MEMS Microphones Market Report Scope & Overview:

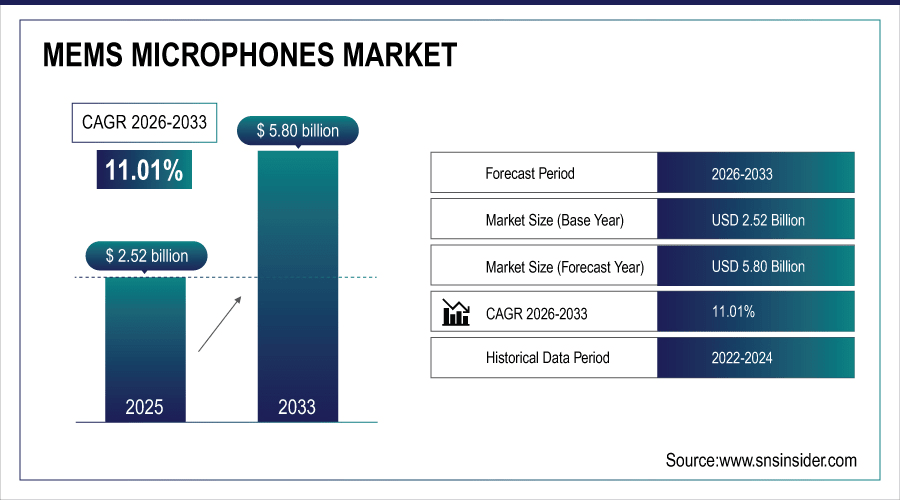

The MEMS Microphones Market size was valued at USD 2.52 Billion in 2025 and is projected to reach USD 7.16 Billion by 2035, growing at a CAGR of 11.01% during 2026-2035.

The MEMS Microphones Market is expanding due to the rising penetration of smart devices such as high penetration of smart devices including smartphones and hearing aids, demand for high-performance acoustic systems for miniaturized portable devices, and growing demand for voice control–based smart products. The increasing market demand driven by the evolution in automotive applications, for example voice-controlled infotainment systems and advance driver-assistance systems. With this, high SNR and noise cancelling product performance is achieved through multi-microphone arrays a proven technology.

85.1% and 50.0% of premium and mid-tier smartphones in 2024 respectively adopt at least 2 MEMS microphones for beamforming and noise suppression, as AI voice assistant use cases including smart speakers are deployed in over 4.2 billion active devices worldwide. MEMS mic adoption in hearing aids jumped 35% YoY, with now 90% of new digital hearing aids using our ultra-low-noise variants, ensuring more reliable speech recognition.

To Get More Information On MEMS Microphones Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 2.52 Billion

-

Market Size by 2035: USD 7.16 Billion

-

CAGR: 11.01% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

MEMS Microphones Market Trends:

-

MEMS microphones are ever shrinking in size and growing in integration, enabling product miniaturization, and are now capable of fitting inside small devices including wearables, ear-wear devices (earbuds),and smartphones without compromising performance.

-

To meet rising application of voice assistants, IoT connected device, smart speakers, and others manufacturers are highly demanding MEMS which can deliver, a high-performance microphone with an accurate voice capture quality

-

MEMS microphones find growing application in voice-controlled infotainment systems in cars, and hands-free applications for noise cancellation (growing convergence between MEMS microphones and advanced automotive electronic applications).

-

Signal to Noise ratio, multi-microphone array and noise suppression technologies are improving the quality of audio (high fidelity sound capture and rendering for premium) fulfilling consumers’ needs & dream to hear their favorite artist in studio/master quality.

-

MEMS microphones have seen a rapid drop in price through advanced manufacturing and improved economies of scale, making them solutions for consumer electronics, healthcare products and industrial applications.

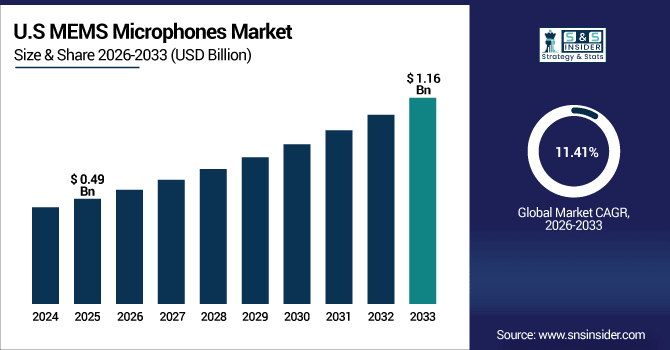

The U.S. MEMS Microphones Market size was valued at USD 0.49 Billion in 2025 and is projected to reach USD 1.44 Billion by 2035, growing at a CAGR of 11.41% during 2026-2035. MEMS Microphones Market growth is due to the burgeoning adoption of smartphones, smart speakers and wearables, where high-quality, miniature audio components are required. The same is boosting the demand as well since there is an exponential growth of voice-enabled systems and IoT-based smart home devices. MEMS microphones are also making parts in the Automotive world, such as use in infotainment systems, hands free communication and noise cancellation.

MEMS Microphones Market Growth Drivers:

-

Rapid Adoption of Smart Devices and Automotive Systems Boosting MEMS Microphones Market Growth.

Advancing requirements for highly compact advanced audio solutions in smartphones, wearables and smart home devices driving the MEMS microphones market. The adoption of voice commerce in turn is driven by the rise of voice-enabled environments, virtual assistants, and IoT interconnection. In automotive, MEMS microphones have been widely used in the infotainment system like, hands-free calls and active noise cancellation. Improving technology such as multi microphone arrays and improved signal to noise ratios are improving audio quality, declining production costs and a shift toward miniaturization benefits MEMS microphones – which are all contributing to a very strong and continued growth of the industry.

MEMS mics have penetrated 65% of new vehicles' automotive infotainment systems for hands-free calling and ANC, with the number of cabin mics increasing to 3–6 mics per vehicle to support voice AI and occupant sensing.

MEMS Microphones Market Restraints:

-

High Manufacturing Costs and Technical Challenges Limiting MEMS Microphones Market Penetration in Certain Segments

Despite its positive thrust, the MEMS microphones market is being countered by initial high costs of manufacturing and fabrication complexities. Combine that with the complexities of higher-level audio functions, such as noise suppression and multi-mic arrays, and you'll see the integration results in longer development cycles and increased costs. In addition, competing technologies (electret capsules in conjunction with the conventional capacitor microphone placement) may hinder the penetration of such systems into the cost-sensitive markets. More specifically, Micro-Electro-Mechanical System (MEMS) manufacturing depends on specialty materials that may in turn prove to be difficult to find and deliver, challenging the minimum viable scale of manufacturing that can be viable in providing market access in developing hurdles and/or reducing size in consumer electronics applications.

MEMS Microphones Market Opportunities:

-

Expansion in Automotive, Wearable, and IoT Markets Presenting Significant Growth Opportunities for MEMS Microphones

Automotive, wearables and IoT connected smart devices drive the MEMS microphones market. Increasing adoption of voice-controlled infotainment systems, smart assistants, and home-automation solutions are driving the growth of high performing miniaturized microphones. Another source of upside is the markets that are jumping to smart devices and smart buildings. Progress in multi-microphone arrays, noise cancelling, and high signal-to-noise ratio allows new entry points for product differentiation.

In 2024, Automotive MEMS mic unit shipments grew 45% YoY as 75% of newly connected cars added voice-controlled infotainment (+50% with 4+ mic arrays) and multi-zone voice assistants function (+25%) in vehicles.

MEMS Microphones Market Segment Analysis:

-

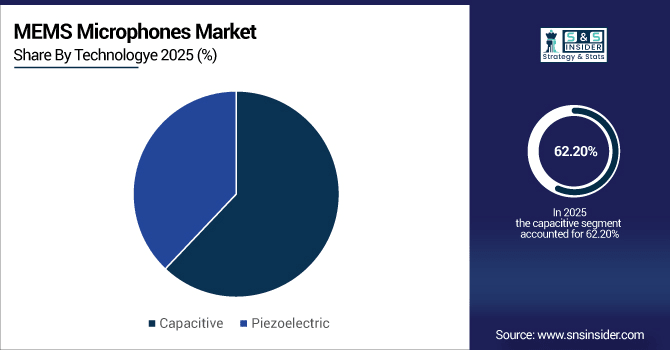

By Technology, capacitive MEMS microphones led the market with a 60.20% share in 2025, while piezoelectric microphones are the fastest-growing segment with a CAGR of 8.10%.

-

By Application, mobile phones dominated the market with a 46.50% share in 2025, whereas IoT and VR applications are growing the fastest at a CAGR of 9.40%.

-

By Type, dialog MEMS microphones held the largest share at 58.70% in 2025, while analog microphones are the fastest-growing type with a CAGR of 8.60%.

-

By Signal-to-noise ratio (SNR), very high (≥64dB) microphones accounted for 44.90% of the market in 2025, while high (≥60dB, <64dB) microphones are the fastest-growing segment with a CAGR of 9.10%.

By Technology, Capacitive Leads Market While Piezoelectric Registers Fastest Growth

The capacitive technology dominates the MEMS microphones market due to its reliability, which is likely to be adopted by consumer electronics, whereas resistive ones have only limited applications, as they are less sensitive in nature. Capacitive microphones have the advantages of high sound precision, low noise and can be adapted to smartphones, wearable devices and automotive systems. On the other hand, piezoelectric MEMS microphones are witnessing highest growth on account of their extreme environmental resistance providing longer durability as well as being potential for military & defense, industrial and automotive and specialty audio applications.

By Application, Mobile Phones Dominate While IoT & VR Shows Rapid Growth

Mobile phones are still the largest application market for MEMS microphones, as they need mini-size and high-performance microphones for long time voice call, video recording, noise cancellation. This demand is in response to the worldwide spread of smartphones and customers' heightened expectation for better sound quality. In the mean time, IoT devices, virtual reality (VR), and smart home systems are growing faster. Such segments need speakers and microphones for voice commands, immersive audio, environment sounds detection etc making it as very promising markets.

By Type, Dialog Lead While Analog Registers Fastest Growth

Dialog MEMS microphones are the current market leader when it comes to voice capture performance, noise suppression and integration in mobile and smart devices. Their proliferation is motivated by the stringent need for high fidelity audio in consumer electronics, automotive and communication devices. On the other hand, analogue MEMS microphones are rapidly growing driven by lower price, integration capability of existing circuits and applicable to emerging IoT Wearable Industrial applications which is appealing more to manufacturing companies.

By SNR, Very High (>=64dB) Lead While High (>=60dB, <64dB) Grow Fastest

Very high signal-to-noise ratio MEMS microphones (≥64dB) is leading the market as they provide higher sound clarity and precision, which is required for smartphones, professional audio equipment and automotive infotainment. These microphones can accurately pick up sound even in the midst of boisterous settings, providing users with an improved overall experience. At the same time, however, high SNR microphones (≥60 dB and <64 dB) are growing most rapidly since they provide a good mix of performance and value that's suited for wearables, smart home devices, IoT gadgets and lower-cost consumer devices.

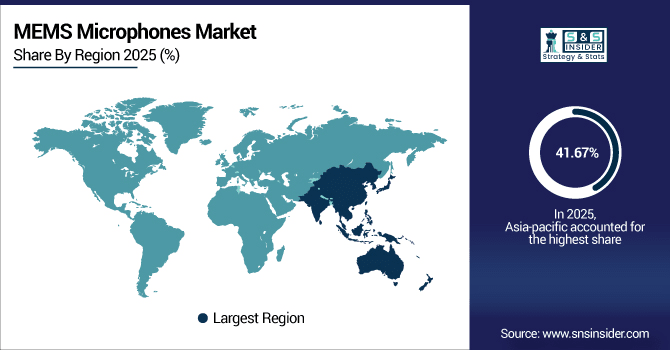

MEMS Microphones Market Regional Analysis:

Asia-pacific MEMS Microphones Market Insights:

In 2025 Asia-Pacific dominated the MEMS Microphones Market and accounted for 41.67% of revenue share, this leadership is due to high penetration of smartphones, high adoption of smart devices, and growth in consumer electronics manufacturing. Production and innovation in countries like China, Japan and South Korea are major hubs. The growing popularity of IoT equipment, wearables and automotive electronics is also boosting market expansion. Technological progress is fostered through R&D investment and supportive policies from the government.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China MEMS Microphones Market Insights

China is a key market due to the large production base, and high consumption of smartphones and smart devices in the country. The country as a whole benefit from extended supply chains and advanced semiconductor fab plants. The adoption of IoT, smart home devices, and voice-enabled devices only accelerates the speed at which adoption is growing..

North America MEMS Microphones Market Insights:

North America is expected to witness the fastest growth in the MEMS Microphones Market over 2026-2035, with a projected CAGR of 11.82% owing to an increasing adoption of MEMS Microphone in smartphones, wearables and smart home applications. It is the biggest market and has high growth through developing application of complex automotive and voice-controlled Voice Recognition. Market Growth Factors Scenarios – Market growth factors include infusion smart pumps with wireless connected (technological preponderance), Key manufacturers profusion and supportive infrastructure promotes the market growth in forecast period.

U.S. MEMS Microphones Market Insights:

The U.S. is a significant market for MEMS microphones, with high penetration of Smartphones, due to robust Smartphone and wearables and other smart home devices penetration. Voice-controlled systems, virtual assistants and IoT integration also play a role in the growth of this market. Demand is also underpinned by automotive services ranging from infotainment to active noise cancellation.

Europe MEMS Microphones Market Insights:

Europe leads the market for MEMS microphones followed by Germany who has a rightly strengthen automobile sector where the main focus is on speech based in-car howling system. Professional Audio Equipment and Industrial IoT are of great assistance as well. They vary between the emphasis of the high quality and reliability of the energy-efficient MEMS Microphones for domestic and export markets for Germany manufactures.

Germany MEMS Microphones Market Insights:

Germany has the largest market for MEMS microphones is Europe, Germany has very well established automobile sector which prioritize on voice enabled in-car howling system. Industrial IoT and professional audio equipment also help. For Germany manufacturers, they emphasize the high quality and reliability of energy-efficient MEMS Microphones for domestic and export markets.

Latin America (LATAM) and Middle East & Africa (MEA) MEMS Microphones Market Insights:

The MEMS Microphones Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the rising smart phone proliferation along with growing disposable income that has led to surge in consumer electronics industry. The popularity of IoT devices, automotive initiatives and smart homes in metropolitan areas are also driving demand. It has a relatively small market size but investments are rising from international manufacturers. New prospects are opening up through technological awareness and infrastructure improvement.

MEMS Microphones Market Competitive Landscape:

AAC Technologies is one of the key MEMS microphone suppliers for smartphone, wearable and automotive applications. ADI have global reach / R&D capability, focus on innovation, high frequency/ miniaturized / higher SNR RF components.

-

In August 2025, AAC Technologies projected over 50% revenue growth in MEMS microphones, driven by AI applications. The company also launched a 2.0 mm x 1.5 mm MEMS microphone module, among the smallest commercially available, enabling thinner TWS earbud designs without sacrificing acoustic performance.

CUI Devices recently released a high sensitivity MEMS microphone with low noise features for use in consumer electronics, industrial and automotive applications. This will be main factors in committing to affordable solutions and product versatility which plays a vital role in capturing up and coming market with the home automation and seamless integration and deployment in smart devices/IoT.

-

In September 2024, Same Sky (formerly CUI Devices) introduced new MEMS microphones featuring high signal-to-noise ratios (SNR) of 62dBA or 64dBA and high acoustic overload points (AOP) of 123dB or 128dB SPL.

Goertek is an industry leader in MEMS microphone production which supplies high-end acoustic devices for smartphone, smart speaker and automotive electronics markets. The corporation invests heavily in R&D in order to produce the high-performance, mute, brat small-size microphones that will be used for its global strategy.

-

In July 2023, Goertek released a combination MEMS microphone/pressure sensor based on Infineon Technologies' die, with multiple controllers embedded in the substrate. This development aims to provide integrated solutions for applications requiring both audio capture and pressure sensing, enhancing the functionality of devices in various consumer electronics.

MEMS Microphones Market Key Players:

-

CUI Devices

-

DB Unlimited, LLC.

-

Goertek

-

Infineon Technologies AG

-

Knowles Electronics, LLC.

-

Nisshinbo Micro Devices Inc. (New Japan Radio Co.)

-

Projects Unlimited Inc.

-

Sonion

-

STMicroelectronics

-

Qualcomm Technologies, Inc. (Vesper Technologies, Inc.)

-

Analog Devices, Inc.

-

Bosch Sensortec GmbH

-

Cirrus Logic, Inc.

-

TDK Corporation (InvenSense MEMS)

-

Hosiden Corporation

-

ON Semiconductor

-

Omron Corporation

-

Sennheiser electronic GmbH & Co. KG

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 2.52 Billion |

| Market Size by 2035 | USD 7.16 Billion |

| CAGR | CAGR of 11.01% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Capacitive and Piezoelectric) • By Application (Mobile Phones, Consumer, Electronics, IoT & VR, Hearing Aids and Others) • By Type (Dialog and Analog) • By SNR (Very High (>=64dB), High (>=60dB, <64dB) and Low (<=59 dB)) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | AAC Technologies, CUI Devices, DB Unlimited, LLC., Goertek, Infineon Technologies AG, InvenSense, Knowles Electronics, LLC., Nisshinbo Micro Devices Inc. (New Japan Radio Co.), Projects Unlimited Inc., Sonion, STMicroelectronics, Qualcomm Technologies, Inc. (Vesper Technologies, Inc.), Analog Devices, Inc., Bosch Sensortec GmbH, Cirrus Logic, Inc., TDK Corporation (InvenSense MEMS), Hosiden Corporation, ON Semiconductor, Omron Corporation, Sennheiser electronic GmbH & Co. KG |