Tugboat Market Key Insights:

Get More Information on Tugboat Market - Request Sample Report

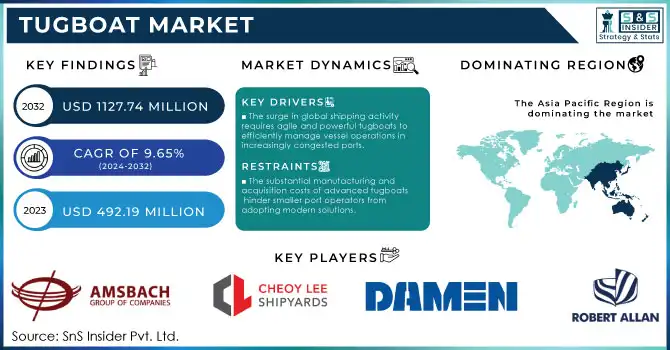

The Tugboat Market Size was valued at USD 492.19 Million in 2023 and is expected to reach USD 1127.74 Million by 2032 with a growing CAGR of 9.65% over the forecast period 2024-2032.

The tugboat market plays a crucial role in the global shipping and maritime industry, primarily offering vital support to larger vessels during the process of docking, undocking, and navigating through narrow or congested waters. These specialized vessels, known for their maneuverability, are used in ports, harbors, and offshore activities, assisting in the movement of ships that are too large to navigate these areas independently. Tugboats typically perform vital functions like towing, pushing, and guiding larger ships, ensuring their safe arrival or departure from docks, terminals, or offshore platforms. The growing demand for efficient and safe maritime operations is expected to fuel the tugboat market, especially as global trade continues to rise. Increased port activities, particularly in developing countries investing in port infrastructure, are contributing to the rising need for tugboats. Additionally, the ongoing trend of larger vessels requiring specialized tugboat services is further driving the market's expansion. Tugboats are also employed in offshore operations, such as oil and gas platform support, which is another factor adding to their relevance in the market.

Recent trends indicate a shift towards eco-friendly tugboats. With the increasing focus on sustainability, there is a noticeable transition toward vessels equipped with hybrid or fully electric propulsion systems, aiming to reduce emissions and reliance on fossil fuels. This aligns with the global push for decarbonization in the maritime sector. Furthermore, there is an increased focus on automation and digitalization in tugboat operations, including remote control systems and advanced navigation technologies. This technological integration is enhancing the efficiency and safety of tugboat services, while also contributing to the market's growth. The future of the tugboat market appears promising, as industries seek to optimize shipping operations and comply with environmental regulations. With an evolving fleet of advanced, eco-friendly tugboats and growing demand in emerging markets, the sector is expected to remain a cornerstone of the global shipping industry for years to come.

MARKET DYNAMICS

DRIVERS

-

The surge in global shipping activity requires agile and powerful tugboats to efficiently manage vessel operations in increasingly congested ports.

The tugboat market is experiencing significant growth, driven by the rising demand for efficient cargo handling. As global shipping activity continues to surge, fueled by expanding international trade and the growth of e-commerce, ports are becoming busier than ever. This increase in maritime traffic necessitates the use of agile and powerful tugboats to streamline operations and ensure safe navigation in congested port areas. Tugboats play a crucial role in docking, undocking, and maneuvering large cargo vessels, particularly in challenging conditions or confined spaces, making them indispensable for modern port operations.

The growth is further accelerated by the increasing number of mega-ships, which require advanced tugboats with higher bollard pull capacity for efficient handling. In addition, the modernization of port infrastructure in emerging economies has spurred the demand for technologically sophisticated tugboats equipped with enhanced propulsion systems, remote control capabilities, and autonomous operations. Government initiatives aimed at improving port efficiency and safety have also contributed to the growing adoption of tugboats. For example, ports are investing in fleets powered by eco-friendly technologies, such as hybrid and LNG engines, to meet stringent environmental regulations. This transition to greener solutions not only aligns with global sustainability goals but also reduces operational costs in the long term.

RESTRAIN

-

The substantial manufacturing and acquisition costs of advanced tugboats hinder smaller port operators from adopting modern solutions.

The tugboat market is experiencing significant growth, driven by increasing global maritime trade, port modernization, and the rising demand for efficient vessel operations. As international trade volumes expand, ports are under pressure to enhance their operational capabilities, creating a strong demand for modern tugboats equipped with advanced propulsion systems, navigation technologies, and eco-friendly designs. The shift towards sustainability has also fueled the adoption of hybrid and LNG-powered tugboats, aligning with global efforts to reduce carbon emissions and meet stringent environmental regulations.

Technological advancements, such as the integration of autonomous and remote-controlled tugboat systems, are further revolutionizing the market, improving safety, and reducing operational downtime. Additionally, emerging economies are investing heavily in expanding and upgrading their port infrastructure, which is anticipated to bolster the demand for tugboats in the coming years. Despite these growth opportunities, the market faces challenges, notably the high initial costs associated with the production and acquisition of technologically advanced tugboats. These costs can pose a significant barrier for smaller port operators, limiting their ability to adopt modern solutions and compete effectively. However, the long-term benefits of reduced fuel consumption, enhanced efficiency, and compliance with environmental norms are expected to drive investment in advanced tugboats.

KEY SEGMENTATION ANALYSIS

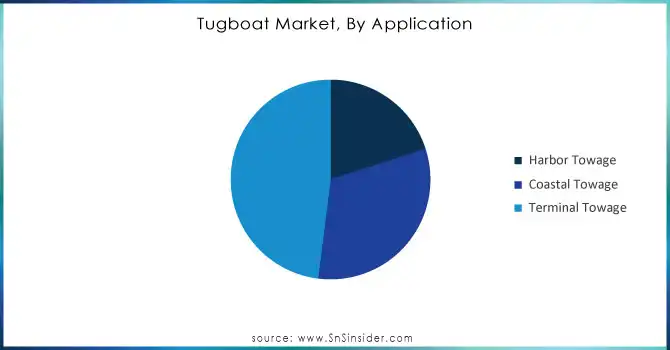

By Application

The Terminal Towage segment dominated with the market share over 48% in 2023, due to its essential role in port operations. Terminal towage involves maneuvering ships within port terminals, ensuring safe docking and undocking, which is crucial for maintaining the flow of goods. As global trade volumes rise, the need for efficient and safe handling of vessels in busy ports has increased, driving the demand for terminal towage services. The expansion of port infrastructure and the growing size of vessels further amplify the importance of terminal towage. Larger ships require more specialized tugboats for maneuvering in confined spaces, and terminal towage provides this service. The segment's dominance is also fueled by advancements in tugboat technology, which enhance performance, safety, and fuel efficiency.

Need Any Customization Research On Tugboat Market - Inquiry Now

By Power Capacity

The 1000 to 2000 KW segment dominated with a market share of over 32% in 2023, driven by its widespread application in harbor and coastal operations. Tugboats in this range are favored for their ability to strike an ideal balance between power and maneuverability, making them versatile in various tasks such as guiding larger ships in and out of ports, assisting with docking, and handling vessels in tight spaces. This power capacity is particularly effective for medium-sized ships and operations in busy harbors, where tugboats need to perform efficiently without excessive fuel consumption. The segment’s dominance is also supported by the growing demand for safe, reliable, and cost-effective tugboats for regular port operations.

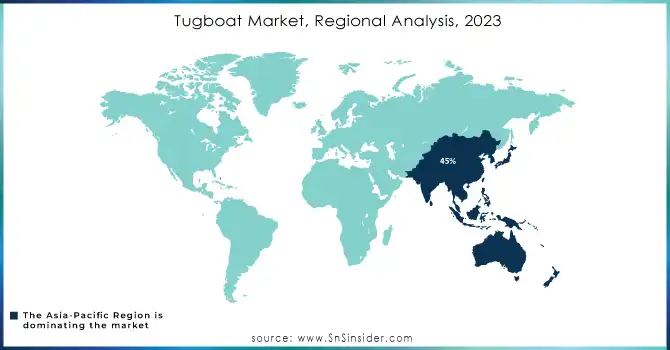

KEY REGIONAL ANALYSIS

The Asia-Pacific region dominated with a market share of over 45% in 2023 due to its strong maritime activities and the presence of some of the world's busiest and largest ports. Countries like China, Japan, and India play a crucial role in this dominance. China, for instance, is a global leader in containerized trade, with major ports such as Shanghai and Hong Kong. Japan's advanced shipping industry, supported by its efficient port infrastructure, further contributes to the region’s leadership. India, with its growing shipping sector and strategic location, also adds to the market strength. The increasing volume of trade and the demand for efficient vessel operations in this region has led to a significant number of tugboats being deployed for tasks like harbor towing, vessel maneuvering, and offshore support.

North America is experiencing rapid growth in the Tugboat Market, fueled by several key factors. The demand for tugboats in the United States and Canada is primarily driven by the expanding oil and gas industries, where tugboats play a crucial role in ensuring the safe transportation of oil rigs and supporting offshore operations. Additionally, ongoing port expansions and modernization efforts in major U.S. and Canadian ports are contributing to the increased need for tugboats, which are essential for docking and maneuvering large vessels in busy harbors. The rise in global trade and shipping activities has also led to a greater need for harbor towing services, which tugboats provide, assisting in the movement of ships in congested ports.

Key Players

-

Amsbach Marine (S) Pte Ltd (Singapore) – Tugboats for harbor and offshore operations.

-

Astro Offshore Pte Ltd. (UAE) – Offshore support vessels, including multipurpose tugboats.

-

Cashman Equipment Corp. (U.S.) – Ocean-going tugboats and towing solutions.

-

Cheoy Lee Shipyards Ltd (Hong Kong) – Custom-designed tugboats with advanced propulsion systems.

-

Cochin Shipyard Limited (India) – High-capacity harbor and seagoing tugboats.

-

Damen Shipyards Group (Netherlands) – ASD (Azimuth Stern Drive) Tugboats, Stan Tug Series.

-

Hongkong Salvage & Towage Services Limited (Hong Kong) – Emergency towing vessels and workboats.

-

Jiangsu Zhenjiang Shipyard Co. Ltd. (China) – Harbor tugs, escort tugs, and ASD tugs.

-

Mazagon Dock Shipbuilders Limited (India) – Naval tugboats and specialized tug solutions.

-

Robert Allan Ltd. (Canada) – Custom-designed tugs for escort, harbor, and offshore operations.

-

Sanmar Shipyards (Turkey) – Compact ASD tugboats and eco-friendly tugboat series.

-

Keppel Singmarine (Singapore) – Dual-fuel tugboats and LNG-powered tugboats.

-

Med Marine (Turkey) – Ship-handling tugboats, mooring boats, and escort tugs.

-

Svitzer A/S (Denmark) – Tugboats for harbor assistance and towage.

-

Nichols Brothers Boat Builders (U.S.) – Tractor tugboats and diesel-electric tugs.

-

Macduff Ship Design Ltd (U.K.) – Conventional tugboats and shallow-draft tugs.

-

Chittagong Dry Dock Limited (Bangladesh) – Multipurpose harbor and seagoing tugs.

-

Drydocks World (UAE) – Specialized tugboats for offshore and marine operations.

-

Piriou Shipyard (France) – Harbor tugs and multipurpose workboats.

-

Eastern Shipbuilding Group (U.S.) – High-horsepower harbor tugs and escort vessels.

Suppliers Known for providing integrated towage and marine services, focusing on offshore and port services globally in Tugboat Market

-

Smit Lamnalco

-

Bollinger Shipyards

-

Port of Rotterdam

-

V.Group

-

Crowley

-

Fratelli Neri

-

A.P. Moller - Maersk

-

Svitzer

-

KOTUG International

-

SeaLink Marine

RECENT DEVELOPMENTS

-

In February 2024: Cheoy Lee Shipyards completed its 50th harbor tug, Joymoni and Keel Komol, following a decade of refinement in collaboration with Robert Allan Ltd's RAmparts 3200-CL design.

-

In May 2024: The Port of Antwerp-Bruges launched the Methatug, a 29.5-meter tugboat powered by methanol, as part of its green fleet initiative, demonstrating the potential of methanol as a sustainable fuel.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 492.19 Million |

| Market Size by 2032 | USD1127.74 Million |

| CAGR | CAGR of 9.65% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Harbor Towage, Coastal Towage, Terminal Towage) • By Type (Conventional Tug, Tractor Tug, Azimuth Stern Drive Tug, Reverse Tractor Tug, Others) • By Power Capacity (Up to 1000 KW, 1000 to 2000 KW, 2000 to 3000 KW, above 3000 KW) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amsbach Marine (S) Pte Ltd (Singapore), Astro Offshore Pte Ltd. (UAE), Cashman Equipment Corp. (U.S.), Cheoy Lee Shipyards Ltd (Hong Kong), Cochin Shipyard Limited (India), Damen Shipyards Group (Netherlands), Hongkong Salvage & Towage Services Limited (Hong Kong), Jiangsu Zhenjiang Shipyard Co. Ltd. (China), Mazagon Dock Shipbuilders Limited (India), Robert Allan Ltd. (Canada), Sanmar Shipyards (Turkey), Keppel Singmarine (Singapore), Med Marine (Turkey), Svitzer A/S (Denmark), Nichols Brothers Boat Builders (U.S.), Macduff Ship Design Ltd (U.K.), Chittagong Dry Dock Limited (Bangladesh), Drydocks World (UAE), Piriou Shipyard (France), Eastern Shipbuilding Group (U.S.) |

| Key Drivers | • The surge in global shipping activity requires agile and powerful tugboats to efficiently manage vessel operations in increasingly congested ports. |

| Restraints | • The substantial manufacturing and acquisition costs of advanced tugboats hinder smaller port operators from adopting modern solutions. |