Smart Home Automation Market Report Scope & Overview:

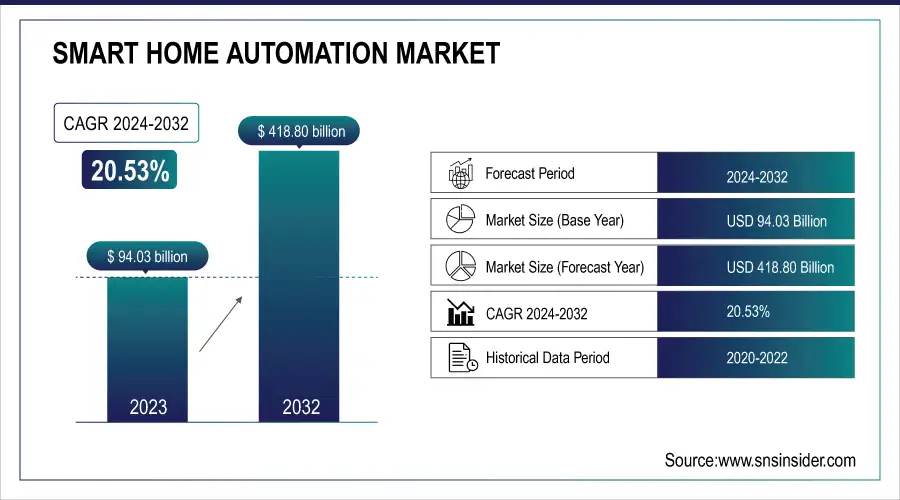

The Smart Home Automation Market was valued at USD 94.03 billion in 2024 and is expected to reach USD 418.80 billion by 2032, growing at a CAGR of 20.53% from 2025-2032.

Connectivity Standards such as Wi-Fi, Zigbee, and Z-Wave are very important in the Smart Home Automation market to provide devices with the means of communicating with each other seamlessly. When prioritizing features like energy efficiency, security, and convenience, the most popular devices include smart thermostats, smart lighting, and smart security systems. As demand for more integrated smart home solutions also continues to grow, households are spending more money on them on average. More than 60.8 million U.S. households (41.3%) adopted smart home technologies in 2024, and load distributions indicate that North America is the world's most mature smart home technology market. Smart home installations cost an average of USD 700,000-USD 750,000 per household, with 90% of smart home installations occurring as part of new construction projects.

Market Size and Forecast

-

Market Size in 2024: USD 94.03 Billion

-

Market Size by 2032: USD 418.80 Billion

-

CAGR: 20.53% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

To Get more information on Smart Home Automation Market - Request Free Sample Report

Smart Home Automation Market Trends

-

Rising demand for convenience, energy efficiency, and security is driving the smart home automation market.

-

Growing adoption of IoT-enabled devices, sensors, and voice-controlled systems is boosting growth.

-

Expansion of connected appliances, lighting, HVAC, and security solutions is enhancing market penetration.

-

Integration with AI, machine learning, and cloud platforms is improving automation and predictive functionality.

-

Increasing focus on energy management, sustainability, and cost savings is shaping adoption trends.

-

Growth of residential construction, urbanization, and smart city initiatives is fueling demand.

-

Collaborations between device manufacturers, software providers, and telecom operators are accelerating innovation and deployment.

The U.S. Smart Home Automation Market was valued at USD 23.90 billion in 2024 and is expected to reach USD 103.30 billion by 2032, growing at a CAGR of 20.08% from 2025-2032. Technological advancements such as AI and IoT for more connected and automated devices are contributing to the growth of the U.S. smart home automation market. With the demand for smart devices such as thermostats, lighting, and security systems, consumers are looking for increased energy efficiency, security, and convenience. The usage of high-speed internet and smartphones boosts smooth integration, whereas rising personal consciousness and choice in the direction of sustainable options additionally propel development.

Smart Home Automation Market Dynamics

Smart Home Automation Market Growth Drivers:

-

Driving Forces Behind the Rapid Growth of the Smart Home Automation Market and Future Trends

Market Drivers The growth of the Smart Home Automation market can widely be attributed to the rising need for convenience, security, and energy efficiency among consumers. The emergence of IoT devices and smart devices has made it possible for users to remotely monitor and control household systems such as lighting, HVAC, and security. The market is also being driven due to an increase in awareness about energy conservation and government initiatives advocating smart infrastructure. Moreover, the incorporation of AI and voice-controlled assistants such as Alexa, Google Assistant, and Siri have made smart homes more accessible and intuitive to use. Some trends, like proximity to wireless technologies and 5G rollout, are speeding up real-time automation features and building mass adoption.

Smart Home Automation Market Restraints:

-

Challenges Hindering Smart Home Automation Market Growth Including Interoperability Privacy and Cybersecurity Concerns

Interoperability among devices from different manufacturers is one of the leading restraints for the Smart Home Automation market. The lack of interconnectivity is a stalemate as various proprietary platforms and protocols are currently being deployed to tackle the diversity of use cases across sectors. The fragmentation can also create complications in compatibility, which could needlessly complicate the user experience and limit how attractive it is for the facilities to completely automate everything. In addition, issues of data privacy and cybersecurity still present challenges. Smart home technologies require individuals to share with them some of their most private details and any leak or misuse of personal data discourages consumers from adopting and enjoying smart home technologies.

Smart Home Automation Market Opportunities:

-

Emerging Market Opportunities in Smart Home Automation Driven by Retrofitting Smart Cities and Elderly Care

There are substantial market opportunities in retrofitting old infrastructure with smart technologies, and home automation is still low or non-existent in the developing country. In addition, a growing number of smart city projects and green building projects around the globe are projected to drive strong demand for integrated automation systems. Developments in new smart appliance technology, energy management, and predictive maintenance present lucrative growth opportunities for manufacturers and solution providers. Also, the growing aging population and adoption of smart technologies for elderly care and assisted living presents an opportunity for growth in the healthcare-aligned home automation segment but is a very niche market пера, more and more smart home devices, and solutions are focused on the elderly and their specific needs.

Smart Home Automation Market Challenges:

-

Challenges in Smart Home Automation Adoption Due to Installation Issues Consumer Awareness and System Reliability

The complication in the installation and setup process is preventing the growth of the market significantly, above all the retrofitting of traditional homes. Expert help is needed by users not so tech savvy and hence its adoption slows down. Furthermore, especially in emerging markets, most consumers are not yet aware of the solutions and they also lack the technical know-how to understand the benefits of smart homes. The other is about how we find it more difficult to ensure long-term reliability and maintenance of connected devices, because if there are frequent software updates and system glitches, it may interrupt daily operation due to loss of connection, control, or state. With the expansion of the market, regional differences are also inevitable, but to achieve sustainable development, it is necessary to standardize quality, performance, and after-sales service.

Smart Home Automation Market Segmentation Analysis

By Component, Hardware dominates the Smart Home Automation market, Services are expected to grow fastest, driven by installation, integration, and maintenance needs.

The Smart Home Automation market was led in hardware with 56.6% of the total market share in 2024. The segment contains important elements that are the base of home automation systems, including smart sensors, control panels, smart locks, thermostats, and security cameras. This is attributed to the increasing adoption of smart security systems, lighting controls, and energy management devices, which demand physical components for operation. In developed regions, hardware will be not as much as extra equipment Development of usage patterns since the consumers are focusing a growing number on performance and protection.

From 2025 to 2032, the services segment is anticipated to grow at the highest CAGR. Fueling this growth is the rising demand for professional installation, integration support, maintenance, and managed services owing to the increasing complexity and use of automation systems. Moreover, enterprise customers are looking for personalized and seamless user experience while service providers who provide continuous assistance and help with system optimization are becoming very much in demand which is why services are going to be the key revenue driver in the future as well.

By Technology, Wireless technology leads the market, Cellular technology is expected to grow fastest, fueled by 5G and always-connected solutions.

Wireless technology dominated the Smart Home Automation market with a 61.8% market share in 2024. This growth is driven by the proliferation of Wi-Fi, Zigbee, Z-Wave, Bluetooth, and different low-power wireless protocols. Wireless systems have been increasingly used for both new constructions and retrofitting existing homes as they have a wide advantage like easy to install, flexible, and low cost. Recent trends in consumer behavior show a shift towards wireless-enabled smart lighting, smart security systems, and voice-controlled devices that eliminate the need for complicated wiring and allow ease of connectivity.

Cellular technology has the fastest CAGR from 2025 to 2032 led by increasing 5G networks and the requirement for always-connected, independent communication networks in smart homes. Whereas traditional wireless systems require home internet, proper cellular technology allows a device to communicate directly with a cloud platform, providing improved reliability and remote accessibility. This is a great boon for rollouts of security applications, smart locks, and energy systems in broadband-scarce areas, and it opens up new avenues for growth.

By Application, Security dominates, The smart kitchen segment is projected to grow fastest with convenience and automation trends.

The Smart Home Automation market was led by the security segment with a share of 29.3% in 2024, as it caters to the demand for advanced home safety and surveillance. Smart locks, video doorbells, motion detectors, and security cameras are some of the most popular products for homeowners who want to monitor and control their homes in real time. And machine learning-based features like facial recognition, anomaly detection, and instant mobile alerts are also paving the way for higher adoption and usage numbers worldwide.

The smart kitchen segment is anticipated to post the fastest CAGR from 2025 to 2032. It is driven by shifting consumer behavior toward the demand for convenience, automation, and sustainability in home cooking and food management. Smart refrigerators, ovens, dishwashers, and voice-activated kitchen gadgets are rising in popularity due to their energy efficiency, time-saving capabilities, and compatibility with virtual assistants. However, with the emergence of busy lifestyles, the smart kitchen solutions market is anticipated to rise significantly in the forecast period of 2023 to 2030.

By Fitment, Retrofit solutions hold the largest share, New construction is expected to grow fastest as developers integrate smart technologies early.

In 2024, the retrofit segment with a 63.3 % market share held the largest market share in the Smart Home Automation market due to the extensive adoption of smart technologies over existing residential property as a result, the relative ease of installing, virtual wireless compatibility, and reduced need for a large amount of setup, homeowners are increasingly upgrading traditional homes smart lighting, security systems, and energy management solutions. This is having a positive effect on segmental growth since retrofit solutions, particularly popular in urban regions where legacy infrastructure replacement is often easier than new construction, are enjoying a sizable market share.

The new construction segment is anticipated to witness the highest growth rate from 2025 to 2032, with builders and developers adopting smart technological features as part of the design of contemporary homes. Such integration at an early stage is important to ensure optimal operation energy efficiency and seamless communication between devices. Smart-ready homes are witnessing rapid growth in this segment, becoming an essential feature in real estate driven by growing urbanization, higher disposable incomes, and an increasing demand for tech-enabled living.

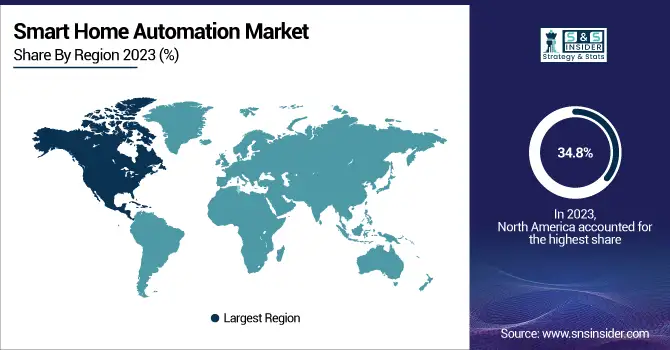

Smart Home Automation Market Regional Analysis

North America Smart Home Automation Market Insights

North America held the largest market share of 34.8% in 2024 in the Smart Home Automation market share owing to high consumer demand for home technologies and high disposable income. Such mature infrastructure, high internet penetration, and increasing awareness of energy-efficient solutions are propelling rapid adoption of smart home systems in the region. For instance, we have the Amazon Alexa ecosystem of the US that combines smart lighting, smart thermostats, and smart security into where users can easily control them centrally. Moreover, Google Nest smart thermostats and video doorbells are gaining traction with American households, taking in more reviews on the convenience and home security spectrum.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Smart Home Automation Market Insights

Asia Pacific is anticipated to exhibit the fastest car from 2025 to 2032 owing to factors such as rapid urbanization, a growing middle-class population, and increasing smartphone penetration. The adoption of smart home technology is expected to increase rapidly as countries such as China, India, and Japan invest heavily in smart city initiatives. Xiaomi in China provides users with connected home products with lower-cost automation ranging from air purifiers to connected TVs to robotic vacuum cleaners allowing home automation to be adopted by a wider set of users. In Japan, Panasonic remains at the forefront of home automation with smart kitchen appliances and energy management systems designed for local tastes and the environment.

Europe Smart Home Automation Market Insights

Europe’s smart home automation market is expanding steadily, driven by rising adoption of connected devices, IoT integration, and energy-efficient solutions. Growing consumer awareness of home security, convenience, and energy management is boosting demand for smart lighting, thermostats, security systems, and voice-controlled devices. Government incentives for energy-efficient technologies and increasing urbanization further support market growth. Leading technology providers and home automation startups are accelerating innovation, enhancing interoperability, and expanding smart home offerings across Europe.

Middle East & Africa and Latin America Smart Home Automation Market Insights

The smart home automation market in the Middle East, Africa, and Latin America is witnessing growth due to rising urbanization, increasing disposable income, and expanding internet and smartphone penetration. Consumers are adopting smart security, lighting, and energy management solutions for convenience and efficiency. Government initiatives supporting smart infrastructure and energy-saving technologies are further driving adoption. Regional players and global technology providers are collaborating to introduce innovative, affordable, and interoperable smart home solutions.

Smart Home Automation Market Competitive Landscape:

Amazon

Amazon, founded in 1994 and headquartered in Seattle, USA, is a global e-commerce and technology leader. Beyond online retail, Amazon drives innovation in cloud computing, AI, consumer electronics, and smart home solutions. Its Alexa platform leverages artificial intelligence and voice recognition to create intelligent, connected experiences. Amazon focuses on enhancing user convenience, enabling personalized interactions, and expanding its ecosystem through seamless integration of AI, smart devices, and services for consumers and businesses worldwide.

-

February 2025: Amazon launched Alexa+, a next-generation AI voice assistant for Prime users, offering enhanced conversational abilities, smart home integration, document summarization, and personalized responses.

Samsung Electronics

Samsung Electronics, founded in 1969 and headquartered in Suwon, South Korea, is a global leader in consumer electronics, semiconductors, and smart home technology. The company develops connected devices, home automation platforms, and AI-driven software to enhance user experiences. Samsung emphasizes innovation, interoperability, and ecosystem expansion, integrating devices with intelligent automation and advanced features. Its SmartThings platform enables seamless control and monitoring of connected homes, empowering users with convenience, efficiency, and smarter living solutions.

-

April 2025: Samsung released a major SmartThings update, featuring enhanced sleep tracking, easier device setup, support for Matter 1.4, smarter automation, and voice message broadcasting across connected devices.

Key Players

Some of the Smart Home Automation Market Companies

-

Amazon

-

Google

-

Apple

-

Philips

-

Honeywell

-

Bosch

-

LG

-

Schneider Electric

-

Ecobee

-

August

-

Ring

-

TP-Link

-

Leviton

-

Control4

-

Crestron Electronics

-

ADT Inc.

-

Savant Systems

-

Logitech

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 94.03 Billion |

| Market Size by 2032 | USD 418.80 Billion |

| CAGR | CAGR of 20.53% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software & Solutions, Services) • By Technology (Cellular, Wireless, Others) • By Application (Security, Lighting, Entertainment, HVAC & Energy Management, Smart Kitchen, Other Appliances) • By Fitment (New Construction, Retrofit) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon, Google, Apple, Samsung, Philips, Honeywell, Bosch, LG, Schneider Electric, Xiaomi, Ecobee, August, Ring, TP-Link, Leviton. |