Smart Hospitality Market Report Scope & Overview:

Get more information on Smart Hospitality Market - Request Sample Report

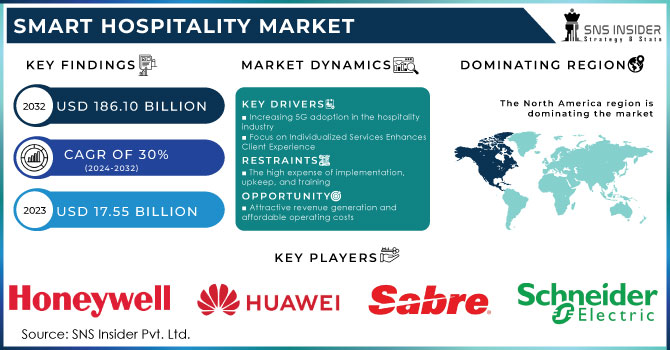

The Smart Hospitality Market is anticipated to increase at a CAGR of 30% from 2024 to 2032, from a value of USD 17.55 billion in 2023 and expected to reach USD 186.10 billion by 2032.

The need for real-time optimal guest experience management, lower operational expenses, and growing interest in IoT are all on the rise, as is the demand for hospitality software and services. These are the main elements that are propelling the development of the smart hospitality market. Smart hospitality is a quickly developing sector that makes use of automated software, intelligent solutions, and mobile devices to enhance customer services. These technologies enable customers to select their rooms, room kinds, and room numbers using their mobile devices, greatly improving the guest experience.

Market Dynamics

Drivers

-

Increasing 5G adoption in the hospitality industry

-

A greater focus is being placed on individualized services to improve the client experience.

-

Increasing consumer desire for guest-focused, hyperconnected personalization and real-time tailored experiences will boost the market.

Hoteliers have the opportunity to establish a strong and meaningful connection with each guest, ensuring they have a memorable experience and increasing the likelihood of receiving positive reviews. By offering a more personalized and tailored travel experience, hoteliers can enhance their brand reputation, foster customer loyalty, and generate additional revenue. The advent of smart hospitality solutions has revolutionized the industry, providing hoteliers with valuable insights and data on guest behavior. This data can be utilized to gain a comprehensive understanding of each visitor, enabling hoteliers to improve their experience through enhanced customer care. With the help of integrated digital platforms such as Property Management System (PMS) and Customer Relationship Management (CRM), hoteliers can access a centralized dashboard that organizes data from various sources. This not only allows for a personalized view of each guest but also helps alleviate operational burdens. the utilization of these digital platforms can lead to a reduction in hotel operating expenses and an increase in guest retention rates. This, in turn, strengthens the hotel's brand positioning and overall success.

By providing a mobile-centric guest experience that enhances the guest's convenience and self-service, hotels are now also reaping benefits. Hoteliers may design a more connected and convenient stay for their customers by developing a mobile-centric booking experience, providing keyless entry using a mobile device, text-based communications, mobile concierge, etc.

Restraints

-

Challenges to data security and information sharing.

-

Need technical persons to effectively handle the software.

-

The high expense of implementation, upkeep, and training

The adoption of sophisticated hospitality systems, including Property Management Systems (PMS) and Guest Experience Management Systems, entails substantial expenses, regardless of whether they are implemented locally or online. The financial constraints imposed by the aftermath of the pandemic have made it particularly challenging for hotels to invest in smart hospitality solutions. The industry is still grappling with the colossal financial losses incurred during this period. Furthermore, hotels that have already embraced smart technologies have encountered significant maintenance costs. However, it is important to recognize that the cost of deployment is typically associated with the level of complexity involved in integrating these applications.

Opportunities

-

Real-time, ideal visitor experience management is becoming more and more popular.

-

Attractive revenue generation and affordable operating costs

-

expanding the usage of energy management systems with the Internet of Things (IoT)

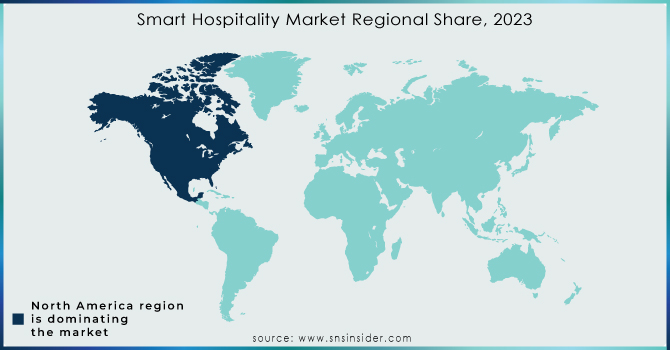

Regional Analysis

North America is the leading in the smart hospitality market, and it is anticipated that it will continue to hold that position throughout the forecast period. This is due to the region's strong demand for high-quality smart services, cloud-based platforms, and top-notch security that goes above and beyond industry standards. The Internet of Things allows hotel staff to remotely control electronic devices in "smart hotels," giving them access to real-time data about their operational state. Asia Pacific, on the other hand, is predicted to experience significant growth during the forecast period. Because of these factors, the smart hospitality market is anticipated to increase significantly throughout the forecast period.

Over the next five years, the smart hospitality industry will increase in this region due to factors like supportive government initiatives and legislation to stimulate the expansion of the hotel sector. The region's smart hotel sector continues to flourish as a result of greater technological advancements, internet infrastructure, expanded IoT applications, and efficient energy use. The market in the region will be driven by a booming tourism sector, a more modern hotel infrastructure, and a high rate of new hotel openings in numerous Asia-Pacific nations like Thailand, Malaysia, and Indonesia.

Need any customization research on Smart Hospitality Market - Enquire Now

Key Players

The major players are IBM, Huawei, Schneider Electric, NEC, Cisco, Honeywell, Sabre, Legrand, Siemens AG, Global Business Solutions, Oracle, Infor, Johnson Controls, Samsung, Leviton, Control4, Wisuite, Stayntouch, Qualsoft Systems, Hospitality Network, Springler-Miller Systems, Guestline, Frontdesk Anywhere, Chris Lewis Group, BuildingIQ, Cloudbeds, and others players.

Recent Developments

In May 2022, Oracle and Orient Jakarta collaborated to develop a cutting-edge property management system. This collaboration proved to be invaluable, especially during the challenging times of the COVID-19 pandemic, as it allowed them to bolster their online presence and provide remote staff training through the use of Oracle Digital Learning technologies.

In January 2022, Johnson Controls made a significant acquisition by purchasing FogHorn, a renowned manufacturer of edge AI solutions. This strategic merger is set to revolutionize the development of sustainable and highly efficient autonomous spaces.

Another notable partnership formed in January 2022 was between Infor and Seven Feathers Casino. This collaboration aims to elevate customer service within the hospitality sector by integrating specialized applications tailored specifically for this industry.

To enhance its digital building offering, which already includes cloud-based building operations and its smart building management platform Desigo CC, Siemens purchased EcoDomus' digital twin software in December 2021.

| Report Attributes | Details |

| Market Size in 2023 | US$ 17.55 Bn |

| Market Size by 2032 | US$ 186.10 Bn |

| CAGR | CAGR of 30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | By Offering[Solution(Property Management System,Guest Experience Management System,Integrated Security Management,Facility Management Software, Network Management Software, Point of Sale Software),Services(Professional Services, Consulting, Integaration and Development, Support and Maintenance, Managed Services)], By Deployment Mode[Cloud, On-premises],By End User[Hotel, Cruise, Luxury, Yatches, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | IBM, Huawei, Schneider Electric, NEC, Cisco, Honeywell, Sabre, Legrand, Siemens AG, Global Business Solutions, Oracle, Infor, Johnson Controls, Samsung, Leviton, Control4, Wisuite, Stayntouch, Qualsoft Systems, Hospitality Network, Springler-Miller Systems, Guestline, Frontdesk Anywhere, Chris Lewis Group, BuildingIQ, Cloudbeds |

| Key Drivers | • Increasing 5G adoption in the hospitality industry • A greater focus is being placed on individualized services to improve the client experience. • Increasing consumer desire for guest-focused, hyperconnected personalization and real-time tailored experiences will boost the market. |

| Market Restraints | • High expense of implementation, upkeep, and training |