Audience Analytics Market Report Scope & Overview:

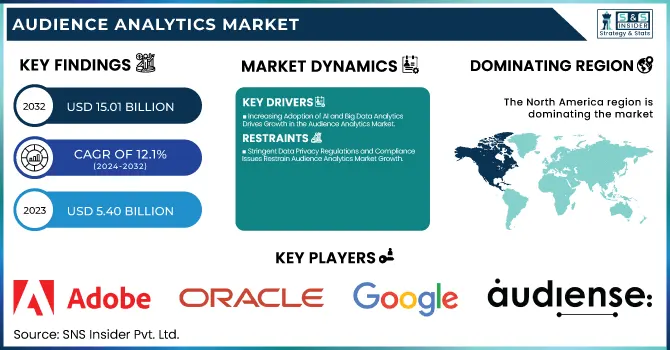

The Audience Analytics Market Size was valued at USD 5.40 Billion in 2023 and is expected to reach USD 15.01 Billion by 2032 and grow at a CAGR of 12.1% over the forecast period 2024-2032.

To Get more information on Audience Analytics Market - Request Free Sample Report

The Audience Analytics Market is growing rapidly due to the rising demand for data-driven decision-making. Businesses use analytics solutions to understand consumer behavior, optimize marketing, and enhance engagement. AI, machine learning, and big data have revolutionized audience insights, enabling real-time tracking and predictive analysis. These tools help organizations analyze demographics, sentiment, and online interactions for personalized content and better user experiences. Increasing focus on audience segmentation, competitive intelligence, and ad performance measurement further drives market growth. However, privacy regulations and ethical data usage remain key concerns, shaping industry strategies and compliance efforts.

Audience Analytics Market Dynamics

Key Drivers:

-

Increasing Adoption of AI and Big Data Analytics Drives Growth in the Audience Analytics Market

The growing integration of artificial intelligence (AI) and big data analytics in audience analytics solutions is a key driver of market growth. Businesses are leveraging these advanced technologies to analyze vast amounts of consumer data in real-time, enabling precise audience segmentation, predictive analysis, and sentiment tracking. AI-powered audience analytics tools provide deeper insights into customer behavior, preferences, and engagement patterns, allowing companies to optimize marketing strategies and enhance user experiences. The increasing adoption of machine learning algorithms further improves the accuracy of audience insights, helping businesses make data-driven decisions.

Additionally, AI-driven automation streamlines data collection and processing, reducing manual efforts and improving efficiency. As digital transformation accelerates across industries, the demand for AI-based audience analytics solutions continues to rise. Companies investing in advanced analytics capabilities gain a competitive edge by delivering personalized experiences, improving customer retention, and maximizing marketing ROI, ultimately driving the expansion of the audience analytics market.

Restrain:

-

Stringent Data Privacy Regulations and Compliance Issues Restrain Audience Analytics Market Growth

The increasing enforcement of data privacy regulations and compliance requirements poses a significant challenge to the growth of the audience analytics market. Laws such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S. impose strict guidelines on data collection, storage, and usage. Organizations using audience analytics solutions must ensure transparency and compliance with these regulations to avoid legal penalties and reputational damage. Privacy concerns among consumers have also led to growing demand for stricter data protection measures, limiting the availability of user data for analysis. Companies must invest in secure data governance practices and consent-based tracking mechanisms, which can increase operational costs and complexity. The evolving regulatory landscape requires businesses to continuously adapt their analytics strategies while maintaining compliance. As data privacy regulations tighten globally, the challenge of balancing analytics capabilities with ethical data use remains a major restraint for market growth.

Opportunities:

-

Rising Demand for Personalized Marketing Creates Growth Opportunities for the Audience Analytics Market

The increasing demand for personalized marketing presents a significant opportunity for the audience analytics market. Businesses are focusing on delivering customized experiences based on consumer preferences, behaviors, and demographics to enhance engagement and brand loyalty. Audience analytics solutions enable companies to analyze user interactions across multiple channels, including social media, websites, and mobile apps, to create highly targeted marketing campaigns. By leveraging AI and machine learning, organizations can develop predictive models that anticipate customer needs and optimize content delivery in real time. Personalization enhances customer satisfaction, leading to higher conversion rates and improved return on investment (ROI) for marketing efforts. As e-commerce, digital advertising, and content streaming platforms expand, the need for audience analytics-driven personalization continues to grow. Companies that effectively utilize audience insights to create relevant and engaging customer experiences gain a competitive advantage, making personalized marketing a major driver of future market expansion.

Challenges:

-

Challenges in Managing Large-Scale Unstructured Data in Audience Analytics Market Growth

Managing large-scale unstructured data remains a critical challenge for the audience analytics market. With the rise of digital interactions, businesses collect vast amounts of audience data from diverse sources, including social media, video platforms, blogs, and online forums. Unlike structured data from traditional databases, unstructured data lacks a predefined format, making it difficult to process, analyze, and extract actionable insights. Advanced analytics tools powered by AI and natural language processing (NLP) help in organizing and interpreting this data, but implementation remains complex and resource-intensive. Companies often face issues related to data silos, inconsistent formats, and integration challenges across multiple analytics platforms.

Additionally, real-time data processing requires significant computing power and infrastructure investments, which may not be feasible for small and medium-sized enterprises (SMEs). To overcome this challenge, businesses need scalable data management solutions, efficient data pipelines, and robust AI-driven analytics tools to maximize the value of unstructured audience data.

Audience Analytics Market Segments Analysis

By Application

Customer Experience Segment Dominates the Audience Analytics Market with a 42% Revenue Share in 2023

The Customer Experience (CX) segment held the largest revenue share in the Audience Analytics Market, accounting for 42% in 2023. The rising demand for personalized interactions and real-time customer insights has propelled the adoption of audience analytics solutions in CX management. Companies are leveraging AI-driven tools to analyze customer sentiment, track behavioral patterns, and optimize engagement strategies across multiple digital touchpoints. Tech giants like Salesforce and Adobe have enhanced their CX platforms by integrating AI-powered analytics. The growing emphasis on hyper-personalization, automated chatbot interactions, and omnichannel engagement further strengthens the demand for audience analytics in CX.

The Sales & Marketing Management segment is growing at the highest CAGR of 13.6% within the forecasted period, driven by the increasing need for data-driven marketing strategies and sales optimization. Businesses across industries are investing in audience analytics to gain actionable insights into consumer behavior, campaign effectiveness, and market trends. Companies like Google and HubSpot have significantly advanced their marketing analytics platforms to enhance targeting accuracy. The integration of predictive analytics and real-time customer segmentation allows marketers to tailor campaigns, maximize engagement, and increase return on investment (ROI). Additionally, social media platforms such as Meta and LinkedIn are refining their audience analytics capabilities to provide advertisers with in-depth consumer insights.

By Component

The Solution segment accounted for the largest revenue share of 63% in 2023, driven by the increasing adoption of AI-powered analytics platforms for real-time audience insights. Businesses across industries are investing in advanced solutions that help analyze consumer behavior, optimize engagement strategies, and enhance decision-making processes. Leading technology providers like Google, Adobe, and Microsoft have expanded their analytics offerings to cater to this growing demand. Microsoft’s Azure AI Analytics enhances audience tracking with advanced data modeling and sentiment analysis. These solutions empower businesses to personalize user experiences, improve campaign effectiveness, and increase customer retention.

The Services segment is experiencing the fastest CAGR of 12.9%, fueled by the increasing demand for consulting, implementation, and managed services in audience analytics. As businesses adopt complex analytics solutions, they require expert guidance for deployment, integration, and optimization. Companies such as IBM, Accenture, and Salesforce have expanded their audience analytics service offerings to help organizations maximize the value of their data. Accenture introduced Intelligent Audience Solutions, leveraging AI and machine learning to help enterprises refine audience targeting and enhance personalization strategies. Salesforce expanded its Marketing Cloud Services, offering predictive analytics and customer journey mapping support. The growing reliance on outsourced analytics expertise and data management services is driving demand in this segment.

By End-Use

Media & Entertainment Segment Dominates the Audience Analytics Market with a 26% Revenue Share in 2023

The Media & Entertainment segment held the largest revenue share of 26% in 2023, driven by the growing demand for data-driven content strategies, personalized recommendations, and targeted advertising. Streaming platforms, social media, and digital publishers leverage audience analytics to understand viewer preferences, optimize content delivery, and enhance user engagement. Companies like Netflix, Disney, and Warner Bros. Discovery have integrated advanced analytics solutions to refine content strategies and improve audience retention. Social media giants like YouTube and Meta have enhanced their ad-targeting capabilities with real-time audience tracking and predictive analytics. The rising consumption of digital content and the shift toward personalized streaming experiences further fuel the adoption of audience analytics in this sector.

The IT & Telecommunication segment is growing at the highest CAGR of 13.13%, driven by the increasing need for real-time customer insights, predictive analytics, and enhanced service personalization. Telecom providers and IT firms are utilizing audience analytics to optimize network performance, improve customer support, and deliver targeted digital services. Major industry players like Verizon, AT&T, and Vodafone have incorporated AI-driven analytics to enhance customer experience and retention. Verizon’s AI-powered customer analytics platform enables predictive churn analysis, helping reduce subscriber losses through proactive engagement strategies. Similarly, AT&T has developed data-driven marketing solutions to refine audience segmentation and optimize digital campaigns. Cloud service providers like Amazon Web Services (AWS) and Google Cloud offer AI-based audience analytics tools to help businesses gain deeper insights into user interactions.

Regional Analysis

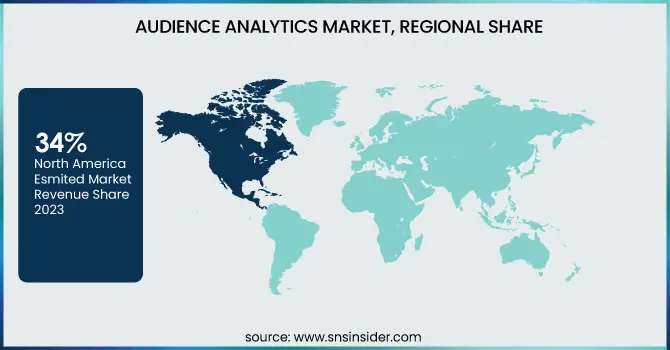

North America led the Audience Analytics Market in 2023, capturing an estimated 34% market share, driven by the high adoption of advanced analytics technologies, a strong digital infrastructure, and the presence of major tech companies. The region's dominance is fueled by the widespread use of AI-powered audience analytics in industries such as media, e-commerce, and digital advertising. The region's strong regulatory frameworks, including GDPR-compliant data privacy practices, also drive demand for advanced audience analytics solutions. With North America being home to the largest streaming platforms, social media networks, and online retailers, the market continues to expand, maintaining its leadership position in audience analytics adoption.

Asia Pacific is experiencing the fastest growth in the Audience Analytics Market, with an estimated CAGR of 13.4%, driven by rapid digital transformation, the expansion of e-commerce, and increasing internet penetration. Countries like China, India, and Japan are seeing a surge in digital advertising, social media usage, and content streaming, creating a high demand for audience analytics solutions. ByteDance (TikTok’s parent company) leverages advanced audience analytics to enhance user engagement and content recommendations, boosting its advertising revenue.

Additionally, Indian telecom giants like Reliance Jio are utilizing big data analytics to personalize customer experiences and improve retention. The region's growing startup ecosystem, along with increasing investments in AI and cloud-based analytics, further accelerates market growth. As businesses in Asia Pacific focus on hyper-personalization and data-driven decision-making, audience analytics adoption continues to rise rapidly.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Audience Analytics Market are:

-

Adobe (Adobe Experience Cloud, Adobe Analytics)

-

Oracle Corporation (Oracle CX Analytics, Oracle Data Cloud)

-

IBM Corporation (IBM Watson Marketing, IBM Customer Experience Analytics)

-

SAS Institute Inc. (SAS Customer Intelligence 360, SAS Visual Analytics)

-

Google LLC (Google Analytics, Google Ads Data Hub)

-

Audiense (Audiense Insights, Audiense Connect)

-

Comscore, Inc. (Comscore Digital Audience Measurement, Comscore Campaign Ratings)

-

Sightcorp (DeepSight Toolkit, DeepSight Face API)

-

Unifi Software (Unifi Data Platform, Unifi AI-Driven Analytics)

-

Telmar (Audience Targeting Solutions, Telmar Planning Tools)

-

Quividi (Quividi Audience Measurement Platform, Quividi Data Enrichment)

-

AnalyticsOwl (Real-Time Web Analytics, Audience Engagement Tracker)

-

Akamai Technologies (Akamai Identity Cloud, Akamai DataStream)

-

NetBase Solutions (NetBase Quid Consumer Analytics, NetBase Social Listening)

-

JCDecaux Group (JCDecaux Data Solutions, VIOOH Programmatic Advertising)

Recent Trends

-

In September 2024, Adobe introduced new AI-driven analytics in Adobe Experience Cloud, enabling brands to measure and personalize AI-generated content. The Adobe Content Analytics tool provided detailed insights into content performance, while updates to Journey Optimizer and Experience Manager enhanced engagement through data-driven personalization.

-

In September 2024, Oracle launched the Financial Crime and Compliance Management Monitor Cloud Service, offering banks advanced visualizations and reporting for compliance management. The system enabled financial institutions to identify risks quickly, improve regulatory reporting, and reduce compliance costs, reinforcing the role of analytics in fraud detection and risk mitigation.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.40 Billion |

| Market Size by 2032 | US$ 15.01 Billion |

| CAGR | CAGR of 12.1 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Application (Sales & Marketing Management, Customer Experience) • By Enterprise Size (Large Size Enterprises, Small and Medium-Sized Enterprises) • By End Use (IT & Telecommunication, Healthcare, Retail & E-Commerce, Automotive & Transportation, Media & Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Adobe, Oracle Corporation, IBM Corporation, SAS Institute Inc., Google LLC, Audiense, Comscore, Inc., Sightcorp, Unifi Software, Telmar, Quividi, AnalyticsOwl, Akamai Technologies, NetBase Solutions, JCDecaux Group. |