Vibration Control System Market Report Scope & Overview:

To get more information on Vibration Control System Market - Request Free Sample Report

The Vibration Control System Market Size was esteemed at USD 5.21 billion in 2023 and is supposed to arrive at USD 8.87 billion by 2032 and develop at a CAGR of 6.1% over the forecast period 2024-2032.

Vibration control systems is a growing market with a focus on improved stability and performance to extend the lifespan of various target industries like (Automotive, Aerospace, Manufacturing etc). This currently includes cars and Aeroplanes accounting for 60% of the market. Particularly in the Airplane vibration control system design advances have the potential to reduce turbulence ranging up to 70% will providing cars with fuel economy improvements with over 5% reductions in addition to extended component service life. Now, vibration control systems have been created for beneficial use in the oil & gas which is projected to grow to $0.5 billion, and the healthcare sectors to protect sensitive equipment technology such as MRI machines.

There are many other technologies like system-on-a-chip, and all of which can also store more data than ever before. Importantly, they can transfer the sensor data to a smartphone over a real-time link and keep the acquisition still precise. Thus, a most important benefit of such systems is that wireless systems can almost instantly communicate something important to all related function units in the whole organization. Such regulations, which are global and also imposed are the most important factor enhancing the growth of the safety solutions related to efficiency, ergonomics, and employees’ safety in general or in particular in the oil & gas, chemicals & petrochemicals among others. The auto industry is not only a destination for the vibration control system market but also a source of capital for the market.

In September 2023: Kinetics Noise Control, Inc. announced the commencement of V.LOCK, a highly effective seismic cable restraint connector. Generally, V.LOCK can restrain non-structural components such as ducts, machinery and piping, electrical cable trays, and other equipment. It restrains services using a more efficient, simpler, and cheaper manner which saves a considerable amount of effort in the field costs.

MARKET DYNAMICS

DRIVERS

The demand for vibration control systems market is growing with the expansion and adoption of such major industries as oil and gas, utilities, and transportation.

The need for vibration control systems is rapidly growing due to the vast expansion and subsequent widespread adoption of a number of industries. Oil and gas, utilities, and transportation are some of the most essential sectors that require increasingly developed solutions to reduce vibrational effects over time. In the oil and gas industry, pipes transporting hydrocarbons in the form of crude oil and gas are often subject to heavy vibrational loads imposed by the employed machinery and soil transportation methods. In order to ensure that the extraction and delivery of vital resources are timely and cost-effective, pipelines and other equipment require specialized systems to prevent vibrational damage. The same is true for the utility sector, including various power plants and other means of energy generation taking advantage of vibration control systems to preserve the quality and service life of machinery. In transportation, including both the railway and highway systems, as well as airports, vibration control systems further contribute by ensuring safe and comfortable travel experiences, as well as avoiding the premature destruction of infrastructure.

Manufacturers are developing new vibration control systems market products like absorbers, dampers, and isolating pads, catering to the growing market needs.

In the vibration control systems market, manufacturers are developing new products like absorbers, dampers, and isolating pads. Manufacturers in the vibration control systems market are highly efficient and are focusing on the development of new products to cater to the rising industries’ needs as the needs of industries undergoing changes. The primary products in the vibration control systems are absorbers, dampers, and isolating pads that find a special application in controlling vibrations through different means. This is correlated with the growing requirement for machinery and equipment in the automotive, aerospace, healthcare, and the industrial manufacturing sectors to perform more efficiently, safely, and for longer durations.

Absorbers are required to reduce the extent of vibration, which is done by converting kinetic energy into another form, basically in the form of heat, within the material having high damping qualities. Moreover, the latest absorbers are becoming an integral part of industrial applications and For Example: Fabreeka’s Fabcel pads are very much used absorbers in industries to absorb the impact and vibrations affecting the machinery and prevent high decibel of sound emittance. These pads are much more useful in heavy machinery, as in this case, they are useful in maintaining the integrity of the structure and to function properly.

Dampers are used as vibration control systems in reducing or resisting the damping effect to the irrepressible materials by the application of new materials and acquire high damping characteristics. This damper includes various new dampers used at industrial levels from constructional equipment to vehicles’ damping. For Example: The latest dampers from Trelleborg damp the vibrations generated by the travel of trains through the use of anti-vibration mounts, which reduces the emission of heavy noises and helps the passenger to remain calm.

RESTRAIN

Integrating the vibration control systems market with existing machinery, especially older or legacy systems, is complex and time-consuming due to retrofitting and upgrading challenges.

Integrating vibration control systems market with existing machinery area, especially older or legacy systems, is associated with numerous challenges, which results in a highly complex and time-consuming process. Firstly, many vibration control technologies and mechanisms are relatively modern and were not considered in the initial design of older machinery. As such, incorporating such mechanisms into older machines requires significant modification, which can be maddening. Specifically, the process of adapting the machine for vibration control involves the proper placement of absorbers, dampers, isolators, and many other types of vibration controls, as well as controlling their movement and pressure, all of which can be intricate and labour-intensive.

For example: simply fitting new control devices into the machinery can be cumbersome because the machine may not have enough space or will be constructed in a manner that is inconvenient for the purposes of physical vibration control. Engineers then must design and execute many modifications to make such new components fit and function in the machinery properly.

Vibration control systems can be expensive to purchase, install, and maintain.

Vibration control systems market are a considerable financial investment for companies. The costs of vibration control systems not only include their acquisition but also their purchase and, in particular, installation. In terms of acquisition, the components of VCS, such as absorber, damper, and isolator, can be extremely expensive, especially high-quality ones. This dimension is critical as often VCS systems should be designed with strict requirements in mind, which increases costs of the vibrating system as a whole and its components. The components of vibration control systems are costly because they are made of materials and according to technologies that allow execution of their function.

At the same time, installation processes impact the costs of vibration control systems following their acquisition. They require certain skills and knowledge that can be often found outside the organization or need to be attracted or inside the company. Installation processes are rather complex and require certain knowledge for the proper establishment and maintenance of vibration control systems parts. Installation processes presuppose tight tolerance and specialized equipment can be needed for their proper calibration. However, machinery can be complex or overly crowded so that the installation processes may require the skills and knowledge necessary to ensure proper installation placement and installation calibration. Furthermore, machinery can be out of order for the time of its installation, which implies revenue loss costs.

Key Market Segmentation

By System Type

-

Motion Control

-

Springs

-

Hangers

-

Mounts

-

Washers & Bushes

-

-

Vibration Control

-

Isolators

-

Isolating Pads

-

Others

-

Vibration control to show fastest CAGR over approx. 6.8% in 2023, driven by the increasing need for solutions that control tremors and vibrations in the oil & gas and power plant industries. These systems utilize various anti-vibration devices – washers, absorbers, mounts, springs, and more – to isolate the impact of shaking and jolting within power plants. The VCS segment itself can be further broken down into sub-categories like isolating pads and isolators.

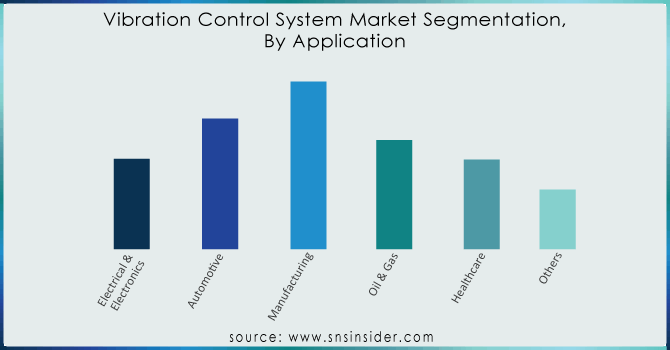

By Application

-

Electrical & Electronics

-

Automotive

-

Manufacturing

-

Oil & Gas

-

Healthcare

-

Others

As of 2023, manufacturing is the biggest user of vibration control systems, making up 28% the global market. This trend is expected to continue due to the rise of industrial machinery manufacturing worldwide. The electrical and electronics sector, in particular, presents significant opportunities for companies involved in vibration control. Here, these systems use a combination of control electronics, vibration sensors, and actuators to create a feedback loop. This loop helps protect delicate equipment and structures from the damaging effects of shock and vibration.

Need any customization research on Vibration Control System Market - Enquiry Now

REGIONAL ANALYSIS

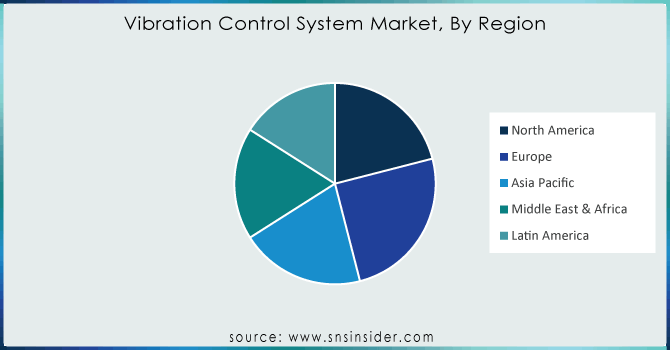

Europe, currently dominating with 25% share in 2023, is expected to see stable growth. Meanwhile, Asia Pacific is the fastest growing region fueled by rapid industrialization in China, India, and Japan. Additionally, China's low-cost manufacturing edge makes them a major player.

North America, though a powerhouse holding over 21% of the 2023 market share, is anticipated to have moderate growth. The U.S. holds supreme position in this region, driven by the high demand for vibration control systems in healthcare, aviation, and defense. It's no surprise then, that the U.S. is a hub for vibration control technology manufacturers and solution providers.

The vibration control system market in the U.S. was estimated to account for a value share of 16.3%. Recent advancements such as the improved and cost-effective sensor development, powerful yet user-friendly data analytics software, together with cloud-based solutions are helping drive growth in the vibration control systems market U.S. Wireless monitoring technology is being increasingly used by manufacturing companies in the world to enhance safety, decision-making support with real-time data and analysis as well as user-friendliness at a competitive implementation cost and Low Return on Investment.

Regional Analysis

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The Major Players are ContiTech Deutschland GmbH, ELESA S.p.A., Trelleborg AB, Fabreeka, Resistoflex, Hutchinson, VICODA GmbH, Sentek Dynamics Incorporated, Kinetics Noise Control, Inc, Kinetics Noise Control, Inc, Isolation Technology Inc and other players

Recent Developments

In November 2022: In November 2022, Sumitomo Riko Company Limited signed an agreement with Lanzatech NZ, Inc., a U.S.-based company with the focus on carbon capture and transformation, on their cooperation in the area of transition to a circular economy for rubber, resin, and urethane waste. The agreement presupposed the development of the required technologies to promote the benefits originating from the advance to such an economy for such types to waste. The companies expected to promote the creation of a sustainable society with zero carbon emissions and a circular economy.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 5.21 Billion |

| Market Size by 2032 | US$ 8.87 Billion |

| CAGR | CAGR of 6.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By System Type [Motion Control (Springs, Hangers, Mounts, Washers & Bushes), Vibration Control (Isolators, Isolating Pads, Others)] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | ContiTech Deutschland GmbH, ELESA S.p.A., Trelleborg AB, Fabreeka, Resistoflex, VICODA GmbH, Sentek Dynamics Incorporated, Kinetics Noise Control, Inc, Kinetics Noise Control, Inc, Isolation Technology Inc |

| Key Drivers |

• The demand for vibration control systems market is growing with the expansion and adoption of such major industries as oil and gas, utilities, and transportation. • Manufacturers are developing new vibration control systems market products like absorbers, dampers, and isolating pads, catering to the growing market needs. |

| RESTRAINTS |

• Integrating vibration control systems market with existing machinery, especially older or legacy systems, is complex and time-consuming due to retrofitting and upgrading challenges. • Vibration control systems can be expensive to purchase, install, and maintain. |