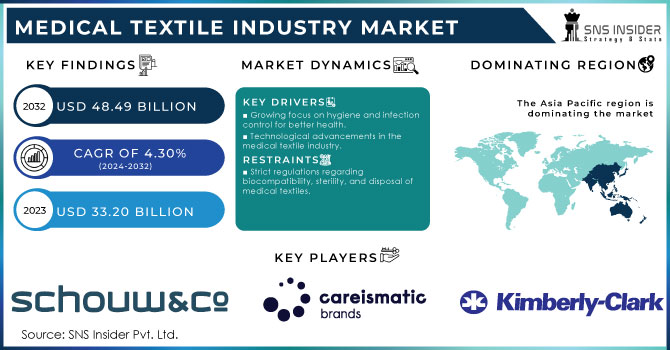

Medical Textile Industry Market Size & Overview:

The Medical Textile Industry Market Size was valued at USD 33.20 billion in 2023 and is expected to reach USD 48.49 billion by 2032 and grow at a CAGR of 4.30% over the forecast period 2024-2032.

Get more information on Medical Textiles Industry Market - Request Sample Report

The medical textile industry market is growing due to the aging population with rising diabetes rates necessitating advanced solutions, and growing awareness about hygiene and the importance of infection control in medical settings is boosting the demand for disposable medical textiles like surgical gowns, drapes, and face masks and further fuels this sector. Additionally, the rise of the healthcare industry, increasing health consciousness among consumers, and the rising prevalence of conditions requiring wound management all contribute to demand.

Governments and health organizations are implementing stringent regulations and standards for medical textiles, ensuring high-quality and safe products, which in turn drives market growth. For instance, The U.S. Food and Drug Administration has been actively approving new medical textile products, including advanced wound care dressings and antimicrobial fabrics, highlighting regulatory support for innovation. This innovation and initiative help manufacturers produce good quality products and increase sales in the medical textile industry.

Moreover, the key players focused on the expansion by acquisition for instance, 3M expanded its medical solutions division in 2022 by acquiring a leading wound care company, further strengthening its product portfolio in advanced wound care textiles.

Furthermore, medical textiles play a crucial role in treating injuries from accidents and managing chronic conditions in the growing geriatric and diabetic populations. Innovation is key, with bio-compatible and biodegradable nanofiber solutions gaining traction for improved healing. Finally, increased R&D efforts and a focus on cost-effective treatments through medical textiles open exciting avenues for future market expansion.

Additionally, the COVID-19 pandemic has significantly increased the demand for personal protective equipment and other medical textiles, highlighting their critical role in healthcare and infection control which drive the market growth.

Medical Textile Industry Market Dynamics

Drivers

Growing focus on hygiene and infection control for better health.

The growing focus on hygiene and infection control for better health is significantly shaping the medical textile industry. Heightened public awareness and stringent infection control policies in healthcare facilities have emphasized the importance of high-quality medical textiles, such as antimicrobial and barrier fabrics, which help prevent the spread of infections. The COVID-19 pandemic particularly underscored the critical role of personal protective equipment, driving unprecedented demand for masks, gowns, and gloves, and highlighting the need for reliable and effective medical textiles. Governments worldwide have implemented stringent regulations and standards to ensure the safety and efficacy of these products, further driving innovation in advanced materials and smart textiles with properties like antimicrobial and fluid repellency.

According to the Centers for Disease Control and Prevention (CDC), about 1 in 31 hospital patients has at least one healthcare-associated infection on any given day. This statistic underscores the importance of stringent infection control practices and the use of effective medical textiles to reduce HAIs which drive the growth of the medical textile market.

Consequently, this heightened focus on hygiene and infection control is not only fostering growth and innovation within the medical textile industry but also extending its applications beyond healthcare to sectors like hospitality and food service, thereby expanding the market and reinforcing the importance of robust infection control practices.

Technological advancements in the medical textile industry.

To adopt better health care, people need to be aware of the rise of chronic disease, and the government organizing campaigns to prioritize healthcare. This focus on preventive care and chronic disease management is expected to translate into more medical procedures, a boon for the medical textile market. For instance, in the US, the National Institute of Health's campaigns on diseases like Alzheimer's, diabetes, and heart disease are raising awareness and likely leading to increased demand for medical textiles used in surgeries, wound care, and other treatments.

Restrain

Strict regulations regarding biocompatibility, sterility, and disposal of medical textiles.

The medical textiles market is crucial with specific functionalities (biodegradable sutures, absorbent swabs, comfortable bedding), ensuring their safety within the body is paramount. Biocompatibility, the textile's reaction with human tissue, becomes especially critical for implantable devices. Stricter regulations are in place for these internal applications compared to external devices. the British and European Standard BS EN 14065 outlines a system for maintaining cleanliness in processed linens used in areas requiring strict control over microbial contamination. This standard, while crucial for hygiene, involves a continuous risk analysis and biocontamination control process, adding slightly higher costs and potentially hindering production scalability.

Medical Textile Industry Market Segmentation

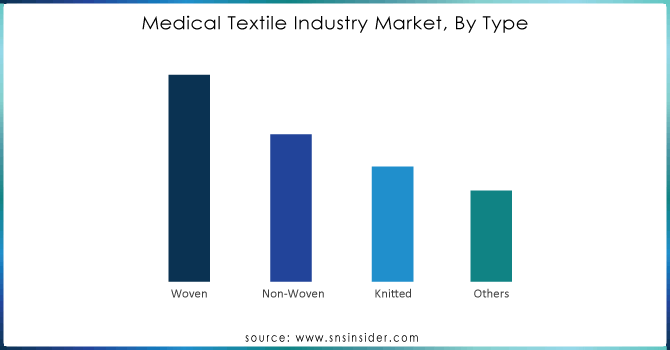

By Type

The non-woven segment has led the medical textiles market, capturing a 48% share in 2023 by type. Non-woven fabrics are produced by bonding fibers through mechanical, thermal, or chemical means rather than traditional weaving or knitting. This production method makes non-woven textiles ideal for disposable medical products, such as surgical masks, gowns, and wound dressings, due to their affordability and ability to be easily sterilized. For instance, companies like 3M have leveraged this segment by introducing advanced surgical drapes and gowns with antimicrobial properties, demonstrating the fabric's adaptability to high-performance requirements

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

The healthcare and hygiene segment is leading the medical textiles market, claiming a 45% share of global revenue in 2023 by application. This dominance is driven by a wide range of products, from face masks and medical gowns to wipes, bedsheets, and sanitary napkins. Public health programs are fostering a focus on hygiene and preventive care. Innovative materials are leading to the development of more effective and comfortable healthcare products.

Medical Textile Industry Market Regional Analysis

The Asia Pacific region dominated the medical textile market, holding a 38.6% revenue share in 2023, and is expected to maintain its growth. This dominance rises due to new manufacturing facilities across China, Japan, India, and other regional powerhouses. The rise of medical textile sector companies expanding production lines to meet the ever-increasing demand for PPE like face masks and gowns. Governments and industry leaders in India, Japan, and South Korea are further fueling growth by providing technological and financial support to accelerate production in this vital market. The increase in demand is also attributed to the region's expanding healthcare spending and urbanization. Innovative medical textile development and acceptance are also aided by regulatory frameworks and policies from the government. The National Health Policy measures of the Indian government, for example, are intended to improve healthcare facilities and services, which will tangentially increase demand for medical textiles.

Key Players

The major key players listed in the medical textiles market are Atex Technologies, Inc., Kimberly-Clark Corp, Life-Threads, Schouw & Co., Careismatic Brands, Fitesa, Bally Ribbon Mills, PurThread Technologies, Inc., Freudenberg & Co. KG, Herculite, Trelleborg AB, Indorama Corporation, and other players.

Recent Development

-

In April 23rd, 2024, ANDRITZ, a global technology leader, announced the successful launch of a new production line for Teknomelt, a Turkish nonwovens manufacturer. This innovative line utilizes ANDRITZ's wetlace CCP technology to create biodegradable, plastic-free wet wipes made from viscose and pulp.

-

In May 2nd, 2024, Suominen, a leader in nonwoven materials, announced an upgrade to their production line in Bethune, South Carolina. This investment aligns with their vision of becoming the top innovator in sustainable nonwovens, further strengthening their capabilities in eco-friendly products.

-

In November, 2023, Trelleborg a world leader in engineered polymer solutions, unveiled a game-changer Dartex® Microclimate EcoPlus. This revolutionary polyurethane coated fabric pushes boundaries in the medical device and mattress cover industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 33.20 Billion |

| Market Size by 2032 | US$ 48.49 Billion |

| CAGR | CAGR of 4.30 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Woven, Non-Woven, Knitted, Other) •By Application (Implantable Goods, Non-Implantable Goods, Healthcare & Hygiene Product, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Exxon Mobil Corporation, CASTROL LIMITED, Kluber Lubrication, Chevron Corporation, FUCHS, Total Energies, Shell plc, PETRONAS Lubricants International, Emery Oleochemicals, Albemarle Corporation, and Others. |

| Key Drivers | •Growing focus on hygiene and infection control for better health. •Technological advancements in the medical textile industry. |

| Restraints | •Strict regulations regarding biocompatibility, sterility, and disposal of medical textiles. |