Sports Composites Market Analysis & Overview:

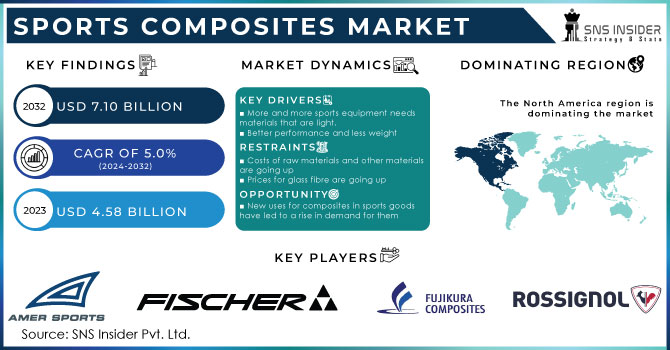

The Sports Composites Market was valued at USD 4.81 billion in 2024 and is expected to reach USD 7.11 billion by 2032, growing at a CAGR of 5% from 2025-2032.

Get More Information on Sports Composites Market - Request Sample Report

The growth of the sports composites market is driven by the increasing demand for lightweight, high-performance materials in sports equipment. Composites like carbon fiber and glass fiber provide exceptional strength-to-weight ratios, enhancing speed, agility, and endurance. Rising participation in sports and fitness, coupled with the expansion of professional leagues, fuels the need for durable, injury-reducing gear. Government R&D initiatives in countries like the USA, Germany, and Japan support advanced composite development. Companies like Toray Industries are partnering with manufacturers to create customized solutions for fishing rods, baseball bats, and golf shafts, further boosting market growth.

Sports Composites Market Size and Forecast

-

Sports Composites Market Size in 2024: USD 4.81 Billion

-

Sports Composites Market Size by 2032: USD 7.11 Billion

-

CAGR: 5% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Sports Composites Market Trends

-

Rising demand for lightweight, high-strength materials in sports equipment is driving the sports composites market.

-

Increasing use of carbon fiber, fiberglass, and hybrid composites is enhancing performance, durability, and safety.

-

Expansion of professional and recreational sports, including cycling, tennis, golf, and winter sports, is boosting market growth.

-

Integration of advanced manufacturing techniques like 3D printing and automated layup is improving design flexibility.

-

Growing focus on sustainability and recyclable composite materials is shaping market trends.

-

Technological innovations in coatings and resins are enhancing product lifespan and performance.

-

Collaborations between sports equipment manufacturers, material suppliers, and research institutions are accelerating innovation.

Sports Composites Market Growth Drivers:

-

The rising usage of agile and less-weight sports equipment drives the market growth.

The increasing usage of agile and lightweight sports equipment is a key driver of market growth in sports composites. The need for advanced sports equipment is increased by governments' growing investments in fitness programs and sports infrastructure. For example, significant funding has been provided by the European Union's Horizon 2020 program for the development of novel materials, such as composites, to improve sports performance and safety. Comparably, the National Institute of Standards and Technology in the US has funded advanced composites research to raise the caliber and functionality of athletic equipment. This trend is seen in recent releases from brands like Adidas and Carbon, who unveiled the future craft 4D running shoe with a 3D printed lattice construction for lightweight support. Additionally, Hexcel Corporation's launch in 2021 of lightweight, impact-resistant composite materials for hockey sticks and skis is another example of how the industry is responding to this increasing demand. The need for gear that enables athletes to compete at their highest level has fuelled these developments, highlighting the important role that lightweight, nimble sports equipment plays in the expansion of the market.

Sports Composites Market Restraints:

-

Production costs are high as compared to traditional products hampering the market growth.

The costly raw materials and complex manufacturing processes are required to produce composites like carbon and glass fiber, which results in increased production expenses. Moreover, the requirement for specialized equipment and trained workers drives up costs even more. Some customers and smaller manufacturers find it difficult to justify switching from traditional materials like metal and wood to advanced composites because of this pricing difference. As a result, increased production costs may prevent widespread adoption, particularly in markets where price fluctuations are significant. The sports composites market may grow more slowly as a result of this economic barrier, even if these materials have obvious performance advantages.

Sports Composites Market Segment Analysis

By Resin Type, Epoxy Resin segment dominates the Sports Composites Market.

The epoxy resin segment dominated the sports composites market with the highest revenue share of more than 38.23% in 2024. Because of its exceptional mechanical strength, great adhesive qualities, and resistance to environmental deterioration, epoxy resins are widely used. Moreover, due to its characteristics, epoxy resins are especially well-suited for high-performance sporting goods like skis, tennis rackets, and bicycles. The ultimate composite material is made to be both lightweight and durable thanks to epoxy resin's capacity to create strong bonds with reinforcing fibers like carbon and glass fibers. Furthermore, epoxy resins ‘adaptability to numerous uses makes them more appealing to a wider range of sports business sectors.

By Fiber Type, Carbon Fiber segment dominates the market.

The carbon fiber held the largest revenue share of around 42.22% in 2024. It is driven by its remarkable strength-to-weight ratio, stiffness, and longevity, carbon fiber is highly valued and is used in high-performance sports equipment. Athletes' speed and agility are improved by its lightweight design, and its high strength offers the required durability to resist heavy use. The supremacy of carbon fiber is further attributed to its resistance to fatigue and environmental variables, as well as its ability to be molded into complicated shapes. This fiber is extensively utilized in many sporting goods, such as hockey sticks, golf clubs, bicycles, and tennis rackets.

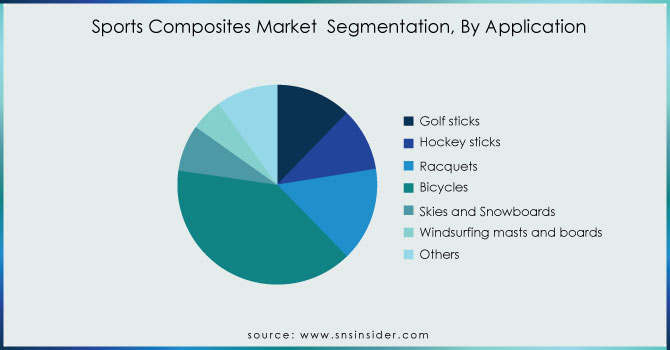

By Application, Bicycle segment dominates the Sports Composites Market.

The bicycle segment held the largest, market share in the application segment of the sports composites market around 39.56% share of the market revenue in 2024. Health and fitness are becoming more and more important in the world, and cycling is acknowledged as a fun and efficient kind of exercise. Bicycles have been more in demand as a result, especially high-performance ones that make use of cutting-edge materials. In this market, carbon fiber composites are highly prized for their remarkable strength-to-weight ratio, which improves cycling performance by lowering the bike's total weight while maintaining the required rigidity and durability. Furthermore, manufacturers are now able to create bicycles with better aerodynamics, vibration dampening, and overall ride quality, making them even more desirable to leisure and competitive riders thanks to technological developments in composite materials.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Sports Composites Market Regional Analysis

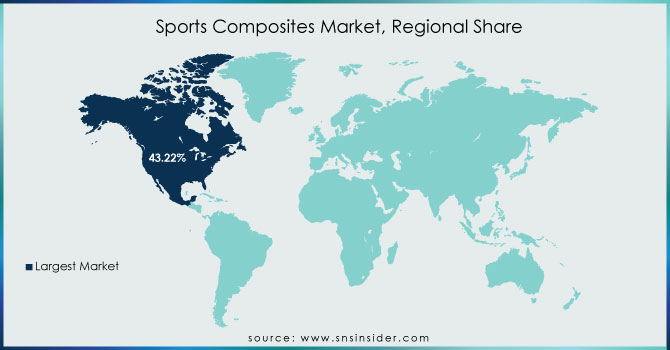

Asia Pacific Sports Composites Market Insights

In 2024, Asia Pacific held the largest market share of about 43.22% of the total sports composites market. Because of the region's rapid economic expansion, more people can now afford to buy high-performance sporting goods owing to increased disposable income. Sports and fitness activities are booming in nations like China and India thanks to government initiatives and growing public awareness of health and wellness. Sports composites market has also been boosted by Asia-Pacific's substantial investments in sports infrastructure, which include the building of adavanced facilities and the hosting of important athletic events. To take advantage of the burgeoning customer base, major sports brands are also growing their businesses in the area. Asia-Pacific is a dominant force in the sports composites market due to a mix of factors including economic growth, rising sports engagement, and strategic investments. This is indicative of the region's critical position in setting global industry trends.

North America Sports Composites Market Insights

North America holds a significant position in the Sports Composites Market, driven by high adoption of advanced sports equipment and growing participation in professional and recreational sports. Strong presence of key manufacturers, increasing investments in R&D, and rising demand for lightweight, durable materials are fueling market growth. The expansion of sports leagues, fitness trends, and government support for innovative composite technologies further accelerates the adoption of carbon fiber and glass fiber-based sports products in the region.

Europe Sports Composites Market Insights

Europe is a prominent region in the Sports Composites Market, supported by advanced manufacturing infrastructure and a strong presence of leading sports equipment brands. Rising consumer preference for high-performance, lightweight gear, coupled with increasing participation in professional and recreational sports, drives demand. Investments in research and development of innovative composite materials, along with government initiatives promoting sports technology and sustainability, are further accelerating the adoption of carbon fiber and glass fiber composites across the European sports industry.

Middle East & Africa and Latin America Sports Composites Market Insights

The Sports Composites Market in the Middle East & Africa and Latin America is witnessing steady growth, driven by increasing sports participation and rising awareness of fitness and wellness. Growing investments in sports infrastructure, government initiatives to promote athletics, and the adoption of lightweight, high-performance composite materials in equipment are fueling market expansion. Regional collaborations with global sports brands and technology providers further support the development and deployment of advanced composites in these emerging markets.

Sports Composites Market Competitive Landscape:

Hexcel Corporation Overview:

Hexcel Corporation is a leading global provider of advanced composite materials, specializing in carbon fiber, reinforcements, and engineered products. The company serves multiple industries, including aerospace, defense, automotive, and sports, offering high-performance solutions that combine lightweight properties with superior strength. Hexcel is known for innovation in prepregs, fabrics, and specialty composites, supporting sustainable practices and performance-driven applications. Its solutions are widely used in sports equipment, aircraft structures, and industrial components worldwide.

-

2024 – Hexcel Corporation: Hexcel launches HexForce 1K woven reinforcement fabric ideal for lightweight composite applications such as golf shafts and hockey sticks, enabling high strength with low weight.

-

2024 – Hexcel Corporation: Hexcel transitions its winter sports industry prepreg production to the HexPly Nature bio-derived product range, increasing sustainability in skis, snowboards, and other winter sports equipment.

-

2025 – Hexcel Corporation: Hexcel and Specialty Materials introduced Hy-Bor, a new high-modulus, high-compression unidirectional prepreg combining Hexcel’s HM carbon fiber and boron fiber—offering performance and weight savings for demanding applications.

Shimano Overview:

Shimano is a global leader in cycling components and fishing equipment, renowned for its innovation and high-quality performance products. The company focuses on research and development to deliver advanced solutions for bicycles, including drivetrains, brakes, and wheels. By integrating cutting-edge materials and technology, Shimano aims to enhance rider experience, efficiency, and competitiveness across professional and recreational cycling markets worldwide. Its commitment to sustainability and lightweight performance makes it a key player in sports composites.

-

2023 – Shimano: Shimano made a strategic investment in composite technology, focusing on developing new carbon fiber components for bicycles as part of its broader innovation strategy.

BMC Overview:

BMC is a premium Swiss bicycle manufacturer specializing in high-performance road, mountain, and e-bikes. The company emphasizes advanced engineering, precision manufacturing, and innovative design to deliver superior ride quality and performance. BMC integrates lightweight materials, including carbon fiber composites, to enhance stiffness, durability, and efficiency. The brand is well-regarded among professional cycling teams and enthusiasts, positioning itself as a leader in the high-end bicycle segment.

-

2023 – BMC: BMC expanded its product line with the launch of the Teammachine SLR01, utilizing innovative carbon fiber layup for improved performance and ride quality.

Giant Manufacturing Co. Ltd Overview:

Giant Manufacturing Co. Ltd is one of the world’s largest bicycle manufacturers, offering a wide range of road, mountain, hybrid, and e-bikes. The company focuses on innovation, advanced manufacturing, and high-performance materials to meet global demand. Giant invests in carbon fiber and other lightweight composites to enhance durability, strength, and ride performance, catering to professional athletes and recreational cyclists alike. Its global production facilities ensure scalability and quality in advanced composite bicycles.

-

2023 – Giant Manufacturing Co. Ltd: Giant announced a significant expansion of its carbon fiber production facilities in Taiwan to meet growing demand for high-performance bicycles.

Key Players:

-

Rossignol

-

Amer Sports

-

Fujikura Composites

-

Newell Brands

-

Topkey Corporation

-

Callaway Golf

-

ALDILA, Inc.

-

Prokennex

-

Easton Sports

-

Mitsubishi Chemical Carbon Fiber and Composites

-

Hexcel Corporation

-

Toray Industries, Inc.

-

SGL Carbon

-

Teijin Limited

-

Zoltek

-

Gurit Holding AG

-

Solvay S.A.

-

Owens Corning

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 4.81 Billion |

| Market Size by 2032 | US$ 7.11 Billion |

| CAGR | CAGR of 5.0% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Resin Type (Polyurethane, Epoxy, Polyamide, Polypropylene, Others) •By Fiber Type (Carbon fiber, Glass fiber, Boron fiber, Others) •By Application (Golf sticks, Hockey sticks, Racquets, Bicycles, Skies and Snowboards, Windsurfing masts and boards, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Rossignol, Fischer Sports, Amer Sports, Fujikura Composites, True Temper, Newell Brands, Topkey Corporation, Callaway Golf, ALDILA, Inc., Prokennex, Easton Sports, Mitsubishi Chemical Carbon Fiber and Composites, Hexcel Corporation, Toray Industries, Inc., SGL Carbon, Teijin Limited, Zoltek, Gurit Holding AG, Solvay S.A., Owens Corning |