Monitoring Tools Market Report Scope & Overview:

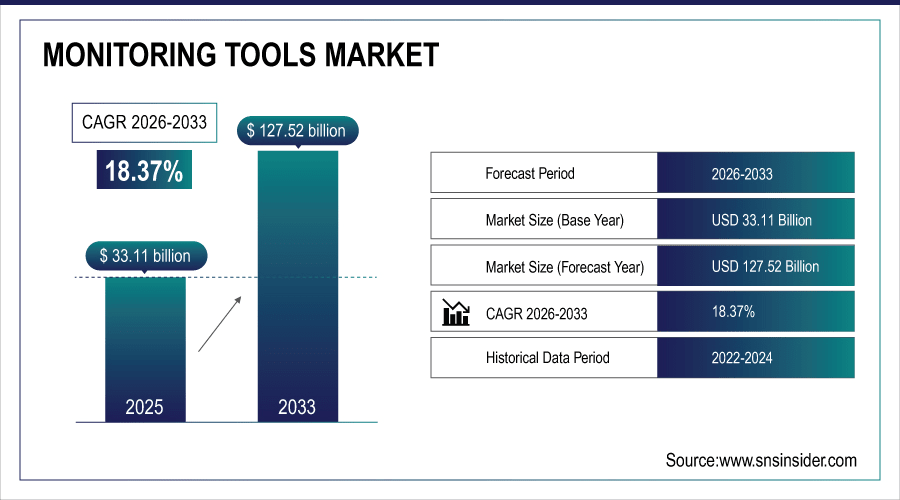

The Monitoring Tools Market size was valued at USD 33.11 Billion in 2025E and is projected to reach USD 127.52 Billion by 2033, growing at a CAGR of 18.37% during 2026-2033.

The Global Monitoring Tools Market growth is poised to get influenced due to rapid action of digital transformation and requirement for uninterrupted IT operations across the industries. Demand is driven by increased penetration of cloud-based infrastructure, AI-led performance analytics and real-time network monitoring. Hybrid, among Solution Types are aiding in scaling the monitoring infrastructure and reducing downtime which further ensures security as well; industries such as IT, BFSI, healthcare and manufacturing contribute to this adoption across regions worldwide.

In June 2025, Dynatrace expanded its AI-powered monitoring platform with cloud-native and hybrid solutions, helping enterprises improve real-time performance analytics, reduce downtime, and strengthen cybersecurity across IT, healthcare, and BFSI sectors.

To Get More Information On Monitoring Tools Market - Request Free Sample Report

Key Monitoring Tools Market Trends

-

Escalating use of AI as well as machine learning in monitoring tools is supporting predictive analytics and has enhanced incident resolution.

-

The cloud deployment type in Pool Monitoring Systems is growing and the hybrid model is also catching up very fast.

-

Demand is growing for real-time network and application performance monitoring among IT and telecom industries.

-

BFSI and healthcare organizations are making significant investments in automated monitoring to maintain high availability and minimize operational risk.

-

Monitoring tools are being integrated with cyber security platforms to allow organizations to monitor threats more effectively.

-

Demand is increasing for IoT and industrial monitoring solutions, particularly in manufacturing and smart infrastructure applications.

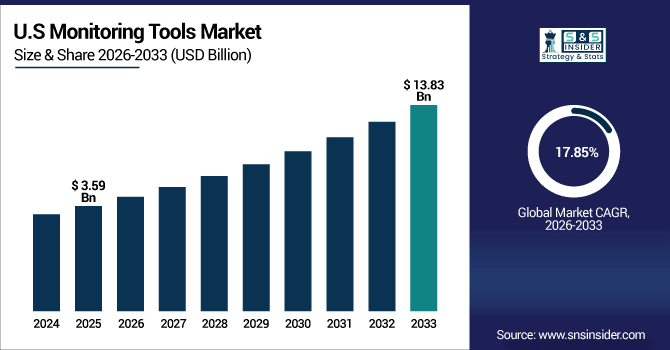

The U.S. Monitoring Tools Market size was valued at USD 3.59 Billion in 2025E and is projected to reach USD 13.83 Billion by 2033, growing at a CAGR of 17.85% during 2026-2033. The demand for AI based monitoring, real-time performance analytics, and automated application and network monitoring are increasing in various verticals of IT sector, healthcare sector, BFSI and government. Continuous availability of systems, proactive issue discovery and IT infrastructure optimization requirements continue to drive this segment for enterprises, cloud platforms and digital transformation projects.

Monitoring Tools Market Growth Drivers:

-

Rising Adoption of AI-Powered and Cloud-Based Monitoring Solutions Drives Real-Time Performance, Proactive Issue Detection, and IT Infrastructure Optimization Across Industries

The growing adoption for the AI based and cloud-based monitoring technology is the major factor driving the growth of Monitoring Tools Market. These solutions allow for tracking performances in real time, early problem detection and IT infrastructure optimization, contribute to reducing on-going time errors and productivity. It is dominantly expanded in IT, healthcare, BFSI and government sectors that are thoroughly using these solutions to enable digital business transformation, ensure business continuity and increase overall system resiliency.

-

In September 2025, Arista Networks projected a 70% growth in its AI networking segment, highlighting the increasing demand for AI-driven networking solutions.

Monitoring Tools Market Restraints:

-

High Implementation and Maintenance Costs Limit Adoption of Advanced Monitoring Solutions, Especially Among Small and Medium-Sized Enterprises

The growth of Monitoring Tools Market, is cost and complexity of advanced monitoring solutions in terms of implementation and maintenance. Budget-strained small and medium-sized businesses struggle to temporarily spend money on deployment, licensing, and management. Such costs can slow adoption, impede scalability and prevent organizations from fully benefiting from AI-powered and cloud-based monitoring tools to help them better manage their IT environment.

Monitoring Tools Market Opportunities:

-

Integration of AI and Machine Learning in Monitoring Tools Enables Predictive Analytics, Proactive Issue Detection, and Enhanced Operational Efficiency

Integration of AI and Machine Learning with the Monitoring Solitons is the Biggest Opportunity in the Monitoring Tools Market. These are predictive analysis tools that can help companies to anticipate any potential problem before it like becomes the issue of the day in an organisation. Using AI-based intelligent insights, companies can maximize software performance, minimize downtime and improve overall productivity, all while feeding the information into monitoring tools for your IT infrastructure.

-

In May 2025, Datadog saw growth due to rising demand for AI-powered monitoring and security solutions, highlighting the increasing reliance on AI for proactive issue detection and improved operational efficiency.

Monitoring Tools Market Segment Analysis

-

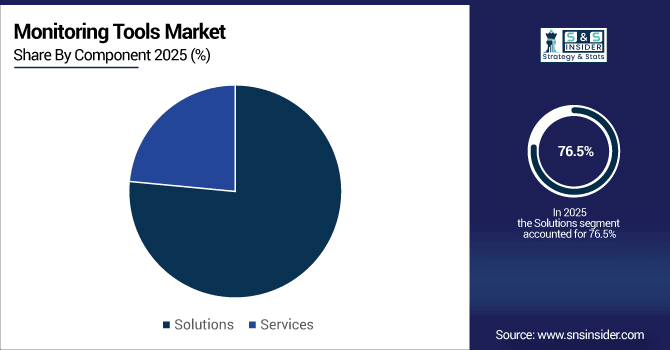

By Component, Solutions dominated the market, accounting for 76.5% share in 2025, while Services is the fastest-growing segment, projected to expand at a CAGR of 19.7% from 2026 to 2033.

-

By Deployment, Cloud-Based solutions dominated the market, accounting for 72.4% share in 2025, while On-Premises is the fastest-growing segment, projected to expand at a CAGR of 23.4% from 2026 to 2033.

-

By Enterprise, Large Enterprises dominated the market, accounting for 62.5% share in 2025, while Small & Medium Enterprises (SMEs) are the fastest-growing segment, projected to expand at a CAGR of 18.4% from 2026 to 2033

-

By End-User, IT & Telecom dominated the market with a 29.5% share in 2025, whereas Healthcare is the fastest-growing segment, expected to grow at a CAGR of 17.5% through 2026 to 2033.

By Component, Software holds majority share, while Services grow fastest

Solutions is the most revenue generating component in Monitoring Tools Market in 2025E as organization prefer implementing robust & full-featured platform for real-time performance management, automate trouble & alerts and control over infrastructure. These are solutions that offer immediate benefit in optimizing IT operations. Meanwhile, Services is the fastest growing with the demand for expert support, managed monitoring, and consulting services that help to tailor, integrate and maintain monitoring tools effectively across complex IT environments.

By Deployment, Cloud-Based solutions dominate, while Hybrid expands fastest

Cloud-based offerings held a majority share of the Monitoring Tools Market in 2025E owing to their scalable, flexible, and cost-effective nature making them ideal for organizations that need to manage their distributed IT infrastructure without heavy investment on on-premises solutions. As enterprises increasingly seek the benefits of cloud and on-premises in one stack, finding ways to integrate and iteratively transition into new environments is a key challenge for hybrid deployment, which is now the fastest growing environment segment.

By Enterprise, Large Enterprises lead market, while SMEs grow fastest

Monitoring tools are used to monitor the overall performance and health of a range of applications, servers, databases and networks within an IT infrastructure to minimize downtime and maintain operational efficiency. Small to Medium Enterprises (SMEs) is the highest growing sector, arising from the growing adoption of digital and an increasingly large range of affordable and flexible monitoring solutions designed for smaller, more nimble business.

By End-user, IT & Telecom dominate, while Healthcare expands fastest

The market was dominated by IT & Telecom in 2025E, as it highly depends on strong network performance monitoring tools, application uptime and security. The health sector continues to be the fastest growth vertical as hospitals and wellness centers embrace AI-powered, cloud-based monitoring technology to ensure system availability, safeguard sensitive information, manage ͞digital transformation efforts for healthcare IT teams. Increasing regulations and the need for constant patient data monitoring are further driving the growth of advanced monitoring devices in healthcare.

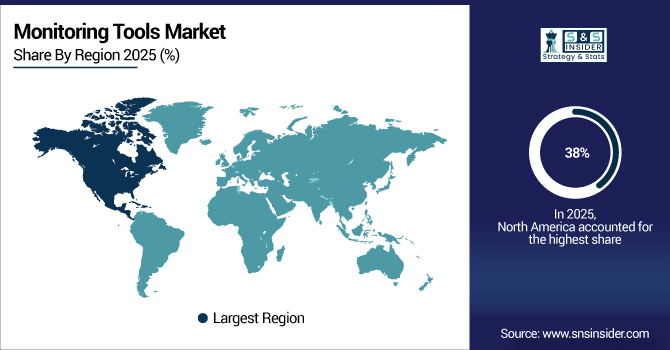

Monitoring Tools Market Regional Analysis:

North America Monitoring Tools Market Insights:

The North America Monitoring Tools market holds the largest share, accounting for approximately 38% of the market. The market in the region is characterized by its widespread advanced IT infrastructure, high cloud and hybrid solutions adoption, and heavy investments in digital transformation among organizations. High demand across IT & telecom, BFSI, and healthcare industries as well presence of key technology providers with regulatory compliances also complement market growth. Fast paced innovation, skilled human resource and wide service network further consolidate North America market position.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Monitoring Tools Market Insights:

U.S. is the biggest Monitoring Tools market, growing with a high demand for advanced IT monitoring, cloud-based solutions and hybrid deployment in ICT, Financial services (BFSI) and healthcare sectors. The juggernaut is further propelled by the presence of leading technology vendors, fast digital evolution and stringent regulatory adherence. What is more, adoption of AI-based monitoring and managed services, concentration on cybersecurity and operational efficiency also continue to add muscle to U.S. market lead.

Asia-Pacific Monitoring Tools Market Insights:

The Monitoring Tools Market in Asia-Pacific is experiencing rapid growth at a CAGR of 19.43%, with the growing digital transformation, expanding IT & telecom industry, and increasing demand of cloud-based & hybrid monitoring solutions in such countries as China, India, Japan, and South Korea. Expansion in the market is driven by increasing use of AI-based monitoring and managed services, as well as cybersecurity solutions. Moreover, the market is driven by fast industrialization, government support for smart infrastructure, and growing enterprise investment in IT infrastructure. The popularity of the Internet in this region and a tech-savvy population also contributes to assertive market positioning in the area.

China Monitoring Tools Market Insights:

China Market of Monitoring Tools is dominating the region, attributed to the swift digitalization, rising proliferation in IT & telecom industry and increasing need for cloud-based and hybrid tools among enterprises. Further, robust uptake of AI-based monitoring, managed services and cybersecurity solutions is driving the market. China’s leadership in the Monitoring Tools market stems from high internet penetration, a sizable tech-scene, as well as fast-growing e-commerce and online services markets.

Europe Monitoring Tools Market Insights:

The Monitoring Tools Market in Europe has a substantial market size of its own owing to the well-established IT infrastructure, deployment of cloud and hybrid monitoring systems among enterprises and large number of technology providers. The region is benefiting from strict regulatory requirement, increasing cyber security demands, and enterprise digital transformation projects. High internet penetration and tech-savvy labor force are backing up the dominance of Europe in Monitoring Tools market.

Germany Monitoring Tools Market Insights:

Germany is leading the Europe Monitoring Tools Market as professional IT infrastructure, strong adoption of cloud-based and hybrid monitoring solution with a presence of technology vendors. Rising regulatory compliance, increasing cyber security needs and digital transformation endeavors in the enterprises also bolster market growth. Furthermore, rising adoption of IT, Telecom, BFSI and manufacturing applications along with investments in AI-based monitoring and managed services further drive Germany market outlook.

Middle East & Africa (MEA) and Latin America Monitoring Tools Market Insights:

Middle East & Africa (MEA) Monitoring Tools Market Digital transformation, escalating IT and telecom uptake alongside growing demand for enterprise cloud based and hybrid monitoring solution are some of the key factors accelerating the MEA market growth. Smart infrastructure, cybersecurity and AI powered monitoring solutions also act as investment enablers for market growth. In MEA, high mobile and internet penetration support the Monitoring Tools market.

Monitoring Tools Market for Competitive Landscape:

AWS you get sophisticated monitoring via solutions such as Amazon CloudWatch for instant information about your infrastructure, applications and network. Its cloud-native tools scale basics such as proactive issue detection, automated alerts and AI-powered analytics. Its AWS monitoring tools are widely adopted across organizations, and they assist in the optimization of resources, uptime and security factors that saw AWS emerging as one of the best cloud-based monitoring service providers.

-

In September 2025, AWS launched Kiro, an AI-powered IDE to streamline software development with intelligent agents that organize and implement project tasks efficiently.

Cisco delivers extensive monitoring facilities designed for network performance, application visibility, and security control. Advanced solutions, such as Cisco AppDynamics and Thousand Eyes, provide detailed analytics on digital experiences to infrastructure and cloud environments. Enabled it strong integrations, Cisco’s monitoring portfolio prevents service downtime and keeps network operation overhead low, all while identifying anomalies to ensure your IT environment remains secure further solidifying its leading position in the hybrid IT and network monitoring markets today.

-

In June 2025, Cisco unveiled a new AI-ready network architecture offering simplified management, advanced security, and optimized performance for campus, branch, and industrial networks.

Dynatrace is a company that offers AI and cloud-based application monitoring and observability platforms. The company's solutions discover the full stack and all dependencies, manage up to tens of thousands of concurrent users and reduce time spent on monitoring by 90%, pinpoint the sources of user-experience issues, optimize application response times, accelerate innovation and fixes with new recommendation algorithms that automatically anticipate potential failures.

-

In February 2025, Dynatrace introduced platform innovations at its Perform event, enabling enterprises to leverage AI for better insights, performance, and business resiliency.

Monitoring Tools Market Key Players:

Some of the Monitoring Tools Market Companies are:

-

Amazon Web Services (AWS)

-

Cisco Systems, Inc.

-

Dynatrace, Inc.

-

Google LLC

-

IBM Corporation

-

Microsoft

-

NETSCOUT Systems, Inc.

-

New Relic, Inc.

-

Riverbed Technology LLC

-

Splunk Inc.

-

Datadog, Inc.

-

SolarWinds Corporation

-

AppDynamics (a Cisco company)

-

Elastic N.V.

-

Broadcom Inc.

-

Micro Focus

-

PagerDuty, Inc.

-

LogicMonitor, Inc.

-

Zabbix SIA

-

Nagios Enterprises, LLC

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 33.11 Billion |

| Market Size by 2033 | USD 127.52 Billion |

| CAGR | CAGR of 18.37 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions and Services) • By Deployment (On-Premises and Cloud-Based) • By Enterprise (Small & Medium Enterprises (SMEs) and Large Enterprises) • By End-User (IT & Telecom, BFSI, Healthcare, Manufacturing & Industrial, Government, Retail and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Amazon Web Services (AWS), Cisco Systems, Inc., Dynatrace, Inc., Google LLC, IBM Corporation, Microsoft, NETSCOUT Systems, Inc., New Relic, Inc., Riverbed Technology LLC, Splunk Inc., Datadog, Inc., SolarWinds Corporation, AppDynamics (a Cisco company), Elastic N.V., Broadcom Inc., Micro Focus, PagerDuty, Inc., LogicMonitor, Inc., Zabbix SIA, Nagios Enterprises, LLC |