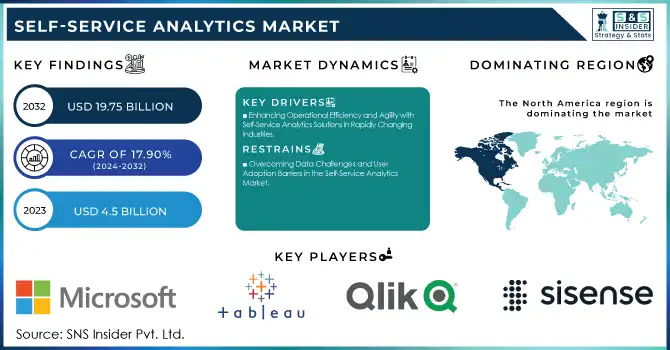

Self-Service Analytics Market Report Scope & Overview:

The Self-Service Analytics Market was valued at USD 4.5 billion in 2023 and is expected to reach USD 19.75 billion by 2032, growing at a CAGR of 17.90% over the forecast period 2024-2032.

To get more information on Self-Service Analytics Market- Request Free Sample Report

Demand for data-driven decision-making across several industries has bolstered the growth of the Self-Service Analytics market. Organizations have realized that equipping business users, analysts, and other non-technical personnel with solutions that enable them to access, analyze data, generate insights, and make decisions on their own, limiting their dependence on IT, is essential. This is propelled by increasing demand for live actionable insights to boost productivity and remain competitive. Various factors, such as cloud computing, big data analytics, and AI-powered tools, which are highly scalable and easy to use, have also contributed to democratizing data access and analytics. Microsoft unveiled a USD 80 billion investment in AI data centers for its coming fiscal year 2025, signaling an increase in demand for AI and cloud services. According to a survey by PwC, 98% of businesses are fast-tracking generative AI-powered data modernization. American Express also states that 60% of customers would rather use self-service tools for simple tasks than touch base with a live representative.

The proliferation of self-service analytics solutions across small and medium-sized enterprises (SMEs) also adds to the market growth, and market as these organizations could not handle complex, IT-centric based analytics processes. Today, self-service analytics tools are more affordable, easier to use, and more accessible, enabling SMEs to use data via analytics solutions for SMEs to grow and optimize. Moreover, healthcare, BFSI, and retail sectors are showing growing traction with these tools for analyzing customer behavior, streamlining operations, and improving decision-making. With organizations increasingly adopting data-driven processes, the need for self-service analytics solutions is likely to increase further, and so would the market's growth. 47% of SMEs will have business intelligence tools in 2024 and 38% soon plan to get them in 2024. About 80% of banks are ramping up their analytics spending with a particular focus on self-service analytics tools to aid customer segmentation and fraud detection. 66% of retail businesses are using self-service analytics, which is increasing customer retention by 10% and operational efficiency by 15%. In addition, 60% around the world gradually veering towards cloud-based analytics in the case of SMEs.

Self-Service Analytics Market Dynamics

Key Drivers:

-

Enhancing Operational Efficiency and Agility with Self-Service Analytics Solutions in Rapidly Changing Industries

The Self-Service Analytics market is anticipated to benefit from the increasing focus on operational efficiency and cost reduction by organizations. As businesses are under immense pressure to optimize processes and minimize operational costs, self-service analytics solutions offer a potent solution for organizations. These solutions enable organizations to perform data analysis without having to rely on a data expert and make decisions faster. Empowering users across the organization to run on-demand analytics also helps minimize bottlenecks, lower time spent on manual data preparation and processing, and more effective resource allocation for the organization. Such improved agility is especially beneficial to enterprises, which are always under pressure to continue moving and executing quickly in industries where change is the only constant. Some organizations are beginning to report 28% cost reductions in 2024 based on self-service BI tools that reduce the reliance on IT. Driven by that insight, Forrester states that 59% of organizations experience improved operational efficiency while from Gartner, 85% of users save as much as 50% of their time when it comes to data preparation. Moreover, Domo study shows that 90% of business users are making quick decisions with self-service analytics proving the tools that drive agility and insight capability in real time.

-

Driving Customer Engagement and Loyalty with Self-Service Analytics Across Industries in 2024

Moreover, growing phenomena of customer-focused approaches is promoting the demand of self-service analytics software. Organizations or businesses from different sectors are putting more emphasis on inferring customer behavior, customer preference, customer engagement, customer experience, and customer loyalty. With self-service analytics, businesses can assess big data to figure out customer traits and then reflect this in better marketing, sales, and service offers. Retail companies, for example, use analytics to examine buying patterns and target promotions to a single customer. This enables businesses to meet customer expectations effectively and in person, resulting in a high level of customer satisfaction and lost revenue. In many industries, such as retail, healthcare, and finance, where success requires understanding customer dynamics, this customer-centric approach is especially important. Self-service analytics will be central in developing and refining these strategies, as customer experience increasingly becomes the leading differentiator in the market. 79% of retail businesses used self-service analytics to foster targeted promotions to customers, increasing retention by 15-20% in 2024. Banking sector noted that 84% of financial institutions are using AI & analytics for engaging customers, at 17% reduction in churn. 78% Healthcare organizations that leverage analytics tools to enhance patient care and operational workflows have experienced a whopping 22% reduction in administrative overheads. Self-service analytics for customer experience also coincides with 23% higher satisfaction scores across industries among businesses.

Restrains:

-

Overcoming Data Challenges and User Adoption Barriers in the Self-Service Analytics Market

The need to maintain quality and consistency of data poses a formidable challenge in the Self-Service Analytics market. However, with more business users using analytics tools comes the risk of using inaccurate or inconsistent data, leading to flawed insights and possibly bad decisions. This problem is even more challenging in large organizations which have multiple data sources and interactive data. Data still needs to be clean, accurate, and up to date, which is a huge challenge in itself, and if we do not govern, integrate and architect data appropriately, the potential of self-service analytics will never be fully unlocked. A further difficulty is that some self-service analytics tools have a high learning curve. These platforms do have user-friendliness in their design, but some are just need the technical knowledge to use them to their full potential. For users without a background in data analysis, they may find it difficult to leverage the tools appropriately, leading to underutilisation of the software or inaccurate analyses. To circumvent this issue, organizations will have to invest in training and user adoption strategies.

Self-Service Analytics Market Segment Analysis

By Software

Tableau led the market with 31.6% in 2023 and is projected to maintain the fastest growing CAGR from 2024–2032. The software market is being dominated by it due to its simplicity, excellent data visualization features, and customized options that cater to the requirements of any scale of organization. The interactive, real-time visualizations that integrate with a diversity of data sources that Tableau offers has empowered businesses to improve their data-driven decision-making process. Tableau will continue to be a leader as more companies fundamentalize the use of more data science & visual analytics to promote efficiencies on the operational side of the business and strategic innovations of data. Tableau's growth outlook is spurred by the trend of widespread adoption of self-service analytics solutions, especially in verticals such as healthcare, financial services, and retail. Tableau is an attractive solution for businesses because it allows users without a deep technical background to utilize data analyzing tools with its agile and scalable solutions, especially as businesses are looking to democratize data analysis from the executive suite, down to the shop floor. Additionally, Tableau has been continuously innovating on AI and machine learning integrations which will continue to fuel its growth in the market as enterprise demands continue to change over time.

By Service

In 2023, Business Users held the largest share at 40.9% and is projected to experience the highest CAGR throughout 2024–2032. This stronghold can be best explained by the rising fad of self-service that enables business professionals, analysts, and other successful non-IT people as well as the capability to perform data analysis by themselves. One radical change in the field of Data Science management is the advent of self-service analytics tools that have drastically slashed the entry barriers for using Data Science allowing business users to easily access, explore, and get insights from the data by themselves without having to depend on IT departments or data scientists to create the necessary infrastructure. This trend is leading many industries to adopt these tools and to democratize data and to make it available to people at all levels in an organization to enable faster data-driven decisions. Part of the explosion in business users in the self-service analytics market is fueled by the move to a more data-centric culture in enterprises. Due to the need for real-time insights by businesses to remain competitive, it is essential to allow business users to access and analyze data directly. This transformation is particularly visible in sectors such as retail, finance, and healthcare, where accessing greater customer insights, operational performance, and market trends becomes essential to success. With self-service analytics tools getting even more easy-to-use and able to connect with a larger number of data-multiple sources, the number of business users using these tools will increase even faster.

By Enterprise Type

In 2023, Large Size Enterprises held the majority of market share at 64.7% and are able to leverage their extensive resources and creativity to invest in comprehensive self-service analytics tools. Such enterprises usually possess an abundance of data within the different departments, thus also requiring sophisticated analytics platforms that can process large-scale data to extract insights across multiple levels within the organization. With the right analytical process, the demand for information is so great that larger enterprises have readily adopted self-service analytics to aid in decision-making, operational efficiency, and competitiveness. And such organizations have data governance and integration teams assigned to take advantage of the analytics platform.

Small and Medium-Sized Enterprises (SMEs) are predicted to see the fastest CAGR through 2024–2032 because these kinds of businesses are adopting self-service analytics to promote efficiency and facilitate decision-making. While SMEs were limited to the cost and the complexity of analytics tools, this segment is now increasingly becoming aware of the value of data-driven strategies. Self-service analytics can now be more accessible to SMEs as solutions are becoming cheaper, easier and more scalable. They enable SMEs to perform customer analysis, operational optimization, and improve their competitiveness with little to no dependency on virtual IT teams. With these tools available to a broader audience, the adoption rate among the smaller end of the population is likely to increase, powering higher growth for SMEs.

By Industry Vertical

The BFSI (Banking, Financial Services, and Insurance) industry had the highest market share of 24.3% in 2023 owing to extensive data consumption in the sector for decision making, risk management, and regulatory compliance. Financial services companies use self-service analytics50 to sift through hundreds of terabytes of transactional data and detect fraud, calculate risk, and personalize customer services. The BFSI sector has not only gained a competitive edge with advanced analytics, but has also used it to deliver superior customer experiences and optimize operational efficiencies. This sector only continues to grow, fueled by the necessity to comply with rigid regulations along with the need for quick response to changing markets.

Healthcare is estimated to exhibit the highest CAGR from 2024–2032, owing to the need for the sector to increasingly rely on data to enhance patient outcomes, improve operational efficiencies, and reduce costs. Introducing self-service analytics, healthcare organizations are now able to make wiser decisions using their data, thus helping with patient analysis, treatment optimization, and better service delivery. With rapidly escalating healthcare costs and a push to provide personalized care, the sector is also concentrated on driving operational efficiencies via data-driven decision-making. Moreover, the drive towards digitization and the increased use of EHRs is generating terabytes of data, with the need for self-service analytics critical for healthcare to extract value. Expect this trend to faster self-service analytics in healthcare, which will be among the high-growth segments.

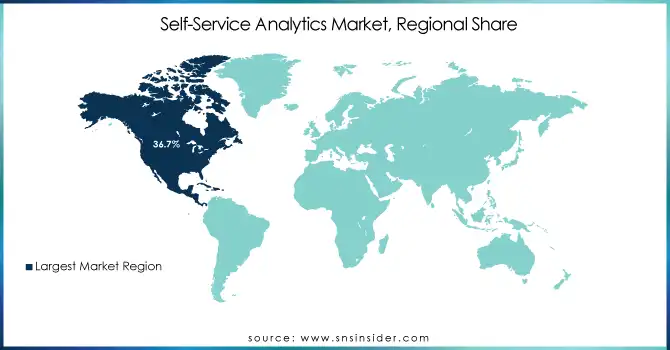

Regional Analysis

The self-service analytics market was led by North America with 36.7% market share in 2023, as the presence of advanced technological infrastructure and high adoption of cloud computing among all industries is expected to drive the growth of the self-service analytics market in the region. This dominance has largely been solidified by various leading analytics providers such as Tableau, Qlik, and SAS, and a rich ecosystem around analytics solutions. North American organizations are using self-service analytics to provide better customer experiences, operational efficiencies, and market advantage for industries such as finance, healthcare, and retail. Large financial institutions in the U.S. (like JPMorgan Chase, for instance) harness self-service analytics to cut through and glean insights from transaction data, mitigate risks, and tailor solutions to client needs for improved decision-making and customer experience.

The Asia Pacific is anticipated to register the fastest CAGR over 2024–2032, owing to technological advancements, boosting data generation, and awareness regarding the need for data analytics across the region. Self-service analytics is being adopted by countries such as China, India, and Japan to revolutionize business and promote innovation. For example, in India, retail and e-commerce sector companies like Flipkart are utilizing analytics to comprehend consumer behavior and enhance inventory management. Companies such as Alibaba, on the other hand, are using self-service analytics to better understand consumers and strengthen their supply chain in China. Increased proliferation of SMEs across the region coupled with the rise of digital infrastructure would continue to fuel self-service analytics in Asia Pacific.

Key players

Some of the major players in the Self-Service Analytics Market are:

-

Tableau (Tableau Desktop, Tableau Server)

-

Microsoft (Power BI, Azure Synapse Analytics)

-

Qlik (Qlik Sense, QlikView)

-

Sisense (Sisense for Cloud Data Teams, Sisense for Cloud Analytics)

-

TIBCO Software (Spotfire, TIBCO Data Science)

-

SAP (SAP BusinessObjects, SAP Analytics Cloud)

-

Domo (Domo Business Cloud, Domo Analytics)

-

IBM (IBM Cognos Analytics, IBM Watson Analytics)

-

Google (Looker, Google Data Studio)

-

Oracle (Oracle Analytics Cloud, Oracle Business Intelligence)

-

Zoho (Zoho Analytics, Zoho Reports)

-

MicroStrategy (MicroStrategy Analytics, MicroStrategy Desktop)

-

Alteryx (Alteryx Designer, Alteryx Server)

-

Sisense (Sisense for Cloud Data Teams, Sisense for Cloud Analytics)

-

Qlik (Qlik Sense, Qlik DataMarket)

-

ThoughtSpot (ThoughtSpot Analytics, ThoughtSpot Search)

-

TARGIT (TARGIT Decision Suite, TARGIT Analytics)

-

GoodData (GoodData Platform, GoodData Insights)

-

Yellowfin (Yellowfin Analytics, Yellowfin Signals)

-

Birst (Birst Analytics, Birst Cloud)

Some of the Raw Material Suppliers for Self-Service Analytics Companies:

-

Intel Corporation

-

NVIDIA Corporation

-

Advanced Micro Devices (AMD)

-

Micron Technology

-

Samsung Electronics

-

Western Digital Corporation

-

Seagate Technology

-

Texas Instruments

-

Broadcom Inc.

-

Qualcomm Incorporated

Recent Trends

-

In June 2024, Qlik launched Qlik Talend Cloud and Qlik Answers, empowering enterprises to adopt AI seamlessly by providing AI-ready data and AI-driven insights with full explainability. These solutions aim to eliminate barriers to AI adoption, enhancing data-driven decision-making across industries.

-

In June 2024, TIBCO launched the TIBCO® Platform, a real-time, composable data platform designed to streamline enterprise solutions with centralized management and enhanced developer collaboration. This platform aims to accelerate digital transformation and operational efficiency.

-

In September 2024, Oracle’s update to Analytics Cloud introduces enhanced AI integration, improved connectivity with data sources, and upgraded visualization tools, empowering users with deeper insights and improved decision-making. These features aim to boost AI-driven data analysis and business intelligence capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.5 Billion |

| Market Size by 2032 | USD 19.75 Billion |

| CAGR | CAGR of 17.90% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Software (Tableau, Sas, Logi Analytics, Qlik, Others) • By Service (Business Users, Consultants, Corporate IT Professionals, Others) • By Enterprise Type (Large Size Enterprises, Small and Medium Sized Enterprises (SMEs)) • By Industry Vertical (BFSI, Consumer Goods & Retail, Healthcare, IT and Telecom, Manufacturing & Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Tableau, Microsoft, Qlik, Sisense, TIBCO Software, SAP, Domo, IBM, Google, Oracle, Zoho, MicroStrategy, Alteryx, ThoughtSpot, TARGIT, GoodData, Yellowfin, Birst |

| Key Drivers | • Enhancing Operational Efficiency and Agility with Self-Service Analytics Solutions in Rapidly Changing Industries • Driving Customer Engagement and Loyalty with Self-Service Analytics Across Industries in 2024 |

| RESTRAINTS | • Overcoming Data Challenges and User Adoption Barriers in the Self-Service Analytics Market |