Microfluidics Market Size & Trends Analysis:

Get more information on Microfluidics Market - Request Sample Report

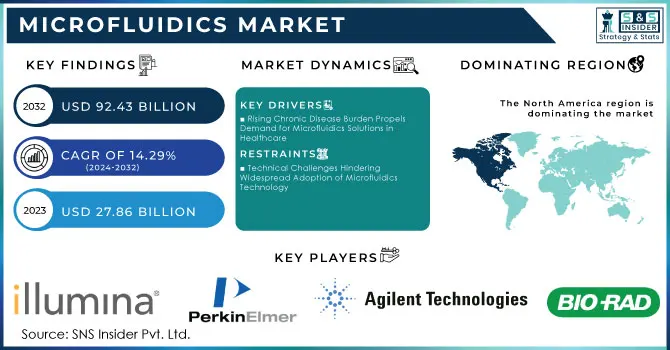

The Microfluidics Market Size was valued at USD 27.86 billion in 2023 and is expected to reach USD 92.43 billion by 2032, growing at a CAGR of 14.29% from 2024-2032.

The microfluidics market is growing rapidly due to the increased need for fast, low-cost diagnostic tools and precision healthcare solutions. Microfluidic devices, for example, lab-on-a-chip and point-of-care testing systems are most critical to making rapid diagnostics that cater to a U.S. Diagnostic & Medical Laboratories market worth USD 79.4 billion in 2023 alone. With more than 5,500 pharmaceutical companies actively conducting R&D worldwide, microfluidics-based technologies help in scalable health solutions. Microfluidics offers maximum efficiency in biochemical analyses for complex analyses with small samples, thus fueling clinical diagnostics and research growth.

Microfluidics is anticipated to propel major progress in personalized medicine and drug development, with worldwide R&D funding exceeding USD 301 billion in 2023. Pharmaceutical firms are progressively utilizing microfluidic technologies to lower drug discovery expenses by as much as 70% via AI. This advancement also enables real-time cellular evaluation in cancer studies and immunotherapy, permitting highly customized treatments. With the increasing demand for precision medicine, microfluidics will be essential in influencing the future of healthcare.

Applications of microfluidics go beyond health sectors, and applications grow in environmental monitoring, wearable health devices, and food safety testing. In 2023, some 40% of US adults engaged in health-related apps, and 35% used wearable devices. Moreover, more people will be integrating themselves into digital health with 75% of the healthcare professionals favorable for AI integration. Microfluidics-enabled devices with AI and machine learning will be integrated for advanced data analysis and automation. This convergence of technology and healthcare positions the microfluidics market for sustained, multi-industry growth.

Microfluidics Market Dynamics

Drivers

-

Rising Chronic Disease Burden Propels Demand for Microfluidics Solutions in Healthcare

The more than half a billion individuals suffering from diabetes and heart/circulatory diseases accounting for nearly one-third of deaths worldwide shows an increase in the need for sophisticated diagnostic and monitoring tools. In the United States, 1.9 million new cancer cases, along with over 600,000 cancer deaths, are estimated for 2023, further adding to the need for early detection and personalized treatment. Microfluidics-based technologies open the way for fast, accurate, and minimally invasive testing, especially for chronic conditions, and hence form a fine management strategy for chronic diseases. With management by disease efficiency gaining center stage in health care, microfluidics, no doubt, will be the bedrock through which the increased burden of chronic diseases will be coherently addressed.

-

Expanding Applications of Microfluidics in Environmental and Food Safety Sectors

In the microfluidics market, environmental monitoring, and food safety testing have gained much momentum as there is an immense need for the real-time tracking of pollutants, along with the identification of contaminations in the current scenario. In 2023, there were more than 7.7 million food safety tests reported by FSIS staff; with this kind of surge in demand and requirement for accurate, efficient testing solutions, microfluidic devices- compact yet precise- are bound to find a place that takes precedence in quickly detecting toxins and pathogens from food sources. As the trend is speeding up and making testing faster and more reliable, microfluidics today is evolving as one of the critical technologies in the environmental and food safety sectors to comply with regulatory standards and to sustain. The expanding application is creating market demand for microfluidic solutions.

Restraints

-

Technical Challenges Hindering Widespread Adoption of Microfluidics Technology

Technical issues have been cited as the largest barrier to full-scale exploitation of microfluidic devices. Replication at scale is difficult because the designs are hard to reproduce at a specific level of detail and the performance is not very consistent. Quality consistency with high-throughput functionality would be another challenge. Such barriers can greatly slow down production and raise costs, putting further demands on scaleability for commercial exploitation of microfluidic technologies. Such technical drawbacks continue to limit the integration of microfluidics in a wide spread of applications, from health applications to environmental testing.

Segment Analysis

By Application

The medical/healthcare has accounted for the largest share of approximately 85% of total revenue in 2023, as the demand for fast, accurate diagnostics, personalized medicine, and point-of-care testing solutions is continually increasing. The applications provide significant benefits in monitoring diseases, early detection, and development of drug systems. The non-medical segment is expected to witness the highest growth - up to 16.94% CAGR from 2024 to 2032-based on rising applications of microfluidics in environmental monitoring, food safety, and wearable health devices. Non-medical applications are gaining driving momentum due to the growing demand for compact real-time testing technologies from various industries.

By Material

PDMS (polydimethylsiloxane) dominates the microfluidics market, generating around 41% of the revenue in 2023, mainly due to its excellent flexibility, optical clarity, and readiness for micromachining. These properties qualify it for a huge number of applications, such as lab-on-a-chip, biosensors, and more diagnostic tools. The cost-effectiveness of PDMS combined with compatibility with standard microfabrication increases its use significantly. Also, with an expected compound annual growth rate of 15.08% in this segment during 2024 and 2032, this product is quite in demand due to its association with complex diagnostics the developing market for personalized medicine, and research and healthcare applications are also growing. The dominance of PDMS will continue to grow in the market as research and healthcare applications develop.

By Technology

Lab-on-a-chip (LOC) technology was the leader in the microfluidics market in 2023, with the application of around 38% revenue share, mainly attributed to its manifold applications in diagnostics, drug testing, and research, providing compact, cost-effective solutions. With this ability to house multiple laboratory functions in a single device, Lab-on-a-chips are considered pivotal for personalized medicine and point-of-care diagnostics. In the Organs-on-chips category, growth is expected to be at the highest CAGR of 21.61% during the forecast period from 2024 to 2032, this market is increasing demand for more accurate models that can be human-like to test drugs and study diseases. The chips are used to replicate human organ functions and represent alternative methods to testing on animals, resulting in high investment and research interest. High demand with technological advancements is likely to make Organs-on-chips the growth driver in the industry.

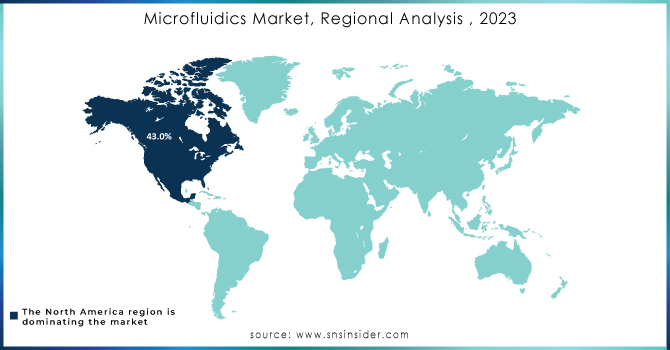

Microfluidics Market Regional Analysis

North America dominated the microfluidics market in 2023 with a revenue share of approximately 42%, driven by the presence of key players, advanced healthcare infrastructure, and strong research and development investments. The region benefits from a growing demand for point-of-care diagnostics, lab-on-a-chip technologies, and innovations in personalized medicine. The U.S. and Canada, with their well-established healthcare systems, are prime markets for microfluidic-based solutions, contributing to the region's dominance. Government initiatives and academic collaborations further enhance the adoption of microfluidics in healthcare and biotechnology.

The Asia-Pacific region is expected to grow at the highest CAGR of 17.48% from 2024 to 2032, fueled by rapid advancements in healthcare infrastructure and increasing demand for medical diagnostics. Countries like China, Japan, and India are witnessing a rise in investments in biotechnology and medical research, making the region an emerging hub for microfluidics. Additionally, the growing population and increasing focus on affordable healthcare solutions are pushing demand for cost-effective microfluidic devices. This combination of growing demand and technological innovation positions Asia-Pacific as the fastest-growing market for microfluidics in the coming years.

Need any customization research on Microfluidics Market - Enquire Now

Latest News-

-

In July 2024, Illumina purchased Fluent BioSciences to improve single-cell analysis and multiomics, streamlining the process and removing complicated microfluidic consumables. Fluent's PIPseq™ V technology will be incorporated to allow for quicker, more economical research.

-

Bio-Rad introduced Celselect Slides 2.0, crafted for enhanced capture of rare cells and circulating tumor cells (CTCs). These slides, designed for use with the Genesis Cell Isolation System, enable enhanced processing of liquid biopsy specimens and improved CTC retrieval.

Key Players

-

Illumina, Inc. (NextSeq 2000, NovaSeq 6000)

-

F. Hoffmann-La Roche Ltd (Cobas 6800 System, Elecsys Immunoassays)

-

PerkinElmer, Inc. (LabChip GX Touch, Epifluorescence Microscopes)

-

Agilent Technologies, Inc. (Agilent 2100 Bioanalyzer, Agilent SureSelect Target Enrichment)

-

Bio-Rad Laboratories, Inc. (Droplet Digital PCR System, QX200 ddPCR System)

-

Danaher Corporation (LabChip GXII Touch, Ion Torrent Next-Generation Sequencing)

-

Abbott (Alinity m System, i-STAT 1 Analyzer)

-

Thermo Fisher Scientific (Ion Proton System, Nanodrop Spectrophotometer)

-

Standard BioTools (BioFlux, Fluidic Card)

-

Life Technologies Corporation (Ion Proton System, QuantStudio 3D Digital PCR)

-

Fluidigm Corporation (Access Array System, Biomark HD System)

-

Qiagen N.V. (QIAxcel, QIAprep Spin Miniprep Kit)

-

Biomérieux (VIDAS, BioFire FilmArray)

-

Cellix Ltd. (VenaFlux, Cellix Fluidic Platform)

-

Elveflow (Elveflow OB1, Elveflow ELVE-HEART)

-

Micronit Micro Technologies B.V. (Microfluidic Chips, Lab-on-a-Chip Platforms)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 27.86 Billion |

| Market Size by 2032 | USD 92.43 Billion |

| CAGR | CAGR of 14.29% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Medical/Healthcare, Non-medical) • By Material (Silicon, Glass, Polymer, PDMS, Others) • By Technology (Lab-on-a-chip, Organs-on-chips, Continuous Flow Microfluidics, Optofluidics and Microfluidics, Acoustofluidics and Microfluidics, Electrophoresis and Microfluidics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Illumina, Inc., F. Hoffmann-La Roche Ltd, PerkinElmer, Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, Abbott, Thermo Fisher Scientific, Standard BioTools, Life Technologies Corporation, Fluidigm Corporation, Qiagen N.V., Biomérieux, Cellix Ltd., Elveflow, Micronit Micro Technologies B.V. |

| Key Drivers | • Rising Chronic Disease Burden Propels Demand for Microfluidics Solutions in Healthcare • Expanding Applications of Microfluidics in Environmental and Food Safety Sectors |

| RESTRAINTS | • Technical Challenges Hindering Widespread Adoption of Microfluidics Technology |