Serverless Security Market Size & Overview

Get more information on Serverless Security Market - Request Free Sample Report

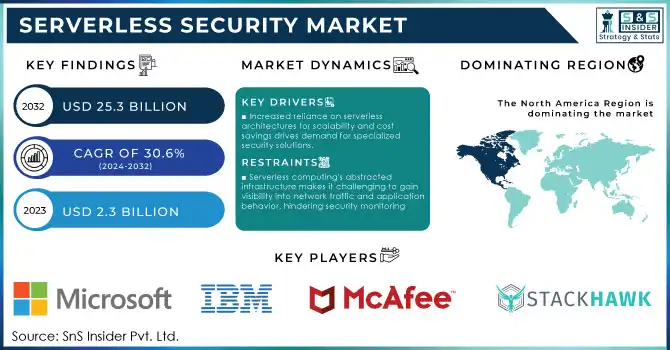

The Serverless Security Market size was valued at USD 2.3 billion in 2023 and is expected to reach USD 25.3 billion by 2032, growing at a CAGR of 30.6% over the forecast period of 2024-2032.

The growing adoption of serverless architectures is revolutionizing cloud computing, enabling businesses to focus on code development without managing the underlying infrastructure. This shift has created a robust demand for serverless security solutions. According to the U.S. National Institute of Standards and Technology (NIST) in its 2023 report on cloud service adoption, over 70% of cloud-native applications now leverage serverless models to optimize scalability and reduce operational overhead. The European Commission’s Digital Economy and Society Index (DESI) 2023 indicated that serverless adoption among SMEs in Europe increased by 22% year-on-year, attributed to government incentives promoting cloud transitions under the EU’s Digital Decade Initiative. Additionally, global cybersecurity threats targeting serverless environments surged by 38% in 2023, according to the United Nations’ International Telecommunication Union (ITU). These figures underscore the rising significance of robust serverless security measures to mitigate risks such as function misconfigurations and insecure APIs.

The demand for serverless security solutions has increased, helping organizations protect applications and maintain compliance with industry regulations. In 2023, the European Commission reported that 45.2% of EU enterprises used cloud services, with 75.3% adopting advanced services like database hosting, security software, and development platforms, marking a 4.2% increase from 2021. Additionally, the adoption of DevOps methodologies has led to greater reliance on serverless computing, enabling faster development and deployment cycles. While this enhances agility, it also presents security concerns, including managing identities, detecting vulnerabilities, and ensuring compliance. Consequently, the need for specialized serverless security solutions has grown to help organizations navigate these challenges.

Serverless Security Market Dynamics

Drivers

-

Increased reliance on serverless architectures for scalability and cost savings drives demand for specialized security solutions.

-

The rise in sophisticated cyberattacks against cloud systems fuels the need for tailored serverless security tools to protect against breaches and unauthorized access.

-

Stringent data protection laws, like GDPR, push organizations to adopt robust security practices in serverless environments to ensure compliance.

-

The dynamic nature of serverless environments requires continuous monitoring and automated response systems to detect and mitigate potential security risks instantly.

One significant driver of the Serverless Security Market is the growing adoption of serverless computing across industries. As organizations increasingly migrate their applications to serverless architectures, they benefit from enhanced scalability, reduced operational costs, and simplified infrastructure management. Serverless platforms, such as AWS Lambda and Azure Functions, enable developers to deploy applications without managing the underlying servers, allowing them to focus on writing code instead of dealing with infrastructure. For instance, Amazon Web Services (AWS) reported in 2023 that its Lambda service has supported over 400 billion executions monthly, highlighting the scale of serverless adoption. Similarly, companies like Coca-Cola and Capital One have adopted serverless computing to improve operational efficiency and reduce the overhead of managing traditional server-based infrastructures.

However, as organizations embrace these benefits, they also face new security challenges. Serverless environments introduce complexities such as the ephemeral nature of serverless functions, which can be difficult to monitor for potential security risks. As a result, specialized security solutions are critical to protect these dynamic systems from vulnerabilities like unauthorized access and data breaches. This driver is further reinforced by the increasing need for organizations to ensure their cloud environments remain secure as they transition to serverless models.

Restraints

-

Serverless computing's abstracted infrastructure makes it challenging to gain visibility into network traffic and application behavior, hindering security monitoring.

-

Serverless systems automatically scale with demand, creating unpredictable security challenges and complicating efforts to maintain consistent protection.

The lack of visibility in serverless environments is an important obstacle in the Serverless Security market. Since serverless computing abstracts away much of the underlying infrastructure, it becomes challenging for security teams to monitor application behavior and network traffic effectively. The absence of transparency creates a challenge in identifying vulnerabilities or unusual activities that could be suggestive of a breach. Security teams have visibility into and control over systems in traditional server environments, but much of that is hidden in cloud provider architecture, such as with serverless computing. This results in a complicated detection of dangers in real-time preventing fast response and leading to a higher probability of data breaches or other cyberattacks. Furthermore, as serverless applications scale dynamically, security teams may struggle to keep up with new functions being created and the continuously changing environment.

Serverless Security Market Segment Analysis

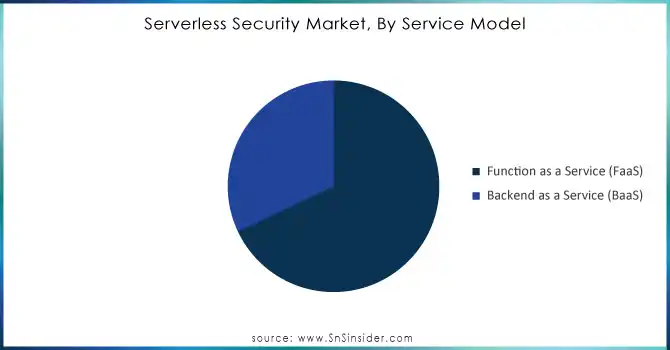

By Service Model

In 2023, the function as a service (FaaS) segment accounted for 68% of the global serverless security market revenue. FaaS is already dominating this segment because it allows developers to run and scale specific functions of code without provisioning servers. The 2023 Technology Adoption Report published by the Government of Canada indicates that 85% of public sector cloud deployments incorporated FaaS for its price advantage and ease of use. Likewise, the U.K. Government Digital Transformation Plan demonstrated that 60% of gov-backed tech startups that used FaaS found it useful to deploy in an agile manner. Combined with the increasing popularity of FaaS in sectors like healthcare and e-commerce, where scalability and cost-effectiveness are key performance indicators, makes it the way ahead. This growth is in step with global initiatives to simplify and accelerate cloud-native application development through easier, serverless methods.

Do you need any custom research/data on Serverless Security Market - Enquiry Now

By Security Type

Application security was the leading category by security type, capturing 30% of global revenue in 2023. This segment is expected to continue to dominate the market due to the growing need for securing serverless applications against various threats, like injection attacks, cross-site scripting (XSS), and unauthorized access. The U.K. National Cyber Security Centre (NCSC) reported in 2023 that serverless application vulnerabilities comprise 45% of all reported issues. At the same time, U.S. Cybersecurity and Infrastructure Security Agency (CISA) has urged the need for improved application secureness paradigms for serverless models owing to risks of exploitation via APIs. Owing to stricter compliance mandates imposed globally, there was an increase in adoption of Application Security solutions across serverless architectures.

By End Use

The segment of IT & telecommunications dominated the market in 2023, with 22% of global revenue share. This dominance in the sector is indicative of the rise in serverless computing that the sector has experienced as a means of improving scalability and operational efficiency. According to the U.S. Federal Communications Commission (FCC), more than half of U.S. telecom operators made the shift to serverless models in 2023, to increase infrastructure resilience and decrease latency. Moreover, 40% of IT companies had integrated serverless frameworks under the Digital India initiative by the Indian Ministry of Electronics and Information Technology (MeitY). The growing IT and Telecom sector in response to the combination of rising data traffic and cloud migration strategies has significantly upsurged the demand for effective serverless security solutions.

By Enterprise Size

Large enterprises dominated the market with 62% revenue share in 2023. Due to the extent of their application portfolios and greater risk from advanced cyber threats, large corporations are often at the forefront of serverless security adoption. In a 2023 report by the Australian Cyber Security Centre [ACSC], 75% of enterprises highlighted their serverless security investments to save from growing threats. Similarly, the U.S. Department of Commerce also cautioned against cyber threats leading to Fortune 500 companies increasing their spending on serverless-related applications by 18 percent in 2023 as the sector continued to depend on strengthened security frameworks for compliance and risk management. This trend was further propelled by government incentives promoting the adoption of secure cloud environments for large enterprises.

Serverless Security Market Regional Analysis

North America led the global serverless security market and accounted for 38% revenue share in 2023. Investments in cloud infrastructure and strict regulations in cybersecurity come as enablers for regional leadership. The U.S. Bureau of Economic Analysis has reported ever-growing federal and private sector spending on serverless security solutions growing significantly year-on-year. The increasing adoption of cloud-native architectures is expected to drive rapid growth in the U.S. serverless security market from 2024 to 2032. Finally, with organizations migrating their workloads from legacy infrastructure to serverless computing to support their efforts for scalability and flexibility, they need more advanced security solutions to secure the serverless environment which requires more investment in both in-house and outside sources.

On the other hand, Asia-Pacific showed the highest CAGR over the forecast period due to the ongoing digital transformation in emerging economies like India and Indonesia. According to the 2023 report on the Digital India progress, the Indian government indicated that serverless deployments grew by 30%, and specifically mentions the public and private sectors engaged in the Indian Smart Cities Mission. This trend is further complemented by high mobile adoption and an emergent demand for cloud technologies across the region.

Recent Developments in the Serverless Security Market

-

In May 2024: StackHawk Partnered with Microsoft Defender for Cloud to advance secure software development. It enhances Defender for APIs' runtime capabilities by adding the integration for more robust visibility into API security during development, as well as for security teams.

-

In March 2023, The U.S. Department of Homeland Security (DHS) announced a $200 million grant for developing advanced serverless security technologies, focusing on protecting federal cloud systems.

Key Players

Service Providers / Manufacturers

-

StackHawk (StackHawk API Security, StackHawk Web Application Security)

-

Microsoft (Defender for Cloud, Defender for APIs)

-

McAfee (McAfee Cloud Security, McAfee Data Loss Prevention)

-

Palo Alto Networks (Prisma Cloud, Prisma Cloud Compute)

-

Trend Micro (Cloud One, Deep Security)

-

Fortinet (FortiWeb, FortiGate Cloud)

-

Check Point Software (CloudGuard, ThreatCloud)

-

Cloudflare (Cloudflare Workers, Cloudflare Security)

-

Zscaler (Zscaler Cloud Security, Zscaler Private Access)

-

IBM (IBM Cloud Security, IBM QRadar)

Key Users

-

Netflix

-

Amazon

-

Google

-

Microsoft Azure

-

Uber

-

Spotify

-

Walmart

-

LinkedIn

-

Dropbox

-

Airbnb

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.3 billion |

| Market Size by 2032 | USD 25.3 billion |

| CAGR | CAGR 30.6% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Model (Function as a Service, Backend as a Service) • By Deployment (Cloud, On-Premise) • By Security Type (Data Security, Network Security, Application Security, Perimeter Security, Others) • By Enterprise Size (SMEs, Large Enterprises) • By End Use (BFSI, Healthcare, Retail and E-commerce, IT and Telecommunications, Government and Public Sector, Manufacturing, Energy and Utilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | StackHawk, Microsoft, McAfee, Palo Alto Networks, Trend Micro, Fortinet, Check Point Software, Cloudflare, Zscaler, IBM |

| Key Drivers | • Increased reliance on serverless architectures for scalability and cost savings drives demand for specialized security solutions. • The rise in sophisticated cyberattacks against cloud systems fuels the need for tailored serverless security tools to protect against breaches and unauthorized access. • Stringent data protection laws, like GDPR, push organizations to adopt robust security practices in serverless environments to ensure compliance. • The dynamic nature of serverless environments requires continuous monitoring and automated response systems to detect and mitigate potential security risks instantly. |

| Market Restraints | • Serverless computing's abstracted infrastructure makes it challenging to gain visibility into network traffic and application behavior, hindering security monitoring. • Serverless systems automatically scale with demand, creating unpredictable security challenges and complicating efforts to maintain consistent protection. |