Automotive Wireless EV Charging Market Size & Overview:

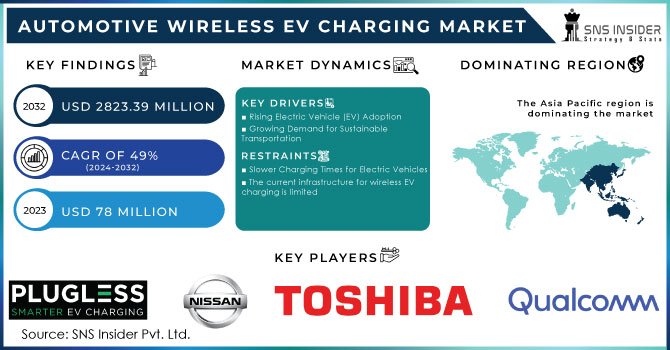

The Automotive Wireless EV Charging Market Size was valued at USD 78 Million in 2023 and is expected to reach USD 2823.39 Million by 2032 and grow at a CAGR of 49% over the forecast period 2024-2032. Electric cars are gaining traction! More people are interested in them due to environmental concerns and rising gas prices. This is pushing car companies to invest more in electric vehicle development, leading to a wider range of choices for consumers. In the US, electric car registrations grew significantly in 2023, despite a slower pace than the previous two years. Government incentives like tax credits helped boost sales, especially for popular models that became eligible. However, stricter requirements for these credits in 2024 have limited the number of qualifying cars. Leasing has emerged as a way to work around this and keep electric car sales going.

Get More Information on Automotive Wireless EV Charging Market - Request Sample Report

Looking globally, electric car registrations hit nearly 14 million in 2023, with a total of 40 million on the road. This represents a major jump from just a few years ago. Electric cars are now a much bigger part of the overall car market, and this trend is expected to continue.

MARKET DYNAMICS

KEY DRIVERS:

-

Rising Electric Vehicle (EV) Adoption

The environmental push for cleaner transportation is fueling a global surge in electric vehicles (EVs). Government incentives like tax breaks and subsidies are greasing the wheels for more EV purchases. Additionally, carmakers are responding with a wider range of EVs that offer greater driving range and more attractive price points, making them a more realistic option for a growing number of consumers. This confluence of environmental awareness, government support, and a more compelling EV market is paving the way for a significant shift towards electric mobility.

-

Growing Demand for Sustainable Transportation

-

Government Support and Infrastructure Development

RESTRAIN:

-

Slower Charging Times for Electric Vehicles

Wireless charging systems typically experience some energy loss during the power transfer process compared to wired charging. This can translate to slightly longer charging times for EVs.

-

The current infrastructure for wireless EV charging is limited

OPPORTUNITY:

-

Integration with Autonomous Vehicles

The rise of autonomous vehicles presents a unique opportunity for wireless charging. Automated systems could seamlessly park and charge vehicles without driver intervention, further enhancing convenience.

-

Integration with V2G (Vehicle-to-Grid) Technology

CHALLENGES:

-

Wireless charging technology is currently significantly more expensive than traditional plug-in charging

This includes the cost of installing charging pads on roads or parking spaces, the additional hardware required in vehicles, and the potential need for infrastructure upgrades.

IMPACT OF RUSSIA UKRAINE WAR

Disrupted supply chains, particularly the global chip shortage (down 10% in EV production in 2022), impact both EV production and wireless charging systems. Additionally, raw material prices have surged by 20-30%, making wireless charging infrastructure more expensive. Economic uncertainty might also lead to a 15% decline in investment in new technologies like wireless charging.

However, the war's emphasis on energy security could lead to a 25% increase in renewable energy investment by 2025, potentially benefiting V2G technology that supports the grid with EVs. Rising fuel prices (over 30% globally in 2022) could also accelerate EV adoption, creating a larger market for wireless charging in the long run.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown could throw a wrench into the automotive wireless EV charging market. Low budgets might lead to a 20% decline in new car sales, potentially impacting EV adoption and the demand for wireless charging. Businesses might also become more cautious, with a 10% decrease in cleantech investment stalling development. Additionally, government cutbacks of 15% in clean transportation funding could hinder market growth.

The focus on efficiency during downturns could make wireless charging, with its potential 10% energy savings, more appealing. An economic pinch might also push 5% more people towards public transport, potentially creating a demand for wireless charging solutions for electric buses and taxis.

The slowdown's ultimate impact depends on its severity. While a short-term 10-15% market slowdown is possible, the long-term outlook remains positive. EV growth driven by environmental concerns is unlikely to disappear. As the economy recovers, the wireless charging market could rebound alongside EVs, with a projected 20% annual growth rate by 2030. Governments committed to clean energy might even prioritize investments in sustainable infrastructure like wireless charging during downturns.

MARKET SEGMENTATION:

BY CHARGING SYSTEMS

-

Magnetic Resonance Charging

-

Capacitive Charging

-

Inductive Charging

While magnetic resonance charging currently dominates the electric vehicle wireless charging market, inductive charging is poised for significant growth. This is due to a growing number of car manufacturers, like Hyundai and FAW, embracing magnetic resonance technology. However, leading wireless charging companies like InductEV and WAVE Charging are currently utilizing inductive charging for EV charging solutions.

BY CHARGING TYPE

-

Dynamic Wireless Charging Systems

-

Stationary Wireless Charging Systems

BY POWER SUPPLY RANGE

-

Up to 3.7 Kw

-

Above 3.7–7.7 kW

-

Above 7.7–11 kW

-

Above 11 kW

BY PROPULSION

-

PHEVs

-

BEVs

Currently BEVs dominating the market with the largest market share.

Large electric vehicles, particularly SUVs, are putting a strain on the supply chain for batteries and critical minerals. In Europe, the average battery in a 2023 electric SUV is nearly double the size of one in a small electric car, requiring significantly more resources.

While SUVs offer a longer range than smaller cars (covered later), even compared to similarly sized electric cars, SUV batteries are still 25% larger. This translates to a significant impact: if all electric SUVs sold in 2023 were replaced with medium-sized cars, it could have saved a global equivalent of 60 gigawatt-hours (GWh) of battery capacity.

This reduction would translate to a substantial saving of critical minerals: nearly 6,000 tonnes of lithium, 30,000 tonnes of nickel, almost 7,000 tonnes of cobalt, and over 8,000 tonnes of manganese.

BY COMPONENT

-

Base Charging Pads

-

Vehicle Charging Pads

-

Power Control Units

BY VEHICLE TYPE

-

Commercial Vehicles

-

Passenger Cars

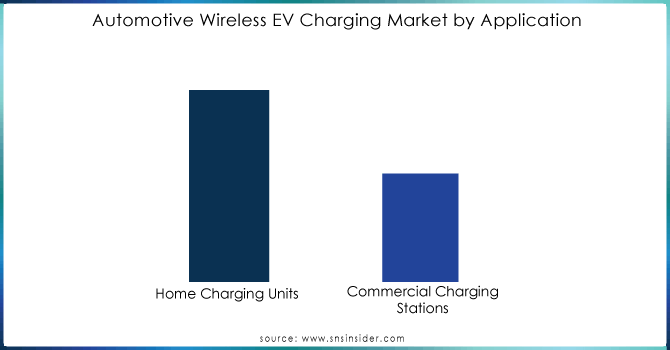

BY APPLICATION

-

Home Charging Units

-

Commercial Charging Stations

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS

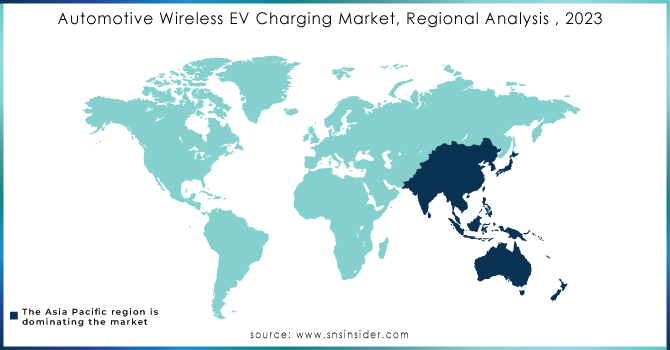

The Asia Pacific region is poised to dominate the electric vehicle (EV) wireless charging market by 2031. Countries like China, Japan, and South Korea are frontrunners in autonomous driving technology, which often complements wireless charging. Major automakers in the region, including Toyota, Nissan, and Honda, are actively partnering with wireless charging providers to expand the market.

China, in particular, is expected to be a powerhouse in the Asia Pacific EV wireless charging market. This is due to a combination of factors: a strong presence of leading players like Shenzhen Vmax and WiTricity, coupled with a large and growing customer base for electric vehicles. This confluence of factors is expected to significantly boost the market's revenue growth in China during the coming years.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some of the major players in the Automotive Wireless EV Charging Market are Plugless Power, Nission, Toshiba Corporation, ELIX Wireless, Qualcomm Inc, BMW, HEVO power, Continental AG, WiTricity, ZTE Corporation and other players.

RECENT TRENDS

-

HEVO, a key player, partnered with automaker Stellantis in Feb 2023 to integrate wireless charging into Stellantis' EVs. This collaboration focuses on safety, efficiency, and durability, aiming to make wireless charging the standard for future EVs.

-

WiTricity Corporation launched the FastTrack Integration Program in July 2023. This program helps car manufacturers (OEMs) quickly evaluate and test wireless charging on their electric vehicles (EVs)

Qualcomm Technologies Inc-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 78 Million |

| Market Size by 2032 | US$ 2823.39 Million |

| CAGR | CAGR of 49% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Propulsion Type (BEV, PHEV) • by Application (Commercial charging system, Residential charging system) • by Distribution Channel (OEM, Aftermarket) • by Power Supply (3<=11 KW, 11-50 KW, >50 KW) • by Component (Base Charging Pad, Power Control Unit, Vehicle Charging Pad) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Plugless Power, Nission, Toshiba Corporation, ELIX Wireless, Qualcomm Inc, BMW, HEVO power, Continental AG, WiTricity, ZTE Corporation |

| Key Drivers |

• Rising Electric Vehicle (EV) Adoption |

| RESTRAINTS |

• Slower Charging Times for Electric Vehicles |