Speech-to-text API Market Size & Overview:

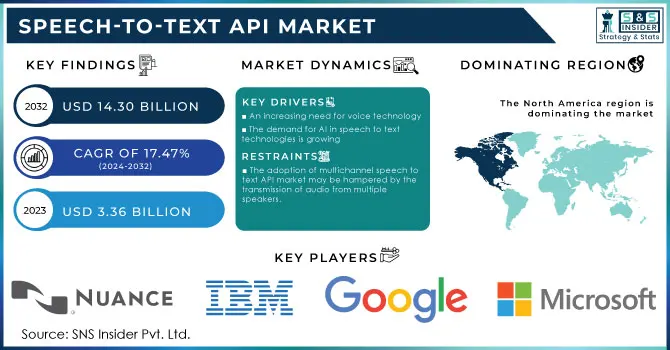

Speech-To-Text API Market Size was valued at USD 3.3 Billion in 2023 and is expected to reach USD 13.5 Billion by 2032, growing at a CAGR of 17.0% over the forecast period 2024-2032.

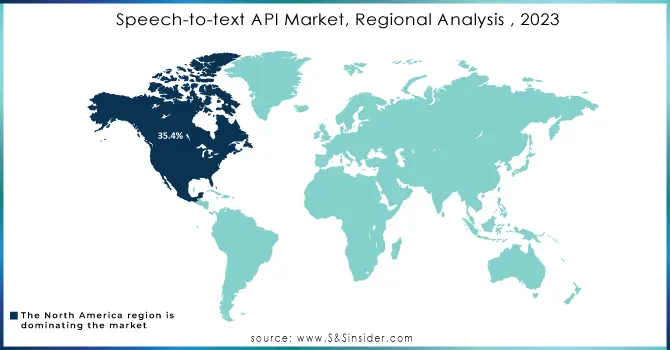

The growth of speech-to-text API markets has been tremendous owing to the adoption of AI-powered solutions for improving operational efficiency and user accessibility across a multitude of industries. Government efforts and technology development have played a key role in driving North America to the largest regional market share during 2023. U.S. government programs including grants for digital accessibility projects under the Americans with Disabilities Act (ADA) have spurred investments in voice recognition technology to enhance access to services for differently able people. Similarly, Canada’s Digital Charter focuses on encouraging AI-driven innovation, contributing to the market's expansion.

Get more information on Speech-to-text API Market - Request Sample Report

In addition, the increasing adoption of voice-enabled applications in education, healthcare, and public service delivery is aligned with the larger societal trend toward adopting voice-based solutions. For instance, In healthcare, initiatives in digitization through transcription solutions to digitize patient records are also backed up with government funding that has fueled adoption rates. On the other hand, with the global trend of businesses embracing digital-first strategies, the demand for speech-to-text APIs has been reinforced even more. These APIs make it easier for customers to interface and also comply with government regulations such as the EU's GDPR that mandate better systems for the collection and processing of data in businesses.

This growth can be attributed to increased demand for mobile devices, the growing elderly population's dependence on technology, more government funding of educational opportunities for differently abled pupils, and an increasing number of people with learning difficulties, natural language processing, or disabilities. The rapid adoption of digitization trends in all sectors and the development of new technological developments in education are also factors contributing to this growth.

Speech-To-Text API Market Dynamics

Drivers

-

Industries such as healthcare, finance, and education increasingly use speech-to-text APIs for real-time transcription and automation. Natural language processing (NLP) and machine learning advancements enhance API accuracy and functionality.

-

The growing use of smart speakers, smartphones, and other IoT devices fuels the need for speech-to-text solutions. These APIs are integral for powering voice assistants like Alexa and Google Assistant.

-

Cloud deployments offer scalability, cost-effectiveness, and accessibility, making them a preferred choice. Enterprises favor cloud systems for seamless integration and reduced infrastructure requirements.

Voice recognition technology has grown to be a cornerstone for various industries, utilizing speech-to-text APIs to increase productivity and user experience. An example can be the industry of healthcare where they generally follow the use of automated transcription to write all the notes associated with a patient's consultation. According to studies, nearly 80 percent of healthcare workers are now using voice-recognition tools for electronic health record (EHR) updates, eliminating wasted time and minimizing administrative mistakes. Speech-to-text APIs play a vital role in facilitating customer service in the finance sector by powering chatbots and voice assistants. For instance, banks use these APIs, enabling the processing of transactions through voice in a secure manner. Industry reports state that financial institutions have seen up to 30% improvement in query solution time with automated voice assistants.

Despite this, education has also adopted voice recognition to help improve accessibility and remote learning, for example, real-time transcription during virtual classes. Several platforms such as Zoom and Google Meet are implementing speech-to-text APIs to provide captions and translations which not only improve experience, but students who struggle with hearing and other issues find it extremely useful. EdTech industry data shows that more than 40% of online lessons globally use such tools. In addition, the use of voice recognition in smart speaker technology continues to see steady growth recent surveys find that 50% of U.S. households now contain at least one smart speaker, mostly fueled and built using speech-to-text APIs. This trend highlights how APIs are changing user experience across different applications.

Restraints

-

Transcriptions often involve sensitive information, creating challenges around compliance and safeguarding data integrity. Security vulnerabilities deter adoption, particularly in heavily regulated sectors

-

Adapting APIs to local dialects and regional languages remains a hurdle, especially in linguistically diverse regions

The major restrain in speech to text API market is the data security and privacy of the users. Many of these APIs manage sensitive, confidential, and high-profile materials such as financial records, healthcare data, or personal communications that will be vulnerable to a variety of cyberattacks. While these technologies have a lot to offer, organizations are particularly nervous about adopting them because of the risk of data breaches and unauthorized access. In addition, compliance with local and global data protection laws like GDPR and HIPAA only complicates matters further. To comply with these standards, companies are forced to adopt strong encryption, safe transport protocols, and filtering, which drives up the cost of implementing them.

This real-time processing requirement makes it even more challenging as it requires quick data processing as well as high-security processes. These concerns are particularly pronounced in regulated industries, where any data misuse could result in severe legal and reputational repercussions.

Speech-To-Text API Market Segment Analysis

By Component

The software segment led the market with a 71% share of revenue in 2023. The rapid technological evolution of AI-based transcription tools, which notably quicken the process and upgrade the precision of this composition, contributes to this domination. The initiatives about the digital journey, for instance, India’s National AI Strategy, financed by the government, have doubled the incentive for advanced software platforms.

The scalability offered by software solutions, especially cloud-based systems has been crucial in adopting them. One prime example is government and enterprise solutions that require heavy data but need something more flexible to accommodate a large volume. Furthermore, the growing emphasis on natural language processing (NLP) advancements funded by agencies like the U.S. National Science Foundation has led to rapid changes in the contextual understanding abilities of those platforms. This ensures accurate transcription even in noisy environments or with diverse accents, addressing key market challenges.

By Application

The fraud detection and prevention application segment dominated the market in 2023 and held the largest speech-to-text API market share. The growth of this section is attributed to its hub functionality in identifying and minimizing the risk level in banking, financial services, and insurance (BFSI) financial systems. Speech-to-text APIs are commonly utilized to sift through customer interactions and identify discrepancies that suggest fraud. This ability to prevent these types of attacks directly supports regulatory requirements such as the U.S. Federal Financial Institutions Examination Council (FFIEC) directives that call for strong security within financial institutions.

The rising number of cyberattacks in the world has shown the need for a system of fraud detection. As an illustration, the 2023 Internet Crime Report by the FBI reported an alarming rise in scams involving our digital transactions, which has driven banks to heavily invest in real-time monitoring systems, making use of speech-to-text APIs, among others. This not only enhances the security of the transaction but also complies with anti-money laundering (AML) and know-your-customer (KYC) regulations, making it the most appealing API across industries.

By Vertical

The BFSI sector was the largest end-user of the speech-to-text API market in 2023. One of the major factors behind the growth of this sector is the dependency on voice-activated technology for customer engagement, securing transactions, and increasing operational efficiency. Many banks use speech-to-text APIs to automate time-consuming workflow processes like call transcription and fraud detection to minimize manual efforts and improve compliance.

Regulatory measures from the Government have also contributed positively to adoption. A perfect example of this is the financial services regulations published by the European Central Bank requiring companies to keep accurate records that the speech-to-text solution enables by transcribing customer interactions on the fly. Moreover, the increasing emphasis on financial inclusion initiatives especially in emerging economies has led to investments in voice-based solutions that serve the unbanked population, thus aiding the growth of this segment.

By Deployment

In 2023, the on-premises deployment mode led the market and held the highest revenue share at 60.2%. The demand for on-premise solutions is expected to remain high in industries with strict data privacy and security requirements, such as defense, healthcare, and BFSI as they prefer on-premise solutions to maintain control over sensitive data. In line with this demand, 55% of organizations worldwide continued to prioritize on-premises deployments for mission-critical applications in 2023, as per a recent survey.

The European Union's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) with their data sovereignty mandates have further pushed this trend. Such regulations make it imperative for organizations to keep a tight leash on customer data, pushing for the adoption of on-premises systems. Additionally, the preference for on-premises solutions in government projects reflects concerns about data breaches and unauthorized access, reinforcing their market position.

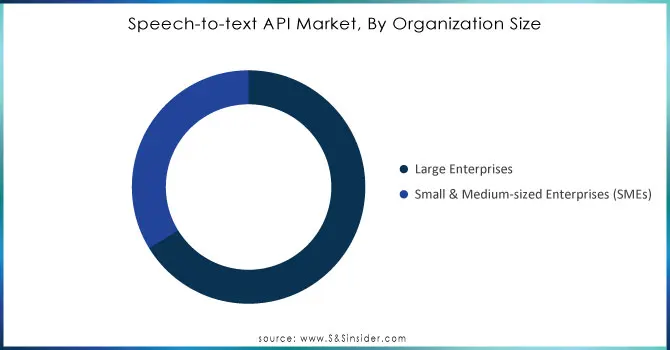

By Organization size

In 2023, the largest revenue share of more than 66.1% was held by the large enterprises segment. High capital stability, which enables big enterprises to take advantage of such API integration, is a key factor in driving the growth of this segment. Nevertheless, the SME segment is projected to grow at more rapidly over the projection period. This segment is driven by the expansion of large companies, which are facing increased competition from developing SMEs.

Need any custom research on Speech-to-text API Market - Enquiry Now

Regional Analysis

North America dominated the speech-to-text API market in 2023, accounting for 34% of the global speech-to-text API market. This technical hub of the world is a direct result of advanced automation and the presence of various digital tools in the region along with political government backing. Various industries, including healthcare, BFSI, and retail in North America have been adopting speech-to-text solutions rapidly, making operations smoother and boosting customer experiences. The United States, in particular, has been at the forefront, with government policies emphasizing digital transformation and accessibility. Demand has surged due to initiatives including funding to enhance AI accessibility tools and for compliance with acts like the Americans with Disabilities Act (ADA).

On the other hand, the Asia-Pacific region is the fastest-growing region, driven by rapid economic growth, and the development of Internet and government-led digital initiatives. Digital India's goal is to empower citizens with technology and initiatives like voice-enabled solutions for use in governance and services. Likewise, China had laid out its vision for AI in its AI 2030 strategy by pushing for advancements in voice technologies and machine learning algorithms, as well as the adoption of speech-to-text systems by enterprises. The region also benefits from rising smartphone adoption and increasing demand for multilingual transcription capabilities, catering to a linguistically diverse population.

Key Players

Service Providers / Manufacturers

-

Google (Google Cloud Speech-to-Text, Dialogflow)

-

Amazon Web Services (AWS) (Amazon Transcribe, Amazon Polly)

-

Microsoft (Azure Speech-to-Text, Custom Neural Voice)

-

IBM (Watson Speech to Text, Watson Assistant)

-

Nuance Communications (Dragon Speech Recognition, PowerScribe)

-

Speechmatics (Real-Time ASR, Batch Transcription)

-

Rev.com (Rev AI, Speech-to-Text Engine)

-

Otter.ai (Otter Live Notes, Transcription Tool)

-

Baidu (DeepSpeech, PaddlePaddle Speech Tools)

-

Tencent (Tencent ASR API, Smart Speech Services)

Key Users

-

Apple

-

Zoom Video Communications

-

Meta (Facebook)

-

YouTube

-

Spotify

-

Adobe (Premiere Pro)

-

Netflix

-

Salesforce

-

Cisco (Webex)

-

Slack

Recent Developments

- In October 2023, AWS released an important update to Amazon Transcribe, the automatic speech recognition service provided by AWS. This is a massive update with an advanced speech model that is now available in more than 100 languages, hugely improving the precision and utility for users around the globe.

| Report Attributes | Details |

| Market Size in 2023 | USD 3.3 Billion |

| Market Size by 2032 | USD 13.5 Billion |

| CAGR | CAGR of 17.00% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vertical (BFSI, IT & Telecom, Healthcare, Retail & eCommerce, Government & Defense, Media & Entertainment, Travel & Hospitality, Others) • By Component (Software, Service) • By Deployment (On-premises, Cloud) • By Organization Size (Large Enterprises, Small & Medium-sized Enterprises (SMEs)) • By Application (Contact Center and Customer Management, Content Transcription, Fraud Detection and Prevention, Risk And Compliance Management, Subtitle Generation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Google, Amazon Web Services (AWS), Microsoft, IBM, Nuance Communications, Speechmatics, Rev.com, Otter.ai, Baidu, Tencent |

| Key Drivers | •Industries such as healthcare, finance, and education increasingly use speech-to-text APIs for real-time transcription and automation. Natural language processing (NLP) and machine learning advancements enhance API accuracy and functionality •The growing use of smart speakers, smartphones, and other IoT devices fuels the need for speech-to-text solutions. These APIs are integral for powering voice assistants like Alexa and Google Assistant •Cloud deployments offer scalability, cost-effectiveness, and accessibility, making them a preferred choice. Enterprises favor cloud systems for seamless integration and reduced infrastructure requirements |

| Market Challenges | •Transcriptions often involve sensitive information, creating challenges around compliance and safeguarding data integrity. Security vulnerabilities deter adoption, particularly in heavily regulated sectors •Adapting APIs to local dialects and regional languages remains a hurdle, especially in linguistically diverse regions |