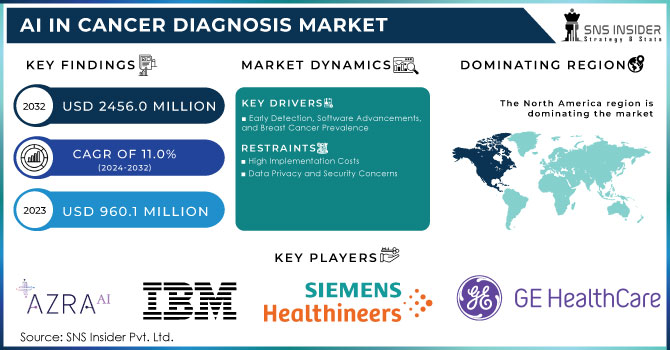

AI in Cancer Diagnosis Market Size & Overview:

The AI in Cancer Diagnosis Market Size was valued at USD 960.1 Million in 2023 and is expected to reach USD 2456.0 Million by 2032 and grow at a CAGR of 11.0% over the forecast period of 2024-2032.

Get More Information on AI in Cancer Diagnosis Market - Request Sample Report

The AI in cancer diagnosis market is growing at a very rapid rate due to the increasing incidence of cancer, advancement in diagnostic technology, and increased need for early and accurate detection. Technological innovations, particularly in AI, revolutionize cancer care through improvements in diagnostics and healthcare infrastructure. Further driving the growth of the market is investments in R&D. For example, the company launched Tempus+ in October 2022, an AI-powered program that mines real-world data for precision oncology research, and among the institutions participating in the said program are Baylor College of Medicine and Stanford Cancer Center. Some key developments in the industry include the U.S. FDA's approval of DermaSensor in January 2024, the world's first AI medical device for skin cancer detection.

The future promises research breakthroughs in AI in cancer care, promising great things in early detection and even precision medicine to usher in the customized treatment approach. Its ability to handle vast volumes of data but discern very complex patterns would transform the diagnosis of cancer and its treatment, thus highly enhancing outcomes while ensuring effectiveness in healthcare delivery. Recently polled researchers say that they believe cancer radiology and pathology will be one of the greatest beneficiaries over the next 10 years, but gynecology will be one of the worst. AI's role in pathology--and particularly in the area of handling large data sets and possibly improving the accuracy of diagnosis--is increasingly being acknowledged. The 2022 study highlighted the effectiveness of AI in detecting mammographic abnormalities while increasing diagnostic precision was obtained with a concomitant decrease in the workload of pathologists.

Some AI Tools With Their Focus Area

| Report Attributes | Details | Focus Area |

|---|---|---|

|

IBM Watson for Oncology |

Analyzes medical literature and patient data to provide treatment recommendations. |

Treatment recommendations |

|

PathAI |

Assists pathologists in diagnosing cancer from histopathology slides by identifying patterns and anomalies. |

Histopathology |

|

Google Health's DeepMind |

Uses AI to analyze medical images for early cancer detection, such as breast cancer and eye diseases. |

Medical imaging |

|

Tempus |

Analyzes clinical and molecular data to personalize cancer treatments based on genetic profiles. |

Personalized treatment |

|

Aiforia |

AI-powered imaging analysis for identifying tumor types and characteristics from pathology slides. |

Digital pathology |

|

Qure.ai |

Applies deep learning to analyze medical images, like chest X-rays and CT scans, for detecting cancer-related abnormalities. |

Medical imaging |

|

Pathologist AI |

Offers digital pathology tools for detecting cancerous tissues and lesions in biopsy samples. |

Digital pathology |

|

Kheiron Medical Technologies |

AI for breast cancer screening, assisting radiologists in interpreting mammograms. |

Breast cancer screening |

|

Freenome |

Uses AI to analyze blood samples for cancer biomarkers, aiming for early detection through liquid biopsies. |

Liquid biopsy |

|

OncoAI |

Integrates AI with genomic data to support personalized treatment plans by predicting responses to therapies. |

Genomic data analysis and personalized treatment |

Technological developments in AI applications such as classification, detection, segmentation, and monitoring further trigger market growth. Government and private sectors are investing in enriching AI adoption in oncology. Qritive's release of QAi Prostate in March 2023 is a good example of the use of AI for the accurate diagnosis of prostate cancer, helping in tumor classification and biopsy analysis. Growth in the market is seen because of strategic collaborations and expansions undertaken by key players. Exscientia partnered with The University of Texas MD Anderson Cancer Center for small-molecule oncology therapies in November 2022. Lunit further expanded to the Middle East in July 2023, which is another AI-driven solution that covers every region around the world. For instance, regulatory frameworks, such as the European Commission's initial AI regulations published in April 2021, would appear to give policymakers at least the comfort of ensuring matters remained ethical and secure data altogether while leaving space to innovate more in the AI in the cancer diagnosis market.

AI in Cancer Diagnosis Market Dynamics

Drivers

-

Early Detection, Software Advancements, and Breast Cancer Prevalence

The increased importance of early detection of cancers grows the AI in the cancer diagnostics market. As early detection significantly contributes toward lowering cancer-associated mortality, timely treatment and better long-term survival rates are allowed through this process. This is increased by using AI algorithms that can analyze medical imaging data, such as CT scans, MRI scans, and pathology slides, with a high degree of precision and time efficiency. These tools minimize the chances of diagnostic errors, initiate timely treatments, and hence improve patient outcomes and lower healthcare costs. Increased awareness about the benefits of early detection is expected to translate to increased demand for AI-powered diagnostic solutions.

The demand for software solutions in this sector is also growing. In 2022, software solutions make up the largest market share because they can process and analyze large complex datasets. AI-powered software is much more important to developing and deploying machine learning and deep learning algorithms, integration with existing healthcare systems, and delivery of continuous updates, leading to increasing diagnostics accuracy and efficiency.

Rising cases of breast cancer also boost growth in the market. Close to 2.3 million women were diagnosed in 2020, while around 685,000 died, making the demand for accurate diagnostic tools critical. Further refining the accuracy of mammogram analyses, AI technologies such as computer-aided detection (CAD) systems can also support personalized screening approaches by analyzing patient-level data. Perhaps, the prime motivation here is the need for AI-assisted screening and diagnosis, while advancement in the detection of cancer in its early stages is something that calls for precise and fast diagnosis. Diagnostic centers form an integral part of this market as they are increasing their reach through the smart usage of AI tools and electronic health record systems.

Restraints

-

High Implementation Costs

-

Data Privacy and Security Concerns

AI in Cancer Diagnosis Market Segmentation Analysis

By Component

Hardware components accounted for the highest revenue share of 39.6% in the market in 2023. The reason this one tops the list is that AI technology adoption has been seen by the manufacturers of medical devices to further improve patient care. An important characteristic of AI in medical devices is their ability to learn and improve from experience and real-world data. Hence, several major players are focusing on the development and improvement of AI-based cancer therapy solutions. In addition, government initiatives drive the AI-based medical devices market. For instance, in January 2021, the FDA in the United States published an action plan on AI/ML-based SaMD to support the regulation of innovative medical devices and digital health technologies.

The CAGR for the segment of software solutions from 2024 to 2032 is expected to be the highest. Growth rates are attributed to adoption in oncology by healthcare providers and payers mainly in AI software solutions. AI software solutions find great application in the prediction of various cancers, including brain, breast, liver, lung, and prostate. Consequently, many of the key participants have focused on developing and launching new equipment and software, which, in turn, makes the competition in the market even more challenging. For instance, in October 2023, Philips collaborated with Quibim, the company committed to imaging biomarkers, for the launch of AI-driven imaging and reporting solutions for MR prostate scans.

By Cancer Type

The most significant type of cancer in terms of revenue for 2023 was breast cancer. This market segment is fueled by the growing incidence of breast cancer globally. According to a release by the American Society of Clinical Oncology, in 2020, estimated new cases of cancer were approximately 2,261,419, and the highest occurrence was reported in the U.S, which is likely to have an estimated 297,790 new cases of breast cancer in 2023. The increasing number of breast cancer cases is propelling further demand for high-tech solutions in the market, and this factor is enhancing growth.

The prostate cancer segment is likely to experience the highest CAGR of 29.9% during the forecast period. According to CDC statistics, prostate cancer affects approximately 13 out of every 100 men in the U.S. In 2023, the National Cancer Institute estimated that new cases of prostate cancer totaled around 288,300, and growing this market through new services and products is the strategy of companies operating in this category. For example, in January 2024, Quibim enhanced its AI-based prostate cancer solutions by releasing QP-Prostate, its AI-based detection tool, which ensures accuracy, and quality, and shortens the time for processing by the end.

By End User

The hospitals segment occupied a substantial share of 48.2% in 2023, while the outpatient clinics segment was the next. The market in this segment is largely driven by higher adoption of AI-powered solutions in hospitals, increased companies' entry into the market to provide services across cancer care within these establishments, and encouraging patients' feedback. The hospital segment will grow aggressively throughout the forecast period.

Additionally, this sector is expected to experience the highest CAGR during the forecast period due to the latest healthcare-specific technological advancements. Digitalization, AI, VR, and immersive technologies have revolutionized testing, treatment, and data acquisition processes in hospitals. In addition, hospitals are increasingly using AI-based algorithms in cancer treatment to provide an accurate diagnosis with a lower probability of misdiagnosis.

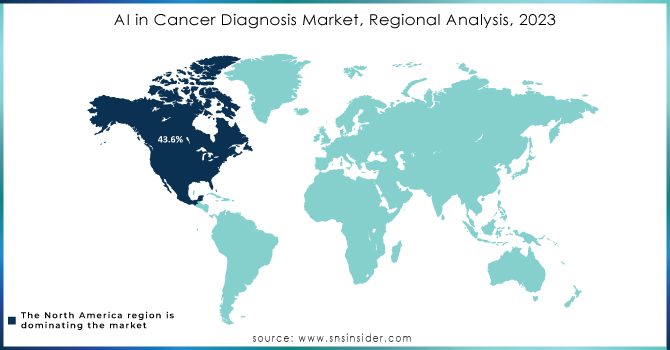

AI in Cancer Diagnosis Market Regional Outlook

North America North America led the AI in the cancer diagnosis market with a commanding revenue share of 43.6% in 2023. This dominance is attributed to the region's advanced digital infrastructure, supportive regulatory and reimbursement policies, and proactive government initiatives promoting AI technology adoption in healthcare. The rising incidence of various cancers is fueling the demand for advanced diagnostics and therapeutics, further driving market growth. In November 2021, Sanofi's collaboration with Owkin Inc. and its investment of USD 180 million in AI advancements for oncology underscore the region's commitment to innovation.

The Asia Pacific region is anticipated to experience the highest CAGR in the AI in cancer diagnosis market during the forecast period. This growth is driven by the increasing adoption of digitalization in diagnostic laboratories and hospitals, a growing elderly population, and a rising prevalence of cancer. According to Globocan, Asia-Pacific accounted for 9.7 million of the 19 million new cancer cases reported globally in 2020. Key initiatives, such as GE Healthcare's collaboration with the National Cancer Centre Singapore in June 2022, aim to leverage AI to enhance cancer care in the region.

China holds the largest revenue share of 22.6% in the Asia Pacific AI in the cancer diagnosis market. Ongoing research in machine learning, image analysis, and data processing is improving the accuracy and efficiency of AI applications in oncology. These research efforts are facilitating the integration of AI into clinical practices and healthcare systems.

Need any customization research on AI in Cancer Diagnosis Market - Enquiry Now

Key Players

-

IBM

-

GE HealthCare

-

NVIDIA Corporation

-

Digital Diagnostics Inc.

-

ConcertAI

-

Median Technologies

-

PathAI

-

EarlySign

-

Microsoft

-

Flatiron

-

Path AI

-

Therapixel

-

Tempus

-

Paige Ai, Inc

-

Kheiron Medical Technologies Limited

-

SkinVision and others.

Recent Developments

In January 2024, NVIDIA Corporation joined forces with Deepcell to advance the application of generative AI in single-cell research, focusing on stem cells, cancer, and cell therapies.

In January 2024, PathAI expanded its PathExplore platform by introducing six new oncology indications. This AI-powered pathology panel is designed for the spatial analysis of the tumor microenvironment (TME).

In December 2023, ConcertAI acquired CancerLinQ, a former subsidiary of the American Society of Clinical Oncology (ASCO). Alongside this acquisition, ASCO entered into a multiyear collaboration agreement with CancerLinQ. This partnership aims to enhance CancerLinQ’s mission—originally launched by ASCO in 2013—to advance cancer care and accelerate clinical research. The new venture will utilize real-world data, analytics, next-generation AI, and other advanced technologies to further develop CancerLinQ’s capabilities.

| Report Attributes | Details |

| Market Size in 2023 | US$ 960.1 Million |

| Market Size by 2032 | US$ 2456.0 Million |

| CAGR | CAGR of 11.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component Outlook (Software Solutions, Hardware, Services) • By Cancer Type (Breast cancer, Lung Cancer, Prostate Cancer, Colorectal Cancer, Brain Tumor, Others) • By End User (Hospitals, Surgical Centers and Medical Institutes, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Azra AI, IBM, Siemens Healthcare GmbH, Intel Corporation, GE HealthCare, NVIDIA Corporation, Digital Diagnostics Inc., ConcertAI, Median Technologies, PathAI, EarlySign and others |

| Key Drivers | • Early Detection, Software Advancements, and Breast Cancer Prevalence |

| Market Restraints | • High Implementation Costs • Data Privacy and Security Concerns |