Self-checkout Systems Market Report Scope & Overview:

Get more Information on Self-checkout Systems Market - Request Sample Report

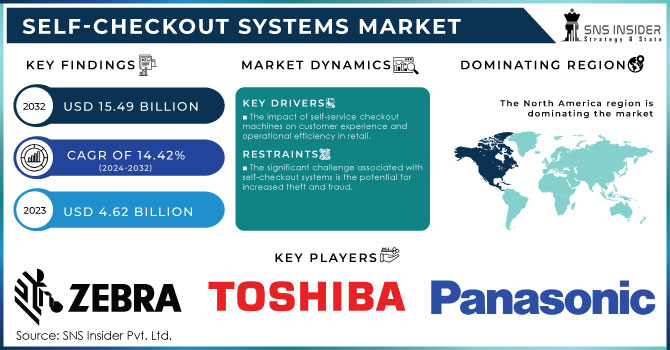

The Self-Checkout Systems Market was valued at USD 4.62 Billion in 2023 and is expected to reach USD 15.49 Billion by 2032, growing at a CAGR of 14.42% over the forecast period 2024-2032.

The self-checkout systems are rapidly gaining traction across various retail sectors, including grocery stores, supermarkets, and convenience stores, as retailers strive to enhance operational efficiency and improve customer satisfaction. A significant driver behind the growth of the self-checkout technology market is the increasing consumer demand for convenience. With busy lifestyles, customers seek quicker shopping solutions that minimize their in-store time. Notably, 90% of shoppers have used a self-checkout kiosk at least once, with 73% of shoppers viewing it as a faster shopping experience and 45% prioritizing time savings. The convenience of self-checkout systems is highlighted by 68% of shoppers who find them especially beneficial for small purchases, while 77% believe they are most efficient for buying a few items. This innovative retail technology has significantly reduced checkout times, averaging a decrease of 30 seconds per transaction, and can lower staffing costs for retailers by up to 50%. Ultimately, 58% of shoppers feel that self-checkout enhances their overall shopping experience, underscoring its critical role in modern retail.

In addition to providing convenience for consumers, self-checkout systems offer substantial benefits for retailers. These systems effectively reduce labor costs by minimizing the number of cashiers required at checkout points, enabling retailers to slash staffing expenses by up to 50% and allocate resources more strategically. Moreover, self-checkout systems streamline the transaction process, cutting checkout times by an average of 30 seconds per transaction and managing up to 50% more transactions compared to traditional lanes. This advancement leads to a reduction in wait times by as much as 30%, enhancing the overall shopping experience for customers. Additionally, self-checkout kiosks can decrease queue lengths by up to 40% during peak hours, significantly improving customer satisfaction. With these efficiencies, retailers are projected to save approximately USD 246 million annually by 2025, highlighting the financial advantages of adopting self-checkout technology.

Self-Checkout Systems Market Dynamics

Drivers

-

The impact of self-service checkout machines on customer experience and operational efficiency in retail.

Self-service checkout machines meet this need by enabling shoppers to scan, bag, and pay for their purchases without having to stand in lengthy lines for assistance from a cashier. This self-service approach not only decreases waiting times but also improves the overall shopping experience. Implementing self-checkout systems in their stores allows retailers to assist multiple customers at once, resulting in higher sales and happier customers. Additionally, labor costs are decreased by utilizing these systems, requiring fewer cashiers for the checkout process. The increase in popularity of mobile payment options and contactless transactions enhances the convenience factor, making self-checkout systems a preferred choice for retailers and customers alike. As technology becomes more familiar in retail environments, customers' demand for faster checkout processes increases. Retailers who implement self-checkout solutions have the opportunity to benefit from this trend by increasing customer loyalty and enhancing operational efficiency.

-

Integrating self-service checkout systems can result in substantial cost reductions for businesses.

Retailers can decrease labor costs by decreasing the number of cashiers needed at checkout lanes, allowing them to allocate resources to other important areas of the business. This change has the potential to enhance operational efficiency, enabling employees to concentrate on customer service, inventory control, and store upkeep. Self-service checkout systems also decrease the likelihood of mistakes made by humans while conducting transactions. Automated scanning and payment processing can enhance the precision of sales transactions, reducing potential losses caused by errors or theft. Furthermore, the effectiveness of self-service checkout systems enables retailers to handle more transactions during busy times, ultimately boosting their potential profits. Long-term cost savings can balance out the initial self-checkout systems investment. Businesses looking to improve their operational capabilities often see a good return on investment when implementing self-checkout systems, making them a desirable choice for retailers.

Restraints

-

The significant challenge associated with self-checkout systems is the potential for increased theft and fraud.

Self-checkout kiosks can be vulnerable to various forms of shoplifting, such as scanning a lower-priced item while placing a higher-priced item in the bag or simply not scanning items at all. Retailers may worry that the convenience of self-checkout systems could lead to a higher incidence of theft, ultimately impacting their bottom line. To combat these concerns, retailers must implement robust security measures to deter theft at self-checkout stations. This may involve the installation of surveillance cameras, employing security personnel, or utilizing advanced technologies such as weight sensors that detect discrepancies between scanned items and their actual weight. However, these additional security measures can increase operational costs and complicate the implementation of self-checkout systems. Moreover, the presence of self-checkout kiosks may lead to a perception among customers that the store is less secure. Shoppers may feel uneasy about the potential for theft, which could affect their overall shopping experience. Retailers must balance the desire for efficient operations with the need to maintain a safe and secure environment for customers.

Self-Checkout Systems Market Segmentation Overview

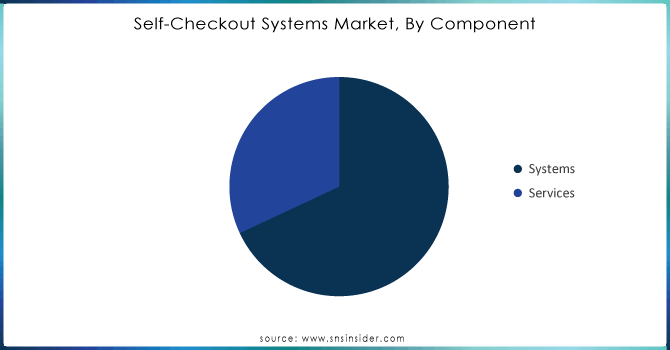

By Component:

The systems segment dominated in 2023 with over 61% market share, which is being fueled by the growing need for automated checkout solutions in retail settings. These systems consist of kiosks and software applications that help streamline transactions, resulting in shorter wait times and improved customer satisfaction. Retailers are more and more utilizing self-checkout systems to reduce labor expenses and enhance operational efficiency. Big retailers like Walmart and Tesco have effectively implemented self-checkout systems to streamline operations and offer a faster checkout experience.

The services segment is anticipated to become the fastest-growing segment during 2024-2032, driven by the growing need for installation, maintenance, and support services for self-checkout systems. As retailers implement these technologies, they need complete service solutions to guarantee that the systems function at their best for a long period. Companies like NCR Corporation and Diebold Nixdorf provide tailored service bundles with training, software updates, and troubleshooting assistance. These services aid retailers in handling system complications, improving user experience, and resolving potential issues promptly.

Need any customization research/data on Self-checkout Systems Market - Enquiry Now

By Type:

Cash-based systems led the market with a 55% market share in 2023. Cash-based systems are beneficial because they are widely accepted across different demographics, especially in areas where cash transactions are common. Retailers gain advantages from cash-based self-checkouts by lowering transaction fees related to card payments and decreasing the possibility of chargebacks. For instance, NCR Corporation and Diebold Nixdorf have effectively incorporated cash-based systems into different retail settings, providing solutions that improve the speed and efficiency of transactions.

Cashless-based systems are accounted to be the fastest-growing segment with a rapid CAGR during 2024-2032, driven by the increasing preference for digital payment methods. Cashless systems are becoming more popular thanks to contactless payments, mobile wallets, and online transactions, providing quick and secure checkout options that appeal to tech-savvy consumers. Major companies such as Toshiba Global Commerce Solutions and Fujitsu offer advanced cashless self-checkout solutions that can be linked to multiple payment platforms, enabling customers to make payments using credit/debit cards, mobile apps, and other digital methods.

Self-Checkout Systems Market Regional Analysis

North America led the market with a 42% market share in 2023. The high usage of advanced retail technologies and the presence of major retail chains like Walmart and Kroger, with their self-checkout systems, are the main factors behind the market's leadership position. The area is boosted by a tech-savvy customer base, which encourages the use of contactless and autonomous payment options. NCR Corporation and Diebold Nixdorf are important participants in this industry, providing advanced self-checkout options to enhance store operations and boost efficiency.

APAC region is projected to have the fastest CAGR during 2024-2032 in the self-checkout systems market. The rapid growth is driven by the quick expansion of retail industries in nations such as China and India, in addition to rising consumer desire for fast and convenient shopping options. The growth of self-checkout technologies is also being fueled by increased digitalization and the implementation of smart city projects. Top companies like Toshiba and Fujitsu are assisting retailers in the area in implementing these systems to enhance customer service and minimize wait times at the checkout.

Key Players in Self-Checkout Systems Market

The major key players in the Self-checkout Systems Market are:

-

NCR Corporation (Self-Checkout Kiosks, POS Systems)

-

Diebold Nixdorf (Vynamic Software, Self-Service Kiosks)

-

Toshiba Global Commerce Solutions (Self-Checkout Solutions, POS Terminals)

-

Zebra Technologies (Self-Checkout Solutions, Mobile Point of Sale)

-

Panasonic Corporation (Self-Checkout Kiosks, POS Solutions)

-

Fujitsu Limited (Self-Checkout Systems, POS Terminals)

-

HP Inc. (Self-Checkout Kiosks, Retail Solutions)

-

TPI Software (Self-Checkout Software Solutions, Retail Management Software)

-

Kiosk Information Systems (Self-Checkout Kiosks, Interactive Kiosks)

-

SZZT Electronics (Self-Checkout Systems, Payment Terminals)

-

Wincor Nixdorf (Self-Checkout Systems, Cash Management Solutions)

-

Coinstar (Self-Service Coin Machines, Kiosk Solutions)

-

VivaKi (Self-Checkout Kiosks, Digital Signage Solutions)

-

Intuit (Self-Checkout Solutions, Point of Sale Software)

-

AURES Technologies (Self-Checkout Systems, POS Hardware)

-

Datalogic (Self-Checkout Scanners, Retail Automation Solutions)

-

SATO Holdings Corporation (Self-Checkout Solutions, Labeling Solutions)

-

NEXTEP SYSTEMS (Self-Service Kiosks, Digital Signage)

-

MHI (Self-Checkout Solutions, Retail Management Software)

-

PayRange (Mobile Payment Solutions, Self-Service Kiosks)

Suppliers

-

Ingenico Group

-

Verifone

-

Elo Touch Solutions

-

Custom Business Solutions

-

Datalogic

-

MagTek

-

IDTech

-

Azkoyen Group

-

Diebold

-

Pyramid Computer GmbH

Recent Development

-

In June 2024, DIAL, the operator of Delhi airport, announced the introduction of a self-service system that allows passengers to quickly drop off their luggage, receive tags, and print boarding passes to speed up the check-in process.

-

In September 2024, Union Coop implemented 'self-checkout' as one of its smart services, enabling customers to finish their transactions without assistance from a cashier. At the moment, the retailer based in Dubai is in the early phases of implementing self-checkout at all its stores to make shopping more convenient for customers.

-

In January 2024, Diebold Nixdorf, a company that offers retail solutions, introduced a new checkout solution based on artificial intelligence (AI) to address the issue of shrinkage in the retail sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.62 Billion |

| Market Size by 2032 | USD 15.49 Billion |

| CAGR | CAGR of 14.42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Systems, Services) • By Type (Cash Based Systems, Cashless Based Systems) • By Application (Supermarket & Hypermarkets, Department Stores, Convenience Stores, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NCR Corporation, Diebold Nixdorf, Toshiba Global Commerce Solutions, Zebra Technologies, Panasonic Corporation, Fujitsu Limited, HP Inc., TPI Software, Kiosk Information Systems, SZZT Electronics, Wincor Nixdorf, Coinstar, VivaKi, Intuit, AURES Technologies, Datalogic, SATO Holdings Corporation, NEXTEP SYSTEMS, MHI, PayRange |

| Key Drivers | • The impact of self-service checkout machines on customer experience and operational efficiency in retail. • Integrating self-service checkout systems can result in substantial cost reductions for businesses. |

| RESTRAINTS | • The significant challenge associated with self-checkout systems is the potential for increased theft and fraud. |