Smart Wildlife Bridge Sensor Market Size Analysis:

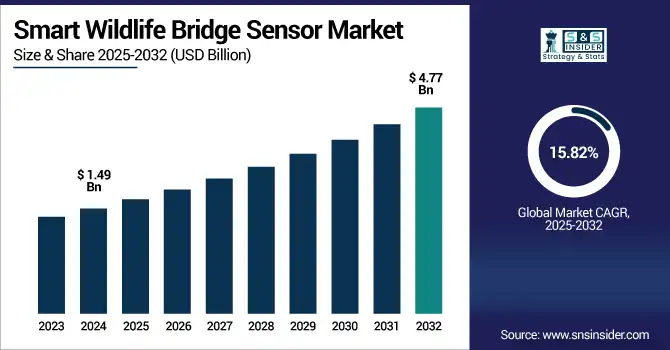

The Smart Wildlife Bridge Sensor Market Size was valued at USD 1.49 billion in 2024 and is expected to reach USD 4.77 billion by 2032 and grow at a CAGR of 15.82% over the forecast period 2025-2032. Global Smart Wildlife Bridge Sensors Market includes market segmentation, regional dynamics, competitive landscape, and emerging technologies. This is driven by the growing emphasis on wildlife protection, road safety, and smart infrastructure. The increase in government initiatives for biodiversity safeguarding and ecosystem observation using sensor-based wildlife corridors is speeding up adoption. Conservation, transportation, and infrastructure, all these factors together contribute to the Global Smart Wildlife Bridge Sensor market growth across the world.

To Get more information on Smart Wildlife Bridge Sensor Market - Request Free Sample Report

For instance, integration of AI and edge analytics in sensor networks has improved wildlife detection accuracy by over 60% in real-time deployments.

The U.S. Smart Wildlife Bridge Sensor Market size was USD 0.35 billion in 2024 and is expected to reach USD 1.09 billion by 2032, growing at a CAGR of 15.48% over the forecast period of 2025–2032.

The U.S. Market is growing significantly with increasing awareness of wildlife-vehicle collisions, rising ecological conservation efforts, and robust government support for smart infrastructure. The purpose of these sensors is to minimize road deaths and provide tracking live data on wildlife movement. Smart Wildlife Bridge Sensor Market analysis highlights evolving the U.S. adoption patterns driven by policy and innovation. The continual adoption of tech through national parks, department of transports, and infrastructure projects in line with various sustainability goals is yet increasing the demand of the market.

For instance, over 60% of the U.S. national parks adjacent to major highways have adopted or piloted smart sensor networks to reduce habitat fragmentation.

Smart Wildlife Bridge Sensor Market Dynamics:

Key Drivers:

-

Rising Wildlife-Vehicle Collisions are Pushing Governments to Adopt Sensor-Based Bridge Solutions for Wildlife Protection and Road Safety.

Wildlife-vehicle collisions have devastating consequences for both human life and ecosystems. Many of developed and developing nations governments are also hitting their targets using smart bridge solutions with sensor technology to reduce these cases. The ability of these sensors to monitor wildlife, issue early alerts, and track movement will avoid potential crossings and allow for faster management by authorities. Additionally, insurance companies and road safety councils are promoting these solutions fueling the market growth and adoption at local and national levels.

For instance, authorities using real-time wildlife detection systems have reported a 60% improvement in response time to animal incursions on roads.

Restraints:

-

High Installation and Maintenance Costs of Smart Wildlife Sensors Limit Adoption Across Underfunded Regions and Remote Landscapes.

Smart wildlife bridge sensor technologies, while effective, come with high upfront costs, such as infrastructure modification, sensor calibration, and post-installation maintenance. Many conservation agencies, particularly those in developing countries and/or remote areas, do not have the money and technical assistance to implement widespread deployments. For instance, cost increases yet again when you throw in the need for maintenance in snowy mountains or tropical forests. Smart Wildlife Bridge Sensor Market trends indicate cost barriers remain a challenge. These nuances inhibit adoption in financially constrained gov departments and NGOs, limiting the market, and slow down sensors infusion to wildlife bridge projects.

Opportunities:

-

Technological Advancements in AI-Based Sensor Analytics Enhance Tracking, Prediction, and Response Capabilities in Wildlife Bridges.

Real-time detection, analysis, and response of movement patterns has been revolutionized through the application of artificial intelligence (AI), integrated with Wildlife sensors. With machine learning algorithms, it is now possible to identify species, predict migration patterns, and send warnings automatically upon detection. This capability enables proactive management of the ecosystem and prevents collisions with wildlife. The continuous innovation of the sensor hardware, cloud-based connectivity, and AI-based software renders these systems more intelligent and scalable thus exposing huge profits for the manufacturers and service providers in the market to build these solutions with advanced and data-driven conservation infrastructure.

For instance, the integration of machine learning has cut false-positive wildlife detection rates by more than 60% in multi-species zones.

Challenges:

-

Environmental Constraints and Terrain Variability Pose Difficulties in Deploying and Sustaining Sensor Networks Over Time.

Smart sensors need to walk in different areas including mountains, forests, wetlands, and each of those has unique environmental difficulties. Extreme weather, dense vegetation, wildlife tampering, and soil erosion may destroy or impair sensor operability. Moreover, battery technology and power supply constraints add additional problems in terms of operational deployment in off-grid areas. These operational challenges result in high O&M costs and complexity that can make continuous monitoring of these systems extremely difficult, presenting a major challenge for O&M. Some of these terrain-specific limitations will, however, need to be addressed so as to enable effective expansion of smart wildlife bridge sensor market.

Smart Wildlife Bridge Sensor Market Segmentation Analysis:

By Type

In 2024, the Infrared Sensors had the highest Smart Wildlife Bridge Sensor Market share of around 29.50% due to their ability to detect objects in low light, and even nocturnal environments, better than any other types of sensors. This also enables them to work well in remote locations where a signal might be blocked. Due to their low-power consumption and high stability, these sensors are commonly selected for long-term deployment. There are some powerful infrared solutions from companies including Banner Engineering that engineers have used broadly for ecological bridge projects. They have rapidly become the standard globally for wildlife corridor projects due to their low cost and ease of integration.

Camera Sensors is anticipated to grow at a compound annual growth rate (CAGR) of 17.59% over 2024-2032, owing to increased adoption by detectives to determine species and analyze behavioral patterns. It is equipped with sensors that help confirm that the animals have crossed and it can also be used for conservation and research purposes due to its visual confirmation. Bushnell for its high-tech wildlife camera systems have been a big factor in this explosion. By integrating with AI technologies, the accuracy of the monitoring is improved which makes camera sensors an attractive observation tool for dynamic and real time ecological projects.

By Application

In 2024, Wildlife Monitoring accounted for the largest revenue share of 36.10%, attributed to the increasing interest to protect animal migration routes and reduce habitat fragmentation. Bridge sensors can be installed on a wide scale, as the need to monitor endangered species has become a global challenge. A key player in providing bioacoustic and sensor-based monitoring tools for these efforts is Wildlife Acoustics Inc. Solutions that provide high-quality movement information and ecological insights useful for policy now play an especially important role for park authorities, NGOs, and governments.

Environmental Monitoring is expected to witness the fastest CAGR of 17.64% during the period from 2024 to 2032, due to its increasing application for measuring environmental variables such as humidity, temperature, and air quality. Now these data points are used to assess the evolution of ecosystems under climate change and infrastructure stress. Smart Platforms for Real-Time Ecological Reporting Libelium is an IoT-based environmental sensors provider that supports these kinds of use cases, including reporting ecosystems in real time. They are being more frequently employed in adaptive management and policy development of conservation programs.

By Connectivity

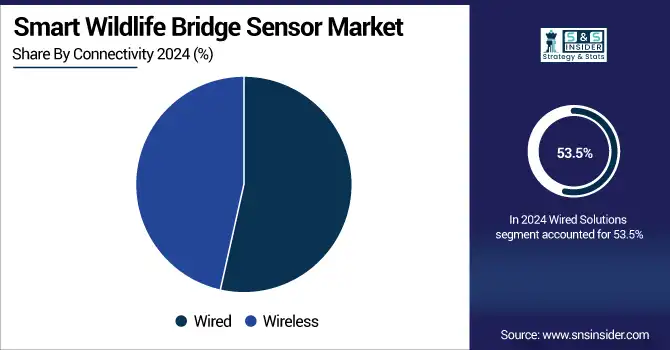

The wired solutions segment captured a 53.5% revenue share for a majority of the market in 2024, owing to the ability to allow a continuous influx of data, creating a real-time monitoring system that is dependable and consistent. Wired sensors are typically blitzed in high-traffic regions where long-term connectivity is necessary to protect wildlife in these areas. Schneider Electric, which has high-reliability industrial sensor systems, is one of the enablers of these technologies. Governments and agencies have responsible and safe either government solutions as their first choice for industries in sourcing development systems where infrastructure and utility are already established.

Wireless is expected to register the highest CAGR of 16.16% over 2024-2032 due to its convenience of deployment in off-grid or rugged terrain environments. Wireless systems have done away with the need for wiring which makes them great at quick installations. Hiber, a satellite-connected wireless sensor network company, facilitates enormous data transfer across terrestrial connections even in the most remote ecological bridges. It is this inherent flexibility which is promoting wireless systems in developed and emerging conservation markets.

By End-User

In 2024, Government Agencies emerged as the dominant revenue spender with a top market share of 38.5% for being the key implementers of wildlife protection programs at national and state levels and ecological safety civilization infrastructure. Funded by international agencies, these bodies place sensors to save bio-diversity and cut down accidents due to these heavy trucks. Many such departments use environmental sensors providing telemetry, such as those offered by Thermo Fisher Scientific, for data collection and real-time analysis. Their tools are essential for compliance with regulation and meaningful decisions about conservation policy for most jurisdictions.

Infrastructure Companies will witness a swift growth in the segment with a 18.48% CAGR over 2024-2032 due to the growing need of eco-design to fluff roads, tunnels, and railway projects. These companies are integrating smart sensors to help drive sustainability objectives and reduce environmental harm. Global infrastructure firm AECOM has taken an active role in moving wildlife bridges with built-in sensor technologies to new development areas. Their participation creates environmentally friendly construction and accelerates the growing market.

Smart Wildlife Bridge Sensor Market Regional Outlook:

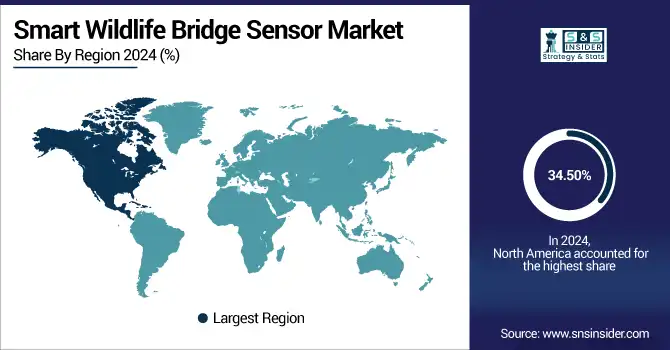

North America dominated the market with a revenue share of 34.50% in 2024 due to the support of effective conservation policies, technology leadership, and strong infrastructure. Now, to reduce wildlife-vehicle collisions and protect biodiversity, governments and environmental agencies all over the U.S. and Canada are using smart sensors to monitor wildlife on wildlife bridges. Another factor that contributes to the dominance of North America in the smart wildlife bridge sensor industry globally is the actuarial presence of leading sensor manufacturers and an increase in funding for ecological research.

-

The U.S. dominates the North American market due to extensive investment in smart infrastructure, strong governmental policies for wildlife conservation, and the widespread deployment of advanced sensor technologies across national parks, highways, and ecological bridges to prevent wildlife-vehicle collisions.

Asia Pacific is slated to witness the highest growth with a CAGR of 20.50% during the forecast period over 2024-2032 owing to fast infrastructural development, urbanization, and increasing environmental concern. China, India, and Australia are among the countries pouring resources into sensor-laden wildlife corridors designed to address biodiversity loss. Population growth and urbanization across developing regions is also driving demand at the regional level, with the potential for Asia Pacific to become the most lucrative growth frontier in this market through wide adoption of smart technologies in transportation planning and development supported by government-backed green infrastructure programs.

-

China leads the Asia Pacific market owing to large-scale infrastructure development, rising environmental awareness, and significant government funding for ecological protection. The country’s focus on smart cities and sustainable transport is accelerating the adoption of wildlife bridge sensors across expanding urban and rural corridors.

Europe is expected to hold significant share in the Smart Wildlife Bridge Sensor Market since, the region has strict environmental regulations and is known for conservation activities and investment in sustainable infrastructure. By contrast, nations, such as Germany, the Netherlands and Sweden are increasingly incorporating sensor-based wildlife crossings as part of the road network. EU encouragement, now both monetary and legislative, to protect biodiversity makes it easier to adopt technologies for more complex cross-border ecological connectivity projects.

-

Germany dominates the European Smart Wildlife Bridge Sensor Market due to its advanced infrastructure, strict environmental regulations, and proactive government initiatives. The country leads in deploying sensor-equipped wildlife bridges to reduce collisions and support biodiversity across highways and protected ecological zones.

The Middle East & Africa is experiencing growth attributed to the UAE investing in sustainable infrastructure and environmental preservation. Brazil ranks highest in Latin America on account of its natural diversity, and the increasing use of sensor technologies in ecological applications to safeguard wildlife at key habitats and major transportation corridors.

Get Customized Report as per Your Business Requirement - Enquiry Now

Smart Wildlife Bridge Sensor Companies are:

Major Key Players in Smart Wildlife Bridge Sensor Market are Banner Engineering, Bushnell Corporation, Wildlife Acoustics Inc., Libelium, Schneider Electric, Hiber, Thermo Fisher Scientific, AECOM, Rocky Mountain Instrument Co., and Sensara and others.

Recent Developments:

-

In November 2024, the University of Amsterdam implemented solar-powered wildlife camera arrays with AI detection that wirelessly transmit photos. Trials showed a 43% lifetime cost reduction and streamlined species monitoring via edge-AI.

-

In March 2025, IoT-enabled Reolink trail cameras with IR lighting were installed under 27 bridges to monitor bat activity. Data collected feeds a cloud dashboard (BatMap), demonstrating real-time bridge-based wildlife sensing.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.49 Billion |

| Market Size by 2032 | USD 4.77 Billion |

| CAGR | CAGR of 15.82% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Infrared Sensors, Motion Sensors, Camera Sensors, Acoustic Sensors, Others) • By Application (Wildlife Monitoring, Traffic Management, Bridge Safety, Environmental Monitoring, Others) • By Connectivity (Wired, Wireless) • By End-User (Government Agencies, Conservation Organizations, Research Institutes, Infrastructure Companies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | FLIR Systems, Trailguard AI, Senstar Corporation, Axis Communications, Bosch Security and Safety Systems, Browning Trail Cameras, Wildlife Acoustics, Inc., HIKVISION, Panasonic Corporation and Reconyx Inc. |