Permanent Magnet Motor Market Size & Growth:

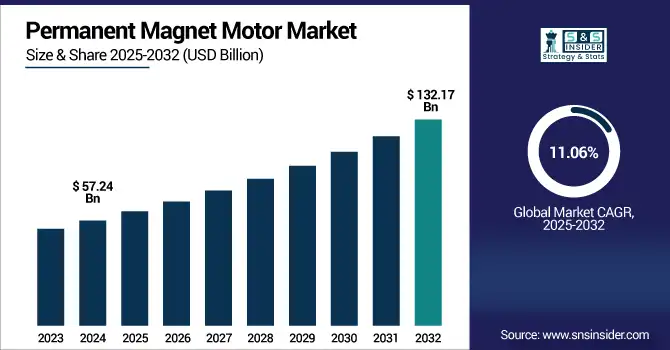

The Permanent Magnet Motor Market Size was valued at USD 57.24 billion in 2024 and is expected to reach USD 132.17 billion by 2032 and grow at a CAGR of 11.06% over the forecast period of 2025-2032.

To Get more information on Permanent Magnet Motor Market - Request Free Sample Report

The Global Market is witnessing strong momentum, and this growth is well-captured in the Permanent Magnet Motor Market analysis, which further segments the landscape by type, end-user, cooling method, application, and regions, including in-depth insights into key growth drivers, restraints, opportunities, and challenges. It is being adopted faster due to increased demand in electric vehicles, industrial automation, and energy-efficient systems. The combination of market dynamics driven by favorable regulations and a constant increase in R&D is aiding in the rapid market growth, thus establishing permanent magnet motors as an essential component across all industry sectors from now up until the forecast period.

For instance, over 70% of modern electric vehicles now incorporate permanent magnet motors due to their high torque density and compact size.

The U.S. Permanent Magnet Motor Market size was USD 10.11 billion in 2024 and is expected to reach USD 22.11 billion by 2032, growing at a CAGR of 10.30% over the forecast period of 2025–2032.

The U.S. Market is experiencing strong growth, fueled by the increasing adoption of electric mobility, rapid growth in renewable energy projects, and a growing focus on energy-efficient motor technologies. Demand is also being bolstered by favorable government policies and the growing domestic manufacturing capabilities. Together, this is paving the way for permanent magnet motors to be used in various industrial and transportation applications, and the U.S. market becoming a major contributor to the long-term growth of the overall market.

For instance, PM synchronous motors accounted for over 78% of global EV traction motor installations in 2024.

Permanent Magnet Motor Market Dynamics:

Key Drivers:

-

Rising Adoption of Electric Vehicles and Industrial Automation is Significantly Fueling Demand for High-Efficiency Permanent Magnet Motors Globally

Demand for permanent magnet motors is probably soaring due to their higher efficiency and compactness, especially with the faster growth of the electric vehicle market and industrial automation. The preference is due to their accurate control, lightweight design and energy conservation, these motors are often used in EV powertrains, robotic systems and automated machinery. And industries are also transitioning from clean energy to smart manufacturing, driving the adoption of motors faster above. Permanent Magnet Motor will also see integration into motor-based products across advanced production plants as well as large scale sustainable mobility solutions; which is why most automotive OEMs are heavily investing here.

For instance, over 80% of EV manufacturers worldwide use permanent magnet motors in their powertrains due to superior torque density.

Restraints:

-

Volatility in Rare Earth Material Prices Disrupts Production Stability and Cost Predictability for Permanent Magnet Motors

Permanent magnet motors require rare earth elements, such as neodymium and dysprosium and most of the supply comes from a few areas globally. The production cost increases tremendously due to price fluctuations pertaining to geopolitical tensions, restrictions on mining and supply chain woes. Such cost volatility prevents small and medium manufacturers from budgeting and scaling. Additionally, over-reliance on a limited number of nations for rare earth supply chains particularly China makes global manufacturing susceptible, which is a significant reticence against steady growth of permanent magnet motor market.

Opportunities:

-

Emerging Markets and Electrification of Public Transport Create Vast Potential for Permanent Magnet Motor Integration

Many countries in Asia, Latin America, and Africa are undergoing rapid urbanization and are being designed around electrified public transportation systems, such as e-buses, metro trains, and hybrid systems. Owing to this context, permanent magnet motors fit these applications perfectly through high efficiency, reliability, and reduced noise. Permanent Magnet Motor Market growth is being fueled by government-mandated clean mobility, subsidies for electric public fleets, and increasing infrastructure development. Market absorption in these strong growth regions will be enhanced further by localized production and partnerships with transit authorities.

For instance, Permanent magnet motors generate up to 50% less acoustic noise compared to induction motors, improving passenger comfort in public transit.

Challenges:

-

Design and Integration Complexities in Retrofitting Permanent Magnet Motors into Existing Systems Pose Engineering and Cost Barriers

Though the performance advantages of permanent magnet motors and also permanent magnet generators are well known, their integration into legacy systems or replacement with conventional motors necessitates costly technical redesign, control unit conversion, and progenitor structure modification. This takes away the efficiency in terms of both, engineering effort and time of installation thus adding to the overall project cost. But industries run on moribund infrastructure will wait for such transitions only when incentivized well or beyond the point of regulatory no return. A diversity of well understood but non-standard retrofitting solutions creates further bottlenecks for implementation and slows adoption, particularly in older industrial bases.

Permanent Magnet Motor Market Segmentation Analysis:

By Application

The Electric Vehicles segment accounted for the largest revenue share of approximately 34.8% in 2024 in the Permanent Magnet Motor Market driven by rising demand for efficient and lightweight motors in EV powertrains. EV manufacturers prefer them due to their high torque density and better performance than induction motors. Construction of a PE-Set Permanent Magnet Motor Tesla, where efficiency and driving range are concerned, the company is a huge fan of permanent magnet motors. The segment is forecasted to grow with the highest CAGR of nearly 11.93% over the forecast period (2024–2032) owing to the growing EV infrastructure, incentives from the government, and shifting toward sustainable mobility.

By Type

Synchronous Motors segment accounted for the largest revenue share of the Permanent Magnet Motor Market, approximately 41.2% in 2024, owing to high operational efficiency, power factor correction capability of synchronous motors and ability to work continuously in industrial operations. They are commonly found in industrial drives, compressors, in large-scale manufacturing environments. An industry-leading maker of industrial automation equipment, Siemens offers a full line of high-performance synchronous motors suitable for energy, process industries, and heavy machinery.

Brushless DC Motors segment is expected to grow the fastest at a CAGR of 11.78% over the period of 2025-2032 due to rising usage in the applications of automotive, aerospace and consumer electronics industry. The benefits of these motors, such as better speed control, miniaturization, and less maintenance makes them very much suitable for modern smart devices and electric mobility. Companies, such as Maxon Motor are continuously expanding their range of brushless DC motors in response to the increasing demand for energy-efficient, lightweight solutions across next-gen electronics and vehicle systems.

By End-User

The Transportation segment accounted for the largest revenue share of the Permanent Magnet Motor Market, over 39.6% in 2024, owing to extensive application of permanent magnet motors in electric trains, metro systems, and electric vehicles. This trend is being further strengthened by a growing emphasis on sustainable transportation and the electrification of logistics. Among these trends, Bombardier, an electric rail system manufacturer, has adopted permanent magnet motors to enhance efficiency. Reflecting broader Permanent Magnet Motor Market trends, the transportation segment is projected to register the fastest CAGR during 2024–2032, approximately 11.71%, driven by rising investments in electric mobility, electric aviation, and rail modernization programs across developed and developing economies.

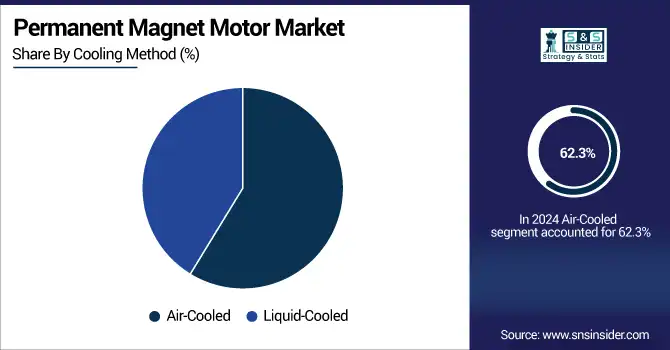

By Cooling Method

The Air-Cooled segment held the largest Permanent Magnet Motor Market share of about 62.3% in 2024, owing to its simple design, cost-effectiveness, and ease of integration for General Industrial applications These motors deliver good thermal performance for most standard applications without the need for any high-level arrangements. ABB, a world-renowned company for motor solutions, offers a diverse portfolio of air-cooled permanent magnet motors to a host of manufacturing, automation and HVAC markets for dependable efficiency and scalability.

The Liquid-Cooled segment of the market is projected to be the fastest-growing at a CAGR of around 11.61% over 2024–2032 due to rising requirements for high-power density and thermal management in small motor applications. This type of cooling enables continuous high-load performance, even during high loads and is thus suitable for electric vehicles, robotics and industrial automation. Such advances are now being embodied by developments, such as liquid-cooled permanent magnet motors from the likes of Parker Hannifin that can more effectively dissipate heat, while also increasing overall system efficiency in high-performance applications.

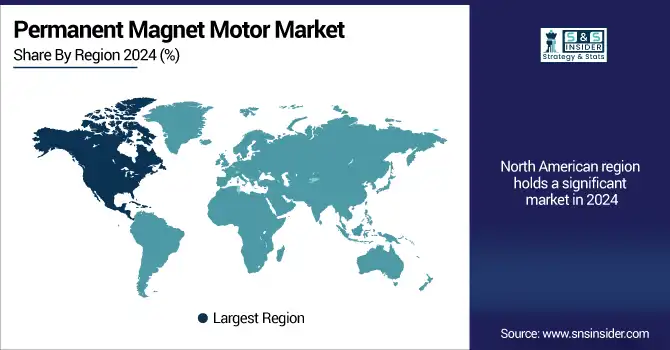

Permanent Magnet Motor Market Regional Insights:

North America accounts for a substantial share of the Permanent Magnet Motor Market, primarily attributed to advancements in technology, the rapid industrialization, and acceptance of electric vehicles. Strong manufacturing infrastructure, favorable government initiatives, and rising renewable energy projects in the region are benefiting Evoqua Water Technologies Inc. Due to the significant demand for sustainable motor solutions, the U.S. has been targeting the market, and several firms are investing in high-efficiency motor offerings.

-

The U.S. dominates the North American Permanent Magnet Motor Market due to strong automotive manufacturing, advanced industrial automation, and robust investments in renewable energy. Government incentives and technological innovation further support widespread motor adoption across various sectors nationwide.

In 2024, Asia Pacific accounted for the highest revenue share of approximately 38.2% in the Permanent Magnet Motor Market, which can be attributed to extensive automotive, electronics, and manufacturing industries in countries, such as China, Japan, South Korea and India. Increasing urbanization and industrialization in the region coupled with favorable government policies is propelling the market growth. Due to the increased domestic production of rare earth elements in China and Australia, demand for electric mobility, and infrastructure investments, Asia Pacific is projected to hold the highest CAGR, 11.96 % over 2024–2032.

-

China leads the Asia Pacific Permanent Magnet Motor Market owing to its massive electric vehicle production, large-scale manufacturing base, and dominance in rare earth material supply. Supportive policies and heavy infrastructure investments continue to boost permanent magnet motor demand across domestic industries.

Europe is one of the significant regions in the Permanent Magnet Motor Market owing to energy efficiency regulations, robust EV adoption, and industrial modernization among others. This led to Germany and France taking the lead in clean mobility and automation. The demand for high-performance permanent magnet motors in the region is being driven by notable automotive and industrial enterprises in addition to growing R&D investments.

-

Germany dominates the European Permanent Magnet Motor Market due to its strong automotive industry, advanced manufacturing infrastructure, and leadership in energy-efficient technologies. Major companies like Siemens and Bosch, along with EV and renewable energy initiatives, significantly boost market growth.

The Middle East & Africa and Latin America are the new markets to be targeted in the Permanent Magnet Motor industry. Due to substantial investments in infrastructure and the ongoing transition to clean energy, the UAE is at the forefront in Middle East & Africa. Favorable policies promoting energy-efficient technologies in major applications, industrial development, and increasing interest in EVs are fueling Brazil's dominance within Latin America.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The Permanent Magnet Motor Companies are ABB Ltd., Siemens AG, Nidec Corporation, General Electric (GE), Toshiba Corporation, Rockwell Automation, Inc., Johnson Electric Holdings Limited, Allied Motion Technologies Inc., WEG S.A. and AMETEK, Inc and others.

Recent Developments:

-

In June 2025, ABB introduced the AMXE250 motor with HES580 inverter package designed specifically for electric buses, achieving up to 12% fewer motor losses and enhanced drivetrain efficiency, marking a major step in sustainable urban mobility.

-

In December 2024, Siemens released version 2412 of Simcenter E‑Machine Design, introducing advanced axial-flux motor modeling capabilities to streamline and accelerate design of PM and PMSM motors with robust thermal and structural analyses.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 57.24 Billion |

| Market Size by 2032 | USD 132.17 Billion |

| CAGR | CAGR of 11.06% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Electric Vehicles, Industrial Automation, Home Appliances, Renewable Energy and Robotics) • By Type (Synchronous Motors, Brushless DC Motors, Stepper Motors and Switched Reluctance Motors) • By End-User (Transportation, Manufacturing, Residential and Commercial) • By Cooling Method (Air-Cooled and Liquid-Cooled) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ABB Ltd., Siemens AG, Nidec Corporation, General Electric (GE), Toshiba Corporation, Rockwell Automation, Inc., Johnson Electric Holdings Limited, Allied Motion Technologies Inc., WEG S.A. and AMETEK, Inc. |