Vendor Risk Management Market Report Scope & Overview:

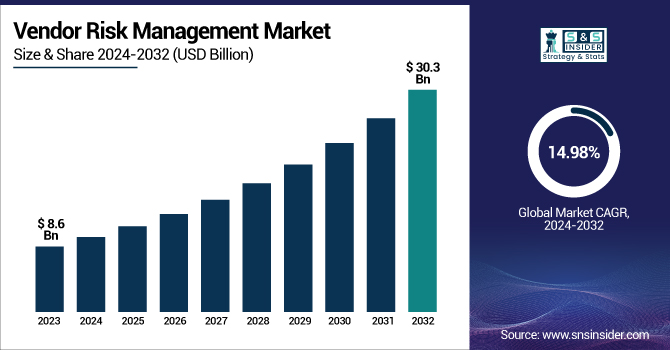

The Vendor Risk Management Market was valued at USD 8.6 billion in 2023 and is expected to reach USD 30.3 billion by 2032, growing at a CAGR of 14.98% from 2024-2032.

To Get more information on Vendor Risk Management Market - Request Free Sample Report

The Vendor Risk Management Market is witnessing strong growth, driven by increasing regulatory pressure and the rising complexity of third-party ecosystems. Key trends include growing adoption rates across sectors such as BFSI, healthcare, and IT, where compliance and data sensitivity are critical. Larger enterprises are conducting more frequent third-party risk assessments compared to SMEs, reflecting their broader vendor networks. Regions like North America and Europe report higher instances of data breaches linked to third-party vendors, highlighting the need for robust monitoring tools. Additionally, cloud-based VRM deployments are gaining momentum across all regions, offering scalability and real-time analytics—indicating a shift toward integrated, AI-powered risk management solutions in upcoming reports.

In 2023, the U.S. Vendor Risk Management Market was valued at USD 3.72 billion and is projected to reach USD 12.85 billion by 2032, growing at a CAGR of 14.78%. The market is expanding due to increasing regulatory compliance requirements, growing third-party ecosystem complexity, and heightened cybersecurity concerns. Enterprises are prioritizing risk mitigation and operational transparency, driving the adoption of advanced vendor risk management solutions.

Vendor Risk Management Market Dynamics

Driver

-

Organizations are adopting VRM solutions to meet strict and evolving global compliance mandates.

Rising regulatory scrutiny across sectors like BFSI, healthcare, and IT is a key driver for the vendor risk management market. Regulatory frameworks such as GDPR, HIPAA, and SOX require organizations to maintain stringent oversight of third-party vendors and ensure secure data-handling practices. This has led to a surge in the adoption of vendor risk management solutions that can automate compliance tracking, audit trails, and reporting processes. Organizations are prioritizing risk transparency and accountability throughout their supply chains, resulting in growing demand for integrated platforms capable of real-time monitoring. These compliance demands are not only pushing existing users to upgrade their systems but are also onboarding new enterprises into the VRM ecosystem.

Restraint

-

The high upfront investment and integration complexity hinder adoption, especially among SMEs.

One of the major restraints in the vendor risk management market is the high initial cost associated with implementing and integrating these solutions, especially for small and medium-sized enterprises. Vendor risk platforms often require custom configurations, third-party data integrations, user training, and ongoing maintenance—all of which add to the total cost of ownership. Additionally, organizations with complex IT infrastructures face challenges in integrating VRM tools seamlessly into their existing systems. This financial and operational burden can delay adoption decisions, particularly in price-sensitive markets or regions with underdeveloped compliance ecosystems. As a result, many smaller firms continue to rely on manual or semi-automated processes for vendor oversight.

Opportunity

-

AI-driven insights enable early detection and management of vendor-related risks.

The integration of AI and predictive analytics presents a significant opportunity in the vendor risk management market. Advanced analytics tools enable organizations to assess vendor risks proactively by identifying patterns, anomalies, and risk triggers before they escalate into actual threats. AI can streamline risk scoring, automate decision-making processes, and enhance visibility into vendor networks, particularly in large enterprises dealing with hundreds or thousands of suppliers. Predictive tools also aid in modeling potential scenarios and testing risk response strategies. As companies prioritize resilience and agility in their vendor ecosystems, AI-powered VRM solutions are gaining traction, creating a pathway for innovation, differentiation, and competitive advantage in the market.

Challenge

-

Inconsistent risk evaluation methods across industries limit effective VRM implementation.

Despite the growing demand for vendor risk management, the absence of universally accepted frameworks poses a significant challenge. Organizations often develop internal risk assessment protocols that vary widely in scope, methodology, and metrics, making it difficult to benchmark and collaborate across industries or regions. This fragmentation can lead to inconsistent evaluations, missed vulnerabilities, and compliance gaps. It also complicates the adoption of automated VRM platforms, which rely on standardized inputs to generate accurate risk insights. Without industry-wide consensus on risk categorization, scoring, and monitoring, enterprises face difficulty in aligning their VRM programs with broader risk governance objectives, hampering the scalability and effectiveness of their initiatives.

Vendor Risk Management Market Segmentation Analysis

By Solution

Financial control dominated the market and accounted for a significant revenue share in 2023. In order to determine which vendors to work with, organizations must conduct their due diligence and ensure that their third-party partners have the financial means to meet contractual obligations. Due diligence: Discerning the financial stability, creditworthiness, and operational viability of prospective vendors is part of the due diligence process. Financial risks with vendors can also come with the most considerable costs, from a business's bottom line to its reputation.

The compliance management segment is anticipated to register the fastest CAGR throughout the forecast period. VRM compliance management solutions are increasingly integrated into the broader Enterprise Risk Management systems. This means compliance is handled alongside other risks, delivering a more holistic perspective of vendor risk.

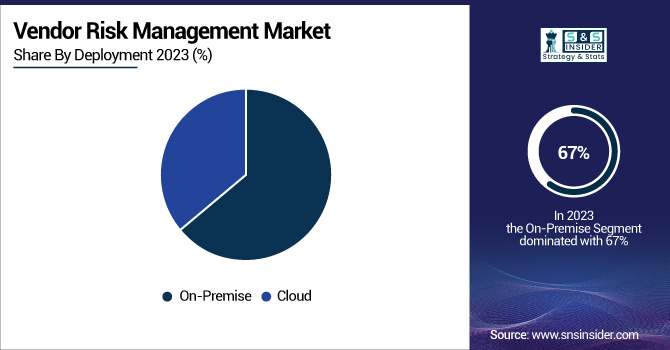

By Deployment

The on-premises segment dominated the market with the largest revenue share of over 67% in 2023. Although cloud computing has grown significantly, many organizations continue to manage on-premises environments because of particular compliance, security, or operational needs. Accordingly, controlling vendor risks about on premises solutions continues to be necessary, especially in heavily regulated sectors and within organizations possessing legacy systems.

The cloud segment is anticipated to grow at a substantial CAGR during the forecast period. Digital transformation is one of the major forces driving the increasing demand for VRM solutions in the cloud segment. With sectors ranging from finance and healthcare to retail and manufacturing relying more on cloud-based platforms and Software-as-a-Service, businesses are also at the mercy of third-party cloud service providers.

By Enterprise Size

The small & medium enterprises segment dominated the market and held the largest revenue share of over 69% in 2023. Organizations can manage the risks stemming from their vendors with more budget-friendly VRM tools and solutions developed for these very SMEs. Thankfully, most of the VRM vendors have come up with cloud-based and SaaS solutions, which scale down and can be purchased at a nominal price by a small organization.

The large enterprise segment is estimated to be the fastest-growing segment with the fastest CAGR over the forecast period. Big organizations usually rely on various vendors for mission-critical services, and business continuity and disaster recovery plans are an integral part of risk management. If a key vendor’s operations are disrupted, this causes a ripple effect on the enterprise’s ability to deliver products and services to customers.

By End-Use

The BFSI segment dominated the market and accounted for a significant revenue share in 2023. The BFSI segment is gaining traction in the VRM market as digital transformation initiatives are gaining momentum. Vendors are intricate webs with evolving landscapes, and the growing proliferation of technologies like AI, blockchain, and IoT only further complicates this environment — all of which require an equally complex catharsis like VRM to manage them. These tools use analytics and machine learning to assess risks proactively and manage the vendor lifecycle.

The healthcare surgery segment is expected to experience the fastest CAGR during the forecast period. With the advent of new technologies such as telemedicine, electronic health records, and cloud-based healthcare platforms, the use of third-party vendors became vital in healthcare business practices. Although these technologies promote operational efficiency, they also add to the complexity of vendor ecosystems, exposing healthcare organizations to risks, including data breaches and operational shocks.

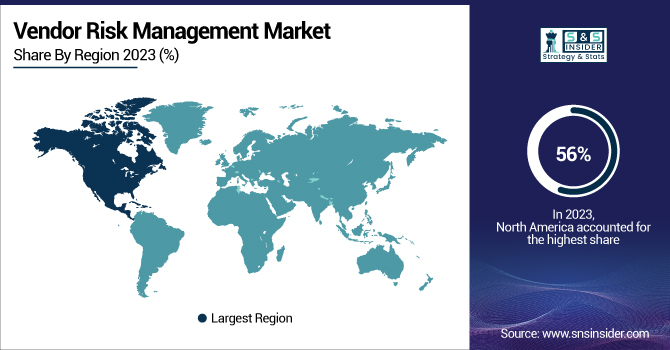

Regional Analysis

North America dominated the market and accounted for a 56% revenue share in 2023. In North America, the increase in the use of technologies, including digital transformation and cloud technology, is also driving the growth of the VRM market. As businesses transition to cloud-like environments, they are becoming increasingly dependent on third-party service providers which brings up concerns related to data privacy, uptime, and reliability of service. More organizations are turning to cloud-based VRM platforms for facilitating the management of cloud vendors and their associated risks; these platforms offer the ability to scale, cost, and have real-time capabilities that can address the difficulties and management complexities vendors bring along.

Asia Pacific is expected to register the fastest CAGR during the forecast period. There is a massive digital transformation going on over here, with tens of thousands of companies migrating to the cloud. Innovations, with countries such as Australia, and Japan leading the charge with organizations exploiting on cloud service providers, SaaS platforms, and IT outsourcing for operational efficiency and cost savings.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

RSA Security – Archer Third Party Governance

-

MetricStream – Third-Party Risk Management

-

OneTrust – Vendorpedia

-

Prevalent Inc. – Prevalent Third-Party Risk Management Platform

-

BitSight Technologies – BitSight Security Ratings

-

NAVEX Global – RiskRate

-

ProcessUnity – Vendor Risk Management

-

LogicGate – Risk Cloud for Third-Party Risk Management

-

Riskonnect – Third-Party Risk Management Solution

-

SAI360 – Vendor Risk Management

-

Aravo Solutions – Aravo for Third-Party Risk Management

-

Galvanize (now part of Diligent) – Third-Party Risk Management

-

IBM Corporation – OpenPages Third-Party Risk Management

-

SAP SE – SAP Risk Management

-

Coupa Software – Coupa Third-Party Risk Management

Recent Developments

-

March 2024: FluidOne acquired SureCloud Cyber Services, aiming to enhance its cybersecurity offerings by integrating expertise in governance, risk, and compliance.

-

August 2024: Genpact expanded its partnership with Advantage Solutions to address challenges in finance and supply chain management within the consumer-packaged goods and retail industries.

-

September 2024: Coupa launched Coupa Navi, a generative AI agent providing real-time navigation and support for business queries, enhancing user experience in spend management.

-

December 2024: NAVEX Global, Inc. announced a major update to NAVEX One Compliance Assistant, introducing microlearning suggestions tailored to individual employee needs, streamlining compliance processes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.6 Billion |

| Market Size by 2032 | US$ 30.3 Billion |

| CAGR | CAGR of 14.98 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Vendor Information Management, Contract Management, Financial Control, Compliance Management, Audit Management, Quality Assurance Management) • By Deployment (Cloud, On-premise) • By Enterprise Size (Large Enterprises, Small & Medium Enterprises) • By End Use (BFSI, IT & Telecom, Retail & Consumer Goods, Manufacturing, Energy & Utilities, Healthcare, Government, Others). |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | RSA Security, MetricStream, OneTrust, Prevalent Inc., BitSight Technologies, NAVEX Global, ProcessUnity, LogicGate, Riskonnect, SAI360, Aravo Solutions, Galvanize (now part of Diligent), IBM Corporation, SAP SE, Coupa Software. |