Soft Facility Management Market Report Scope & Overview:

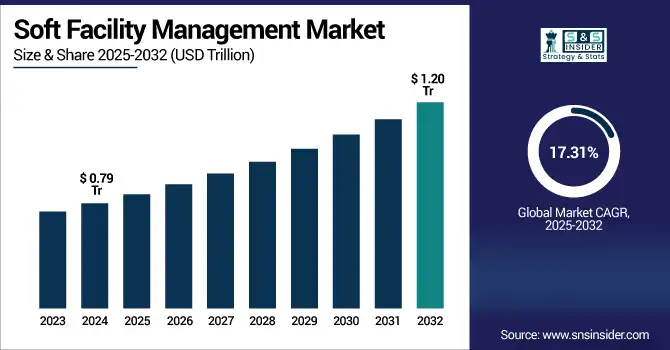

Soft Facility Management Market size was valued at USD 0.79 trillion in 2024 and is expected to reach USD 1.20 trillion by 2032, growing at a CAGR of 17.31% from 2025-2032.

To Get more information on Soft Facility Management Market- Request Free Sample Report

The Soft Facility Management Market growth is driven by increasing demand for outsourced services, rising emphasis on workplace hygiene and safety, and growing adoption of integrated facility management solutions. As organizations focus on cost-efficiency and core business operations, the shift toward third-party management of services like cleaning, catering, and security is accelerating. Additionally, advancements in digital technologies such as IoT and cloud platforms are enhancing operational transparency and service quality. Rapid urbanization, expansion of commercial infrastructure, and the need for sustainable, flexible, and employee-centric workplaces are further propelling market growth across diverse sectors including healthcare, education, and corporate enterprises.

-

According to the U.S. International Trade Commission (USITC), professional services including facility management, catering, security, and cleaning accounted for USD 378.2 billion in cross-border U.S. exports and USD 184.7 billion in imports in 2023, underscoring the significant global trade and reliance on outsourced services.

U.S. Soft Facility Management Market size was valued at USD 0.20 trillion in 2024 and is expected to reach USD 0.30 trillion by 2032, growing at a CAGR of 5.25% from 2025-2032.

The U.S. Soft Facility Management Market is growing due to increasing corporate outsourcing, rising demand for workplace safety and cleanliness, and greater focus on employee well-being. Growth is further supported by regulatory compliance needs, expansion of healthcare and commercial sectors, and the adoption of tech-driven facility management solutions across industries.

Market Dynamics

Drivers

-

Growing demand for cost-effective, outsourced facility solutions across commercial and industrial sectors is driving soft FM adoption globally.

As businesses come under more pressure to cut operational overheads, many are opting to outsource non-core functions such as cleaning, catering and landscaping. Soft facility management (FM) services are elected by organizations as a strategic decision for maintaining hygiene, safety, and customer experience keeping the direct labor or infrastructure cost at bay. The flexibility of service contracts, packaged services, and scalability across different environments (retail, education, healthcare and offices), makes outsourced soft FM very attractive. As a result, the adoption of soft FM has continued to grow in developed and developing economies.

-

The National Institute of Standards and Technology (NIST) quantified $15.8 billion annually in inefficiencies due to poor interoperability in the U.S. capital facilities sector (including commercial, institutional, and industrial facilities), noting that two-thirds of these costs fall on facility owners and operators.

Restraints

-

Low awareness and lack of standardization in developing regions hinder widespread soft FM adoption and market penetration.

Many developing nations continue to rely on informal or unorganized facility service arrangements with only a limited awareness of structured FM models at enterprise levels. The lack of regulatory enforcement, clear meter service standards, and metering workforce credentialing undermines the confidence in outsourced solutions. Across these regions, SMEs either consider setting up formal contracts as too expensive, or have issues of trust/haship. As a result, service providers are unable to scale or reach these markets, limiting total market growth and preventing service providers from capturing latent demand in under-exploited regions.

Opportunities

-

Increased digitalization and IoT-enabled facility solutions present massive growth potential for soft FM service differentiation and automation.

The usage of digital tools like smart sensors, mobile workforce apps, and CAFM (Computer-Aided Facility Management) for real-time monitoring, and automation of soft FM tasks. They contribute to quality service, transparency, and cost efficiency by allowing management to keep track of cleaning schedules, waste levels, and room occupancy, among other data. Enterprise tech providers can leverage technology-driven service capabilities in order to address smart buildings, airports, hospitals, and many more sectors thereby winning larger contracts by delivering greater value faster. With digital transformation gaining momentum across verticals, combining data-driven soft FM opens up avenues for new revenue streams and enhanced client engagement for service providers.

-

In a 2022 survey, 78% of facilities had deployed smart-building technologies and the same share reported energy efficiency gains and cost reductions as a result. However, 94% of adopters collect data, yet 34% say they lack the skills to fully leverage analytics highlighting a key challenge in realizing full value.

-

According to GEP, IoT solutions in facility settings can cut maintenance costs by up to 20%, lower unplanned downtime by up to 50%, and extend asset lifespan by 25%, reinforcing the strong ROI of automation

Challenges

-

High workforce dependency and labor shortages limit scalability and service quality in the soft FM industry.

Soft FM services like cleaning, catering and concierge are still low tech and manpower-intensive, leeching on a large low-skilled workforce. Service providers are unable to manage quality and speed of service due to increasing labor shortages in both developed economies and a few developing economies. Wage inflation, unionization, and immigration restrictions are also making it challenging to manage the workforce. Moreover, changing personnel entails retraining costs and inconsistencies in quality. These issues pertaining to workforce services are a choke point in scaling up operations, keeping clients engaged and ensuring continuity of services across locations.

Segment Analysis

By Organization Size

Large enterprises dominated the Soft Facility Management market due to their extensive infrastructure, high operational complexity, and need for consistent service quality across multiple locations. These organizations prefer comprehensive, long-term FM contracts that ensure compliance, brand reputation, and efficiency. Their substantial budgets allow investment in integrated FM solutions, supporting large-scale outsourcing and tech adoption to streamline operations across diverse corporate, industrial, and institutional environments.

Small and medium enterprises are expected to grow fastest due to increasing awareness of cost-efficiency and professionalism through outsourced FM services. As SMEs scale operations and adopt formal management practices, demand rises for structured facility support. The trend toward digital transformation and flexible service contracts enables SMEs to access high-quality FM solutions without heavy capital expenditure, driving strong growth across sectors like retail, co-working spaces, and regional office setups.

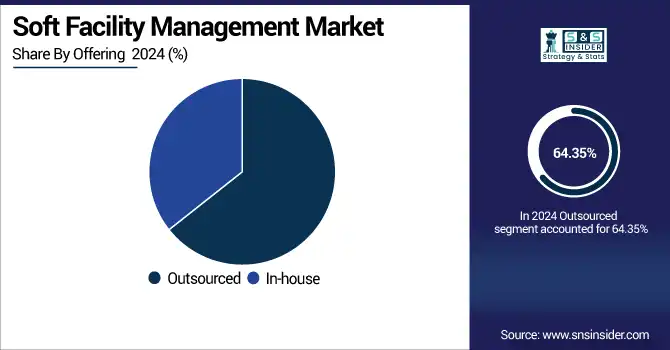

By Offering

Outsourced services dominate the market because organizations prioritize core business focus while reducing costs and compliance burdens through third-party expertise. Outsourcing offers access to trained personnel, latest tools, and scalable services without managing internal teams. This model also ensures better service accountability and performance through defined contracts and KPIs, especially in sectors like IT parks, airports, hospitals, and malls requiring specialized, 24/7 facility management.

In-house FM is projected to grow fastest as some organizations seek greater control over service quality, branding, and data security. This is particularly true in sensitive sectors such as government institutions, defense, and critical infrastructure, where internal teams ensure confidentiality. Moreover, advancements in digital FM tools are enabling in-house teams to efficiently manage and monitor operations, leading to a resurgence in insourcing trends for strategic FM needs.

By End Use

The business and corporate segment led the market due to the vast number of commercial offices, tech campuses, and administrative buildings requiring regular soft FM services. These environments prioritize high standards of cleanliness, hospitality, security, and landscaping to support employee satisfaction and brand image. The segment’s consistent demand for year-round, high-volume services drives substantial revenue generation for FM providers.

The construction and real estate segment is projected to grow the fastest due to ongoing urbanization and infrastructure development. With rising demand for residential complexes, commercial spaces, and property management, FM providers are increasingly engaged in maintaining new builds. Additionally, developers and property managers outsource FM to ensure efficient operations, tenant satisfaction, and asset value preservation, especially across Asia-Pacific and the Middle East regions.

By Soft Services

Office support and security services held the largest share due to continuous, non-discretionary demand across all business sectors. Services like reception, mail handling, visitor management, and manned guarding are essential for daily operations, compliance, and risk mitigation. Security remains a top concern in offices, data centers, and high-rise buildings, prompting organizations to invest steadily in this segment for peace of mind and business continuity.

Cleaning services are expected to expand fastest due to heightened post-pandemic hygiene awareness across public, healthcare, and work environments. Organizations now demand frequent deep-cleaning, sanitization, and specialized services like HVAC cleaning and disinfection. Regulatory standards and employee wellness initiatives are driving higher budgets for cleaning. Furthermore, automation, eco-friendly products, and outcome-based cleaning models are attracting both new contracts and technology-driven upgrades across industries.

Regional Analysis

North America dominated the Soft Facility Management market due to its mature infrastructure, high outsourcing penetration, and strong presence of multinational corporations demanding professional FM services. The region benefits from advanced technology adoption, stringent regulatory standards, and a well-established service provider ecosystem. Sectors like corporate offices, healthcare, education, and retail consistently invest in premium soft FM solutions, ensuring continued market leadership and recurring contract-based revenue generation.

The U.S. is dominating the Soft Facility Management market in North America due to its vast commercial infrastructure and high outsourcing adoption.

Asia Pacific is projected to grow fastest owing to rapid urbanization, infrastructure expansion, and increasing outsourcing trends across emerging economies. Rising awareness of organized facility services, growing commercial real estate, and rising foreign investment in industrial parks fuel demand. Governments across India, China, and Southeast Asia are also pushing for smart cities and modern public infrastructure, creating significant opportunities for soft FM providers to scale operations and tap into underserved markets.

Europe holds a major position in the Soft Facility Management market due to mature infrastructure, strict compliance standards, and widespread outsourcing practices across commercial, institutional, and public sectors, driving consistent demand for integrated and specialized facility services.

The U.K. is dominating the Soft Facility Management market in Europe due to its advanced FM practices, outsourcing maturity, and strong corporate demand.

Middle East & Africa and Latin America are witnessing steady growth in the Soft Facility Management market, driven by expanding infrastructure, rising urbanization, and increasing outsourcing in commercial and institutional sectors, supported by growing awareness of organized facility services and hygiene standards.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

AHI Facility Services Inc., Aramark, CBRE Group Inc., Compass Group, Cushman & Wakefield plc, Guardian Service Industries Inc., ISS A/S, SMI Facility Services, Sodexo Inc., Tenon Group, Mitie Group plc, Securitas AB, ABM Industries Inc., OCS Group, Serco Group plc, Atalian Global Services, Vinci Facilities, Brookfield Global Integrated Solutions (BGIS), JLL (Jones Lang LaSalle Incorporated), Cleansing Service Group (CSG).

Recent Developments:

-

2025: ISS A/S signed a new multi‑country facility services agreement with a global technology client, expanding coverage into three European countries, valued at over DKK 100 million annually over three years, effective July 2025.

-

2023: CBRE Group Inc. deployed its AI‑powered Nexus platform across 1 billion sq ft for Smart FM, improving maintenance efficiency, reducing energy costs by ~20% and technician dispatches by ~25%.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 0.79 Trillion |

| Market Size by 2032 | USD 1.20 Trillion |

| CAGR | CAGR of 5.51% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Outsourced, In-house) • By Soft Services (Office Support and Security Services, Cleaning Services, Catering Services, Other) • By Organization Size (Large Enterprises, Small & Medium Enterprises) • By End Use (Business & Corporate, Healthcare, Retail, Education, Travel & Hospitality, Construction & Real Estate, Government & Public Sector, Manufacturing, Military & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | AHI Facility Services Inc., Aramark, CBRE Group Inc., Compass Group, Cushman & Wakefield plc, Guardian Service Industries Inc., ISS A/S, SMI Facility Services, Sodexo Inc., Tenon Group, Mitie Group plc, Securitas AB, ABM Industries Inc., OCS Group, Serco Group plc, Atalian Global Services, Vinci Facilities, Brookfield Global Integrated Solutions (BGIS), JLL (Jones Lang LaSalle Incorporated), Cleansing Service Group (CSG) |