Report Scope & Overview:

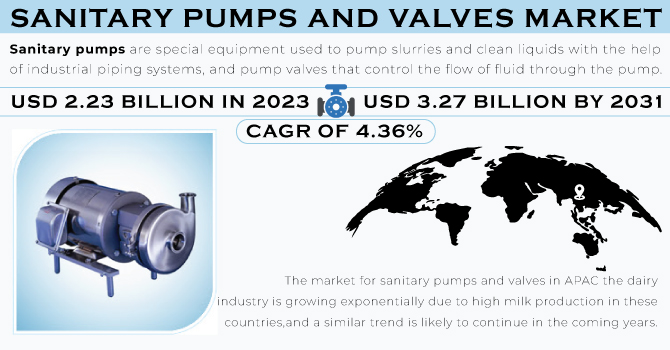

The Sanitary Pumps and Valves Market Size will be valued at USD 3.27 billion by 2031, and it was valued at USD 2.23 billion in 2022, and grow at a CAGR of 4.36% over the forecast period 2024-2031.

Sanitary pumps are special equipment used to pump slurries and clean liquids with the help of industrial piping systems, and pump valves that control the flow of fluid through the pump. Market growth was driven by global industrial growth and increased awareness of hygiene in all industries used in the latter. A major driving force in the market for sanitary pumps and valves includes industrial growth in all end-of-life industries, including processed foods, beverages, medicines, milk, and more worldwide. In addition, increasing producers' awareness of hygiene in all end-of-life industries and providing clean products to end-to-end customers is another factor driving the need for clean pumps and valves in all hygiene industries. As a result of this growing awareness, a few strong laws and policies are being developed by the government or other related organizations to maintain the level of safety and hygiene in the products and industries used in the end use product. These rules and regulations may be considered as encouraging the global expansion of the sanitary pump and valve industry.

To get more information on Sanitary Pumps and Valves Market - Request Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

Manufacturers are increasingly focusing on factory automation.

-

Government rules are strict in order to ensure an ideal degree of hygiene.

-

Increasing awareness of the need of maintaining cleanliness in process industries.

RESTRAINTS:

-

Price fluctuations in raw materials impacting end product.

OPPORTUNITIES:

-

The increasing emphasis of industry players on providing better customer service.

-

End-user demand is predicted to increase as R&D for sanitary pumps and valves is increased.

CHALLENGES:

-

Failures or malfunctions may result in unanticipated machine downtime.

-

Increased competition from firms in the grey market and the unorganized sector.

IMPACT OF COVID-19:

With the onset of the COVID-19 epidemic, the world is witnessing a health and economic pandemic. The global outbreak of COVID-19 has forced several businesses to shut down their production plants and stop most of the work in the first two to three months. During this period, industrial purchases and exports and imports of consumer goods were significantly affected, which also contributed to the production of sanitary pumps and valves in the first and second quarters of 2020. During the COVID-19, a major target, of companies is to strengthen their businesses by finding safer ways to continue production operations or by finding other sustainable ways to generate revenue. During this time, however, the end-of-life pharmaceutical industry and the food industry have seen a significant increase in their demand. Thus, two to three months after the decline of the novel epidemic, the pharmaceutical and food industries made a comeback and began to recover rapidly. Due to this growing demand, the demand for sanitary pumps and valves from the pharmaceutical and food processing industries can be seen growing across the market.

Based on Type, the sanitary pumps and valves market is segmented into Positive displacement, Centrifugal and Others. Centrifugal pumps are very old and very simple pumps developed with the principle of centrifugal force technology. Their inexpensive production and easy, long-lasting performance make them the most widely accepted type of sanitary pumps on the market. There are many advantages to centrifugal pumps, which include their excellent ability to transfer liquid with low viscosity, easy-to-adjust flow rate, low cost, easy-to-maintain design, solid extraction, compact fluid consisting of fixed or solid particles, and the availability of many flexible designs. wide and out pressure. As a result of these structures, the market share of centrifugal pumps currently dominates the sanitary pump market and could appear to increase significantly during the forecast period.

Based on Priming, the sanitary pumps and valves market is segmented into Non self-priming and Self-priming. Non self-priming sanitary pumps dominate the market for sanitary pumps and valves and are expected to continue their dominance during forecasting. This is because most of the clean pumps available on the market are designed to be non-abrasive, and a few of them are specially designed. Centrifugal pumps, the most commonly used pumps in all hygiene systems, always need to be turned off before they can run. Due to the many benefits offered by automated pumps such as handling a variety of liquids and solids that work very well without damaging the pump system, the demand for self-producing pumps can be seen growing in the market as a whole. However, the pumps are not the oldest and are compacted due to the lack of additional priming elements added to the system, they still make the largest shareholders in the market.

MARKET SEGMENTS:

BY TYPE:

-

Positive displacement

-

Centrifugal

-

Others

BY POWER SOURCE:

-

Air

-

Electric

BY PRIMING

-

Non-self-priming

-

Self-priming

BY END-USER INDUSTRY

-

Processed foods

-

Pharmaceuticals

-

Dairy

-

Alcoholic beverages

-

Others

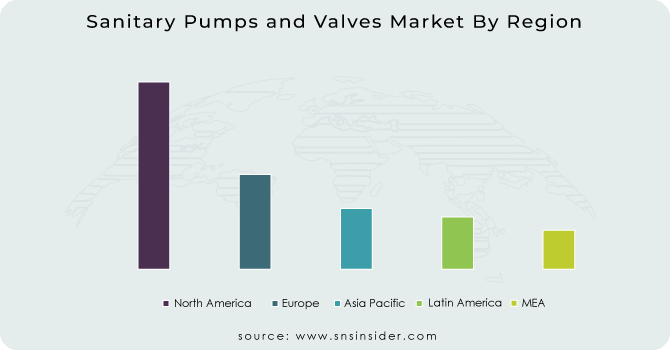

REGIONAL ANALYSIS:

The market in APAC is expected to grow at a very high rate during the forecast period. This impressive growth is due to the growing demand for hygiene products in end-of-life industries such as dairy, processed foods, pharmaceuticals and beverages in major countries such as China, Japan, and India. The market for sanitary pumps and valves in APAC the dairy industry is growing exponentially due to high milk production in these countries, and a similar trend is likely to continue in the coming years. In addition, population growth in the emerging economy, rising per capita income, industrial growth, and rapid urban growth are just a few of the factors that drive market growth in the region.

To Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS:

The key players in sanitary pumps and valves market are GEA Group Aktiengesellschaft, Fristam Pumpen KG, SPX Flow, ITT INC, ALFA LAVAL, PSG, Xylem, Ampco Pumps Company, Verder, Viking Pumps & Other Players

Fristam Pumpen KG-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.23 Bn |

| Market Size by 2031 | US$ 3.27 Bn |

| CAGR | CAGR of 4.36% From 2024 to 2031 |

| Base Year | 2022 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Positive Displacement, Centrifugal, Others) • By Power Source (Air, Electric) • By Priming (Non Self-Priming, Self-Priming) • By End User Industry (Processed Foods, Non-Alcoholic Beverages, Pharmaceuticals, Dairy, Alcoholic Beverages, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | GEA Group Aktiengesellschaft, Fristam Pumpen KG, SPX Flow, ITT INC, ALFA LAVAL, PSG, Xylem, Ampco Pumps Company, Verder, Viking Pumps |

| Key Drivers | • Manufacturers are increasingly focusing on factory automation. • Government rules are strict in order to ensure an ideal degree of hygiene. • Increasing awareness of the need of maintaining cleanliness in process industries. |

| Restraints | • Price fluctuations in raw materials impacting end product. |