Vapor Recovery Units Market Report Scope & Overview:

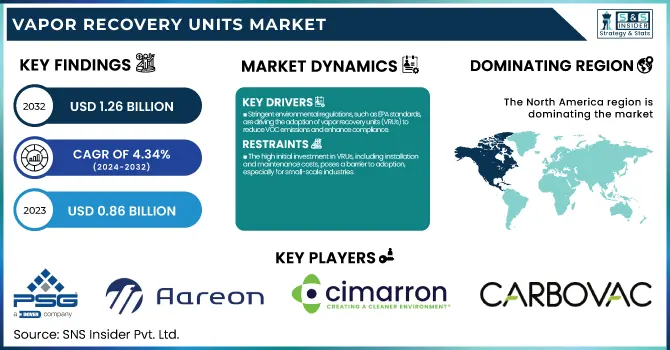

The Vapor Recovery Units Market Size was esteemed at USD 0.86 billion in 2023 and is supposed to arrive at USD 1.26 billion by 2032 with a growing CAGR of 4.34% over the forecast period 2024-2032. The report provides a unique perspective on the Vapor Recovery Units (VRU) market by analyzing production output trends and regional utilization rates, revealing operational efficiency insights. It examines maintenance and downtime metrics, highlighting system reliability and cost implications. Additionally, the report tracks technological adoption rates across regions, showcasing the shift toward advanced recovery solutions. Export/import data offers a trade flow assessment, while an emerging focus on carbon capture integration in VRUs and automation-driven optimization adds depth to industry advancements.

To Get more information on Vapor Recovery Units Market - Request Free Sample Report

Vapor Recovery Units Market Dynamics

Drivers

-

Stringent environmental regulations, such as EPA standards, are driving the adoption of vapor recovery units (VRUs) to reduce VOC emissions and enhance compliance.

Governments worldwide enforce stringent environmental regulations to curb air pollution and reduce volatile organic compound (VOC) emissions, significantly driving the demand for vapor recovery units (VRUs). Regulatory authorities like the U.S. Environmental Protection Agency (EPA) have defined specific guidelines for emissions, which force industries, particularly oil & gas, chemicals, and petrochemicals, to utilize VRUs for capturing vapors and recover before releasing them into the atmosphere. Other industrialized nations, in addition to the European Union, have similar regulations that burden companies to comply or be subject to fines, motivating investments in vapor recovery technologies. These rules not only reduce environmental pollution but also encourage sustainable industrial practices with increasing concerns about climate change and air quality, governments are likely to bring in stricter emission norms, which will further accelerate the adoption of VRUs across the industries. Adhering to these regulations streamlines operations and improves corporate sustainability efforts.

Restraint

-

The high initial investment in VRUs, including installation and maintenance costs, poses a barrier to adoption, especially for small-scale industries.

The adoption of Vapor Recovery Units (VRUs) is often hindered by high initial investment costs, which include expenses related to equipment, installation, and integration with existing infrastructure. These costs can represent a substantial barrier for small-scale industries and independent operators, though — and so, relatively lower-cost alternative solutions, such as flaring, find appeal despite their environmental impacts. These also lead to long-term operational costs, as VRUs need to be frequently maintained. Not only do companies have to invest in personnel and systems for improving the bottom line and meeting regulations, but they also require skilled personnel and advanced monitoring systems, which will further eat into their costs. With VRUs generating long-term savings through the reclamation of valuable hydrocarbons as well as minimized emissions penalties, the large capital outlay often poses a barrier to entry for cash-strapped companies. This is especially tough in emerging markets for sectors with scarce financial capacity and limited state support for emission mitigation technologies. Manufacturers and policymakers will need to identify affordable VRU systems, explore leasing options, and discuss financial incentives with SMEs to drive uptake.

Opportunities

-

Technological advancements in VRUs, including automation, IoT integration, and real-time monitoring, enhance efficiency, reduce emissions, and optimize operations.

Technological advancements in Vapor Recovery Units (VRUs) are significantly enhancing their efficiency and driving market adoption. Innovations such as enhanced automation, Internet of Things (IoT) integration, and real-time monitoring systems allow for precise control and optimization of vapor recovery processes. Predictive Maintenance using advanced sensors and data analyticsImproved efficiency through predictive maintenance allows for substantially lower operational costs and downtime. Advances in vapor capture efficiency also reduce hydrocarbon losses and environmental footprint, improving both compression and absorption technologies. The smart nature of control systems allows these fleets to be monitored remotely to comply with stringent emission regulations while streamlining operations. Real-time parameter optimization using AI-powered analytics further enhances performance. All these developments make VRUs more efficient, cheaper, and simpler to work with, which results in oil & gas, petrochemicals, and storage terminal industries gradually switching to them. The role of VRUs in making the oceans cleaner as technology improves and continues to automate and make them more efficient will also help keep the environmental balance in check and at the same time reduce operational costs.

Challenges

-

Retrofitting VRUs into older industrial setups is costly and complex due to compatibility issues, space constraints, and operational disruptions.

Integrating vapor recovery units (VRUs) into existing industrial infrastructure presents significant challenges, particularly in older facilities that were not originally designed for such systems. If a retrofitted plant is to be considered, this can be technically complex and expensive, as it usually involves extensive modifications involving new piping, controls, and emissions monitor equipment. The difficulties of installation are compounded by compatibility issues with legacy equipment, space constraints, and a requirement for bespoke engineering solutions. Moreover, time spent during the retrofitting can break the operations causing potential revenue loss. System efficiency is not the only thing that companies must also consider as they adhere to the updated environmental regulations, too. The initial high capital required for the retrofitting and possible disruptions to normal operations often keep industries away from adopting the VRUs in cost-sensitive markets. Nevertheless, increasing modularization of the VRU designs and automation are alleviating the concerns for the retrofitting making it achievable, and promoting more adoption in the oil & gas, chemicals, and fuel storage terminals, among others.

Vapor Recovery Units Market Segmentation Analysis

By Application

The transportation segment dominated with a market share of over 42% in 2023, Substantial VOC emissions occur during fuel and petrochemical loading, unloading, and transit, leading to stricter environmental standards around the globe. The Environmental Protection Agency has identified global fuel transportation practices where VRUs have made strides in compliance with emission control regulations in places where energy demand and trade are at an all-time high. Furthermore, regulations such as those imposed by the U.S. Environmental Protection Agency (EPA) and the European Environment Agency (EEA) set strict limits, thus propelling market growth. The combination of the use of advanced VRU technologies facilitates the enhancement of efficiency, thus propelling their penetration in the field of pipelines, marine vessels, and tanker trucks for transportation the leading and fastest-expanding application in this market.

By End-use industry

The Oil & Gas segment dominated with a market share of over 62% in 2023, owing to strict environmental regulations regarding the emission of volatile organic compounds (VOC) and greenhouse gases (GHG). Regulatory authorities require emission control measures from sources, which can be established through the widespread use of vapor recovery systems. These units are widely used around upstream, midstream, and downstream to extract recoverable hydrocarbons, increase operational efficiency, and reduce the environmental impact. Furthermore, the oil & gas industry will continue its dominance as the major end-use industry for vapor recovery technologies, supported by the rising emphasis on sustainability, cost savings, as well as the growing need to comply with stringent emission standards.

Vapor Recovery Units Market Regional Outlook

North America region dominated with a market share of over 40% in 2023, primarily due to stringent environmental regulations imposed by agencies like the Environmental Protection Agency (EPA), which mandate strict emission control measures. The region has a very strong oil & gas sector, especially Exploration and Production activities, mainly in the United States and Canada. Increasing concern regarding volatile organic compound (VOC) emissions and the need for adherence to air quality standards has led to faster adoption of vapor recovery units (VRU). Furthermore, improvements in technologies in emission abatement and the adoption of supportive government policies help the market grow. North America holds the leading position in this sector due to the presence of several leading VRU manufacturers and the growing investments in the energy industry.

Asia-Pacific is the fastest-growing region in the vapor recovery units market, due to high industrialization and urbanization rates. Countries such as China and India are ramping up energy consumption owing to growing manufacturing, transportation, and petrochemicals sectors. To limit emissions, the governments in the region have started implementing stricter environmental regulations, which is increasing the adoption of vapor recovery technologies. Furthermore, the increasing focus on sustainability along with corporate efforts to lower their carbon footprints are driving industries actively seeking solutions to control emissions. Demand for oil & gas infrastructure and vapor recovery technology is boosting the market and is likely to drive it even further due to rising investments in the sector. One way the region is expected to contribute to the vapor recovery unit expansion is due to the growing demand for energy-efficient and strict environmental enforcement in Asia-Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

-

PSG Dover (Blackmer Vapor Recovery Systems)

-

Aareon (Vapor Recovery Solutions)

-

Cimarron Energy, Inc. (VRUs for Oil & Gas Applications)

-

John Zink Company (Flare Gas & Vapor Recovery Systems)

-

Carbovac (Oil & Gas Vapor Recovery Units)

-

SYMEX Technologies (Industrial Vapor Recovery Solutions)

-

VOCZero (Carbon-Based Vapor Recovery Systems)

-

Flogistix (FX Series Vapor Recovery Units)

-

Kappa Gi (Petroleum & Chemical Vapor Recovery)

-

Kilburn Engineering Ltd. (Customized Vapor Recovery Units)

-

BORSIG Membrane Technology GmbH (Membrane-Based VRUs)

-

Petrogas Systems (Compression-Based Vapor Recovery Systems)

-

Hy-Bon/EDI (A Cimarron Company) (Gas Compression & VRUs)

-

Parker Hannifin Corporation (Filtration-Based Vapor Recovery Solutions)

-

Cool Sorption A/S (Fuel & Petrochemical VRUs)

-

KVT Process Technology (Absorption & Adsorption VRUs)

-

Whirlwind Methane Recovery Systems (Low Emission VRUs)

-

Zeeco, Inc. (Fired & Non-Fired Vapor Recovery Units)

-

AEREON (A Cimarron Company) (Carbon Bed & Membrane VRUs)

-

Praxair Technology, Inc. (Cryogenic Vapor Recovery Systems)

Suppliers for (Advanced VRU systems for oil & gas, emissions control, and flare gas recovery) on Vapor Recovery Units Market

-

John Zink Hamworthy Combustion

-

Petrogas Systems

-

AEREON

-

PSG Dover

-

Whirlwind Methane Recovery Systems

-

VOCZero Ltd.

-

Flogistix LP

-

Cool Sorption A/S

-

Hy-Bon/EDI

-

Kappa Gi

RECENT DEVELOPMENT

In October 2023: Flogistix, a leading provider of vapor recovery and methane reduction solutions, announced its participation in the Abu Dhabi International Petroleum Exhibition and Conference (ADIPEC).

In March 2024: Audubon Engineering Company unveiled its patented Vapor Upcycle System (VUS), engineered to capture hazardous air pollutants and convert them into energy, aligning with the EPA’s updated National Emission Standards for Hazardous Air Pollutants (NESHAP).

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 0.86 Billion |

| Market Size by 2032 | USD 1.26 Billion |

| CAGR | CAGR of 4.34% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Processing, Storage, Transportation) • By End-use Industry (Oil & Gas, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | PSG Dover, Aareon, Cimarron Energy, Inc., John Zink Company, Carbovac, SYMEX Technologies, VOCZero, Flogistix, Kappa Gi, Kilburn Engineering Ltd., BORSIG Membrane Technology GmbH, Petrogas Systems, Hy-Bon/EDI, Parker Hannifin Corporation, Cool Sorption A/S, KVT Process Technology, Whirlwind Methane Recovery Systems, Zeeco, Inc., AEREON, Praxair Technology, Inc. |