PNP Transistor Market Report Scope And Overview:

Get More Information on PNP Transitor Market - Request Sample Report

The PNP Transistor Market Size was valued at USD 2.41 Billion in 2023 and is expected to reach USD 4.09 Billion by 2032 and grow at a CAGR of 6.1% over the forecast period 2024-2032.

The PNP transistor market has experienced tremendous growth over the last few years and is expected to expand further because of various factors influencing the global electronics and semiconductor industries.

The continued expansion of 5G networks would continue to fuel a strong demand for PNP transistors, which are essential elements in power management and amplification of signals in the underlying telecommunication infrastructure. By 2032, some 221.49 million 5G devices will ship in the U.S. A further projection shows that 59% of smartphones will become 5G-compatible in 2023. Global 5G networks are projected to cover 85% of the world by 2030. This, therefore, represents a tremendous challenge for PNP transistors in base stations and network hardware as well as other kinds of telecom systems. Furthermore, the high growth in data traffic that is going to increase 40% annually from 2024 will also increase the demand for efficient, compact semiconductor solutions like PNP transistors. In the developing 5G infrastructure, the role of PNP transistors in delivering power-efficient, high-performance networks is going to be crucial. Increased use of 5G in IoT applications, autonomous vehicles, and smart cities will further be a driving force behind the higher growth of the PNP transistor market over the coming years.

PNP Transistor Market Dynamics

KEY DRIVERS:

-

Growing Demand for Advanced Communication Networks Drives the Need for PNP Transistors

The increasing demand for high-speed communication technologies, especially 5G networks, significantly boosts the PNP transistor market. With telecom operators around the world upgrading their infrastructure to 5G, the need for efficient, compact, and high-performance semiconductors like PNP transistors is growing. As more industries move towards ultra-reliable low-latency communications (URLLC), the market for these semiconductors expands. The continuous rollout of 5G and future generations of mobile networks are expected to lead to higher semiconductor demand, contributing to the growth of the PNP transistor market. With telecommunications becoming a critical part of daily life and business, the adoption of technologies such as the Internet of Things (IoT), autonomous vehicles, and smart cities will further intensify the need for PNP transistors in various systems.

-

Expansion of Electric Vehicles and Green Energy Solutions Fuels the Demand for PNP Transistors

The shift towards electric vehicles and renewable energy sources is creating new opportunities for the PNP transistor market. EVs, particularly in the automotive sector, require highly efficient power management and battery systems, where PNP transistors play a crucial role. These transistors are used in electric motor drives, power converters, and battery management systems to ensure optimal performance and energy efficiency. As more governments implement policies to reduce carbon emissions, there is a growing push for clean energy and sustainable mobility solutions. The shift to renewable energy, such as solar and wind power, also drives demand for PNP transistors in power converters. With EV adoption expected to grow at a CAGR of over 20% globally in the coming decade, the need for high-performance semiconductors, including PNP transistors, will increase in parallel, further accelerating the market's expansion.

RESTRAIN:

-

High Cost of PNP Transistor Manufacturing Hampers Market Growth

Advanced PNP transistors require special materials, complex fabrication processes, and precision in manufacturing, which makes them expensive to produce. This is very impactful in price-sensitive industries like consumer electronics, where companies may look for cost-effective alternatives. The prices of raw materials like silicon can fluctuate, and high demand for specialized fabrication facilities tends to raise production costs. This may limit the widespread usage of high-performance PNP transistors, mainly in countries with budget constraints or in new industries. High raw materials, like silicon, and advanced fabrication techniques in the production process result in high production costs.

Additionally, semiconductor manufacturers require massive investment in research and development to produce more efficient transistors. One of the most prominent examples is the USD 7.86 billion grant that Intel received under the CHIPS Act, which clearly shows the financial investment needed to manufacture chips in the country. Intel alone is investing more than USD 90 billion in manufacturing in several states in the United States. This will certainly be reflected in the prices of several semiconductor components, such as PNP transistors. Also, increasing labor, energy, and raw material costs in the semiconductor industry further complicate the financial dilemmas of companies producing such components.

PNP Transistor Market Segments Analysis

BY TYPE

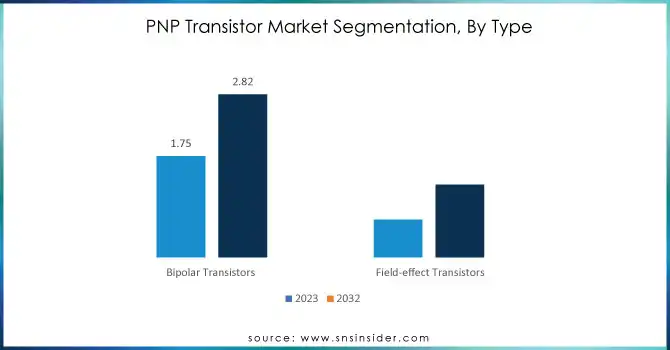

The Bipolar Transistors segment holds the largest share of the revenue, accounting for 73% in 2023. This dominance is largely attributed to their high performance in signal amplification and switching applications, particularly in consumer electronics, telecommunications, and automotive sectors. Bipolar Junction Transistors (BJTs), a key type of bipolar transistors, are widely used in power management systems due to their superior gain characteristics. Notable companies such as ON Semiconductor and Infineon Technologies have recently introduced advanced products in this segment, enhancing performance and efficiency.

The Field-effect Transistors segment is growing at the fastest CAGR of 7.59% within the forecasted period, reflecting the increasing demand for energy-efficient, high-performance transistors in various sectors. FETs, including MOSFETs and JFETs, are favored for their low power consumption and high input impedance, making them ideal for use in communication systems, automotive electronics, and computing. Companies like Texas Instruments and Nexperia have recently introduced innovative FET-based products to meet this growing demand. Texas Instruments launched the LMR36006 Power Converter, incorporating advanced FET technology to deliver efficient power management.

BY APPLICATION

The Inverter Circuits segment held the largest market share in 2023, accounting for 36% of the total revenue. Inverter circuits are crucial in converting direct current (DC) to alternating current (AC) and are widely used in renewable energy systems, motor drives, and power supplies. This dominance is driven by the increasing adoption of renewable energy sources like solar and wind, which require efficient inverter systems to integrate with the grid. For instance, STMicroelectronics introduced the STPOWER MOSFET technology for inverter applications, providing superior energy efficiency and reliability.

The Driver Circuits segment is expected to grow at the fastest CAGR of 8.11% during the forecast period. Driver circuits are essential for controlling the operation of other components such as motors, displays, and sensors in automotive, consumer electronics, and industrial applications. For example, Texas Instruments recently launched the DRV8871 Motor Driver IC, which offers advanced features for controlling motors in automotive and industrial applications. Similarly, ON Semiconductor introduced the NCD5700 High-Side Driver, designed for efficient control of power devices in automotive and industrial sectors.

PNP Transistor Market Regional Overview

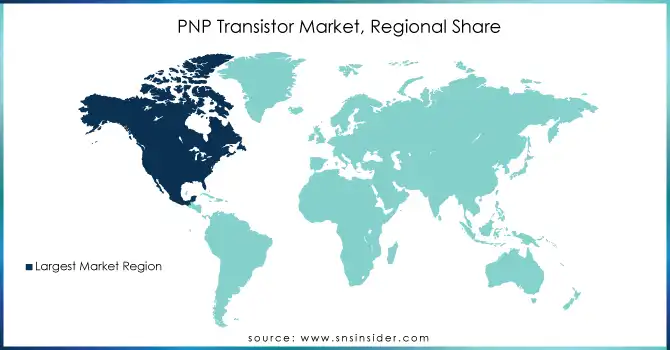

In 2023, North America dominated the PNP transistor market, accounting for a significant market share. The U.S., in particular, has been a key player in driving innovation, with companies such as ON Semiconductor, Texas Instruments, and Intel leading the way in the development and production of advanced PNP transistors. For instance, In November 2024, Intel's investment of over USD 90 billion in semiconductor manufacturing under the CHIPS and Science Act, alongside ON Semiconductor’s development of high-efficiency power transistors, supports North America's dominance in the market. Moreover, the increasing adoption of electric vehicles (EVs) and renewable energy systems in North America further boosts the demand for power management solutions, where PNP transistors play a crucial role in efficient energy conversion and signal switching.

The Asia Pacific region is the fastest-growing region in the PNP transistor market, with an estimated CAGR of 7.76% from 2024 to 2032, driven by rapid industrialization, increased demand for consumer electronics, automotive innovations, and growing investments in renewable energy systems. This growth is attributed to the region's strong manufacturing capabilities and the increasing adoption of electric vehicles (EVs), renewable energy sources, and advanced technologies such as 5G. Countries like China, South Korea, and Japan are key contributors to this growth. For instance, China’s leadership in electronics manufacturing and the growing emphasis on EV production and renewable energy solutions significantly boost demand for components like PNP transistors, which are essential for power management in these applications. Additionally, South Korea’s technological advancements, particularly in semiconductors, also drive the market's expansion.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

Some of the major players in the PNP Transistor Market are:

-

Rohm Semiconductor

-

Infineon Technologies

-

Microchip Technology

-

Diodes Incorporated

-

Nexperia

-

ON Semiconductor

-

Texas Instruments

-

Toshiba Corporation

-

Vishay Intertechnology

-

Central Semiconductor

-

Macom Technology Solutions

-

Nokia

-

Broadcom Inc.

-

Fairchild Semiconductor

-

Semikron

-

Analog Devices

-

Sanken Electric Co., Ltd.

-

Mitsubishi Electric

RECENT TRENDS

-

In May 2024, Infineon introduced a new set of Bipolar Junction Transistors aimed at improving energy efficiency and overall performance for power electronic systems. Their focus was on expanding their product lineup to meet growing demands for more reliable and high-performance solutions in various applications.

-

In August 2024, Nexperia announced it would begin offering popular power BJTs in a space-optimized, energy-efficient DFN2020D-3 package. This move was aimed at meeting the increasing market need for compact and power-efficient solutions, particularly in automotive and energy-efficient electronics.

-

In September 2023, Nexperia launched dual 500mA Resistor-Equipped Transistors, which were designed to facilitate high-power load switching in applications where space was at a premium. This initiative was expected to enhance performance in constrained environments, benefiting sectors like automotive and consumer electronics.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.41 Billion |

| Market Size by 2032 | US$ 4.09 Billion |

| CAGR | CAGR of 6.1 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Bipolar Transistors, Field-effect Transistors) • By Application (Inverter Circuits, Interface Circuits, Driver Circuits, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Rohm Semiconductor, Infineon Technologies, Renesas Electronics, Microchip Technology, Diodes Incorporated, Nexperia, ON Semiconductor, Texas Instruments, STMicroelectronics, Toshiba Corporation, Vishay Intertechnology, Central Semiconductor, Macom Technology Solutions, Nokia, Broadcom Inc., Fairchild Semiconductor, Semikron, Analog Devices, Sanken Electric Co., Ltd., Mitsubishi Electric. |

| Key Drivers | • Growing Demand for Advanced Communication Networks Drives the Need for PNP Transistors • Expansion of Electric Vehicles and Green Energy Solutions Fuels the Demand for PNP Transistors |

| Restraints | • High Cost of PNP Transistor Manufacturing Hampers Market Growth. |