Static Random-Access Memory Market Size

To get more information on Static Random-Access Memory Market - Request Free Sample Report

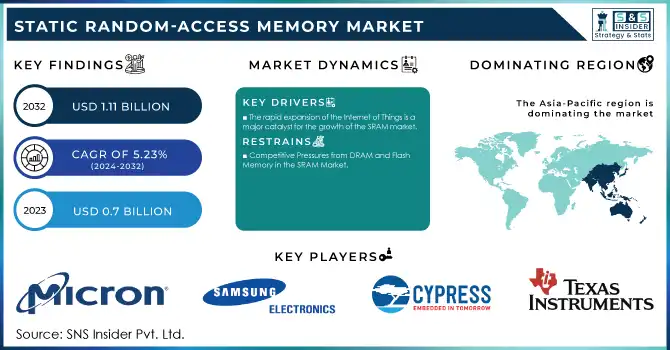

The Static Random-Access Memory Market Size was valued at USD 0.7 billion in 2023 and is expected to grow to USD 1.11 billion by 2032 and grow at a CAGR of 5.23% over the forecast period of 2024-2032.

The growing demand for high-performance computing (HPC) across industries is a major driver for the SRAM market. As industries like telecommunications, healthcare, and autonomous vehicles require faster data processing, the need for high-speed memory solutions has surged. Static Random Access Memory (SRAM), renowned for its speed and reliability, is crucial in these applications due to its ability to provide rapid data access. This increase in demand for HPC solutions directly translates to a heightened need for SRAM chips, particularly in sectors where data processing speed is critical.

The development of high-speed memory solutions is central to advancements in embedded systems, which rely on SRAM for efficient performance. A comprehensive analysis of traditional SRAM and DRAM cells reveals that while SRAM cells take up more area, their speed and reliability make them indispensable in real-time, high-performance applications. Additionally, innovations in memory designs, such as the introduction of a new P-3T1D DRAM cell with 50% faster reading times, highlight the continuous drive for faster and more efficient memory technologies. These innovations in memory architecture, alongside the growing demand for AI, machine learning, and IoT, contribute significantly to the SRAM market's expansion.

As industries move towards more computationally intensive workloads, the demand for SRAM will continue to rise. In particular, the automotive and mobile device sectors, which rely heavily on low-latency, high-speed memory, will fuel further growth. The increasing complexity of computational tasks in these industries reinforces the importance of SRAM in the broader technology ecosystem, ensuring its role in driving future market growth. With rapid technological advancements and rising demand, the SRAM market is poised for robust expansion in the coming years.

Static Random-Access Memory (SRAM) Market Dynamics

Drivers

-

The rapid expansion of the Internet of Things is a major catalyst for the growth of the SRAM market.

With IoT applications spreading across sectors such as healthcare, automotive, smart homes, and industrial automation, the demand for efficient, low-power, and high-speed memory solutions like SRAM has become more pressing. IoT devices require embedded systems that can handle real-time data processing and provide quick access to frequently used data. SRAM's ability to offer low latency and high-speed data retrieval, along with its energy efficiency, makes it the perfect fit for these applications. As IoT networks become more complex, with an increased reliance on sensors, actuators, and controllers, the need for SRAM with enhanced performance is expected to rise. These devices must process large amounts of data in real-time, with minimal power consumption, and SRAM ensures seamless data access for these operations. The expanding use of IoT in critical sectors such as autonomous vehicles, medical devices, and smart cities further underscores the importance of SRAM for ensuring reliability and high-speed performance in these applications. The rise of next-gen IoT technologies, including 5G networks, edge computing, and AI-driven applications, amplifies the need for high-performance memory solutions like SRAM. As IoT ecosystems grow, particularly with the proliferation of connected devices and smart applications, the demand for SRAM is poised to surge, driving the overall growth of the market and positioning SRAM as a key enabler of the IoT revolution.

Restraints

-

Competitive Pressures from DRAM and Flash Memory in the SRAM Market

The SRAM (Static Random-Access Memory) market faces strong competition from DRAM (Dynamic RAM) and Flash memory, each offering distinct advantages that limit SRAM's broader adoption. DRAM is the main rival to SRAM, particularly in general-purpose computing applications. While SRAM offers faster data access, DRAM provides higher memory density and is more cost-effective due to its simpler structure, using fewer components per cell. This allows DRAM to deliver larger memory capacities at a lower cost per bit, making it the preferred choice for consumer electronics, personal computers, and servers. Flash memory, on the other hand, competes with SRAM in non-volatile storage applications. Unlike SRAM, which is volatile, Flash memory retains data even when power is lost, making it ideal for solid-state drives (SSDs), USB drives, and memory cards. Flash offers significantly lower cost per gigabyte compared to SRAM, making it more suitable for storage needs where large capacities are crucial. Although Flash has slower read/write speeds than SRAM, it still outperforms traditional storage devices like hard drives, offering a good balance of cost and performance.

Static RAM Market Segment Analysis

by Type

The Synchronous SRAM (SSRAM) segment holds a dominant share of around 66% in the Static Random Access Memory market in 2023. This type of SRAM is widely preferred due to its faster data transfer rates and synchronization with system clocks, making it ideal for high-performance applications. Synchronous SRAM is used extensively in systems requiring high-speed data access and low latency, such as cache memory in processors, network devices, and graphics cards. Its ability to offer reliable and efficient performance in real-time data processing contributes significantly to its market dominance. The growing demand for faster, more efficient memory solutions in sectors like telecommunications, computing, and automotive further drives the adoption of synchronous SRAM, ensuring its continued leadership in the market.

by Memory

The "Up to 1Mb" segment dominates the Static Random-Access Memory market with a share of around 44% in 2023. This segment is primarily driven by the widespread use of SRAM in embedded systems, consumer electronics, and automotive applications, where memory requirements are typically lower. Static Random Access Memory with capacities up to 1Mb offers the ideal balance of speed, reliability, and power efficiency for small-scale applications such as microcontrollers, real-time systems, and peripheral devices. It is particularly favored in applications where fast data retrieval is crucial, but the size of the memory does not need to exceed 1Mb. The segment’s strong market position reflects the high demand for compact, energy-efficient memory solutions in these sectors, supporting its continued growth in the Static Random Access Memory market.

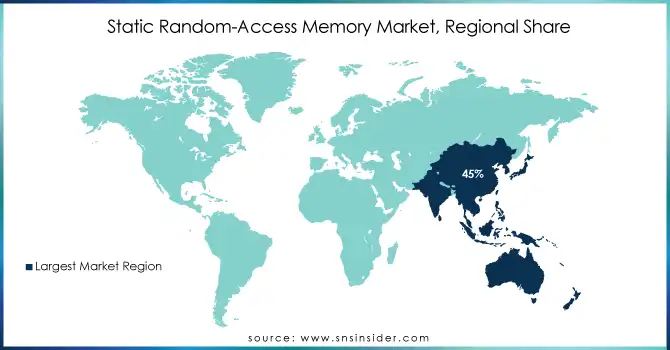

SRAM Market Regional Outlook

Asia-Pacific holds a dominant 45% share of the Static Random-Access Memory market in 2023, driven by the region's robust electronics manufacturing sector. Key players such as China, Japan, South Korea, and Taiwan are major contributors, with leading semiconductor companies like Samsung Electronics, SK hynix, and Taiwan Semiconductor Manufacturing Company playing a pivotal role in SRAM production. China, the largest market, benefits from significant investments in tech infrastructure, boosting SRAM demand in consumer electronics, automotive, and IoT sectors. Japan and South Korea focus on high-performance SRAM for advanced computing and telecommunications, while Taiwan continues to lead in semiconductor innovation. The growth of IoT, 5G, and electric vehicles further accelerates SRAM demand, solidifying Asia-Pacific's dominance in the global market.

North America is expected to be the fastest-growing region in the Static Random-Access Memory market from 2024 to 2032. The growth is primarily driven by the region's strong presence in advanced technology sectors such as high-performance computing, telecommunications, automotive, and consumer electronics. The United States, in particular, is home to leading semiconductor companies, including Intel, Micron Technology, and Advanced Micro Devices, which are crucial players in the SRAM market. The increasing demand for data centers, cloud computing, and AI applications is propelling the need for high-speed, low-power memory solutions like SRAM. Additionally, the growing adoption of electric vehicles and IoT devices in North America further drives the demand for reliable and efficient memory technologies. As the region continues to invest in infrastructure and technology innovation, the North American SRAM market is set for substantial growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major Players in Static Random-Access Memory Market with their product:

-

Micron Technology (Mobile SRAM, High-Speed SRAM)

-

Samsung Electronics (LPDDR SRAM, High-Performance SRAM)

-

Cypress Semiconductor (now part of Infineon) (PSoC SRAM, High-Speed SRAM)

-

NXP Semiconductors (Automotive SRAM, General-Purpose SRAM)

-

STMicroelectronics (Automotive and Industrial SRAM)

-

Texas Instruments (Low-Power SRAM, High-Speed SRAM)

-

SK hynix (Mobile SRAM, DRAM/SRAM hybrid products)

-

Renesas Electronics (Automotive SRAM, Embedded SRAM)

-

ON Semiconductor (Automotive SRAM, Industrial SRAM)

-

Intel Corporation (SRAM for Networking Equipment, Embedded SRAM)

-

Toshiba Corporation (SRAM for Consumer Electronics, Automotive SRAM)

-

Microchip Technology (Microcontroller SRAM, Flash and SRAM solutions)

-

Broadcom (Networking SRAM, High-Speed SRAM)

-

Analog Devices (Specialized SRAM for Industrial Applications)

-

Winbond Electronics (General-Purpose SRAM, DRAM/SRAM solutions)

-

Infineon Technologies (Automotive SRAM, Low-Power SRAM)

-

Fujitsu Semiconductor (High-Speed SRAM, Embedded SRAM)

-

Qimonda (Mobile SRAM, DRAM/SRAM integrated solutions)

-

Elpida Memory (Mobile and High-Performance SRAM)

-

GigaDevice Semiconductor (Low-Power SRAM, Flash-SRAM hybrid products)

List of Suppliers provide raw materials used in the production of Static Random-Access Memory (SRAM) chips are primarily semiconductor materials and other essential components used in manufacturing integrated circuits (ICs).

1. Silicon Wafers Suppliers:

-

SUMCO Corporation (Silicon Wafers)

-

Shin-Etsu Chemical Co., Ltd. (Silicon Wafers)

-

Global Wafers Co., Ltd. (Silicon Wafers)

-

Siltronic AG (Silicon Wafers)

2. Specialty Metals and Chemicals:

-

BASF (Chemicals for semiconductor manufacturing)

-

Air Products and Chemicals (Specialty gases for semiconductor processing)

-

Dow Inc. (Chemicals and materials for semiconductor packaging)

- Merck Group (Materials and chemicals for semiconductor processes)

3. Photoresists and Lithography Chemicals:

-

Tokyo Ohka Kogyo Co., Ltd. (TOK) (Photoresists)

-

JSR Corporation (Photoresists and chemicals)

-

DuPont (Photoresists and lithography materials)

-

Shin-Etsu Chemical Co., Ltd. (Silicon wafers, and photoresists)

4. Packaging and Bonding Materials:

-

ASE Technology Holding (IC packaging and assembly services)

-

Amkor Technology (Packaging solutions for semiconductors)

-

JCET Group (Semiconductor packaging materials)

5. Semiconductor Equipment Manufacturers:

-

Applied Materials (Equipment and materials for semiconductor fabrication)

-

Lam Research (Etching and deposition equipment for semiconductor manufacturing)

-

ASML (Photolithography equipment for semiconductor manufacturing)

6. Rare Earth Materials and Other Components:

-

China Northern Rare Earth Group High-Tech Co. (Rare earth materials for semiconductor production)

-

Molycorp (now part of MP Materials) (Rare earth elements used in semiconductor components)

Recent Development

-

January 9, 2024, Infineon Technologies introduced radiation-hardened asynchronous SRAM chips for space and harsh environments. Designed with Infineon’s RADSTOP technology, these rad-hard SRAMs offer high reliability and performance, with access times as low as 10 nanoseconds and embedded error correction code (ECC) for single-bit error correction.

-

April 9, 2024, Intel unveiled its Gaudi 3 AI accelerator at the Intel Vision event, built on a 5nm process. Offering 50% faster AI performance and 40% greater efficiency than NVIDIA’s H100, Gaudi 3 provides open community-based software and industry-standard Ethernet networking for scalable systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 0.7 Billion |

| Market Size by 2032 | USD 1.11 Billion |

| CAGR | CAGR of 5.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Asynchronous SRAM, Synchronous SRAM) • By Memory size (Up to 1Mb, 1Mb to 4Mb, 4Mb to 16Mb, Above 16 Mb) • By End-Use Industry(IT & Telecom, Consumer Electronics, Automotive, Aerospace & Defense, Industrial, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Micron Technology, Samsung Electronics, Cypress Semiconductor (now part of Infineon), NXP Semiconductors, STMicroelectronics, Texas Instruments, SK hynix, Renesas Electronics, ON Semiconductor, Intel Corporation, Toshiba Corporation, Microchip Technology, Broadcom, Analog Devices, Winbond Electronics, Infineon Technologies, Fujitsu Semiconductor, Qimonda, Elpida Memory, GigaDevice Semiconductor. |

| Key Drivers | • The rapid expansion of the Internet of Things (IoT) is a major catalyst for the growth of the SRAM (Static Random Access Memory) market. |

| Restraints | • Competitive Pressures from DRAM and Flash Memory in the SRAM Market. |