Interactive Projector Market Size & Trends:

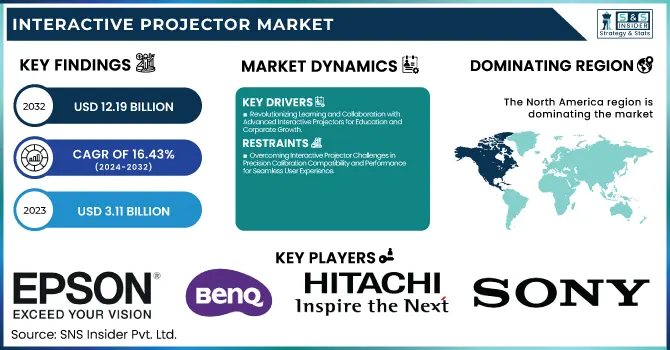

The Interactive Projector Market was valued at USD 3.11 billion in 2023 and is expected to reach USD 12.19 billion by 2032, growing at a CAGR of 16.43% over the forecast period 2024-2032. Innovations such as Augmented Reality (AR) and gesture-controlled projection are providing interactive projectors with an AR element that allows for immersive experiences without any physical touch, changing the areas in which they can be used, from education to gaming, and business. The level of customization and modular solutions allows users to improve parts of the appliance instead of replacing them for the sake of flexibility.

To Get more information on Interactive Projector Market - Request Free Sample Report

Accessibility to AI is facilitating a wide range of automation and speech recognition and real-time adaptability and kinds, further, becoming more potent the function of the project for several rising technology IM due to hybrid work development and remote collaboration capable interactive projection systems to be learned through cloud-Integrated. After experiencing minor growth toward the end of the decade, by 2024, the U.S. interactive projector market began to rebound, with the education sector notably activating more than 60% of K-12 classrooms incorporating interactive projectors to help facilitate learning. Roughly 45% of businesses in the corporate sector started using interactive projectors for collaborative meetings and presentations, showing a trend towards more intelligent and cooperative tools for communication.

The U.S. Interactive Projector Market is estimated to be USD 0.87 Billion in 2023 and is projected to grow at a CAGR of 16.23%. The rapid adoption of interactive projectors in smart classrooms, and corporate hybrid workspaces is driving the growth of the U.S. interactive projector market, along with the rise in demand for collaborative learning, technological advances in AI and AR, and increasing use of interactive projectors in training and presentations.

Interactive Projector Market Dynamics

Key Drivers:

-

Revolutionizing Learning and Collaboration with Advanced Interactive Projectors for Education and Corporate Growth

The rising demand for smart learning solutions in educational institutions and corporate training settings is primarily accelerating the growth of the interactive projector market. As schools and businesses embrace the digital world in these challenging times, the need for interactive learning tools has skyrocketed, helping to enhance engagement and collaboration. Also, technological improvements in projection, including higher resolution, increased brightness, and better touch, have all greatly enhanced the user experience. Moreover, the preference for ultra-short throw projectors along with the ability of these projectors to reduce and eliminate shadows and glare, is expected to drive the market. In addition, the increasing use of interactive projectors in corporate settings for presentations and conferences also aids market growth as companies will look for economical and compact solutions.

Restrain:

-

Overcoming Interactive Projector Challenges in Precision Calibration Compatibility and Performance for Seamless User Experience

Technical limitations on the interactivity of projectors with video sources and compatibility issues are challenges faced by the interactive projector market. Interactive projectors have long needed precise calibration and maintenance to work properly, a task impractical for non-technical users. Inconsistent touch sensitivity and lag in response time also lead to a poorer user experience which restricts adoption in professional and academic environments. However, it still suffers from the need for specific lighting conditions to obtain clear projection quality as too much ambient light deteriorates visibility and can sabotage presentations. This may limit mass acceptance, particularly in situations where lighting control is challenging due to the aforementioned technical restrictions.

Opportunity:

-

Unlocking Growth in Interactive Projectors with AI Cloud Connectivity AR VR and Digital Transformation

Technological advancements like cloud platform connectives and AI-based interactive technologies are driving the opportunities in the interactive projector market. Clinical education and patient education are an important part of the utilization of interactive projectors in the healthcare sector, and this, in turn, offers the opportunity for growth over the forecast period. Moreover, the growing application of AR and VR in projection systems offers new possibilities for immersive types of learning experiences. Rapid digital transformation, combined with efforts of the governments to strengthen the educational infrastructure in the countries will unlock a wider and sustainable opportunity in the emerging markets, particularly in Asia-Pacific and Latin America. All these drivers combined are favorable drivers of market growth.

Challenges:

-

Navigating Competitive Challenges as Alternative Display Technologies and Digital Solutions Disrupt Interactive Projectors

Another significant challenge stems from the growing competition offered by alternative display technologies, including interactive flat-panel displays and LED walls. They provide better image quality, lower maintenance, and longer life, which is why some users prefer these alternatives; Even more so, the switch to online learning and remote collaborating tools lowers the dependence on interactive projectors, since many digital whiteboards and cloud-based software solutions can cover the same features as interactive projectors without the need for any projectors at all. Also, difficulties related to the longevity of hardware and long-term care needs come into play since organizations are looking for long-lasting, sustainable display options. These factors must be overcome to continue growing the interactive projector market.

Interactive Projector Market Segment Analysis

By Technology

3LCD technology continued to lead the interactive projector market in 2023, capturing 54.7% of the market due to its advanced color reproduction, brightness, and efficient power consumption. 3LCD projectors are recommended for educational and business applications that provide better image detail and deeper colors and are ideal for most interactive learning with wide and corporate presentation solutions. This wide applicability factor, coupled with their lower costs and high reliability, has resulted in great penetration of RFIDs in several industries.

The fastest CAGR will be recorded by Liquid-Crystal-on-Silicon (LCoS) technology from 2024 to 2032, due to the ability to provide high-resolution content and ultimately a better image quality compared to micro-display technology. LCoS projectors are increasingly being adopted in applications where some of the more expensive models used to dominate such as healthcare, simulation training, and immersive learning environments. The rise in demand for high-end display systems and improvements in projection processes are expected to help LCoS become a major component of the interactive projector industry.

By Projection

In 2023, ultra-short throw projectors held the largest interactive projector market share of 53.3% because the interactive projectors can project a large and high-quality image from a very short distance. Overhead projectors are highly popular in schools and corporate environments because they reduce shadows and prevent the user from passing light and interrupting the original projection. For interactive applications, their compactness, ease of installation, and lesser eye fatigue make them most suitable and thus propel their growth in the market.

Short-throw projectors are projected to grow at the highest CAGR from 2024 to 2032, due to the cost-to-performance ratio they provide. Short-throw projects are even more flexible for rooms that are small to medium-sized, making them the perfect choice for classrooms, meeting rooms, and collaborative workspaces. The consumer shift toward interactive learning and business collaboration tools as well as technological advancements in projection technology is likely to drive the short throw projector demand, thereby pushing the market growth at a rapid rate.

By Application

The interactive projector market was dominated by the education segment in 2023, with a market share of 44.8%. The increasing digitalization of learning tools in schools, colleges, and training centers has created a demand for interactive projectors, promoting student engagement and interactive learning experiences. Market growth has been further boosted by the initiatives taken by the government for modernizing classrooms coupled with the growing adoption of e-learning and smart education solutions. Interactive projectors have gained a firm foothold in the education sector due to the creation of dynamic, cooperative learning environments that they facilitate.

Healthcare is anticipated to hold a significant market share over the projected period, with the fastest CAGR from 2024 to 2032 owing to the escalating adoption of interactive projectors in medical training, patient education, and surgical simulations. Advanced visualization technology is gaining a high-value proposition in hospitals and medical institutions, driving improved diagnostic precisions and learning efficiency. Interactive projectors are proving essential to the revolution of medical education and training as healthcare providers invest in digital transformation.

Interactive Projector Market Regional Analysis

The interactive projector market was dominated by North America in 2023, capturing a 38.7% market share due to increasing penetration of smart classroom technologies and better corporate training solutions. The region has seen robust digital investments and many schools and universities have implemented interactive projectors to engage students in learning. Moreover, these projects are used more and more by businesses for collaborative meetings and training. Large market players such as Epson, SMART Technologies, and Dell have aided in technology developments and product penetration. Market leadership in North America is being reinforced through a long-standing infrastructure, increased focus on measurement, and both industrial and corporate collaboration via the corporate learning centers in parallel collaborating with various regional policy experiments.

Asia-Pacific is expected to be the fastest-growing region with the highest CAGR from 2024 to 2032 on account of the fast-paced digital transformation, initiatives by the government in respect of education, and increasing adoption in healthcare and business applications. Nationwide such as China, Japan, additionally India are profiting greatly with clever class, as well as digitized healthcare remedies. Companies like BenQ, Panasonic, and Casio are making strides in the market and launching innovative interactive projectors for the education and enterprise segments of the region. In addition, the Asia-Pacific market will expand rapidly during the forecast period due to rising demand for affordable interactive learning tools of high quality and increasing corporate digitization in Asia-Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Epson (BrightLink 1485Fi)

-

BenQ (LH890UST)

-

Hitachi (CP-TW3005)

-

Sony (VPL-SW235)

-

Panasonic (PT-TW371R)

-

ViewSonic (PS750W)

-

Optoma (EH320USTi)

-

Casio (XJ-UT311WN)

-

Christie (Captiva DWU500S)

-

TouchMagix (MagixFloor)

-

Mayeter (Games Floor Projection)

-

Oway (Interactive Whiteboard FT6)

-

Airzoy (Interactive Floor System)

-

Holkoi Systems (HD5802 4K Smart Projector)

-

Hisense (PX3-Pro Laser Projector)

Interactive Projector Market Trends

-

In May 2024, Epson, the leading projector brand, unveiled its latest large-venue 4K 3-chip 3LCD laser projectors, highlighting high-impact display solutions for professional and commercial use.

-

In July 2024, BenQ India launched the BenQ Board RE04 Series, its latest interactive flat panel (IFP), designed to enhance collaboration and smart learning in education and business environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.11 Billion |

| Market Size by 2032 | USD 12.19 Billion |

| CAGR | CAGR of 16.43% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Digital Light Processing (DLP), 3LCD, Liquid-Crystal-on-Silicon (LCoS)) • By Projection (Standard throw, Short throw, Ultra-short throw) • By Application (Education, Business, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Epson, BenQ, Hitachi, Sony, Panasonic, ViewSonic, Optoma, Casio, Christie, TouchMagix, Mayeter, Oway, Airzoy, Holkoi Systems, Hisense. |