Smart Speaker Market Analysis and Overview:

To Get More Information on Smart Speaker Market - Request Sample Report

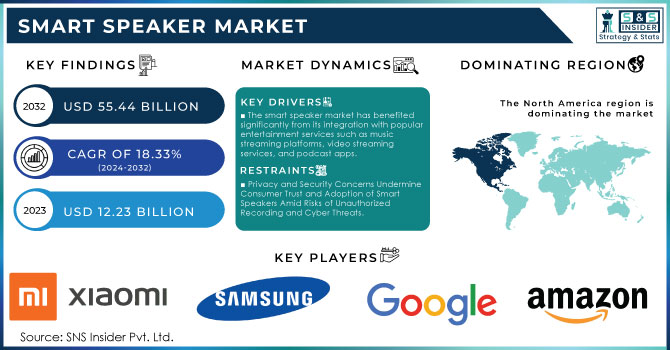

The Smart Speaker Market was valued at USD 12.23 Billion in 2023 and is expected to reach USD 55.44 Billion by 2032, growing at a CAGR of 18.33% over the forecast period 2024-2032.

The smart speaker market has experienced significant growth in recent years, driven by advances in artificial intelligence (AI), voice recognition technology, and the growing integration of smart home ecosystems. These devices, equipped with AI-based voice assistants like Amazon's Alexa, Google Assistant, and Apple's Siri, have transformed the way users interact with technology in their homes, providing hands-free control over a range of tasks, from playing music to controlling smart appliances and accessing real-time information. Voice assistants have become an integral part of the digital landscape, with 30% of internet users aged 16-64 worldwide utilizing them weekly, and in the U.S., around 33.6% of users in the same age group report similar usage. In 2024, approximately 98 million people in the U.S. own smart speakers, reflecting a significant increase in technology adoption. On the technical side, the average voice search result is concise, containing only 29 words, and often pulled from Featured Snippets.

The increasing demand for smart home solutions has been a critical factor in the expansion of the smart speaker market. As consumers look for more convenient ways to manage home automation, smart speakers have become a central hub in their connected home setups. These devices seamlessly integrate with other smart home products, such as lighting systems, thermostats, and security cameras, allowing users to control them through simple voice commands. The growing popularity of smart home devices, coupled with rising disposable incomes, has contributed to higher adoption rates of smart speakers, especially in developed markets like North America and Europe.

Smart Speaker Market Dynamics

Drivers

-

The smart speaker market has benefited significantly from its integration with popular entertainment services such as music streaming platforms, video streaming services, and podcast apps.

Smart speakers function as hubs for entertainment, providing users with a convenient method to manage and access their media consumption using voice commands. By asking their smart speaker, consumers can immediately listen to their preferred songs, podcasts, or audiobooks. Around 95% of U.S. households now subscribe to at least one or more streaming services, with Netflix, Amazon Prime Video, and Apple TV+ topping the charts. Similarly, Music streaming is the dominant format in the US, with 86% of revenue coming from the format in 2023. Certain intelligent speakers provide additional functions like multi-room audio, allowing users to listen to synchronized music in different rooms. Moreover, smart speakers with screens like Amazon Echo Show and Google Nest Hub enhance entertainment by enabling users to watch videos, stream TV shows, and view photos. This smooth incorporation with entertainment platforms is a significant factor in the popularity of smart speakers, particularly among millennials and tech enthusiasts who value convenience and entertainment in their everyday routines. With the increasing popularity of streaming platforms, the smart speaker market is projected to experience more growth.

-

Voice commerce, which involves using voice commands to search for and purchase products online, is a growing trend that is driving demand for smart speakers.

The rising popularity of e-commerce and growing acceptance of voice-activated shopping assistants are leading to more cases when buyers refer to smart speakers for buying and ordering products from Amazon, Walmart, Alibaba, and other online platforms. Voice commerce transactions are expected to increase from 5 billion USD in 2021 to 20 billion USD in 2023. 22% of consumers make purchases directly through voice, and 17% have used it to reorder items. Either user can make a quick request by voice about the available options of the product, or simply receive a recommendation concerning the best product. This simplifies the process and buyers do not have to waste time accessing websites or applications, checking something, or making amendments. Users can reorder household necessities, verify product availability, and get tailored suggestions via their intelligent speakers. This smooth shopping experience is attractive to busy shoppers, leading to an increase in voice commerce. Retailers and brands are realizing the possibilities of voice commerce and are adapting their e-commerce platforms to support voice search. With improved AI algorithms and personalized interactions, the increased sophistication of voice shopping will lead to smart speakers remaining crucial for the growth of voice commerce.

Restraints

-

Privacy and Security Concerns Undermine Consumer Trust and Adoption of Smart Speakers Amid Risks of Unauthorized Recording and Cyber Threats.

Privacy and security concerns are undoubtedly one of the most significant barriers to smart speaker adoption. Many consumers avoid using these devices as they are continuously listening to voice commands, and private communication and other sensitive information might be recorded, stored, or shared without one’s permission. Although smart speakers were reported to have mistakenly recorded private conversations, there is no evidence that this information has been used in any malicious way, but it does raise some privacy and security concerns. In addition, because this technology is interconnected with the Internet and various other devices in the household, it is susceptible to cyber threats. For instance, if a rogue device can take over someone’s Amazon Echo, it also can control the lights and locks of the other smart devices of such a person’s smart home. In this light, consumers feel reluctant to use adopt smart speakers.

Smart Speaker Market Segmentation

By Type

Virtual Assistants dominated the segment with a 45% market share in 2023. Famous instances include Amazon's Alexa, Google Assistant, and Apple's Siri, which provide features such as playing music, controlling smart lights, giving weather updates, and organizing schedules. As an example, the Echo series from Amazon, which comes with Alexa, is widely utilized for handling tasks and managing IoT devices within intelligent households. The smooth incorporation of various third-party apps and devices is what makes virtual assistants an integral aspect of contemporary life, fueling their market supremacy.

Wireless speakers are expected to become the fastest-growing segment during 2024-2032, due to their ease of connectivity, portability, and superior sound quality. These devices usually have Bluetooth or Wi-Fi capabilities, enabling users to listen to music and podcasts wirelessly. Some instances are Sonos wireless speakers and JBL's Bluetooth speakers, created for superior audio experiences. Businesses such as Sonos have capitalized on the desire for audio systems that can be synchronized in multiple areas within a household.

By Application

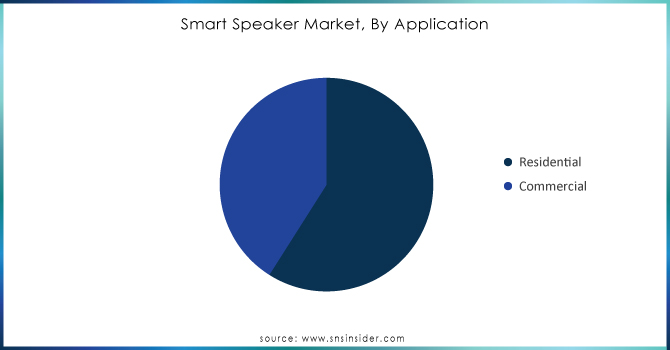

The residential segment led the smart speaker market with more than 59% market share in 2023, mainly driven by the increasing popularity of voice-activated home assistants, which simplify daily activities. Devices like Amazon Echo, Google Nest, and Apple HomePod blend effortlessly into homes, providing functions such as music streaming via voice command, smart home management, and daily alerts. With the growing popularity of smart home devices, the need for smart speakers in homes is increasing due to their ability to connect with other smart appliances like lights, thermostats, and security systems, making them essential for home automation.

The commercial segment is projected to register the fastest growth rate during 2024-2032, due to its benefits for improving customer interactions and workplace productivity. An instance of this is Marriott Hotels incorporating Amazon Alexa for Hospitality so that guests can use voice commands to manage devices in their rooms. Moreover, Google Nest smart speakers are utilized in workplace settings to organize meetings, handle calendars, and offer touch-free access to information.

Do You Need any Customization Research on Smart Speaker Market - Enquire Now

Regional Analysis

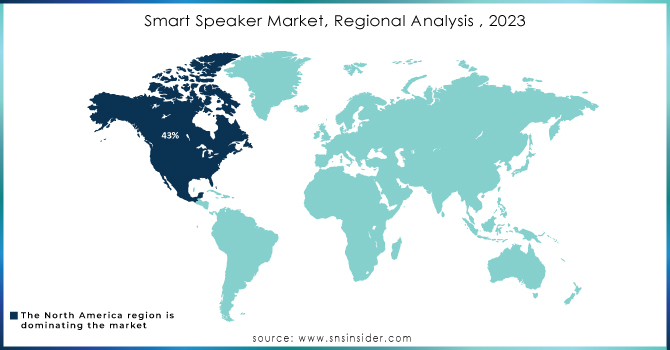

North America led the smart speaker market in 2023 with a 43% market share, due to the high adoption of smart home technology and rising interest in AI-powered virtual assistants such as Amazon Alexa, Google Assistant, and Apple Siri. Amazon, Google, and Apple play significant roles in maintaining dominance, and they are key market players who consistently innovate their product offerings. The widespread use of Amazon's Echo devices and Google Nest products in homes throughout the United States and Canada. These gadgets are compatible with smart home systems, improving ease with voice-controlled operation of household devices, security systems, and entertainment arrangements.

APAC is anticipated to grow at a faster CAGR during 2024-2032, due to urbanization, higher internet usage, and a burgeoning middle class that favors smart home technology. China and India are at the forefront of the growth in this area, with companies such as Baidu, Alibaba, and Xiaomi introducing affordable smart speakers designed for local languages and preferences. For instance, Xiaomi's Mi Smart Speaker and Alibaba's Tmall Genie are popular in China, while Amazon and Google have increased their presence in India. The need for multilingual voice assistants with localized features has positioned APAC as a major growth center.

Key Players

The major key players in the Smart Speaker Market are:

-

Amazon (Echo Dot, Echo Show)

-

Google (Nest Audio, Nest Mini)

-

Apple (HomePod, HomePod Mini)

-

Bose (Home Speaker 300, Portable Smart Speaker)

-

Samsung (Galaxy Home Mini, AKG Wireless Smart Speaker)

-

Sonos (Sonos One, Sonos Move)

-

Alibaba (Tmall Genie X1, Tmall Genie CC)

-

Xiaomi (Mi AI Speaker, XiaoAI Speaker Pro)

-

Sony (SRS-RA3000, LF-S50G)

-

Lenovo (Smart Clock Essential, Lenovo Smart Display)

-

Harman Kardon (Citation One, Invoke)

-

JBL (JBL Link Portable, JBL Link Music)

-

LG (XBOOM AI ThinQ WK7, XBOOM AI ThinQ WK9)

-

Microsoft (Surface Headphones, Cortana Integrated Speaker)

-

Facebook/Meta (Portal, Portal Mini)

-

Tencent (Xiaowei Smart Speaker, Tingting Smart Speaker)

-

Baidu (DuerOS Xiaodu Smart Speaker, Xiaodu at Home)

-

Marshall (Marshall Uxbridge Voice, Marshall Stanmore II Voice)

-

Philips (Smart Sleep Wake-Up Light, Philips Hue Smart Speaker)

-

Panasonic (SC-GA10, SC-NA10)

Suppliers who provide raw materials/components for these key players:

-

Qualcomm

-

MediaTek

-

Texas Instruments

-

Broadcom

-

NXP Semiconductors

-

STMicroelectronics

-

Murata Manufacturing

-

Infineon Technologies

-

Analog Devices

-

Micron Technology

Recent Development

-

In July 2024, Apple launched the HomePod Mini smart speaker in a new midnight color. Made with 100% recycled mesh fabric, the new model is similar to the Midnight HomePod second-gen launched early last year.

-

In July 2024, Amazon released Echo Spot, an Alexa-enabled smart alarm clock with a compact colorful display that makes it easy to see the time, weather, and song titles from your nightstand.

-

In October 2023, Sonos launched in India the Sonos Era 300 and Sonos Era 100 smart speakers. The US-based audio device maker described the Era 300 as a bold, revolutionary speaker built to deliver the best experience for outloud spatial audio with Dolby Atmos.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 12.23 Billion |

| Market Size by 2032 | USD 55.44 Billion |

| CAGR | CAGR of 18.33% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Virtual Assistants, Wireless Speakers, Others) • By Virtual Assistant (Alexa, Google Assistant, Cortana, Siri, Others) • By Component (Hardware, Software) • By Application (Residential, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon, Google, Apple, Bose, Samsung, Sonos, Alibaba, Xiaomi, Sony, Lenovo, Harman Kardon, JBL, LG, Microsoft, Facebook/Meta, Tencent, Baidu, Marshall, Philips, Panasonic |

| Key Drivers | • The smart speaker market has benefited significantly from its integration with popular entertainment services such as music streaming platforms, video streaming services, and podcast apps. • Voice commerce, which involves using voice commands to search for and purchase products online, is a growing trend that is driving demand for smart speakers. |

| RESTRAINTS | • Privacy and Security Concerns Undermine Consumer Trust and Adoption of Smart Speakers Amid Risks of Unauthorized Recording and Cyber Threats. |