Security Inspection Market Report Scope & Overview:

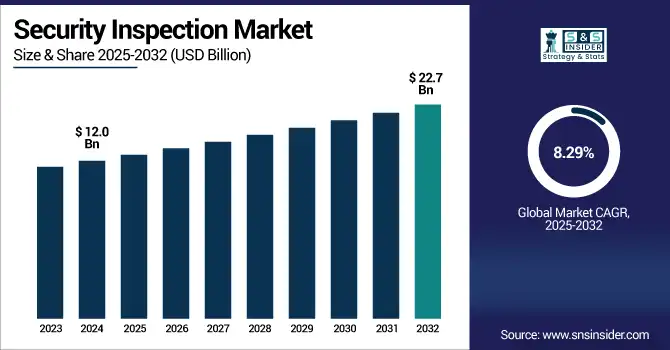

The security inspection market size was valued at USD 12.0 billion in 2024 and is expected to reach USD 22.7 billion by 2032, growing at a CAGR of 8.29% during 2025-2032.

To Get more information on Security Inspection Market - Request Free Sample Report

Security inspection market growth is driven by the growing need for improved threat detection, public safety concerns, and regulatory compliance over critical infrastructure, transport hubs, and border security are expected to drive the growth of the global market during the projected timeline. As terrorism, illegal goods, and cyber-physical threats become a top-priority issue, both public and commercial sectors are utilizing HD screening technologies, such as X-ray scanners, metal detection, biometric authentication processes, and AI-based watching, which are all key driving factors for the market.

Additionally, the increasing international travel, modernization of urban security systems, and the need for non-intrusive inspection systems are boosting the adoption of the technology. Furthermore, AI, IoT, and real-time analytics integrations are changing the type of security inspection systems from reactive systems to proactive threat management systems. The rise of smart city initiatives and corresponding investments is accelerating the adoption of security inspection technologies. These trends, among others, collectively cement a positive outlook for security inspection solutions globally, across public, industrial, and transportation sectors.

The U.S. security inspection market is witnessing strong growth due to the rise of homeland security threats, the rise in airport and border security surveillance, and the growth of AI-based screening technologies. Market growth is gaining momentum by increasing adoption in testing transportation, government buildings, and critical infrastructure. The U.S. market is projected to grow from USD 3.9 billion in 2024 to USD 7.2 billion by 2032, at a CAGR of 8.08%, driven by the rising security inspection market trend of intelligent, automated threat detection systems.

Market Dynamics:

Drivers:

-

Rising Global Security Threats and Regulatory Mandates are Boosting Demand for Advanced Security Inspection Technologies Across Public and Private Sectors

Rapid growth of terrorist activities, smuggling, and cross-border crimes made security inspection systems indispensable at airports, seaports, governmental buildings, and public places. More and more governments are cracking down and imposing strict regulations on the use of high-end inspection systems to screen for explosives, arms, and drugs. Consequently, the demand for high-performance screening solutions, such as full-body scanners, X-ray inspection systems, and trace detection equipment has witnessed a notable upsurge. This is further driving the market growth as private organisations are increasingly realising the need to maintain a safe work environment and safeguard data. In addition, global security policies and partnerships, including TSA guidelines and IATA standards, keep investing in contemporary inspection solutions to ensure optimal upfront risk management.

Global Terrorism Index 2024 recorded a 22% increase in global terrorist deaths to 8,352 in 2023, and a rise in the average lethality per attack by 56%, underlining the need for sophisticated detection systems.

Restraints:

-

High Deployment and Integration Costs are Limiting Adoption among SMEs and Budget-Constrained Government Institutions

However, the high capital cost presents a significant challenge, especially in the case of small and medium-sized enterprises (SMEs) and the developing world, for which security inspection systems are critically needed. Though 3D X-ray imaging, biometric verification, and AI-powered surveillance technologies appear advanced, they come with considerable installation, training, and maintenance fees. Moreover, the need to combine these systems with existing security frameworks and IT infrastructure usually requires custom solutions, specialized skills, and long implementation cycles, all of which contribute to a higher TCO. Adoption is also limited by budgets in public sector agencies, particularly in low and middle-income countries. This sensitivity towards cost can limit the scalability and applicability of newer inspection technologies over various environments.

Infosecurity Europe reported that 95% of SMEs either have no or fewer than half an FTE dedicated to cybersecurity, underscoring limited resources to deploy or integrate new security systems effectively

Opportunities:

-

Adoption of AI, IoT, and Real-Time Analytics is Enabling Intelligent, Automated, and Scalable Security Inspection Solutions

Artificial Intelligence (AI), Internet of Things (IoT) interface, and associated real-time analytics give transformative opportunities in the security inspection market. IoT facilitates constant data collection and remote monitoring of systems, whereas AI facilitates predictive threat detection and anomaly recognition. Combined, these technologies enable inspection systems to make decisions faster, with higher accuracy and automatically, minimizing human error and enhancing response time. Moreover, the same real-time data analysis also improves situational awareness, enabling security personnel to assess threats dynamically and maintain constant surveillance. With smart cities and critical infrastructure relying more on digital ecosystems, the need for smart, integrated inspection solutions is increasing, providing vendors with previously untapped markets for long-term contracts.

54% of companies had both AI and IoT in their infrastructure as of early 2024, and an additional 33% planned to implement them within two years.

Challenges:

-

Growing Privacy and Ethical Concerns are Creating Public Resistance and Regulatory Hurdles for Surveillance-Based Technologies

The security inspection system intends to improve the safety of mass, but there are many severe privacy problems with the security inspection technology, especially for the technology based on biometrics and full-body scanning Formations. Civil rights groups have often complained about the invasive nature of such systems and warned that there is a risk that personal data could be misused, that there could be racial profiling, and that there could be overreach in surveillance powers.

However, in democratic nations, such opposition can lead to prolonged approval times for such policies and inhibit the implementation of New Age Inspection Solutions. Besides, the inconsistent data protection laws and the non-existence of international standards on privacy prevent the global harmonization of these systems. This means businesses in the field similarly have to contend with compromising between security and transparency, while creating investments in data security protocols and ethical questions contributing to maintaining public trust alongside regulatory compliance.

Segmentation Analysis:

By Product:

Cargo and baggage inspection systems dominated the market in 2024 and accounted for a significant revenue share, due to the increasing international trade, stringent customs regulations, and the requirement of non-intrusive scanning. This segment will continue to be the market leader as the need for automation, scanning with AI-based integration, and the need for threat detection for large-scale transportation infrastructures will propel the demand for the segment.

In June 2024, OSI Systems secured a USD 11 million order to supply mobile cargo and vehicle inspection systems, underscoring strong investment and demand in scalable, on-the-move scanning solutions.

Explosives and drugs trace detection systems are projected to register the fastest CAGR, threats of terrorism, drug trafficking, and homeland security. Nanotechnology and portable, real-time sensors for trace detection are being developed, and there are ongoing research efforts to make detection faster and ready-to-use on the spot. In aviation, border control, and public events, their use is growing and will continue through 2032.

By Type:

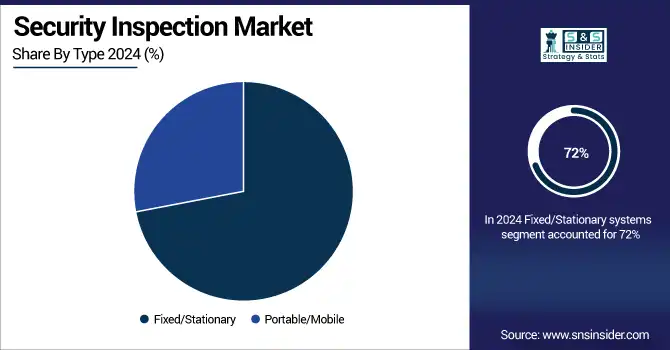

Fixed/Stationary systems dominated the market in 2024 and accounted for 72% of the security inspection market share, owing to their mass deployment at major traffic areas, including airports, borders, and government buildings. due to their durability, high capacity, and the integration of large-scale infrastructure, they are a necessary component of continuous inspection. This sector will continue to dominate as countries look to permanent security enhancements to transportation and key infrastructure.

In March 2024, TSA began testing a fixed, self-service security checkpoint prototype at Harry Reid International Airport (Las Vegas). The system consolidates primary and secondary screening on a single conveyor lane, aiming to reduce manpower from five to two officers while maintaining throughput.

Portable/Mobile security inspection systems are projected to register the fastest CAGR, due to flexibility, quick deployment, and growing allowance for temporary checkpoints, remote areas, and occasional-based security, all within growing portable/mobile security inspection systems are estimated to be the fastest-growing type, as reported by the forthcoming report. These factors, accompanied by the availability of static structures for lightweight-based scanning and wireless and battery-powered systems, are improving the mobility and real-time analytics, which is expected to make these useful in the dynamic threats environment through 2032.

By Technology:

X-ray Imaging dominated the market in 2024 and accounted for a significant revenue share, owing to widespread adoption by airports, cargo terminals, and other critical infrastructures. It provides the ability to scan at high speed, and inexpensive detection of contraband and explosives. Such mature but essential technology will continue to be a cornerstone tool through 2032.

Computed Tomography is projected to register the fastest CAGR, owing to its ability to provide volumetric imaging in 3D and high-accuracy detection. Regulatory changes, particularly in aviation security (TSA mandates), are driving a faster adoption of CT for both carry-on baggage and checked baggage screening systems. The price per scan is dropping, and as the integration of AI expands, CT is emerging as the globally gold standard for advanced threat detection.

By Application:

Aviation dominated the market in 2024 and accounted for a significant revenue share, owing to stringent regulations imposed on international air travel, the high volume of passengers traveling daily, and the vital requirement of real-time detection of all threats in aviation. CT scanners, biometric systems, and automated screening lanes are being adopted in airports globally to enhance security. As the aviation traffic has reached the pre-pandemic level and it is getting highly funded for the development of airport-based infrastructure, this segment is expected to lead till 2032.

Border Security is expected to register the fastest CAGR due to the increase in cross-border smuggling, rising migration issues, and growing geopolitical tensions. Scanners for cargo, vehicles, and people range from sophisticated systems now being fielded globally to manual ones, recently used in some nations to scan land and maritime borders. As mobile X-ray, trace detection, and AI-powered surveillance enable fast and non-intrusive inspections, border security is rising to the top of global security strategies.

Regional Analysis:

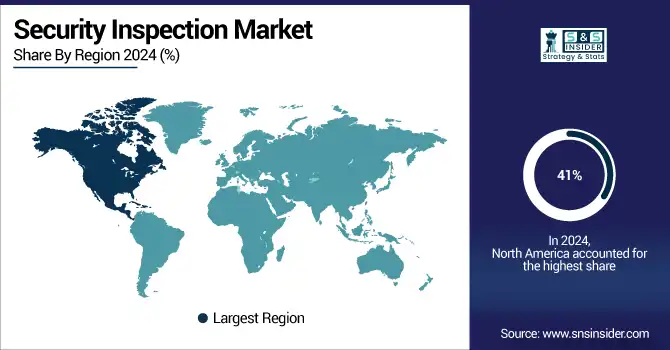

North America dominated the security inspection market in 2024 and represented 41% of revenue share, with high defense expenditure, superior airport infrastructure, and increased adoption of high-end inspection technologies. Demand is bolstered by the U.S. government projects, such as TSA modernization programs and border surveillance investments.

According to a security inspection market analysis, Asia-Pacific is projected to register the fastest CAGR, owing to rapid infrastructure development, growing cross-border trade, and increasing security threats in emerging economies. In countries such as China and India, airport expansion and border monitoring are accompanied by investments in intelligent city surveillance. The continued densification of urban areas with technologies, such as facial recognition will lead not only to the integration of smart citizen technologies, it will create the future of digital citizenship and the future of environments.

The Europe security inspection market is driven by stringent safety regulations in the EU, rising threats on critical infrastructure, and growing demand for airport and border integration of AI-integrated systems. Smart surveillance and customs modernization will see continued investments, enabling stable growth across transportation and public security sector during 2025-2032.

Germany leads the European market owing to airport infrastructure in the country, high use of public transport, and efficient border control management. The automated inspection technologies will further be adopted and will witness a growth due to the government focus on digitization, digital surveillance, anti-terrorism measures and smart city initiatives, further strengthening its position through 2032.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major security inspection market companies are Smiths Detection, OSI Systems, Inc. (Rapiscan Systems), Leidos Holdings, Inc., Nuctech Company Limited, Analogic Corporation, Astrophysics Inc., Teledyne FLIR LLC, L3Harris Technologies, CEIA S.p.A., Westminster Group Plc, VOTI Detection Inc., Adani Systems Inc., Gilardoni S.p.A., Bruker Corporation, Safran S.A. (Morpho Detection), Smiths Group plc, Unival Group GmbH, Kromek Group plc, VMI Security, Rohde & Schwarz, and others.

Recent Developments:

-

In March 2025, Smiths Detection Partnered with Deepnoid to test AI in carry-on X‑ray and CT scanners, enhancing threat detection speeds.

-

In May 2025, Smiths Detection Awarded contract to equip Dubai International Airport checkpoints with HI‑SCAN 6040 CTiX systems.

|

Report Attributes |

Details |

|

Market Size in 2024 |

US$ 12.02 Billion |

|

Market Size by 2032 |

US$ 22.7 Billion |

|

CAGR |

CAGR of 8.29% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product (Personnel Screening Systems, Checkpoint Screening Systems, Explosives and Drugs Trace Detection Systems, Liquid and Radioactive Substance Monitors, Cargo and Baggage Inspection Systems, Vehicle Inspection Systems) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, ASEAN Countries, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar,Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

|

Company Profiles |

Smiths Detection, OSI Systems, Inc. (Rapiscan Systems), Leidos Holdings, Inc., Nuctech Company Limited, Analogic Corporation, Astrophysics Inc., Teledyne FLIR LLC, L3Harris Technologies, CEIA S.p.A., Westminster Group Plc, VOTI Detection Inc., Adani Systems Inc., Gilardoni S.p.A., Bruker Corporation, Safran S.A. (Morpho Detection), Smiths Group plc, Unival Group GmbH, Kromek Group plc, VMI Security, Rohde & Schwarz and others in the report |