Contact Lens Market Report Scope & Overview:

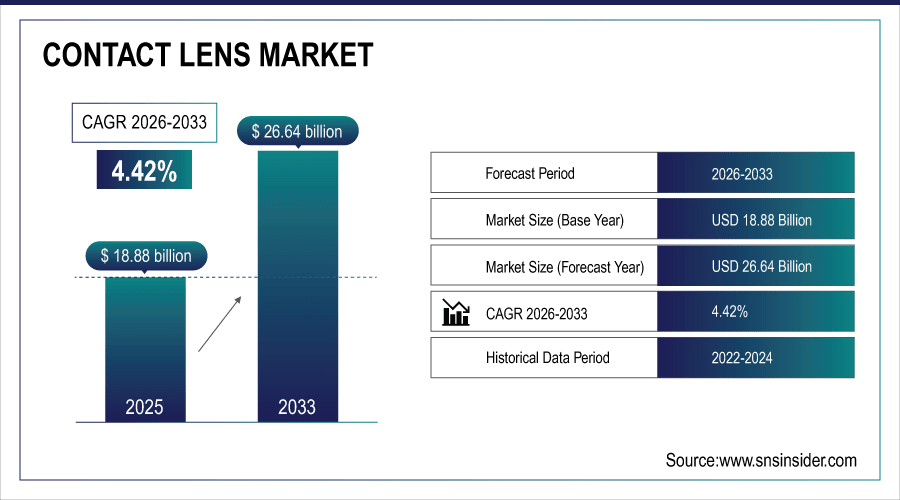

The Global Contact Lens Market size was valued at USD 18.88 billion in 2025E and is projected to reach USD 26.64 billion by 2033, growing at a CAGR of 4.42% during the forecast period 2026–2033.

The worldwide contact lens market continues to grow, accounting for over 140 million wearers in 2025. Correction of refractive errors still is the main field, soft and silicone hydrogel products are the most important share also because of comfort and safety benefits. Daily disposables continue to catch on with the young, and online is now over 35% of the worldwide market. Innovations in progressive lens materials and designs also contribute to driving uptake across a wide range of consumer segments globally.

Multifocal and toric designs together comprised over 30% of contact lens demand in 2025, driven by presbyopia and astigmatism correction needs.

To Get More Information On Contact Lens Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 18.88 Billion

-

Market Size by 2033: USD 26.64 Billion

-

CAGR: 4.42% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Contact Lens Market Trends:

-

Soft contact lenses will remain popular, holding over 70% of the global market value in 2027 with faster growth observed for daily disposables among younger users.

-

Silicone hydrogel lenses are expected to increase close to 35% between 2025 and 2029 as a result of enhanced oxygen transmission and comfort.

-

More than 140 million people around the world are projected to wear contacts in 2025, a number that is expected to grow to more than 170 million by 2033.

-

The Asia Pacific is projected to witness 25% growth in contact lens users by 2028 due to increasing myopia prevalence and growing middle-income group.

-

Online retail will account for more than 40% of contact lens sales worldwide by 2030 as digital sales channels and subscription models continue to gain in popularity.

U.S. Contact Lens Insights:

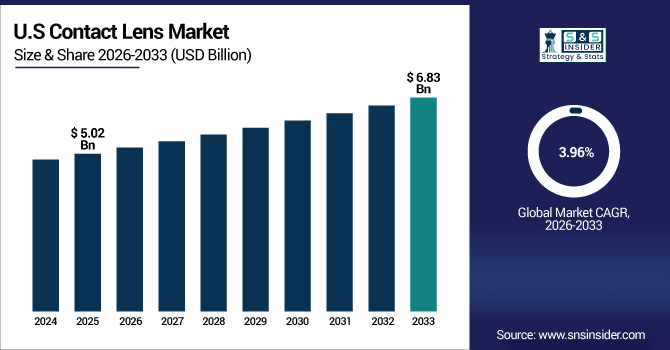

The U.S. leads the North American contact lens market, valued at USD 5.02 billion in 2025E and projected to reach USD 6.83 billion by 2033, expanding at a CAGR of 3.96%. With almost 32 million active lens wearers, the U.S. is a hub for optimised daily disposable and silicone hydrogel penetration. Backed by over 9,000 optometry offices and premium retail partners, innovation and specialization lens growth fuel extremely strong share of market.

Contact Lens Market Growth Drivers:

-

Rising Global Myopia Prevalence and Vision Correction Needs Accelerate Demand for Advanced Soft and Silicone Hydrogel Contact Lenses.

The rising prevalence of myopia is a major driver for the contact lens market. By 2025, more than 2.6 billion people worldwide will suffer from myopia and significant demand for prevention and correction solutions exists. Soft and silicone hydrogel contact lenses are the most widely used for refractive correction, accounting for more than 73% of worldwide lens wear. A younger consumer, lifestyle-driven preference and continued innovation in the area of advanced lens materials (for improved comfort) make this demand even stronger.

In 2025, daily disposable lenses grew by nearly 12% year-on-year, making them the fastest-expanding segment in the global contact lens market.

Contact Lens Market Restraints:

-

High Risk of Eye Infections and Discomfort from Improper Lens Use Restrains Long-Term Adoption and Market Growth.

The risk of eye infections and discomfort is a major restraint in the contact lens market. Approximately 1 in every 500 contact lens users is affected by an eye infection called microbial keratitis each year. Poor hygiene and overnight lens wear also have a role to play in increasing that risk. Furthermore, it has been reported that approximately 20% of new users terminate contact lens wear within the first year due to comfort, dryness or safety issues.

Contact Lens Market Opportunities:

-

Growing Demand for Daily Disposable and Specialty Lenses Creates Opportunities for Innovation, Premium Pricing, and Wider Consumer Adoption.

The growing demand for daily disposable and specialty lenses presents a significant opportunity for market expansion. The occurrence of daily disposable was to be around 45% on all lens use in the year, showing user ‘s convenience and less risk of infection. Torics and multi-focal, the specialty lens components of this demand accounted for first time demand in over 30% of cases to meet astigmatic, presbyopic needs. This double growth trend also supports premium pricing policies and stimulates permanent innovation in lens design and materials.

In 2025, online retail accounted for more than 35% of global contact lens sales, opening strong opportunities for digital expansion and subscription-based models.

Contact Lens Market Segmentation Analysis:

-

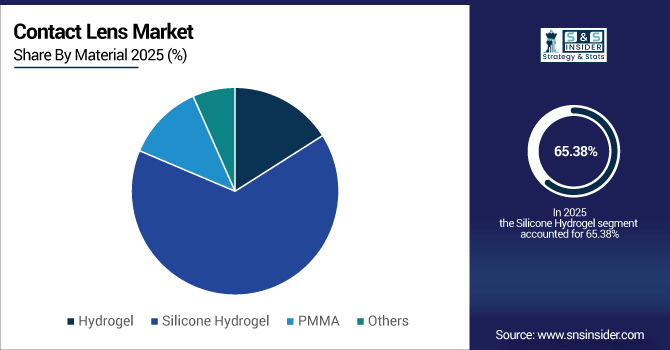

By Material, Silicone Hydrogel will have the largest share with 65.38% in 2025E, and PMMA is expected to grow with the highest CAGR of 5.11%.

-

By Product Type, Soft Contact Lenses has dominated the market with a share of 72.45% in 2025E and Scleral Lenses is growing at a highest CAGR of 5.36%.

-

By Design, Spherical Lenses accounts for 58.27% in 2025E, followed by Multifocal Lenses which is growing at CAGR of 5.14%.

-

By Usage, Daily Disposable Lenses is the second largest value share of 45.19% in 2025E, and is also expected to register the fastest CAGR of 5.07%.

-

By Application, they be divided by application, Corrective Lenses will lead its segment over 68.11% share in 2025E; and Cosmetic & Aesthetic Lenses at a CAGR of 5.39%.

-

By Distribution Channel, ptical Stores account for the largest market share with 41.82% in 2025E, followed by the Online Retail growing at a CAGR of 5.43%.

By Material, Silicone Hydrogel Dominates While PMMA Lenses Grow Rapidly:

The silicone hydrogel lenses are the front-runners due to their oxygen transmissibility and more than 80 million wearers around the world in 2025 present themselves to daily wear and extended wear. These lenses decrease dryness and hypoxia, being the materials preferred by present generation. PMMA lenses, which are rigid and less comfortable, have enjoyed a resurgence in interest for specialized therapeutic applications such as treatment of keratoconus.

By Product Type, Soft Contact Lenses Dominate While Scleral Lenses Grow Rapidly:

The majority of contact lenses will be soft as over 100 million people globally still wear them in 2025 for comfort and ease-of-use. The category is also driven by daily disposable options, which lower the chances of infection. Although fewer than 2 million patients wear scleral lenses, they are the fastest-growing category because of their specialized medical indications for treating corneal irregularities and advanced conditions but also due to increasing ophthalmologist awareness.

By Design, Spherical Lenses Dominate While Multifocal Lenses Grow Rapidly:

Spherical lense remaining the most common used over 90 million people for correction of common vision like myopia, hypermetropia. They are the preferred alternative due to low cost and ease of replacement. Multifocal lenses with projected 12 million users in 2025, this type is expanding quickly under mounting presbyopia prevalence (around adults aged of 40 and over). The rising innovation in comfort and clear near-to-distance vision correction increases attention on multifocal lens designs globally.

By Usage, Daily Disposable Lenses Dominate While Weekly Replacement Lenses Grow Rapidly:

Daily disposables are the most popular, with over 60 million wearers in 2025, attracted by their cleanliness and convenience without any need for cleaning solutions. The lenses reduce the risk of infection and are a hit from young users. While weekly replacement lenses are a smaller base of about 10 million wearers, the segment is growing and provide wearers with that balance between price and ocular health at a time when consumers want both.

By Application, Corrective Lenses Dominate While Cosmetic Lenses Grow Rapidly:

Corrective lenses dominate the market and are worn by more than 120 million individuals worldwide for refractive error correction such as myopia, hyperopia and astigmatism in year 2025. They are the driving force behind demand for the industry. Cosmetic lenses, which have had some 15 million users worldwide, are becoming increasingly popular as a fashion or stylish item in Asia-Pacific markets. Greater accessibility to coloured and decorative lenses drives adoption, particularly among younger wearers attracted to lifestyle-focused vision products.

By Distribution Channel, Optical Stores Dominate While Online Retail Grows Rapidly:

Optical stores continue to be the most widely used distribution channel, with over 55 million pairs of spectacles sold through retail channels globally in 2025 in a context underpinned by professional fittings and face-to-face consultations. Yet online retail is growing more quickly, with over 45 million of those consumers purchasing lenses digitally. E-commerce and subscription-based models, becoming more accessible online in urban areas are rapidly growing the channel as internet penetration and home delivery surge.

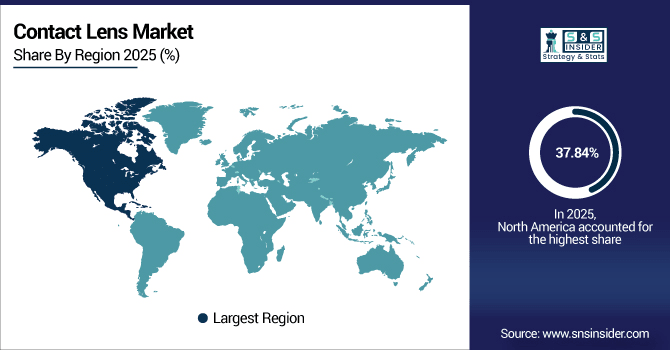

Contact Lens Market Regional Analysis:

North America Contact Lens Market Insights:

North America leads the global contact lens market with a 37.84% share in 2025E, supported by over 45 million wearers. Nearly 32 million users are located in the U.S., fuelled by high adoption rates of silicone material hydrogel and daily disposables. Featuring over 12,000 optometry facilities and well-developed retail distribution channels, the region thrives on high consumer spending, early uptake of premium products, as well as relentless innovation by top manufacturers.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Contact Lens Market Insights:

The U.S. remains a flashpoint of contact lens technology innovation, where more than 250 FDA-cleared lenses are predicted by 2025, including sophisticated toric, multifocal and specialty scleral designs. It’s also the frontrunner in smart lenses, with pilot trials including 10,000+ patients already testing glucose-sensing and augmented reality-enabled contacts.

Asia-Pacific Contact Lens Market Insights:

The Asia-Pacific contact lens market is projected to grow at a CAGR of 5.31%, making it the fastest-growing region worldwide. By the year 2025, over 900 million people in the region would be suffering from myopia, which results in high demand for corrective lenses. Both Japan and South Korea display strong penetration of daily disposables, with China and India consistently fuelling volume growth through affordability expansion, increased urban penetration. Growing online retail fraternity and popularity of cosmetic lenses also contribute to the fast growth of market.

Japan Contact Lens Market Insights:

Japan is the largest Asia-Pacific contact lens market, with over 18 million wearers in 2025 accounting for almost one third of regional sales. Over 14% of people wear lenses, and daily disposables account for 55% of sales. Its success is also being shaped by premium adoption, mature retail networks and more hygiene-focused consumers.

Europe Contact Lens Market Insights:

Europe is a key hub in the global contact lens market, with over 35 million active wearers in 2025 across Germany, France, the UK, and Italy. The penetration rate in the area is high, with over 60 percent of users choosing soft lenses. Accessibility is further facilitated by public healthcare coverage to over 90% of the population. Europe still leads the way for premium daily disposables and speciality lenses with 5,000+ optical retail chains and innovation backed by EU funding.

U.K. Contact Lens Market Insights:

The U.K. has been leading Europe in its adoption of contact lenses with more than 12 million wearers by 2025, one of the highest penetration rates within the region. Daily disposables remain the most popular products, representing over 60% of sales. Robust optical retail chains and optical services collated by the NHS lead to steady gains for Rx lenses and specialty lenses.

Latin America Contact Lens Market Insights:

The Latin American contact lens market is growing, with 1.8 million more fittings per year by 2025. The fastest growth occurs in Mexico, where demand for cosmetic lenses has increased 25% over three years. Backed by 2,200 ophthalmology clinics and increasing affordability, the region is making access to corrective and cosmetic lenses easier.

Middle East and Africa Contact Lens Market Insights:

This is also significantly growing in the MEA contact lens market with more than 6 million active wearers by 2025. Saudi Arabia and South Africa are progressing adoption, driven by growing demand for cosmetic lenses. 1,500 optical retail stores and increasing e-commerce penetration- increases urbanization and youth-oriented fashion driving the market.

Contact Lens Market Competitive Landscape:

Johnson & Johnson Vision dominates the global contact lens market with over 40% share in 2025E, serving more than 45 million wearers worldwide. Its ACUVUE brand is the largest contact lens product in the world both by sales and patients fitted, operating out of 100+ countries. The company is also heavily investing in innovation, with more than 15,000 patient trials on smart and next-gen lenses to maintain its leadership in both correction and specialty contact lens categories.

-

In June 2025, Johnson & Johnson Vision launched ACUVUE OASYS MAX 1-Day MULTIFOCAL for ASTIGMATISM, the first daily disposable contact lens addressing both presbyopia and astigmatism.

Alcon ranks second with a global presence in 140+ countries and a consumer base exceeding 20 million active wearers. Its flagship brands, including DAILIES TOTAL1 and AIR OPTIX, are sold in over 30,000 eye care practices across the globe. With the backing of three dedicated R&D centers, Alcon fosters growth through advancements in toric and multifocal designs that keep it at the forefront of premium daily disposable and specialty lenses.

-

In April 2025, Alcon introduced the PRECISION1 daily disposable campaign in India, India’s first SMARTSURFACE lens with over 80% water content at the surface, targeting active lifestyle wearers.

CooperVision holds the third position, fitting over 25% of U.S. soft lens users in 2025 and serving more than 14 million wearers globally. CooperVision is the market leader in myopia management with its Biofinity and MyDay silicone hydrogel brands, with fit programs available in 60+ countries. Operating five global manufacturing sites and producing 2 billion contact lenses a year, it guarantees availability, scale and experience in corrective and performance eye-wear solutions.

-

In August 2025, CooperVision expanded its Plastic Neutral Contact Lens Initiative to Hong Kong, bringing participation to 34 countries and preventing the equivalent of more than 513 million plastic bottles from entering oceans.

Contact Lens Market Key Players:

Some of the Contact Lens Market Companies are:

-

Johnson & Johnson Vision

-

Alcon

-

CooperVision

-

Bausch + Lomb

-

Hoya Corporation

-

Carl Zeiss Meditec AG

-

Seed Co., Ltd.

-

Contamac Ltd.

-

Essilor International S.A.

-

Novartis AG

-

STAAR Surgical Company

-

SynergEyes, Inc.

-

X-Cel Specialty Contacts

-

Valeant Pharmaceuticals (Vision division)

-

Medennium

-

UltraVision CLPL

-

Menicon Co., Ltd.

-

The Cooper Companies

-

Contamac

-

ZEISS International

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 18.88 Billion |

| Market Size by 2033 | USD 26.64 Billion |

| CAGR | CAGR of 4.42% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Soft Contact Lenses, Gas Permeable Lenses, Scleral Lenses, Hybrid Lenses, Others) • By Design (Spherical, Toric, Multifocal, Others) • By Material (Hydrogel, Silicone Hydrogel, PMMA, Others) • By Usage (Daily Disposable, Weekly Replacement, Monthly Replacement, Conventional) • By Application (Corrective, Cosmetic & Aesthetic, Prosthetic, Therapeutic) • By Distribution Channel (Optical Stores, Hospitals & Clinics, Online Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Johnson & Johnson Vision, Alcon, CooperVision, Bausch + Lomb, Hoya Corporation, Carl Zeiss Meditec AG, Seed Co., Ltd., Contamac Ltd., Essilor International S.A., Novartis AG, STAAR Surgical Company, SynergEyes, Inc., X-Cel Specialty Contacts, Valeant Pharmaceuticals (Vision division), Medennium, UltraVision CLPL, Menicon Co., Ltd., The Cooper Companies, Contamac, ZEISS International |