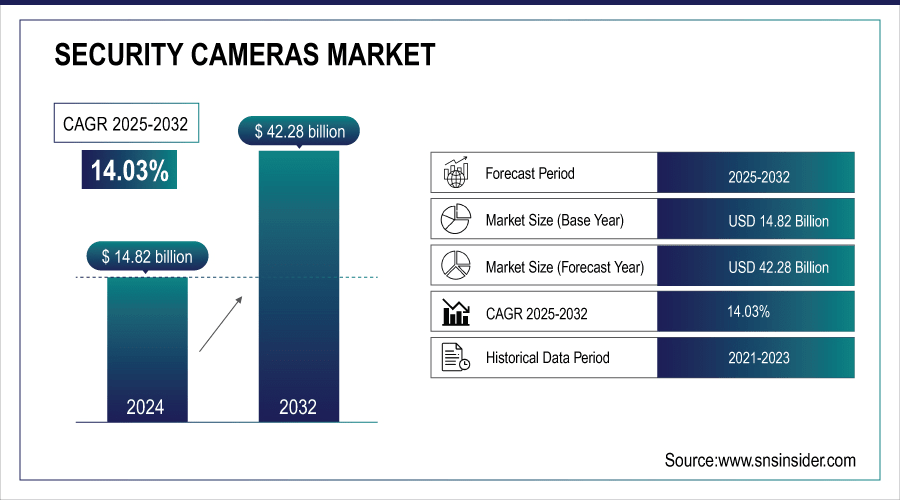

Security Cameras Market Size & Growth:

The Security Cameras Market size was valued at USD 14.82 billion in 2024 and is expected to reach USD 42.28 billion by 2032 and grow at a CAGR of 14.03% over the forecast period of 2025-2032.

The global market provides detailed security cameras market analysis by growth drivers, regional dynamics, segmental performance, and the competitive landscape. With this, comes new technologies, changing requirements, and trends in clever surveillance that are all shifting the industry perspective. It also highlights the regional growth, helping on providing in-depth analysis across key segments, by type, application, resolution, and end-user. The Business is also focusing on innovation, integration and expands use of security systems in residential, commercial, and industrial sectors.

For instance, AI-powered surveillance systems represented 45% of global deployments in 2024, driven by demand for real-time analytics.

To Get more information on security cameras market - Request Free Sample Report

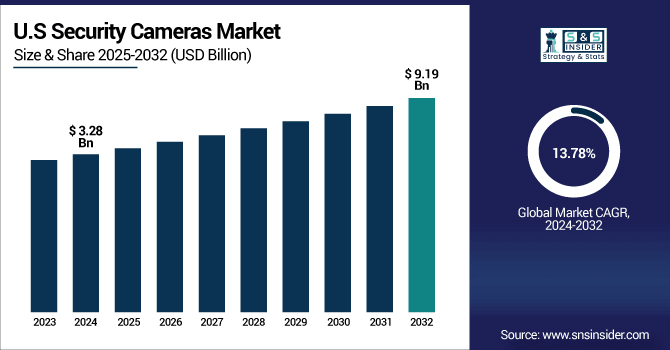

The U.S. security cameras market size was USD 3.28 billion in 2024 and is expected to reach USD 9.19 billion by 2032, growing at a CAGR of 13.78% over the forecast period of 2025–2032.

The U.S. is witnessing a rapid security cameras market growth backed by high investments on smart city infrastructure and rising need for the advanced surveillance in both the commercial and residential sectors. The growing need for public safety, however, is supplemented by accelerating adoption, notably driven by technology, such as AI-based video analytics and facial recognition. In parallel, the upsurge of national crime levels and the increasing surveillance places at government buildings and transportation lines are speeding up the application of security cameras speedily domestically.

For instance, over 70% of the U.S. surveillance vendors have implemented NDAA-compliant and encrypted video transmission systems.

Security Cameras Market Dynamics:

Key Drivers:

-

Rising Global Crime Rates and Public Safety Concerns Are Accelerating the Adoption of Security Cameras Across All Environments

With crime rates rising in terms of or burglaries, thefts and vandalism, is forcing governments, businesses and homeowners to implement high-definition surveillance system. With rising public safety concerns throughout urban centers, many are beginning to implement a real-time video option to augment existing law enforcement capabilities. The only thing security cameras do is deter bad behavior, and provide forensic evidence after the fact. Municipal deployments are increasing in streets, public transportation, and other high-density areas as cities expand. Moreover, factors such as growing consumer awareness regarding personal and property security in turn are also driving installation of solutions at residential end or small business end ultimately supporting the market growth for long term.

For instance, over 50% of small businesses in the U.S. now rely on HD camera systems for 24/7 remote monitoring.

Restraints:

-

Concerns Over Privacy and Data Protection Are Raising Regulatory and Ethical Challenges for Surveillance Deployments

There are valid concerns over surveillance overreach and violations of privacy rights in public or workplace settings that come up when security cameras are installed. Unregulated use of facial recognition and AI analytics can lead to data abuse or data profiling. In turn, data protection laws and compliance standards, such as GDPR restrict how footage is captured, stored, and shared. This creates the large need for organizations to secure encryption, anonymization, and video data processed legally, complicating design efforts and increasing liability. In strongly regulated areas, these worries may slow-down or even limit implementations.

Opportunities:

-

Expansion of E-Commerce and Retail Sectors Boosts Need for Real-Time Surveillance and Inventory Monitoring

The growing e-commerce and physical retail store market globally is driving the need for smart surveillance systems. Video surveillance is also being used more often to monitor customer behavior, system shrinkage, assist with queue management, and improve employee security. Touchless integration with retail analytics platforms allows to gain insights into consumer traffic and operational efficiency. Advanced video solutions can prevent theft and optimize logistics in warehouses and distribution centers. Security cameras market trends highlight increased adoption in retail environments globally.

For instance, over 75% of major retail chains now use AI-powered cameras for loss prevention and real-time threat detection.

Challenges:

-

Cybersecurity Threats Pose Major Risks to Connected Security Camera Systems and Stored Video Data

With security cameras connecting to cloud networks and IoT ecosystems by the day, they represent a potential attack vector for cyber-attacks. Vulnerabilities can be exploited by hackers looking to penetrate and gain unauthorized access, shut down systems, or leak sensitive footage. The risk is worsened by weak passwords, lack of modern firmware, and unencrypted data transmission. Surveillance system breaches can violate privacy, harm reputations, and result in liability for organizations. A continuous global challenge across the market is the implementation of strong cybersecurity protocols, including two-factor authentication, end-to-end encryption and timely updates.

Security Cameras Market Segmentation Analysis:

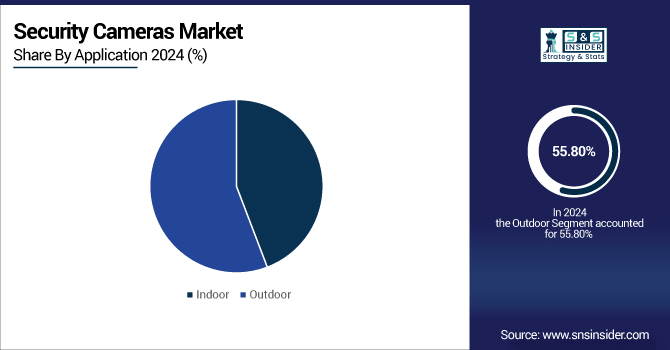

By Application

Outdoor application segment led the security cameras market share by 55.80% in 2024, owing to expanded need for perimeter security in urban areas, business progressions, parkways, and transportation centers. These cameras tend to be weatherproof and come with infrared night-vision capability. One of the most advanced manufacturers globally is Hikvision, which produces outdoor systems with built-in AI and video analytics. These high-volume outdoor deployments are largely attributed to government-backed smart city projects and public safety programs.

Indoor segment is projected to register the fastest CAGR of 14.85%, owing to growing installation in retail stores, offices, hospitals, and educational institutions. They can be placed anywhere high, provide faultless images, and can step into the intelligentsia system. Panasonic i-PRO specializes in reliable indoor surveillance solutions and is driven by high-resolution and cloud-enabled models helping the Indoor Cameras segment expand. Indoor setups are being adopted by homeowners and businesses alike for the sake of convenience, safety, and operational visibility.

By Type

Infrared (IR) Bullet cameras dominated the security cameras market with a 42.5% revenue share in 2024 owing to their enhanced night vision and long-range surveillance functionality. The strength of their build gives them the edge for outdoor usage for things, such as perimeter surveillance, parking lots and industrial sites. One of the most important suppliers covering this space is Dahua Technology, who provides a number of IR bullet models in all levels of performance with a solid platform for harsh environments ready. Such cameras are highly adopted as they serve visible deterrents in public and critical infrastructure.

The Dome camera segment is expected to grow at the highest CAGR of 14.58 during 2024-2032 owing to 360-degree coverage and pleasing to the eye, minimizing effects of the overall environment. Due to their aesthetic appearance and vandal-resistant qualities, bullet cameras are gaining preference in retail, hospitality, and indoor commercial applications. Vandal-resistant and AI-enabled dome solutions for indoor spaces with high traffic are in development by Bosch Security Systems. Modern architectural layouts that naturally embrace the above-mentioned with tech-enhancements have also put this segment into overdrive.

By Resolution

Ultra-High Definition (UHD) cameras had the largest market share of 28.30% in 2024, owing to their capabilities to capture ultra-clear footage, which is an essential for any forensic investigation. They are operating in places where visual precision matters. Avigilon, a Motorola Solutions company known for its AI and UHD-powered systems that are used in everything, from airports to law enforcement, UHD cameras remain a favored option for high-risk and high-density areas as organizations seek more transparency and scope.

Megapixel Cameras are forecasted to have the fastest CAGR of 14.62% (3-12 MP), which are low-cost options that maintain a satisfactory level of imaging clarity for monitoring without the high expense of some high-performing megapixels. CP PLUS, being one of the largest manufacturers in Asia, offers cost-effective scalable megapixel camera systems suitable for SMES. Low cost, somewhat of a bandwidth hog, and ease of integration are driving large numbers of commercial users to these systems for cost effective surveillance.

By End-User

Commercial segment led the market in 2024, capturing 38.50% of the market share on the back of widespread adoption across offices, malls, and banks, amongst other hospitality applications. So first, they started using video surveillance in their business to reduce theft, to assure compliance, and to watch over the operations. Axis Communications, a significant player in the arena of IP surveillance, is widely employed by commercial businesses due to its smart analytics features and remote access capabilities. Continued investments across diverse commercial environments are driven by high ROI and advanced features.

Residential segment is expected to be the fastest-growing segment with a CAGR of 15.66% over the forecast period of 2024-2032 due to the rising concern for home security and the availability of easy-to-use robot surveillance products. Amazon subsidiary Ring ushered in a new era of home monitoring with its smart doorbells and indoor cameras. Availability of plug-and-play solutions at affordable price points and integration with home automation systems is making residential security more affordable and appealing to individual consumers.

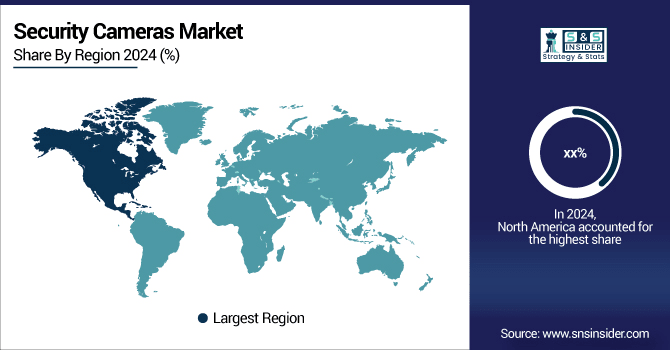

Security Cameras Market Regional Outlook:

North America accounts for a large portion of the security cameras market. This growth can be attributed to the high level of adoption of security cameras among commercial, government, and residential end-users. A great support for growth is the high rates of crime in many countries nowadays, and the development of technological processes and the widespread use of AI-enabled surveillance systems. Major players and continued smart city projects make the region a complementary enabler for heightened demand among intelligent, connected, and high-resolution security camera solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The U.S. dominates the North American market due to advanced infrastructure, high security spending, early adoption of smart surveillance, and strong presence of leading manufacturers. Widespread public safety initiatives further drive demand across commercial and government sectors.

In 2024, Asia Pacific held the share of 31.80% in terms of revenue, and is expected to grow at the fastest rate with a CAGR of 14.80% during the forecast period of 2024-2032, owing to supportive government surveillance initiatives and rising infrastructure investments in China, India, and Southeast Asia. The hunt for video surveillance in transport, retail, and public space has been driven by extensive urbanization, public safety, and inexpensive local manufacturing. The push from regional governments towards smart cities and safe city programmes continues to be the driving factor for the large-scale deployment of high-end and budget surveillance solutions.

-

China leads the Asia Pacific market due to massive government surveillance programs, rapid urbanization, low-cost manufacturing, and strong domestic brands. High deployment in public spaces, transport hubs, and smart city projects further cements its regional dominance in security cameras.

Europe is the growing segment in security cameras market, due to increasing security concerns, urban surveillance projects, and stricter statutory compliance. Increasing adoption of AI-enabled and cloud-based camera systems in both the commercial and public sectors is driving the growth of the region. Deployment is being led in the U.K., Germany, and France, backed up by smart city programs and investments in assets, such as roads and rail.

-

The U.K. dominates the European security cameras industry due to its high surveillance camera density, strong government support, and early adoption of advanced technologies. Extensive use in public safety, transportation, and urban monitoring drives the country's leading market position.

The Middle East & Africa security cameras market is dominated by the UAE owing to the smart city initiatives and deployment of high-performance surveillance systems in urban hubs. Brazil accounts for the largest market in Latin America as soaring crime rates have led both private and public expenditures increasing expenditure on security infrastructure in residential, commercial and public transportation sectors.

Security Cameras Companies are:

Major Key Players in Security Cameras Market are Hikvision, Dahua Technology, Axis Communications, Bosch Security Systems, Hanwha Vision (formerly Hanwha Techwin), Avigilon (Motorola Solutions), FLIR Systems, Panasonic i-PRO, Honeywell Security, CP PLUS, Uniview, Pelco, VIVOTEK, Sony Corporation, ADT Inc., Lorex Technology, GeoVision Inc., MOBOTIX AG, ZKTeco, and Eagle Eye Networks and others.

Recent Developments:

-

In January 2025, Dahua launched the Dahua 5E platform (emphasizing easy installation and maintenance), the MultiVision panoramic cameras, and cloud‑ready Wireless Series (Hero B1, Cube A1, Picoo models).

-

In January 2025, Axis showcased its ARTPEC‑9 chip in 8K/41 MP cameras, AI threat detection, Axis Cloud Connect, body‑worn camera systems, and next‑generation cybersecurity features.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 14.82 Billion |

| Market Size by 2032 | USD 42.28 Billion |

| CAGR | CAGR of 14.03% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Infrared (IR) Bullet, Dome and Box) • By Application (Indoor and Outdoor) • By Resolution (Standard Definition (SD), High Definition (HD), Ultra-High Definition (UHD) and Megapixel Cameras (3-12 MP)) • By End-User (Residential, Commercial, Industrial sector and Government & defense sector) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Hikvision, Dahua Technology, Axis Communications, Bosch Security Systems, Hanwha Vision (formerly Hanwha Techwin), Avigilon (Motorola Solutions), FLIR Systems, Panasonic i-PRO, Honeywell Security, CP PLUS, Uniview, Pelco, VIVOTEK, Sony Corporation, ADT Inc., Lorex Technology, GeoVision Inc., MOBOTIX AG, ZKTeco and Eagle Eye Networks. |