Smart Wind Turbine Blade Sensor Market Report Scope & Overview:

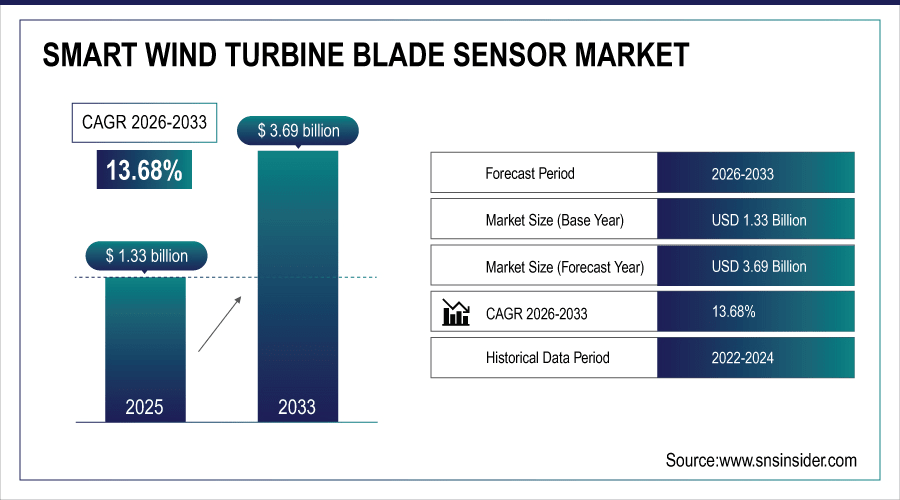

The Smart Wind Turbine Blade Sensor Market size was valued at USD 1.33 Billion in 2025E and is projected to reach USD 3.69 Billion by 2033, growing at a CAGR of 13.68% during 2026-2033.

The Smart Wind Turbine Blade Sensor Market analysis highlights the use of various sensors such as vibration, strain, temperature and acoustic emission in blade inspection for longer life and failure detection. Increasingly growing need for condition and structural health monitoring (SHM) is fueling the market growth with offshore applications acquiring faster pace of growth in line with the more severe operating conditions.

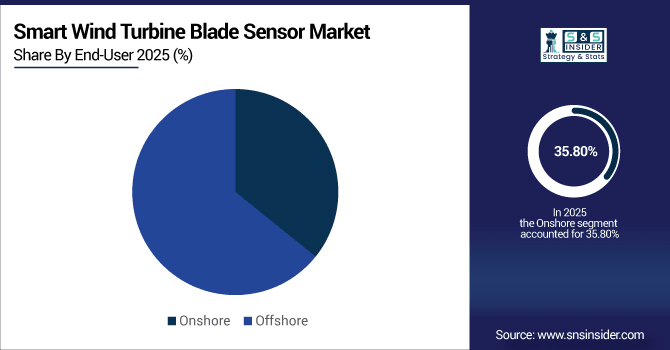

The offshore wind turbine segment is projected to grow at a faster rate compared to onshore, with some reports estimating it to account for over 35% of the smart blade sensor market by 2025, driven by harsher environmental conditions and higher maintenance costs.

To Get More Information On Smart Wind Turbine Blade Sensor Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 1.33 Billion

-

Market Size by 2033: USD 3.69 Billion

-

CAGR: 13.68% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Smart Wind Turbine Blade Sensor Market Trends

-

Intelligent blade sensors are becoming more and more connected with IoT, SCADA and AI platforms to provide real-time monitoring, predictive analytics and improved wind turbine operation decision making.

-

Advanced blade sensors are in demand for offshore wind farms as bigger turbines in challenging locations need durable monitoring systems to cut downtime and stretch operational lives.

-

Fiber Bragg Grating (FBG) and distributed fiber-optic sensing becomes more popular, providing higher precision in strain monitoring and structural health evaluations for the next-generation turbine blades.

-

The blades have sensors to allow for longer blade life, less material waste and measurable CO₂ savings that supporting sustainability goals around the world and decrease the overall cost of wind energy.

-

Manufacturers and new firms are concerned, they devote considerable resources to develop blade sensor innovation, developing the smaller size with more durability, multi- functionality for sensors in order to compete in renewable energy markets worldwide.

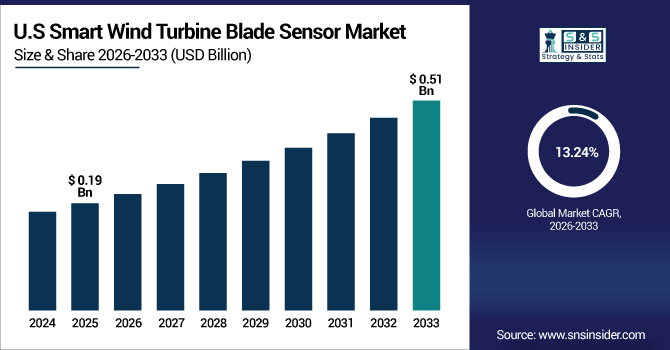

The U.S. Smart Wind Turbine Blade Sensor Market size was valued at USD 0.19 Billion in 2025E and is projected to reach USD 0.51 Billion by 2033, growing at a CAGR of 13.24% during 2026-2033. Smart Wind Turbine Blade Sensor Market growth is driven by increasing investments in renewable energy sector and federal policies supporting clean energy consumption. The growing number of mega onshore and offshore wind projects is driving the demand for robust blade monitoring solutions. Growing emphasis on predictive maintenance and O&M cost saving continues to underpin traction for vibration, strain, and acoustic emission sensors.

Smart Wind Turbine Blade Sensor Market Growth Drivers:

-

Increasing adoption of predictive maintenance solutions to enhance efficiency and reduce wind turbine operational downtime

Increasing predictive maintenance in wind power is a significant factor driving the smart blade sensor market. By monitoring vibration, strain and acoustic signals in fine time resolution these sensors show early detections of possible failures, which can dramatically lower the amount of downtime due to equipment outages. Utilities and operators want more advanced sensor technology to prolong blade life, maximize turbine performance, and make real inroads on operational costs.

Downtime Reduction: Wind farm operators using predictive maintenance powered by smart blade sensors report 20–30% reductions in unplanned downtime

Smart Wind Turbine Blade Sensor Market Restraints:

-

High initial investment costs and integration challenges hinder widespread adoption of advanced blade sensing systems

Despite its tremendous advantages, substantial barriers to overcome are the expensive cost of smart sensors and complexity in installation. Retrofitting of existing turbines and integration with the installed park SCADA system are often complicated for technical reasons. For smaller operators, these costs can cancel out near-term gains, and adoption is slowed. Unknowns about long-term reliability and complex design data management, in addition to a significant facet of the total cost, slow penetration rates of smart wind turbine blade sensor solutions worldwide.

Smart Wind Turbine Blade Sensor Market Opportunities:

-

Rising offshore wind projects and sustainability goals create demand for advanced blade monitoring and sensing technologies

Increasing global deployment of offshore wind farms offers highly lucrative prospects for smart blade sensors suppliers. It’s going to take a bit of time and effort but, as turbines get bigger and more powerful, in increasingly hostile offshore environments, more careful monitoring becomes necessary to ensure safety and optimal performance. Net-zero targets by governments and companies also drive demand for blade health monitoring systems. Not only do these sensors help to prolong the life of turbines, but they further decrease carbon footprints which are increasingly becoming part of long-term sustainability goals worldwide.

Extending turbine blade life by 5 years through smart monitoring can reduce the lifetime carbon footprint of a wind farm by up to 8%, by delaying manufacturing of replacement blades and reducing maintenance vessel emissions

Smart Wind Turbine Blade Sensor Market Segment Analysis

-

By sensor type, vibration sensors led the market with a 45.28% share in 2025, while strain sensors are expected to register the fastest growth with a CAGR of 9.37%.

-

By application, condition monitoring dominated the market with a 41.82% share in 2025, whereas structural health monitoring is forecasted to grow the fastest with a CAGR of 8.24%.

-

By blade material, glass fiber led the market with a 39.55% share in 2025, while carbon fiber is projected as the fastest-growing segment with a CAGR of 8.10%.

-

By end-user, onshore accounted for 35.80% of the market in 2025, and offshore is expected to grow the fastest with a CAGR of 9.30%.

By End-User, Onshore Lead While Offshore Grow Fastest

By application, onshore segment has largest share of smart wind turbine blade sensor market, due to wide-scale installation, mature infrastructure, and the relatively lower cost of operation. Vibration and condition monitoring sensors are widely incorporated in these projects to maximize turbine reliability. However, offshore wind systems are expected to grow the quickest, supported by government investments that encourage growth through innovation and scale, the deployment of increasingly large turbines, and part and component development to address more challenging marine environments in which these systems must operate.

By Sensor Type, Vibration Sensors Leads Market While Strain Sensors Registers Fastest Growth

Vibration sensors are leading the smart wind turbine blade sensor market due to their extensive use for condition monitoring, rotor balance and detection of early faults in turbines operations. Their reliability and low cost running make them the option of choice for operators, especially in big size onshore park. However, strain sensors which fiber-optic configurations (Fiber Bragg Gratings) in particular, are emerging as the largest growing portion. These provide advanced inspection for blade fatigue, stress distribution and micro-damage, supporting widespread adoption in the next generation of turbine design.

By Application, Condition Monitoring Dominate While Structural Health Monitoring Shows Rapid Growth

Condition monitoring makes the largest contribution to the smart wind turbine blade sensor market, where operators seek to understand vibration, temperature and performance data in real time. This app minimizes down time and maintenance costs, it optimizes energy output, thereby extends the turbines life span. And SHM is coming on as the fastest growing application as there's a requirement to detect cracks, delamination and material fatigue in long turbine blades. The uptake of SHM is expected to be ever faster especially in offshore where further advanced blade integrity solutions are required.

By Blade Material, Glass Fiber Lead While Carbon Fiber Registers Fastest Growth

Glass fiber is the most attractive blade material owing to its low cost, strength-to-weight comparison and overwhelming share in typical turbine blade production worldwide. It is still the material of choice for onshore installations and will support the widespread use of monitoring sensors. Meanwhile, the carbon fiber segment is experiencing the fastest growth and is favored for future generation of large offshore blades due to its lightweight functionality and strength. With turbines now exceeding 100 meters in height, the need for carbon-fiber-based-sensors is dramatically increasing, bringing new levels of monitoring capabilities as the world pursues its energy efficiency and sustainability goals.

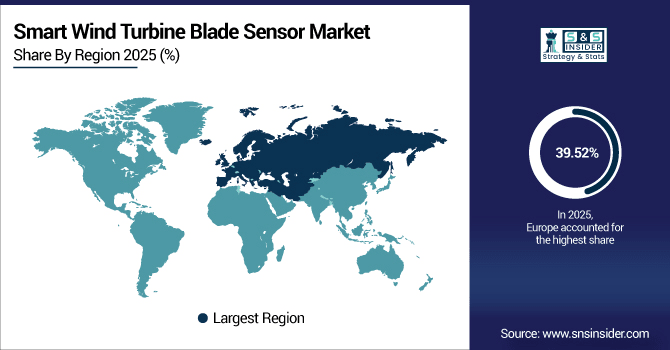

Smart Wind Turbine Blade Sensor Market Regional Analysis:

Europe Smart Wind Turbine Blade Sensor Market Insights

In 2025E Europe dominated the Smart Wind Turbine Blade Sensor Market and accounted for 39.52% of revenue share, this leadership is due to the surged the construction of condition monitoring and SHM systems. The addition of high-tech sensors is increasingly the norm in new turbines, and retrofitting for older models also widens the market. Favorable legislation and bold clean energy goals drive growth throughout Europe.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Germany Smart Wind Turbine Blade Sensor Market Insights

Germany is the largest one and more It is no surprise that German wind energy Germanys position as a market leader for wind Predictive maintenance is commonly implemented based on vibration and strain sensors.

Asia Pacific Smart Wind Turbine Blade Sensor Market Insights

Asia Pacific is expected to witness the fastest growth in the Smart Wind Turbine Blade Sensor Market over 2026-2033, with a projected CAGR of 14.44% due to growing at a faster rate, primarily due to the significant increase in China and India and other countries of Southeast Asia. That will include giant, onshore and offshore wind projects which will drive demand for vibration and strain sensors. Government policies for alternative fuel encourages the use of condition and structural health monitoring systems.

China Smart Wind Turbine Blade Sensor Market Insights

China dominates the Asia-Pacific market with healthy wind capacity additions and government support. Onshore turbines drive installations and thus the demand for smart blade sensors. Use of Fiber Optic Strain Sensors and SHM systems is booming in the offshore applications.

North America Smart Wind Turbine Blade Sensor Market Insights

North America holds a high potential demand for smart wind turbine blade sensors, especially in Unites States and Canada. Costs Benefit of Power Plant Health Utilities and IPPs stress predictive maintenance and condition monitoring. Vibration and strain sensors are commonplace for onshore projects to achieve higher productivity and lower downtime.

U.S. Smart Wind Turbine Blade Sensor Market Insights

The U.S. is the largest market in North America, where large onshore wind farms in Texas, Iowa and Oklahoma are propelling growth. Regarding the condition monitoring, more and more vibration or strain sensing technologies are being used for predictive maintenance.

Latin America (LATAM) and Middle East & Africa (MEA) Smart Wind Turbine Blade Sensor Market Insights

The Smart Wind Turbine Blade Sensor Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the increasing use of vibration as well as condition monitoring sensors. There is an increased investment in SHM solutions due to larger turbine size and the critical need for reliability. Smart Sensor Market Smart sensors are deployed where government aid is provided for renewable energy and sustainability programs.

Smart Wind Turbine Blade Sensor Market Competitive Landscape:

Siemens Gamesa is one of the leading wind turbines suppliers in the world. It combines smart blade sensors to monitor vibration, strain and structural health with the objective of improving turbine reliability. Its R&D is in predictive maintenance, reducing down time and operations costs. Siemens Gamesa’s large installed base around the world means there is great demand for sensor solutions.

-

In August 2025, Siemens Gamesa, in collaboration with RWE, has scaled up the use of recyclable resin wind turbine blades at the Sofia offshore wind farm in the UK. This initiative aligns with circular economy goals and net-zero objectives, marking a significant step toward sustainable wind energy manufacturing.

GE Renewable Energy supplies smart bladed sensors for performance tuning of its state-of-the-art wind turbines. Its turbines include vibration and strain check-out technologies to sustain predictive maintenance. GE is shored up by offshore wind growth, digital integration and sustainability focused initiatives that keep the company’s power output reliable.

-

In March 2025, GE Renewable Energy, in collaboration with LM Wind Power and TNO, optimized wind turbine blades to boost overall wind farm efficiency. The project focused on blade tip improvements, utilizing advanced measurement techniques to enhance turbine performance.

Vestas is a global wind turbine manufacturer focused on cutting-edge blade monitoring technology. Its turbines are equipped with vibration, strain and acoustic sensors for condition monitoring and structural health sensing. Vestas is heavily investing in digitalization, predictive maintenance and integration of IoT. International projects executed by the company, in particular Europe and North America, drive global adoption of smart sensors and improve turbine performance.

-

In December 2024, Vestas announced a restructuring of its Isle of Wight factory to focus on manufacturing blades for onshore wind power, leading to the elimination of 300 jobs. This decision aligns with the British government's plans to decarbonize its power sector

Smart Wind Turbine Blade Sensor Market Key Players:

Some of the Smart Wind Turbine Blade Sensor Market Companies are:

-

Siemens Gamesa Renewable Energy

-

General Electric Company

-

Vestas Wind Systems A/S

-

LM Wind Power (a GE Renewable Energy business)

-

Nordex SE

-

Suzlon Energy Limited

-

Mitsubishi Heavy Industries Ltd.

-

ABB Ltd.

-

Leine Linde AB

-

Moventas Gears Oy

-

Amphenol Corporation

-

Blade Dynamics Ltd.

-

Smart Fibres Ltd.

-

PolyTech A/S

-

Weidmüller Interface GmbH & Co. KG

-

SKF Group

-

Nissens A/S

-

Moog Inc.

-

Bachmann electronic GmbH

-

Phoenix Contact GmbH & Co. KG

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.33 Billion |

| Market Size by 2033 | USD 3.69 Billion |

| CAGR | CAGR of 13.68% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor Type (Strain Sensors, Vibration Sensors, Temperature Sensors, Acoustic Emission Sensors, and Others) • By Application (Condition Monitoring, Structural Health Monitoring, Performance Optimization, and Others) • By Blade Material (Glass Fiber, Carbon Fiber, Hybrid, and Others) • By End-User (Onshore, Offshore) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Siemens Gamesa Renewable Energy, General Electric Company, Vestas Wind Systems A/S, LM Wind Power (a GE Renewable Energy business), Nordex SE, Suzlon Energy Limited, Mitsubishi Heavy Industries Ltd., ABB Ltd., Leine Linde AB, Moventas Gears Oy, Amphenol Corporation, Blade Dynamics Ltd., Smart Fibres Ltd., PolyTech A/S, Weidmüller Interface GmbH & Co. KG, SKF Group, Nissens A/S, Moog Inc., Bachmann electronic GmbH, Phoenix Contact GmbH & Co. KG |