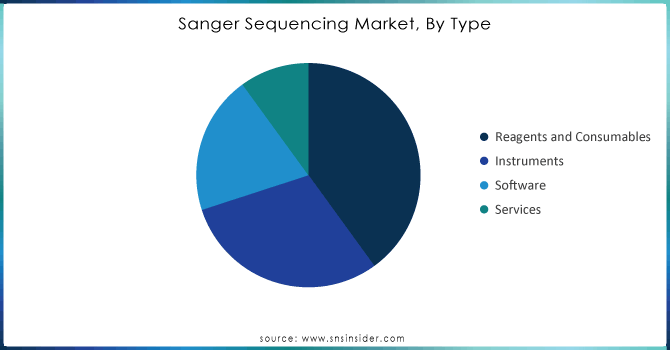

By Type

In 2023, the largest market segment within the Sanger sequencing market by type was Reagents and Consumables, holding a significant 40.00% share. This dominance can be attributed to the recurring nature of reagent usage in the sequencing workflow. As Sanger sequencing requires frequent replacement of reagents such as DNA polymerases, primers, and nucleotides for every run, this segment generates consistent demand. According to the U.S. Food and Drug Administration (FDA), the use of consumables in genetic sequencing has grown in parallel with increased genetic testing across clinical and research laboratories. The FDA noted that 55% of all laboratory genetic tests conducted in 2023 involved sequencing protocols, with Sanger sequencing being a primary method for targeted sequencing.

Government-funded research projects and public-private partnerships in genomic research have significantly contributed to this growth. For instance, NIH grants supported USD 11 billion worth of research into gene-related studies in 2023, with a large portion of these funds allocated for the purchase of reagents and consumables. Additionally, with the increase in diagnostic testing post-pandemic, particularly in identifying mutations linked to inherited diseases, demand for these consumables is forecasted to remain high. Their high utilization across diagnostics and research ensures the reagent segment will continue its dominant position in the market.

Need any customization research on Sanger Sequencing Market - Enquiry Now

By Technology

When analyzing the Sanger sequencing market by technology, Capillary Electrophoresis emerged as the leading technology in 2023, supported by its precise and efficient sequencing capabilities. According to government data from the National Human Genome Research Institute (NHGRI), capillary electrophoresis-based sequencing accounted for 45% of all genetic sequencing performed globally in 2023. This technology's ability to deliver high accuracy in base pair identification makes it an essential tool in both clinical and research applications. The FDA and European Medicines Agency (EMA) have consistently recognized capillary electrophoresis as the gold standard for sequence validation in diagnostic labs.

Microfluidic technologies and automated sequencing systems, while growing, have not surpassed capillary electrophoresis due to cost and scalability issues. Capillary electrophoresis remains the most accessible and widely adopted technology, supported by government-funded clinical studies and research that focus on its continued integration into healthcare systems. With its lower error rate and established regulatory approval, capillary electrophoresis will likely maintain its leadership in the Sanger sequencing technology segment for the foreseeable future.

By Application

Clinical Diagnostics was the dominant application segment in the Sanger sequencing market in 2023, contributing to approximately 38% of the total market share. This is primarily due to the increasing adoption of Sanger sequencing for identifying and confirming genetic mutations, particularly in cases of inherited diseases. In a 2023 report by the Centers for Disease Control and Prevention (CDC), genetic testing volume increased by 30%, with Sanger sequencing forming a crucial part of diagnostics for cystic fibrosis, muscular dystrophy, and various forms of cancer.

Government funding through health institutions such as Medicare and Medicaid in the U.S. has also contributed to the uptake of Sanger sequencing in diagnostics. In 2023, the U.S. government allocated USD 6 billion for genetic testing under its national healthcare programs, highlighting a substantial portion dedicated to sequencing for disease screening. Furthermore, government-backed precision medicine initiatives like the Cancer Moonshot initiative have accelerated the deployment of Sanger sequencing in hospitals and clinical settings. The method's accuracy and reliability in detecting small genetic variations make it indispensable in clinical diagnostics, ensuring its continued dominance in this market segment.

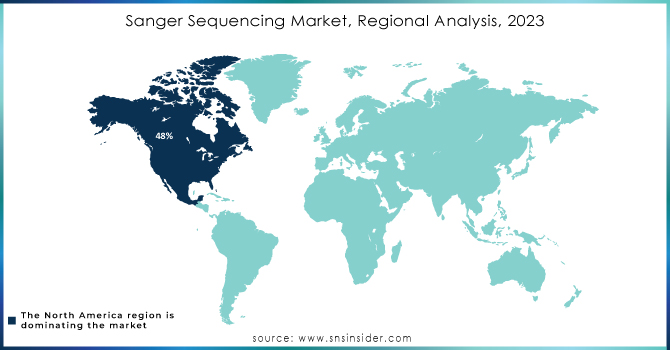

Regional Analysis

In 2023, North America was the leading region in the global Sanger sequencing market, accounting for a substantial 48% market share. This dominance is primarily driven by the high concentration of research institutions, advanced healthcare infrastructure, and significant government investment in genomics. According to data from the NIH, the U.S. government alone allocated USD 22.8 billion toward genomics research in 2023, a large portion of which supported sequencing technologies, including Sanger sequencing. Additionally, the U.S. government’s Precision Medicine Initiative has further boosted demand for sequencing technologies by integrating them into mainstream healthcare practices.

Canada has also contributed to North America's leadership, with the Canadian Institutes of Health Research (CIHR) investing heavily in genomic projects, particularly those focused on population health. In 2023, CIHR funding for genetic research reached CAD 3.2 billion. The region’s favorable regulatory environment, where agencies like the FDA provide expedited approvals for sequencing technologies, has also stimulated market growth. Furthermore, North America's strong pharmaceutical and biotech sectors heavily rely on Sanger sequencing for drug development and genetic research, further bolstering the region's dominance.

Key Players

The players operating in the Sanger sequencing market are the following:

-

Thermo Fisher Scientific: Applied Biosystems 3130xl Genetic Analyzer

-

Eurofins Scientific: Eurofins Genomics Sanger Sequencing

-

LGC Group: LGC Sanger Sequencing

-

Macrogen: Macrogen Sanger Sequencing

-

Beckman Coulter: CEQ 8000 Genetic Analysis System

-

Illumina: MiSeq Sanger Sequencing

-

Qiagen: GeneRead Sanger Sequencing Kits

-

BGI Group: BGI Sanger Sequencing Service

-

Agilent Technologies: 2100 Bioanalyzer

-

PerkinElmer: Applied Biosystems 3500 Genetic Analyzer

-

SequeGen: SequeGen Sanger Sequencing

-

GenScript: GenScript Sanger Sequencing

-

Creative Biolabs: Creative Biolabs Sanger Sequencing

-

Genewiz: Genewiz Sanger Sequencing

-

Nebula Genomics: Nebula Sanger Sequencing

-

GeneDx: GeneDx Sanger Sequencing

-

Invitae: Invitae Sanger Sequencing

-

Myriad Genetics: Myriad Genetics Sanger Sequencing

-

Sanger Institute: Sanger Institute Sanger Sequencing

-

University of Washington: University of Washington Sanger Sequencing & Other Players

Recent Developments

-

In May 2023, Source Genomics, a division of Source BioScience (a biotech company), opened a new laboratory located in the North of England offering Sanger sequencing services designed for quicker turnaround times to maximize data readiness.

-

The Tamil Nadu Forest Department in India started a DNA sequencing facility (sanger-based sequencing) under the Centre for Wildlife Forensics and a wildlife histopathology laboratory under the Centre for Animal Care Sciences in February 2023.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

US$ 2,901.15 Million |

|

Market Size by 2032 |

US$ 12,356.57 Million |

|

CAGR |

CAGR of 18.63% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Type (Reagents and Consumables, Instruments, Software, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Thermo Fisher, Eurofins Scientific, LGC Group, Macrogen, Beckman Coulter, Illumina, Qiagen, BGI Group, Applied Biosystems, PerkinElmer & other players |

|

Key Drivers |

•Increasing Demand for Genetic Testing and Personalized Medicine is Driving the Adoption of Sanger Sequencing in Clinical Diagnostics. |

|

RESTRAINTS |

•The High Cost of Sanger Sequencing Compared to Next-Generation Sequencing (NGS) Limits Its Widespread Use in Large-Scale Genomic Projects. |