Automotive Night Vision and Pedestrian Detection Technologies Market Report Scope & Overview:

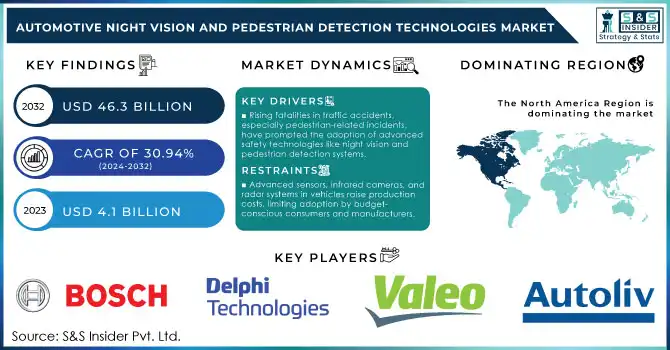

The Automotive Night Vision and Pedestrian Detection Technologies Market size was valued at $4.1 Bn in 2023 & will reach $46.3 Bn by 2032, with a CAGR of 30.94% over the forecast period of 2024-2032.

Get More Information on Automotive Night Vision and Pedestrian Detection Technologies Market - Request Sample Report

The Automotive Night Vision and Pedestrian Detection Technologies Market has seen substantial growth over the past few years, driven by increasing regulatory mandates for road safety, advancements in technology, and rising consumer demand for enhanced driving experience. Automotive night vision systems that enhance the visibility of pedestrians and objects in a driver's field of view can contribute to improved driver awareness and avoid accidents in low ambient light conditions such as poorly lit urban and rural environments, have also gained popularity as well. Offering high-definition images of the environment in real-time, these systems assist drivers in identifying risks before the driver can see them normally. Another major driver for this market is the pedestrian detection systems such as sensors, cameras and radar to identify pedestrians and animals in the path of the vehicle. Pedestrian detection is of crucial importance for safety, as the demand for advanced driver assistance systems (ADAS) as well as fully autonomous vehicles increases and reduces pedestrian deaths. By analyzing data from multiple sensors using algorithms and machine learning, these systems ensure considerable accuracy, even in complex traffic situations.

The rise of safety regulations enforcement and road safety driving the market growth. New regulations in the European Union now mandate the inclusion of pedestrian detection systems in all new vehicles. This has driven automakers to incorporate night vision and pedestrian detection features into their cars. Additionally, increasing ownership of luxury and premium vehicles typically featuring advanced safety technologies has propelled the growth of this market. Automakers such as BMW and Mercedes-Benz are leading the way with these technologies in their high-end vehicles, fueling more demand.

The evolution of AI and machine learning has also played a crucial role in boosting the efficacy of pedestrian detection systems, ultimately increasing their performance in complex environments and adverse weather conditions, including fog, rain, or glare from headlights. With growing advances in innovation within the automotive industry, together with enhancements in vehicle safety functions, the applications of automotive night vision and pedestrian detection are expected to increase to meet the wants of drivers and pedestrians.

| Technology | Accident Reduction (%) | Effectiveness in Preventing Accidents |

|---|---|---|

| Night Vision (Infrared Cameras) | 30% | Helps detect pedestrians, animals, and obstacles in low-light conditions, preventing collisions before they become visible to the driver. |

| Pedestrian Detection (Cameras + Radar) | 50% | Provides real-time alerts for pedestrians and cyclists, especially in urban areas, reducing the risk of fatal accidents. |

| Forward Collision Warning Systems (Radar + Cameras) | 40% | Radar and cameras combined in collision warning systems significantly reduce rear-end crashes by providing timely alerts and enabling automatic braking. |

| Lane Departure Warning Systems (Cameras) | 25% | Helps prevent accidents caused by driver fatigue or distraction by alerting the driver when the vehicle drifts out of the lane. |

| Adaptive Cruise Control (Radar) | 35% | Improves safety by adjusting vehicle speed to maintain a safe following distance, preventing rear-end accidents in highway driving. |

| Automatic Emergency Braking (Radar + Cameras) | 45% | Reduces accidents by automatically applying brakes when an imminent collision is detected, particularly in low-speed scenarios. |

Automotive Night Vision and Pedestrian Detection Technologies Market Dynamics

Drivers

-

Rising fatalities in traffic accidents, especially pedestrian-related incidents, have prompted the adoption of advanced safety technologies like night vision and pedestrian detection systems.

-

As consumers seek more safety-conscious vehicles, automakers are integrating advanced systems like night vision and pedestrian detection into their products to meet these expectations.

-

Innovations in infrared sensors, cameras, and radar systems improve the accuracy and effectiveness of night vision and pedestrian detection technologies.

Performance improvements have been significantly aided by newer infrared sensors, cameras, and radar systems for night vision and pedestrian detection. These advancements improve the accessibility and accuracy of these systems which are important for vehicle safety in difficult light or environmental conditions. An example is the infrared sensors which sense the heat from pedestrians or animals to allow the system to identify the potential hazards before they are visible to the driver. Enable the system to still work in complete darkness and provide drivers with a more clear and detailed view of the surroundings. Simultaneously, the high-resolution cameras combined with machine learning algorithms enhance the system's ability to detect and classify pedestrians, cyclists, and other objects in various surroundings. These cameras are used in combination with radar, enabling them to provide both depth and leading information to the driver for an all-around driver safety system. This radar and camera technological fusion is critically important to detect hazards in low-visibility scenarios, such as fog, rain, and snow, where monocular camera-based systems may become ineffective. Radar systems are another important type of collision detection and communication technology, providing real-time information on the range and aim of outside objects to aid in pre-collision warnings and automatic braking.

Combining these technologies, considerably improves the night vision and pedestrian detection systems reliability, thus enabling reduction in accidents and increasing road safety. Features within these innovations not only assist in increasing driver awareness but also contribute to the practice of driverless vehicles as specific detection of objects helps the autonomous vehicle become more aware of decision-making processes. In addition to this, the automotive night vision and pedestrian detection market is anticipated to grow substantially with automobile manufacturers investing heavily in developing these technologies. So the manufacturer is following with the advanced systems, which are not only for safety but also keeping the requirement to comply with the regulation and consumer demand for advanced vehicle features.

Restraints

-

The integration of advanced sensors, infrared cameras, and radar systems in vehicles increases the overall production cost, limiting adoption by lower-budget consumers and manufacturers.

-

The advanced nature of these technologies requires precise calibration and regular maintenance, adding to the complexity and cost of ownership for vehicle owners and fleet operators.

-

Many consumers remain unaware of the benefits or existence of night vision and pedestrian detection technologies, hindering demand and slowing market growth.

The primary barrier to consumer uptake of night vision and pedestrian detection technologies is a lack of awareness about their advantages. These technologies, which are designed to improve vehicle safety by identifying pedestrians, animals, and obstacles even in low-light circumstances, are also inadequately used mainly as the wider audience does not entirely understand their abilities. In particular, for consumers in the non-luxury vehicle category, recognizing the benefits of these features in terms of accident mitigation, particularly in a low-light environment, maybe even less prevalent. Historically, the automotive sector honed in on selling standard safety features to consumers who expect madness like airbags, seatbelts, and other basic safety features. It has put a spotlight on the discussion of these features over promoting more high-tech features such as night vision and pedestrian detection. Because of this, consumers tend to look for familiar safety features when buying a car. Furthermore, these new technologies are often offered only as paid upgrades or available as standard only in the pricier trim lines, which is itself a deterrent to buyers who may feel the added costs are unnecessary.

Automakers and technology providers are focusing on raising consumer awareness of the safety benefits provided by these systems. Increasing demand for advanced driver-assistance systems (ADAS) and stringent vehicle safety regulations are raising consumer awareness regarding the importance of night vision and pedestrian detection to reduce accidents. But to be relied upon in full, the automotive industry will need to communicate value and make them available at lower price points.

The increasing emphasis on consumer education — from marketing campaigns to regulatory pressure is expected to drive greater demand for such protective technologies. For broad adoption, though, it will take some time -- car buyers seem to ignore or discount these technologies for now in favor of more traditional safety features.

Automotive Night Vision and Pedestrian Detection Technologies Market Segment Analysis

By Type

The Head-up Display (HUD) segment dominated the market and represented revenue share of 47.0%. The segment is expected to grow due to the growing implementation of ADAS solutions and the need for minimizing driver distraction. With wireless head-up display (HUD) technology, vehicles can now convey information to the driver — speed, navigation directions, and safety alerts, among other things — without drivers having to look away from the road. Also, the incorporation of augmented reality (AR) functionality continues to drive growth throughout this segment. And with the growing demand for safer and more intuitive driving, manufacturers are likely to keep HUD in the lead, bringing innovations via on-the-road drivers with yet more functional, less costly device concepts. This segment has a bright future with heavy demand mainly from the luxury vehicle segment where more manufacturers are expected to package this technology and also from mass-market vehicles where the technology is slowly being adopted.

The Navigation Display segment is likely to have the highest growth over the forecast period with a CAGR of 32.05%. This segment is growing due to the rapid development of connected cars and in-vehicle infotainment systems. Displays in navigation are crucial for real-time route, traffic information, and location-dedicated services, thus, boosting the driver experience. Booming smartphone penetration with a rise in their adoption of vehicle infotainment systems and increasing penetration of voice-assisted navigation is the major factor fueling rapid growth in the segment. With evolving consumer demand for seamless connectivity and user-friendly, functionality, the navigation display segment will continue to find new growth opportunities. Future innovations like 3D mapping and better voice recognition are likely to accelerate uptake in both premium and mass-market cars respectively.

By Application

The passenger cars segment dominated the Automotive Night Vision and Pedestrian Detection Technologies Market with a revenue share more than of 71.23%, due to the increasing adoption of advanced safety features in personal vehicles. As consumer demand continues to increase for more safety-especially during low-visibility conditions-automakers have added night vision and pedestrian detection systems to high-end vehicles with designs for mainstreaming into entry-level cars. Increasing safety awareness, in addition to the increasing focus on advanced driver-assistance systems (ADAS), is expected to drive the passenger vehicles market, propelling the demand for such technologies. Furthermore, the introduction of stringent safety norms is also compelling the automobile manufacturers to incorporate night vision and pedestrian detection systems in new models. The outlook for this segment remains strong with continuous improvements in sensor technology and government requirements for minimum vehicle safety standards helping spur growth.

The Commercial Vehicles segment is anticipated to have the highest CAGR of 31.98%. The need for night vision and pedestrian detection systems in commercial vehicles is growing quickly as logistics and transportation businesses integrate more safety technologies to assure the safety of drivers and road users and to reduce operational costs by minimizing accidents. They assist in enhancing driver visibility, especially at night time or in adverse weather conditions, helping to lessen the possibility of an accident with pedestrians, cyclists, and other objects. This trend of increasing adoption, however, is accentuated by the booming e-commerce segment and ever-increasing global logistics requirements for such systems to be incorporated into commercial fleets. Driven by government initiatives for standardization and implementation of regulatory safety standards in heavy-duty trucks, this segment is likely to witness high growth in the coming years, especially in regions including North America and Europe.

Automotive Night Vision and Pedestrian Detection Technologies Market Regional Overview

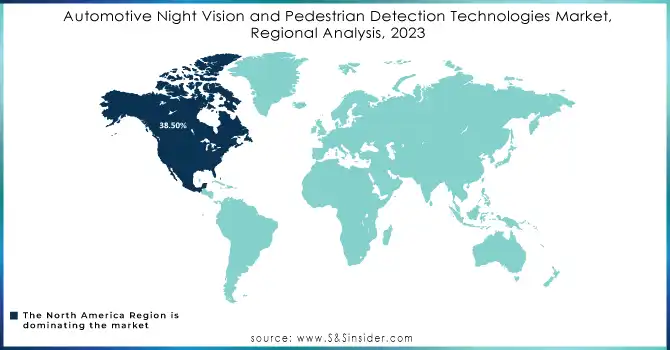

North America held a major share of 38.50% in the Automotive Night Vision and Pedestrian Detection Technologies Market in 2023. The foremost responsibility for the region's command is the excessive preference for protection functions in luxury in addition to mainstream vehicles. The U.S. and Canada have been at the forefront in terms of the adoption of high-tech automotive gadgets, and automakers have fitted cars here with a variety of advanced safety features like night vision and pedestrian detection directed at meeting tough regulatory requirements and consumer demand. With the continuous rise in consumer awareness and the availability of technology, North America is likely to remain the foremost market over other vehicle types. Also, the burst of autonomous vehicles and smart city development in this region will further strengthen the growth of these technologies for the years to come.

The Automotive Night Vision and Pedestrian Detection Technologies Market in Europe is expected to grow at the highest CAGR during the forecast period. In Europe, the growth is aided by strict safety regulations in the region, including the European Union's focus on road safety by encouraging advanced driver-assistance systems (ADAS). With more focus being placed on pedestrian safety by both governments and, ultimately, consumers, the inclusion of night vision and pedestrian detection systems is becoming more hotly pursued technology. And with consumers in nations such as Germany, the UK and France requesting vehicles with enhanced levels of safety equipment, the use of these technologies will continue to grow. Future growth of the European market will also be supported by rising electric and autonomous car deployment and demand for advanced safety features.

Need Any Customization Research On Automotive Night Vision and Pedestrian Detection Technologies Market - Inquiry Now

Key Players in Automotive Night Vision and Pedestrian Detection Technologies Market

The major key players along with their products are

-

Bosch - Bosch Night Vision System

-

Delphi Technologies - Pedestrian Detection and Collision Mitigation System

-

Valeo - Valeo SCALA® Laser Scanner (used in autonomous vehicles, also integral to pedestrian detection)

-

Autoliv - Pedestrian Protection System

-

ZF Friedrichshafen AG - Night Vision with Pedestrian Detection

-

Daimler AG - Mercedes-Benz Night View Assist Plus

-

Continental AG - Continental Night Vision System

-

Aptiv - Advanced Driver Assistance System (ADAS) with Pedestrian Detection

-

FLIR Systems (Teledyne FLIR) - FLIR Thermal Night Vision Camera

-

Magna International - Magna’s Camera-Based Pedestrian Detection System

-

Hitachi Automotive Systems - Hitachi Pedestrian Detection System

-

LAPIS Semiconductor - Night Vision System Sensors

-

Toshiba Corporation - Toshiba Night Vision Sensors for Cars

-

NVIDIA Corporation - NVIDIA Drive AGX (used for pedestrian detection in autonomous vehicles)

-

Qualcomm Technologies - Snapdragon Automotive Platform (integrates ADAS for pedestrian detection)

-

Veoneer - Veoneer Pedestrian Detection Systems

-

Harman International - Harman Automotive Night Vision Solutions

-

Sharp Corporation - Sharp Automotive Night Vision Camera

-

BMW Group - BMW Night Vision with Dynamic Light Spot

-

Toyota Motor Corporation - Toyota Pedestrian Detection System

Recent Developments

-

In February 2024, Advics launched its next-generation thermal camera technology, which enhances pedestrian detection in low-light environments, improving safety in urban driving conditions. The thermal camera technology is designed to provide clearer imagery and faster detection, vital for avoiding accidents in high-risk areas like pedestrian crossings.

-

Autoliv, in March 2024, announced an upgrade to its pedestrian detection system that integrates artificial intelligence (AI) for improved accuracy in identifying pedestrians, cyclists, and animals, especially in challenging weather conditions. This AI-driven system is designed to work seamlessly with other Advanced Driver Assistance Systems (ADAS).

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.1 Billion |

| Market Size by 2032 | USD 46.3 Billion |

| CAGR | CAGR of 30.94% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Head-up Display,Instrument Cluster, Navigation Display) • By Application (Passenger Cars, Commercial Vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bosch, Delphi Technologies, Valeo, Autoliv, ZF Friedrichshafen AG, Daimler AG, Continental AG, Aptiv, FLIR Systems (Teledyne FLIR), Magna International, Hitachi Automotive Systems, LAPIS Semiconductor, Toshiba Corporation, NVIDIA Corporation. |

| Key Drivers | • Rising fatalities in traffic accidents, especially pedestrian-related incidents, have prompted the adoption of advanced safety technologies like night vision and pedestrian detection systems. • As consumers seek more safety-conscious vehicles, automakers are integrating advanced systems like night vision and pedestrian detection into their products to meet these expectations. |

| Restraints | • The integration of advanced sensors, infrared cameras, and radar systems in vehicles increases the overall production cost, limiting adoption by lower-budget consumers and manufacturers. • The advanced nature of these technologies requires precise calibration and regular maintenance, adding to the complexity and cost of ownership for vehicle owners and fleet operators. |