Intelligent Battery Sensor Market Size & Trends:

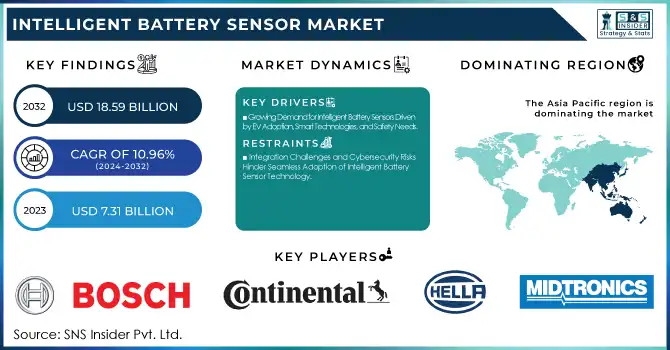

The Intelligent Battery Sensor Market Size was valued at USD 7.31 Billion in 2023 and is expected to reach USD 18.59 Billion by 2032 and grow at a CAGR of 10.96% over the forecast period 2024-2032. Intelligent Battery Sensor top trends are seeing increasing adoption and penetration as the presence of IBS is growing in electric and hybrid vehicles, fleet management, and renewable energy systems. Metrics such as operational and performance metrics, battery health monitoring, real-time data accuracy, and failure detection are improving battery efficiency and lifespan.

To Get more information on Intelligent Battery Sensor Market - Request Free Sample Report

A further range of advanced technical and/or functional metrics such as interoperability, low-latency communication, and self-diagnostic capabilities are serving to improve the reliability of IBSs. Further, the application of AI and smart analytics-driven metrics is automating the predictive maintenance, anomaly detection, and cloud-enabled monitoring for optimizing battery performances and improving the longevity of battery systems along with preventing unexpected failures in automotive and energy storage applications.

Intelligent Battery Sensor Market Dynamics

Key Drivers:

-

Growing Demand for Intelligent Battery Sensors Driven by EV Adoption, Smart Technologies, and Safety Needs

Rising utilization of electric vehicles (EV) and hybrid vehicles, and the need for battery management systems are the main drivers of the global Intelligent Battery Sensor (IBS) market. Amid government-imposed emission regulations across the globe, along with EV adoption subsidies from various economies, automakers are integrating IBS to improve battery efficiency, lifespan, and real-time monitoring. Furthermore, the increasing penetration of smart automotive technologies such as start-stop and telematics engines is expected to drive the demand for IBS in passenger and commercial vehicles. However, to address predictive maintenance, better fuel efficiency, and safety regulations, manufacturers have also been heightened towards using intelligent sensors for automotive and industrial applications.

Restrain:

-

Integration Challenges and Cybersecurity Risks Hinder Seamless Adoption of Intelligent Battery Sensor Technology

One of the key challenges in the Intelligent Battery Sensor (IBS) market is the complexity associated with integrating with current battery management systems (BMS). The problem is that many legacy automotive and industrial systems are just not designed to support advanced IBS, and this is going to require transformational changes of these systems in the vehicle architecture and the control units. As a result, compatibility issues arise, and manufacturers and fleet operators face challenges in the seamless implementation of IBS. Also, data security-related risks and cybersecurity threats are significant issues. IBS is used for online monitoring of battery health so it depends on real-time data transmission if there is any kind of vulnerability in the system, it leads to a data breach or hacking risks in the case of connected and autonomous vehicles.

Opportunity:

-

Renewable Energy Growth IoT AI and Aftermarket Demand Drive Expansion of Intelligent Battery Sensors

The growing emphasis on renewable energy storage solutions offers an excellent prospect for the producers of IBS. As the ongoing renewable energy projects of solar and wind energy continue expanding, battery monitoring solutions are important for enhancing energy storage and avoiding power losses. In addition to this, the demand for IBS is increasing in the telecommunication sector to improve the backup power systems in data centers and mobile networks. Additionally, the aftermarket segment is commercially attractive because these vehicles and industrial equipment are getting older and need to replace the battery management system. In addition, the Internet of Things (IoT) and artificial intelligence (AI)-driven analytics will also open up new prospects for the integration of IBS between smart grids and aerospace/defense.

Challenges:

-

Environmental Challenges and Lack of Standardization Hinder Widespread Adoption of Intelligent Battery Sensors

The technical limitation is related to IBS which can occur in severe environmental conditions. For instance, in electric vehicles, aerospace, and defense applications the sensor must perform well under extremely high temperatures, vibrations, and moisture. Inaccurate readings for battery performance and safety could result from any sensor not working well. Finally, there is still a huge barrier to entry in terms of the standardization required at various vehicle platforms and across multiple industries. However, this lack of standardized protocols for battery monitoring and communication between IBS and other electronic control units (ECUs) has led to market fragmentation, which is a barrier to widespread adoption and innovation.

Intelligent Battery Sensor Market Segment Analysis

By Type of Sensor

In 2023, integrated sensors held the largest Intelligent Battery Sensor (IBS) market share of 38.9%. The combination of voltage, current, and temperature sensing in one package is one of the main reasons for their widespread adoption in automotive and industrial applications. This feature improves battery performance, efficiency, and safety, making them a popular option for manufacturers.

The voltage sensors segment is anticipated to witness the highest CAGR over the forecast period of 2024 to 2032 due to the growing demand for real-time battery monitoring of electric vehicles (EVs) and renewable energy storage systems. These components are key to maximizing efficiency in power when we want more advanced future technologies.

By Vehicle Type

The Intelligent Battery Sensor (IBS) market was led by passenger vehicles in 2023, capturing a 47.8% share as battery management solutions are rapidly penetrating traditional and hybrid vehicles. The increasing focus on fuel efficiency, reduction of emissions, and electrification of vehicles led to an increased demand for IBS in this segment.

Electric vehicles (EVs) are projected to grow at the highest CAGR during the forecast period (2024-2032) owing to increased EV penetration, government incentives, and enhanced battery technology. IBS integration in EVs will be key in extending battery life, safety, and performance as automakers integrate smart energy management systems.

By Sales Channel

In 2023, the OEMs held a significant share of the Intelligent Battery Sensor (IBS) market as they acquired a 71.8% share of the market through the direct installation of the IBS in the newly developed vehicles by the OEM automobile manufacturers. Original Equipment Manufacturer (OEM) adoption is being influenced by growing industry demand for sophisticated battery monitoring systems from passenger and commercial vehicles using BEVS batteries, guaranteeing optimal battery health and longevity.

The aftermarket is expected to witness the highest growth rate with a CAGR from 2024 to 2032 owing to the increasing need for battery replacements, retrofitting in older vehicles, and the expanding adoption of EVs. The aftermarket will observe high growth as consumers look for economical battery management upgrades before the start of the second life and in fleet and independent service networks.

By Application

In 2023, the Intelligent Battery Sensor (IBS) market was dominated by Battery Management Systems (BMS), accounting for 44.2% of the global market, owing to their importance in monitoring and optimizing battery performance in vehicle and energy storage applications. Increasing penetration of electric & hybrid vehicles is propelling the demand for Battery Management Systems (BMS) and integrated Battery Systems (IBS) for better efficiency, safety, and lifespan.

The telematics segment is predicted to grow faster at a significant CAGR throughout the years 2024 and 2032, owing to the rapid demand for connected vehicle solutions, predictive maintenance, and fleet management. The integration of IoT and AI is widespread in telematics-driven battery monitoring that will leap up its adoption into many sectors.

By End Use

The Intelligent Battery Sensor (IBS) market was led by automotive manufacturers in 2023, which contributed to the maximum share of the overall market at 51.2% owing to the increasing penetration of IBS in passenger & commercial vehicles for real-time battery monitoring & efficiency improvement. Demand was propelled further by the accelerating uptake of electric and hybrid vehicles.

Renewable energy providers are predicted to expand at the highest CAGR from 2024-2032, owing to the increasing demand for effective energy storage technology in solar and wind farms. When turnaround to clean energy begins to happen, IBS will make a significant contribution to making the battery more efficient, and safe, and facilitating the stability of the grid.

Intelligent Battery Sensor Market Regional Landscape

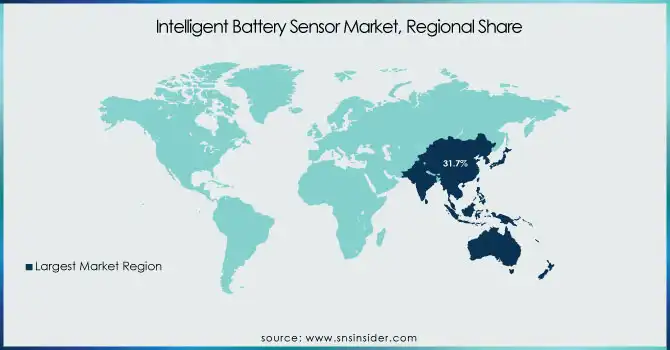

The global Intelligent Battery Sensor (IBS) market was led by Asia Pacific with a share of 31.7% in 2023, owing to the presence of automobile manufacturing, electric vehicle (EV) production, and advancements in battery technology in the region. Historically, nations such as China, Japan, and South Korea have been at the forefront of rapid consumer adoption of EVs (electric vehicles) by offering governmental support and investing resources into battery management systems. Chinese power players like BYD and CATL are powering innovations in EV battery management, introducing high-end IBS in cutting-edge applications to optimize performance and efficiency. Toyota and Honda of Japan are also deploying IBS on hybrid and electric models, for effective power and safety management.

North America is projected to experience the most rapid growth over the 2024 to 2032 period, supported by growing EV direction, existing emission regulations, as well as the development of telematics and conductive smart batteries. There are increased investments in battery manufacturing and energy storage in the U.S. and Canada. Tesla has already been expanding its IBS technology throughout its EV portfolio to promote battery efficiency, and General Motors (GM) and Ford are also adding IBS into their latest electric as well as hybrid models. Moreover, providers of renewable energy such as NextEra Energy are using IBS to enhance battery chronicle in solar and wind energy systems.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Intelligent Battery Sensor Market are:

-

Robert Bosch GmbH (Battery Management System, Intelligent Battery Sensor)

-

Continental AG (Current Sensor Module, Battery Impact Detection System)

-

HELLA GmbH & Co. KGaA (Intelligent Battery Sensor, Battery Monitoring Unit)

-

NXP Semiconductors N.V. (MM9Z1J638 Intelligent Battery Sensor, Battery Cell Controller IC)

-

Midtronics, Inc. (GRX-3000 EV Battery Service Tool, DSS-7000 Diagnostic System)

-

Valence Technology, Inc. (U-Charge Battery Management System, Intelligent Battery Monitor)

-

Texas Instruments Inc. (bq40z50-R2 Battery Management Controller, bq34z100-G1 Fuel Gauge)

-

DENSO Corporation (Battery Monitoring Unit, Battery ECU)

-

Analog Devices, Inc. (LTC2944 Multicell Battery Monitor, ADM1278 Hot Swap Controller)

-

Infineon Technologies AG (TLE9012AQU Battery Monitoring IC, TLE9015QU Battery Communication IC)

-

TE Connectivity Ltd. (Battery Management System Connectors, High-Voltage Interconnects)

-

Eberspaecher Vecture Inc. (Battery Management System, Battery Thermal Management System)

-

Current Ways Inc. (Battery Management System, Intelligent Battery Charger)

-

Murata Manufacturing Co., Ltd. (Battery Monitoring IC, Wireless Battery Management System)

-

Delphi Technologies (Battery Management System, Battery Pack Controller)

Recent Trends

-

In October 2024, Hella Gutmann and VARTA Automotive partnered to enhance battery diagnostics in European workshops, improving efficiency for low-voltage systems in modern vehicles.

-

In November 2024, NXP Semiconductors introduced the industry's first Ultra-Wideband (UWB) wireless battery management system, enhancing EV design by eliminating complex wiring and improving reliability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.31 Billion |

| Market Size by 2032 | USD 18.59 Billion |

| CAGR | CAGR of 10.96% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor Type (Voltage Sensors, Current Sensors, Temperature Sensors, Integrated Sensors) • By Vehicle Type (Passenger Vehicle, Commercial Vehicle, Electric Vehicles) • By Sales Channel (OEM, Aftermarket) • By Application (Battery Management Systems (BMS), Telematics, Start-Stop Systems) • By End Use (Automotive Manufacturers, Fleet Operators, Telecommunications Companies, Renewable Energy Providers, Aerospace & Defense, Consumer Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Robert Bosch GmbH, Continental AG, HELLA GmbH & Co. KGaA, NXP Semiconductors N.V., Midtronics, Inc., Valence Technology, Inc., Texas Instruments Inc., DENSO Corporation, Analog Devices, Inc., Infineon Technologies AG, TE Connectivity Ltd., Eberspaecher Vecture Inc., Current Ways Inc., Murata Manufacturing Co., Ltd., Delphi Technologies. |