Smart Air Purifier Market Report Scope & Overview:

To get more information on Smart Air PurifierMarket - Request Free Sample Report

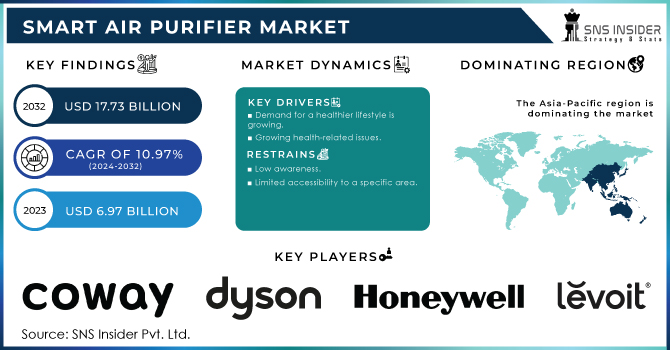

The Smart Air Purifier Market size was valued at USD 6.97 billion in 2023 and is expected to reach USD 17.73 billion by 2032 and grow at a CAGR of 10.97% over the forecast period 2024-2032.

The smart air purifiers market is growing rapidly, with both consumers and businesses realizing the importance of clean air for maintaining health and productivity. Intelligent air purifiers use advanced technologies to identify, remove, and cleanse indoor air pollutants like dust, allergens, and volatile organic compounds (VOCs) to improve air quality. Major players in the industry make considerable investments in the area of research and development to improve the effectiveness of their air purifiers and implement new retrofits that will simplify their usage. For instance, Dyson spent almost USD 2 billion on R&D in the 2023 launch to improve its products, including air purifiers, and in response to the high demand. One of the major changes in the technology of air purifiers that have been achieved by the company is a high-efficiency particulate air filter that currently captures 99.97% of particles as small as 0.3 microns. Moreover, continuous research in the given area aims to improve their longevity and effectiveness.

The growth of urban areas and industrial activities has caused higher rates of air pollution, in both outdoor and indoor environments. Consequently, there is an increasing need for air purifiers that provide both standard filtration and intelligent functions, including live air quality monitoring, automatic adjustments according to air quality data, and compatibility with smart home systems. For example, advanced air purifiers made for hospitals and research centers need high air quality standards to avoid pollution. It is essential to have air purifiers with specialized filters and high-performance capabilities in these environments to ensure sterile conditions are maintained.

Market Dynamics

Drivers

- Health-conscious consumers drive demand for smart air purifiers in the quest for cleaner living spaces.

The current health consciousness among consumers should be noted as the crucial factor affecting the development of the smart air purifier market. Indeed, with the growing focus on healthy lifestyles, people are more likely to take an interest in devices that can be conducive to their well-being. In this way, smart air purifiers should be considered rather appealing in this context as they effectively help to minimize the presence of airborne particles, hence contributing to a cleaner and healthier atmosphere. It is worth noting that modern customers are more concerned about the influence of poor air quality on their physical health as exposure to such a condition increases the chance of asthma, allergies, and respiratory infections. In addition, the presence of additional features such as real-time air quality trackers, health alerts, and other relevant options can also add value to such products as they can offer significant support in protecting health.

- Government Regulations and Incentives Boost Growth in the Smart Air Purifier Market.

In addition, the adoption of government regulations and incentives that improve air quality and contribute to health is another factor driving growth in the smart Air Purifier Market. For instance, in the U.S., the Environmental Protection Agency (EPA) has launched initiatives like the "Indoor Air Quality Tools for Schools" program, encouraging the use of air purifiers in educational institutions to protect children from indoor air pollutants. Some governments have put in place standards limiting industrial and vehicle emissions, and are starting to advocate the use of air purifiers for cleaner interior environments as well. In some cases, governments and environmental organizations also offer incentives for buying such as rebates or tax credits. It offers these as an enticement to ease consumer price pain and get them on the smart air purifier bandwagon. The increased demand for smart air purifiers is anticipated to contribute in the growth of the global market greatly with stricter regulations and burgeoning incentives.

Restraints

- Cost Considerations and Maintenance Challenges in Smart Air Purifier Ownership

Smart air purifiers function on a need for regular maintenance to maximize the utility derived from them. Such maintenance invariably amounts to ongoing costs. The major maintenance needs that accompany a smart air purifier include filter replacement, cleaning the unit, and occasional servicing of the device. The costs associated with filter replacements may be significant, especially given that the filters used in more advanced smart air purifiers may be high-end, such as HEPA filters, activated carbon filters, etc. In addition to maintenance costs, the energy utilization of smart air purifiers might also be a concern. In an ideal world, smart devices are built in an intelligent and energy-efficient manner, but the very need for the device to run continuously means that the owners would incur significant electricity costs. These are the types of concerns that would hamper the decision-making of a potential buyer worried about the costs associated with ownership of a smart air purifier.

Market Segmentation

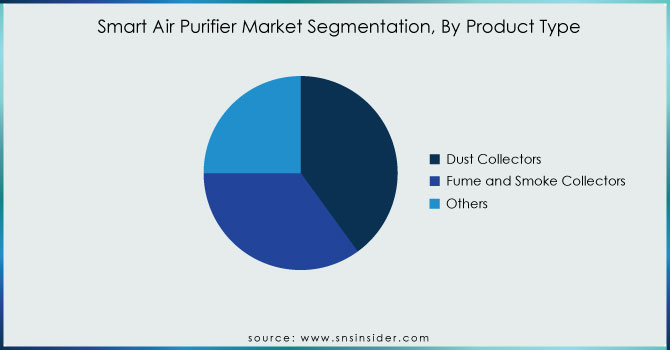

By Product Type

Dust Collectors dominated the market in 2023 with more than 38% market share. Dust collectors are commonly utilized because they are efficient in eliminating particles from the air, a common issue in residential and industrial environments. These gadgets come with state-of-the-art filtration systems like HEPA filters, which effectively trap dust particles, allergens, and other pollutants. Growing recognition of air quality and increased occurrence of respiratory ailments have fueled a substantial need for dust collectors.

Fume and Smoke Collectors are the most rapidly expanding segment within the Smart Air Purifier Market during 2024-2032. The rise is sparked by growing worries about air pollution and the necessity for specific strategies to control fumes and smoke coming from different industrial processes, cooking, and smoking. Fume and smoke collectors are meant to capture certain airborne pollutants like volatile organic compounds (VOCs), smoke, and chemical fumes that are not effectively managed by typical dust collectors.

By Technique

High-efficiency Particulate Air (HEPA) held a market share of over 36% in 2023. HEPA filtration is usually the most popular type because it is widely known for effectively trapping airborne allergens, dust, and pollutants. HEPA filters are widely relied on and frequently utilized in residential, commercial, and industrial settings, positioning them as a top pick in the market.

Ultraviolet Germicidal Irradiation is going to be the fastest-growing region during 2024-2032, it is likely to be the fastest-growing as the health risks tend to increase and more users prefer using air purification systems equipped with the technology that can kill and deactivate bacteria and viruses in the air including those associated with the most recent global health event.

By End-User

The residential segment led the market in 2023 with a market share of over 40% and is also expected to retain its position during the forecast period. The rising recognition of indoor air quality, along with growing worries about pollution and allergens, is causing an increase in the need for intelligent air purifiers in households. Moreover, the residential sector's dominance is reinforced by the growth in disposable income, urbanization, and the rising popularity of smart home technologies. The residential industry is experiencing fast expansion because of the increasing middle-class population and their preference for a healthy living space. Smart features like IoT connectivity and real-time monitoring are very attractive to homeowners who are into technology, driving faster growth in this segment compared to other sectors.

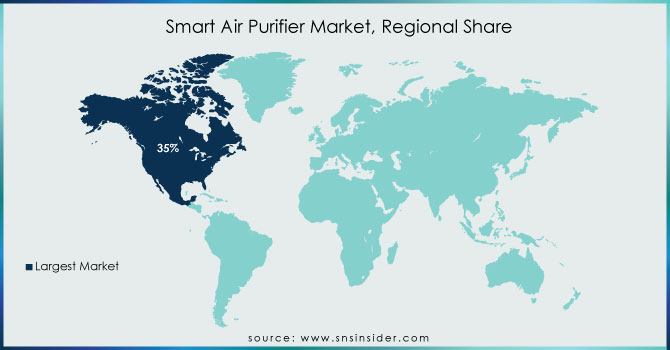

Regional Analysis

North America dominated the market in 2023 with a market share of over 35%, largely because the region has the strictest clean air regulations in the world and the highest level of consumer awareness. The United States is the leading country in the market, given that the region has the most advanced infrastructure and shares a large market of smart home users. The prevalence of respiratory diseases and in-house airborne impurities has also contributed greatly to the advantage of the market. Additionally, major players and developments in air purifier technology lie in that region.

Asia Pacific is emerging as the fastest-growing market during 2024-2032 for smart air purifiers because the levels of air pollution are increasingly high due to the highest rates of industrialization and urbanization, for instance in India and China. Notably, China set its sights on clean air less than five years ago. It has the largest population with a rising number of middle-class and annual incomes. Further, there is a growing focus on technologies and smart home solutions that support the market.

Need any customization research on Smart Air Purifier Market - Enquiry Now

KEY PLAYERS

The major key players in the market are Coway Co., Ltd, Dyson Technology Limited, Honeywell International Inc, Levoit, LG Electronics Inc, Xiaomi Corporation, Koninklijke Philips N.V, Sharp Corporation, Unilever PLC, Winix Inc.& others

Recent Development

-

In July 2024, Dyson introduced the Purifier Cool Formaldehyde TP09, featuring advanced filtration technology designed to capture and destroy formaldehyde. It includes a new sensor that detects and reports indoor air quality in real-time and integrates with Dyson's app for remote control and monitoring.

-

In June 2024, Xiaomi released the Mi Air Purifier 5, which boasts a larger filtration area and enhanced HEPA filters for improved air quality. The device supports voice control via smart home assistants and includes a redesigned quieter fan mechanism.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.97 Billion |

| Market Size by 2032 | USD 17.73 Billion |

| CAGR | CAGR 10.97% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Dust Collectors, Fume and Smoke Collectors, Others) • by Technique (Activated Carbon Filtration, High-efficiency Particulate Air (HEPA), Thermodynamic Sterilization System (TSS), Ultraviolet Germicidal Irradiation, Ionizer Purifiers, Other) • by End-User (Residential, Commercial, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Coway Co., Ltd, Dyson Technology Limited, Honeywell International Inc, Levoit, LG Electronics Inc, Xiaomi Corporation, Koninklijke Philips N.V, Sharp Corporation, Unilever PLC, Winix Inc.& Others |

| Key Drivers |

|

| Restraints |

|